Vietnam Master in Management

advertisement

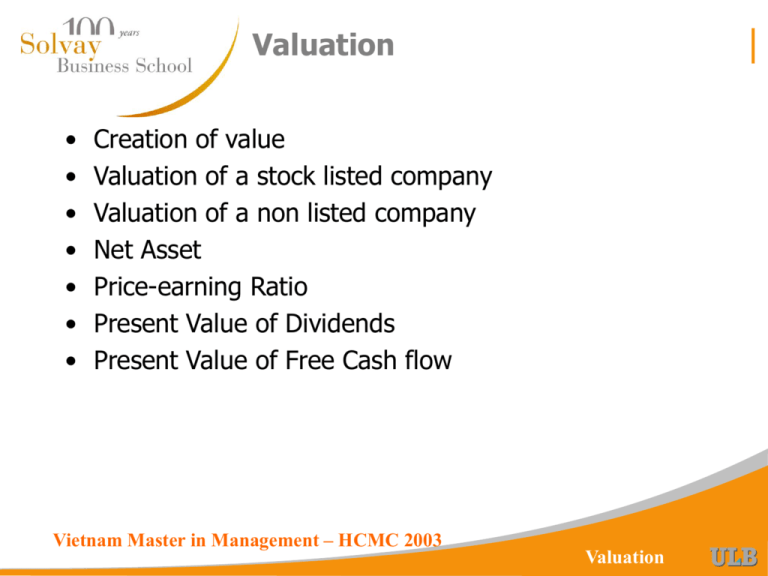

Valuation • • • • • • • Creation of value Valuation of a stock listed company Valuation of a non listed company Net Asset Price-earning Ratio Present Value of Dividends Present Value of Free Cash flow Vietnam Master in Management – HCMC 2003 Valuation Creation of value • The goal of any company : to create value This means : increase the value of the company for the shareholders With full respect for the legal framework • social, fiscal, environmental regulations And for all the other stakeholders • • • • employees customers suppliers neighbors Vietnam Master in Management – HCMC 2003 Valuation Creation of value • How can the value be increased ? by buying assets at a price lower than their economic value • real estate : buying during a depression (crisis) by selling assets at a price higher than their economic value • real estate : selling during a boom Vietnam Master in Management – HCMC 2003 Valuation Creation of value • The best way to create value : Innovation introducing new products • Microsoft • Cellular phones introducing new production processes • Car manufacturers improving the productivity of labor improving the quality of products etc. Vietnam Master in Management – HCMC 2003 Valuation Market capitalization of a stock listed company • For listed companies the share price is known daily the value of the company is equal to the price share multiplied by the number of shares V = pshare.nshares V = Market capitalization (“market cap”) • If the market is efficient the Market Cap is always the true value of the company Efficient market means that at any time all the market has all the information on the company Vietnam Master in Management – HCMC 2003 Valuation Fair value of a stock listed company • There is often a difference between the share price and the true value unequal distribution of the information • good or bad news for the future not known by the market from inside information … to ... inside trading booming or bubble effect (psychology) misinterpretation of the facts by the market Vietnam Master in Management – HCMC 2003 Valuation Fair value of a stock listed company • Even for a stock listed company it is useful to calculate a “fair value” based on : All the information available on the company Comparison of the share price and of the financial ratios with similar listed companies • It is interesting to buy When the share price is lower than the fair value • It is interesting to sell When the share price is higher than the fair value Vietnam Master in Management – HCMC 2003 Valuation Valuation of a non listed company • A valuation of a non listed company can only be known when : Shares of the company are sold The sale price is known • But it is possible to estimate the value of a non-listed company by using different methods Based on the book value Based on comparison with similar listed companies Based on the present value of the future financial flows of the company Vietnam Master in Management – HCMC 2003 Valuation Net Asset • Is the book-value of the equity a correct valuation of a company ? No : difference between book-value and market price of the assets & liabilities • It is possible to replace in the Balance Sheet all the book-values by the market prices • and to calculate a revised value of the equity Net Asset = Assets (at market prices) - Liabilities (at market prices) • The Net Asset is a valuation of the company Vietnam Master in Management – HCMC 2003 Valuation Saigon Hotel - Net Asset (000 US$) ASSETS LIABILITIES Fixed assets Inventories Receivables Cash 10.391 22 251 55 TOTAL 10.717 Equity Provision Long term debt ST oper debt ST fin debt Other debt Vietnam Master in Management – HCMC 2003 4.998 91 4.091 409 1.128 0 10.717 Valuation Saigon Hotel - Net Asset • Additional information The company owns the hotel building • The book-value is 6.045 and the market price estimation 9.055 The director is an art collector and the company owns art pieces • The book value is 125 and the market price 850 There are bad receivables for a book-value of 45 In the cash placement the company owns Microsoft shares bought in 1992 for 10 and whose present stock price is 100 The tax rate on all profits is 40% • What is the Net Asset of the Saigon Hotel ? Vietnam Master in Management – HCMC 2003 Valuation Price-earning Ratio • A second valuation method for a company is the PriceEarning Ratio (PER) • The Price-earning Ratio is equal to the value of the company divided by the net result PER V / EAT • For listed companies it can be calculated directly by dividing the share price by the net result per share eps = EAT / nshares PER = pshare / eps Vietnam Master in Management – HCMC 2003 Valuation Price-earning Ratio • The PER is higher for a company with higher growth prospects for the earnings • the risks being equal with lower risks • the growth prospects being equal • The PER is published daily in the financial papers on the financial Websites (cfr bourses) Vietnam Master in Management – HCMC 2003 Valuation Price-earning ratios Examples (Oct 30, 2001) Company Vodafone (GBP) Telecom Ita Mob British Telecom France Telecom Volkswagen Renault LVMH pshare 157,8 5,9 3,4 40,0 41,7 32,8 38,2 Vietnam Master in Management – HCMC 2003 eps PER 3,48 0,29 0,13 ? 5,87 4,49 ? 45,3 ? ? 28,3 7,1 ? 25,7 Valuation Price-earning ratios Examples (Oct 30, 2001) Company Vodafone (GBP) Telecom Ita Mob British Telecom France Telecom Volkswagen Renault LVMH pshare 157,8 5,9 3,4 40,0 41,7 32,8 38,2 Vietnam Master in Management – HCMC 2003 eps PER 3,48 0,29 0,13 1,41 5,87 4,49 1,49 45,3 20,5 26,2 28,3 7,1 7,3 25,7 Valuation Price-earning ratios Historic (Nov 2, 2000) Company Vodafone (GBP) Telecom Ita Mob British Telecom France Telecom Volkswagen Renault LVMH pshare 35,3 10,1 7,6 121,9 59,3 56,5 85,4 Vietnam Master in Management – HCMC 2003 eps PER 1,73 0,23 0,32 2,71 2,93 2,23 7,17 20,4 43,3 24,1 45,0 20,2 25,3 11,9 Valuation Price-earning ratios - exercises • What is the value of the Saigon Hotel in 2002 EAT = 432.000 $ PER = 15 • High level due to excellent location and future prospects • Explain the difference between the PER Coca-cola & Pepsico Compaq & IBM • Which industry should have the higher PER electricity or telecom classical telecom or cellular companies Vietnam Master in Management – HCMC 2003 Valuation Present Value of Dividends • Let us start from a very simple approach • Suppose that we know that the expected value of the share of a company one year from now is v1 that a dividend div1 will be paid at that time that the Cost of the Capital for this company is r • Then we can write the equation for the Present Value of the share v0 = (div1 + v1) / (1+r) Vietnam Master in Management – HCMC 2003 Valuation Present Value of Dividends • We can repeat this calculation by writing the value of the share at time 1 based upon the value and dividend at time 2 v1 = (div2 + v2) / (1+r) • and so on . . . v2 = (div3 + v3) / (1+r) • We can then write v0 = (div1 + (div2 + v2) / (1+r))/(1+r) v0 = div1/(1+r) + div2/(1+r)2 +…+ pT/(1+r)T Vietnam Master in Management – HCMC 2003 Valuation Present Value of Dividends • If we consider that the company lives in perpetuity we can write v0 = div1/(1+r) + div2/(1+r)2 +…+ divt/(1+r)t + … V0= DIV1/(1+r) + DIV2/(1+r)2 +…+ DIVt/(1+r)t + … • Or v0 = t=1 divt/(1+r)t V0 = t=1 DIVt/(1+r)t Vietnam Master in Management – HCMC 2003 Valuation Present Value of Dividends • If we consider that : the company will live in perpetuity the growth rate of the dividend is constant and equal to g • Then divt = div1.(1+g)t-1 • Gordon & Shapiro proved mathematically that v0 = div1 / (r-g) V0 = DIV1 / (r-g) of course one must have r>g • The lower the Cost of Capital the higher the value • The higher the growth rate the higher the value Vietnam Master in Management – HCMC 2003 Valuation PV of Dividends - Examples • What is the Present Value of the Quiz Company ? the next dividend will be 12.000.000 $ the Cost of Capital is 14% the growth rate of dividend (perpetual) is 2% • What is the Cost of capital of company B ? the next dividend will be 100.000 $ the present value is 1.000.000 $ the growth rate of dividend (perpetual) is 4% Vietnam Master in Management – HCMC 2003 Valuation DCF model Present Value of Free Cash Flow • An improved approach is to use the prospected Cash Flows from the Business Plan to estimate the value • The Total Entreprise Value is equal to the PV of all FCF Entreprise Value = Equity + Financial Debt Free Cash Flow before Interest • FCF = Net Operating Earning After Tax + Depreciation • Net Operating Earning After Tax (NOPAT) = EBIT.(1 - Tc) EV0 = t=1 FCFt/(1+r)t The Enterprise Value is equal to the PV of all Free Cash Flows « Discounted Cash Flow Model » Vietnam Master in Management – HCMC 2003 Valuation DCF Model How to use it ? • Using the Business Plan one can calculate the EV Calculating the NOPAT and the FCF • Problem : The Business Plan is made for a limited period of time 5, 10 or 20 years • We need to estimate the value of the Cash Flows after the Business Plan period Vietnam Master in Management – HCMC 2003 Valuation DCF Model Terminal Value The Terminal Value represents the EV for the perpetuity after the end of the Business Plan period • Based on the Gordon-Shapiro formula VT = DIVT+1 / (r-g) or EVT = FCFT+1 / (r-g) • T = last year of the Financial Plan « Normalized » FCF for the perpetuity FCFT+1 = NOPATT+1 • Future capex = Future depreciation (keep the production capacity) g = perpetual growth rate • To be estimated cautiously (2% to 4%) • Total Enterprise Value is then EV0 = t=1T FCFt/(1+r)t + (NOPATT+1/(r-g))/(1+r)T Vietnam Master in Management – HCMC 2003 Valuation DCF model Equity Value • The Value of the Equity is equal to The Enterprise Value (EV) Less The Financial Debt (Dfin) • All interest bearing debts – – – – Long term Short term Eventually others (if bearing interest) Less Financial placement V0 = EV0 - Dfin,0 Vietnam Master in Management – HCMC 2003 Valuation DCF - The Quiz Company Year 1 2 3 4 5 6 7 8 9 10 FCF (MUS$) 11 15 16 19 15 15 15 15 15 15 Vietnam Master in Management – HCMC 2003 Valuation DCF - The Quiz Company • Calculate the best estimation of the present value of company C if the Cost of capital is 14% if the Cost of capital is 12% Vietnam Master in Management – HCMC 2003 Valuation Saigon Hotel – DCF valuation • We will apply the DCF model to the Base Case • Using a set of assumptions Cost of Capital (r) • From 8% to 12% Perpetual growth • From2% to 4% • Example : The Base Case BPcons.xls - VALO!A2 Vietnam Master in Management – HCMC 2003 Valuation Saigon Hotel – Valuation Sensibilities Studies Assumptions Base Case Extension r = 8% g = 2% 5.499 8.330 10.624 r = 9% g = 2% 4.576 7.028 8.967 r = 9% g = 3% 5.189 7.912 10.114 r = 9% g = 4% r = 10% g = 3% r = 11% g = 3% 6.048 9.150 11.720 4.308 6.670 8.532 3.633 5.724 7.333 Vietnam Master in Management – HCMC 2003 Chain Valuation DCF – Decision tool • In order to choose the best scenario • Maximize the value Vietnam Master in Management – HCMC 2003 Valuation Summary The Values of Saigon Hotel Method Assumptions Value ($) Net asset PER PER = 15 PV of dividend PV of FCF Base Case Extension Case Chain Case 6.480 n.a. r=9% g=3% Vietnam Master in Management – HCMC 2003 5.189 7.912 10.114 Valuation Conclusions of the lesson • Creation of value is the goal of any company • For a stock listed company the market value can be observed through the stock price the fair value can differ from the market value • For non listed companies there are different methods to estimate the value Net Asset PER PV of Dividends DCF Model (PV of FCF) • The different methods can give different values Vietnam Master in Management – HCMC 2003 Valuation Synthesis of the course • Begin with the strategy • Build a Business Plan based on the strategy With different strategic scenarios … and sensibilities studies • The Financial Plan must be balanced Measure and improve the financial structure • Optimize the investments decisions Net Present Value maximization • In order to create value Valuation methods Optimize your Business Plan Vietnam Master in Management – HCMC 2003 Valuation