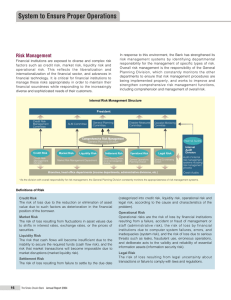

Financial Risk Management

advertisement

Financial Risk Management Course Syllabus Personal Information • • • • Instructor Name: Ming-Yuan Leon Li Instructor Tel: Ext 53421 E-mail: lmyleon@mail.ncku.edu.tw Office Hours: – Wednesday: 10:00-12:00 AM • Office Number: 63315 Course Descriptions/Objectives • Help students to better understand the topic relating to “financial risk management” by textbook studying and extra handouts. • The goals of this course are the following : – Provide quick access to the whys and how of risk management – Provide easy-to-understand information, including equations and examples that can be quickly applied to most risk management problems. – Provide information about how risk measurement is used in the management of risk and profitability Course Descriptions/Objectives • After studying the course , you should be able to answer the following four questions: – How much could we lose ? – Can we absorb a significant loss without going bankrupt? – Is the return high enough for us to take risk? – How can we reduce the risk without significantly reducing the return? Grading • • • • 1st Exam (25%): held in the 7th week 2nd Exam (25%): held in the 13th week 3rd Exam (30%): held in the 18th week Class participation (20%) Grading – Class participation • Homework –Writing report and/or oral report • Quick Quiz –In the ending of each chapter, I will provide a quick quiz including several simple questions to review today's content –Your performance will be evaluated into your score Textbook • Chris Marrison, Fundamental of Risk Measurement – Book store: 新陸書局 – Mr. 江, 0936-968488 – TEL: 02-2381-9277 Course Calendar/Schedule • Before 1st Exam: – The Basic of Risk Management (Ch 1 to Ch 2) – Market Risk Management (Ch 5 to Ch 8) • Between 1st and 2nd Exam: – Market Risk Management (Ch 9 to Ch 11) – Asset Liability Risk Management (Ch 12 to Ch 13) • After 2nd Exam: – Asset Liability Risk Management (Ch 13 to Ch 15) – Credit Risk Management (Ch 15 to Ch 19) Course Policies • The purpose of this class is to identify the hidden agenda in this subject • I will follow the textbook to present the important topics of risk management, especially for banks • It is expected that every student attend all classes and take all examinations when scheduled • In order to maximize your learning and to receive credit for your classes, you must attend at least 80% of classes Slides • The slides in PowerPoint file • How to find them – My personal web-site – http://140.116.51.3/chinese/faculty/mingyuan/ myweb11/index.htm • Some suggestions – Download them and study them before the class Certain Important Perspectives Review • What is the risk? – A potential loss in the future • How to measure the risk – Use the historical data to simulate the distribution of return rate of your portfolio – For example, 2-year data to picture the distribution curve – Assume the return rate in the next trading day will be drawn from the same distribution • How to picture the distribution? – Mean and Standard errors – Correlation coefficients Some Important Perspectives Review • Two Examples – The daily return rates of U.S. S&P 500 stock index – The daily return rates of Taiwan company: Acer 2353 Distribution of Return Rate for U.S. Market 0.35 Use 2-yea data (near 500 daily return rates data) to simulate the underlying distribution of return rates of our portfolio Assume the return rate in the next trading day is drawn from the same distribution 0.3 0.25 Rt, for t=1 to 500 Rt, for t=501,502, … 0.2 If we assume the return rate follows the normal distribution, then the potential loss can be presented by standard error 0.15 Standard0.1 error, σ Standard error, σ 0.05 0 -4 -3 -2 -1 0 1 2 3 4 Distribution of Return Rate for U.S. Market (1)If we assume the return rate follows the normal distribution, then the potential loss can be presented by standard error 0.35 (2) The P[ return rate<-2.33Xσ]=1% The P[ return rate<-1.96Xσ]=2.5% 0.3 The P[ return rate<-1.645Xσ]=5% 0.25 (3) If we assume the initial investment money is 100,000, the loss of ”>100,000X 2.33Xσ” in the next day0.2 will have 1% probability of occurrences 0.15 Standard0.1 error, σ Standard error, σ (0.94%) 0.05 0 -4 -3 -2 -1 0 1 2 3 4 Homework (1) • Please pick up one company • Figure the distributions of their daily stock price returns • One-year daily data at least • Estimate its mean and standard error • Assume the initial investment is 1 million dollars (1,000,000) • Calculate the potential 1% loss in the next day Homework (1) • Does the distribution follow a normal distribution? – Normalize the returns: (returns-mean)/SD – The 1% critical value of the distribution vs. 2.33 More Discussions • One asset versus Portfolio? – Variance and covariance/correlation – Risk contribution? – stock: 100 units, bond: 50 units; – Q: a portfolio=stock + bond: 150 units? • Normal distribution? • Other types of risk? Structure of Financial Risk Management • Define the risk – Market risk – ALM risk • ALM interest rate risk • ALM liquidity risk – Credit risk • Measure the risk – Use the historical data to picture the distribution of the loss Structure of Financial Risk Management • Manage the risk – Reduce the risk • Hedge • Diversification – Capital preparation – Risk allocation • Which unit takes the risk? – Performance evaluation • Risk-adjusted performance Market Risk Credit Risk Floating rate vs. Fixed rate: interest rate risk Long-term vs. short-term: Liquidity Risk