DSCI 3870: Management Science

advertisement

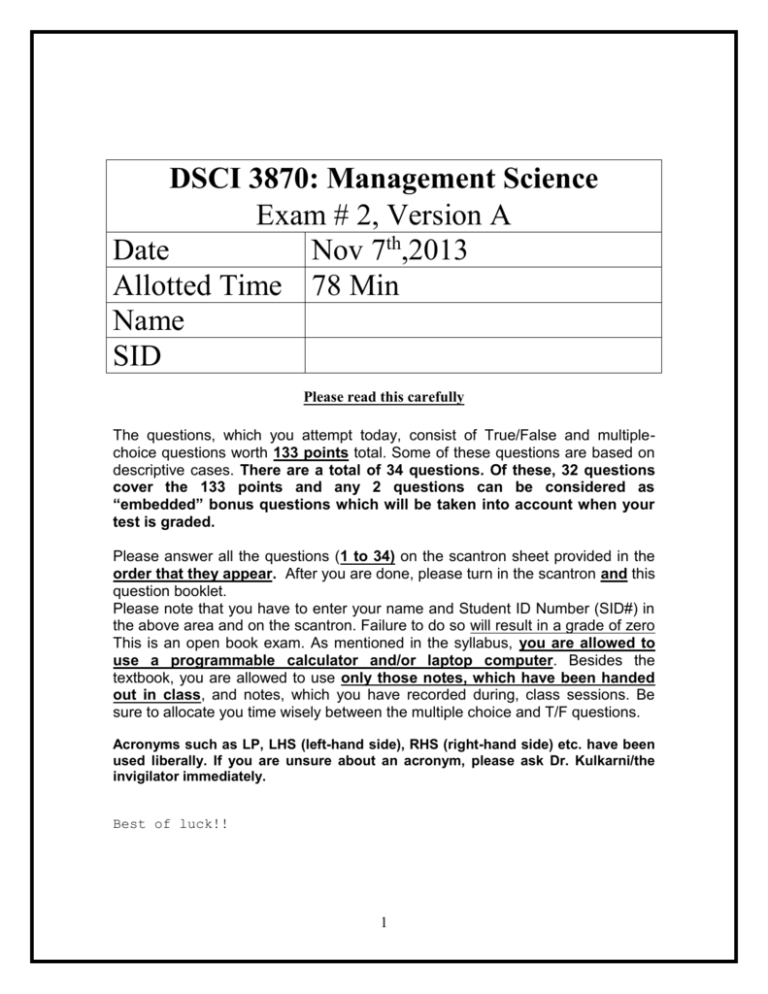

DSCI 3870: Management Science Exam # 2, Version A Date Nov 7th,2013 Allotted Time 78 Min Name SID Please read this carefully The questions, which you attempt today, consist of True/False and multiplechoice questions worth 133 points total. Some of these questions are based on descriptive cases. There are a total of 34 questions. Of these, 32 questions cover the 133 points and any 2 questions can be considered as “embedded” bonus questions which will be taken into account when your test is graded. Please answer all the questions (1 to 34) on the scantron sheet provided in the order that they appear. After you are done, please turn in the scantron and this question booklet. Please note that you have to enter your name and Student ID Number (SID#) in the above area and on the scantron. Failure to do so will result in a grade of zero This is an open book exam. As mentioned in the syllabus, you are allowed to use a programmable calculator and/or laptop computer. Besides the textbook, you are allowed to use only those notes, which have been handed out in class, and notes, which you have recorded during, class sessions. Be sure to allocate you time wisely between the multiple choice and T/F questions. Acronyms such as LP, LHS (left-hand side), RHS (right-hand side) etc. have been used liberally. If you are unsure about an acronym, please ask Dr. Kulkarni/the invigilator immediately. Best of luck!! 1 1. The amount that the objective function coefficient of a decision variable would have to improve before that variable would have a positive value in the solution is the A. dual price. B. surplus variable. C. reduced cost. D. upper limit. 2. The dual price for a constraint that compares funds used with funds available is 0.058. This likely means that A. the cost of additional funds is 5.8%. B. if additional funds can be obtained at a rate of at most 5.8%, they should be. C. if additional funds can be obtained at a rate of more than 5.8%, they should be. D. the objective function value is 5.8% 3. The range of feasibility measures A. the right-hand-side values for which the objective function value will not change. B. the right-hand-side values for which the values of the decision variables will not change. C. the right-hand-side values for which the dual prices will not change. D. each of the above is true. 4. If a decision variable is not positive in the optimal solution, its reduced cost is A. what its objective function value would need to be before it could become positive. B. the amount its objective function value would need to improve before it could become positive. C. zero. D. its dual price. 5. The objective function for portfolio selection problems usually is maximization of expected return or A. maximization of investment types B. minimization of cost C. minimization of risk D. maximization of number of shares 2 6. In the game that we played in class, I discussed an alternate solution that was not optimal (it was $10 less than the optimal in terms of profit) but it was more practical. What was the key difference between this “practical” solution versus the optimal solution? A. It involved making all products B. It involved using all the available inventory C. It involved selling leftover inventory in the open market D. It involved making some products and buying some. 7. In a linear programming problem, the binding constraints for an optimal solution are 5X + 3Y < 30 and 2X + 5Y < 20.As long as the slope of the objective function stays between _______ and _______ respectively, the current optimal solution point will remain optimal. A. 5/3, 2/5 B. 3/5, 5/2 C. 20 , 30 D. 3/2 , 1 Use the following graphical representation for a maximization problem to answer the two questions which follow. The formulation is embedded in the picture shown below : 3 Over what range can the objective function coefficient for x2 (let’s call it c2) vary, without changing the current optimal solution? A. 0 < c2 < B. 1 < c2 < 5 C. 4 < c2 < 8 D. – < c2 < 5 8. 9. A. B. C. D. What is the absolute value of the shadow price corresponding to Constraint 3? 0 2 2.5 3 The next five questions are based on the following case: A large jewelry store is placing an order with its supplier. Four types of jewelry can be ordered: necklaces, bracelets, rings, and earrings. It is assumed that every piece ordered will be sold, and their profits in dollars, respectively, are 100,120,150, and 125. There are several conditions that the store needs to worry about. One of these is the amount of display space. They decided to develop an LP model whose output determines how many necklaces, bracelets, rings, and earrings the jewelry store should order to maximize profit. Constraint 1 measures display space in units, Constraint 2 measures time to set up the display in hours. Constraints 3 and 4 are marketing restrictions that dictate maximum and minimum amounts of combinations of items that can be sold. See the formulation and MS Excel reports and answer the questions that follow. Let: X1= the number of necklaces X2= the number of bracelets X3= the number of rings X4= the number of earrings MAX:100X1+120X2+150X3+125X4 S.T. X1+2X2+2X3+2X4≤108 - (Constraint 1) 3X1+5X2+X4≤120 - (Constraint 2) X1+X3≤25 - (Constraint 3) X2+X3+X4≥50 - (Constraint 4) 4 Objective Cell (Max) Final Name Value Cell $H$5 profit 7475 Decision Variable Cells Name X1 X2 X3 X4 Final Value 8 0 17 33 Reduced Cost 0 -5 0 0 Objective Coefficient 100 120 150 125 Allowable Allowable Increase Decrease 1E+100 12.5 5 1E+100 12.5 25 25 5 Name Constraint 1 Constraint 2 Constraint 3 Constraint 4 Final Value 108 57 25 50 Shadow Price 75 0 25 -25 Constraint R.H. Side 108 120 25 50 Allowable Allowable Increase Decrease 15.75 8 1E+100 63 33 17 4 8.5 Cell $B$3 $C$3 $D$3 $E$3 Constraints Cell $F$7 $F$8 $F$9 $F$10 10. How many necklaces and rings should be stocked? A. 8 necklaces and 17 rings B. 8 necklaces and no rings C. 17 rings and 33 necklaces D. 8 rings and 17 necklaces 11. How much space will be left unused and how much time will be used? A. 108 units of space will be left unused and 63 hours of time will be used. B. No space will be left unused and 57 hours of time will be used. C. 57 units of space will be left unused and 108 hours of time will be used D. 63 units of space will be left unused and 0 hours of time will be used. 12. By how much will the marketing restriction captured by Constraint 4 be exceeded by? A. It will be exceeded by 50. B. It will not be exceeded. C. It will be exceeded by 25. D. It will be fall short by 25. 5 13. To what value can the profit on necklaces drop to and the profit on rings increase to, respectively, before the current optimal solution changes? A. 87.5 and 162.5 B. and 25 C. 12.5 and 25 D. 112.5 and 137.5 14. You are offered the chance to obtain more space. The offer is for 15 units of space at a total cost of $1500. Should you accept the offer and why or why not? A. Yes, because the marginal cost of every unit of space being offered is less than the shadow price B. No, because the marginal cost of every unit of space being offered is less than the shadow price C. Yes, because the marginal cost of every unit of space being offered is more than the shadow price D. No, because the marginal cost of every unit of space being offered is more than the shadow price Please answer the next question based on the information in the table below which displays the range of optimality for Variable 1. Variable 1 Lower Limit 60 Current Value 100 Upper Limit 120 15. What will happen to the optimal solution if the objective function coefficient for Variable 1 decreases by 20? A. Nothing. The values of the decision variables, the dual prices, and the objective function will all remain the same. B. The value of the objective function will change, but the values of the decision variables and the dual prices will remain the same. C. The same decision variables will be positive, but their values, the objective function value, and the dual prices will change. D. The problem will need to be resolved to find the new optimal solution and dual price. 16. In the 3-part video that we saw in class, one of the applications of Management Science was: A. Scheduling police officers in a major city B. Optimal placement of advertisements on websites C. Breast cancer diagnosis and prognosis D. Electricity grid optimization 6 The next four questions are based on the following case: Karga coffee roaster blends three types of coffee beans (Brazilian, Colombian and Peruvian) and sell it at Health Coffee Drink retail chain. Each kind of bean has different fat and calorie contents. Information regarding the two ingredients in the three coffee beans and cost of the three coffee beans is shown below. One pound is sixteen ounces. Brazilian Colombian Peruvian Cost ($/pound) 5 6 7 Fat (in grams/pound) 75 60 85 Calories (per ounce) 15 20 18 Karga would like to create a blend that has an average fat content of at least 78 grams/pound and it should have at least 1600 calories overall. The available quantities are 1500lb of Brazilian, 1200lb of Colombian and 2000lb of Peruvian beans. Karga wants to make 4000lb of the blend at the lowest possible cost. Let B = Pounds of Brazilian coffee beans to blend C = Pounds of Colombian coffee beans to blend P = Pounds of Peruvian coffee beans to blend 17. What is the appropriate objective function? A. Max: 5B+6C+7P B. Min: 5B+6C+7P C. Max: B+C+P D. Min: B+C+P 18. Which of the following captures the constraint on the fat requirement? A. 75B+60C+85P≥78 B. 3B18C+7P≤0 C. 75B+60C+85P≤78 D. 3B18C+7P≥0 19. Which of the following captures the constraint on calories? A. 15B+20C+18P≥1600 B. 15B+20C+18P≥100 C. 15B+20C+18P≤1600 D. 15B+20C+18P≤100 20. What does the constraint P≤2000 indicate? A. The available quantity for Brazilian bean B. The available quantity for Colombian bean C. The available quantity for Peruvian bean D. The available quantity for all bean The next four questions refer to the following case: 7 The Denton County Sheriff’s Department schedules police officers for 8-hour shifts. The beginning times for the shifts are 8:00 am, Noon, 4:00 pm, 8:00 pm, Midnight and 4:00 am. An officer beginning a shift at one of these times works for the next 8 hours. During normal weekday operations, the number of officers needed varies depending on the time of the day. The department staffing guidelines require the following minimum number of officers on duty (see the table below). The Denton County Sheriff’s Department would like to formulae a linear program and determine the number of police officers that should be scheduled to begin the 8-hour shifts at each of the six times (8:00 am, noon, 4:00 pm , 8:00 pm, midnight and 4:00 am) to minimize the total number of officers required. Let X1= the number of officers beginning work at 8:00 am, X2= the number of officers beginning work at noon, and so on. Time of Day 8:00 am - Noon Noon - 4:00 pm 4:00 pm - 8:00 pm 8:00 pm - Midnight Midnight - 4:00 am 4:00 am - 8:00 am Minimum Officers on Duty 10 6 5 6 4 7 21. An appropriate objective function would be: A. Min: 10X1 + 6X2 + 5X3 + 6X4 + 4X5 + 7X6 B. Max: 10X1 + 6X2 + 5X3 + 6X4 + 4X5 + 7X6 C. Min: X1 + X2 + X3 + X4 + X5 + X6 + X7 + X8 D. Min: X1 + X2 + X3 + X4 + X5 + X6 22. The constraint for 4:00 pm – 8:00 pm is given as: A. X1 + X2 ≥ 5 B. X2 + X3 ≥ 5 C. X1 +X2 + X3 ≤ 5 D. X1 +X2 + X3 ≥ 5 23. The constraint X1 + X2 ≥ 6 is for: A. Noon - 4:00 pm B. 4:00 pm - 8:00 pm C. 8:00 pm - Midnight D. Midnight - 4:00 am 24. Scheduling exactly 38 officers (i.e. 10+6+….+7), to begin work at 8:00 am and none to begin work at any of the remaining shift times is a feasible solution to the problem. A True B. False 8 The next three questions are based on the following case: Futurama Kitchen Appliances Ltd (FKA) produces trendy microwaves. Two of its microwave models are the market leaders. FKA Genius is one of the models and is sold for a price of $ 120 and FKA Miracle is sold for a price of $150. Producing FKA Genius requires 3 standard heating coils and 4 IC boards and producing FKA Miracle requires 2 heavy duty heating coils and 3 IC board. There are presently 90 standard heating coils and 100 heavy duty heating coils available. There are 198 IC boards available. Variable definition for the linear programming problem, the feasible region and the sensitivity analysis are provided below. You are required to answer the questions which follow using this information, the GLP figure and the MS Excel analysis as needed. Let, G = number of Genius models produced M = number of Miracle models produced M 50 48 46 44 42 40 38 36 34 32 30 28 26 24 22 20 18 16 14 12 10 8 6 4 2 0 Hv. Dty. Ht. Coil: 0.0 G + 2.0 M = 100.0 Payoff: 120.0 G + 150.0 M = 8940.0 IC Board: 4.0 G + 3.0 M = 198.0 St. Ht. Coil: 0 1 2 3 4 5 6 7 8 9 3.0 G + 0.0 M = 90.0 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Optimal Decisions(G,M): (12.0, 50.0) St. Ht. Coil: 3.0G + Hv. Dty. Ht. Coil: IC Board: 4.0G + 0.0M <= 90.0 0.0G + 2.0M <= 100.0 3.0M <= 198.0 Futurama. 1 2 3 4 5 6 7 8 A Decision Variables Quantity Profit Contribution Subject To Stand Coil Heavy Duty Coil IC Boards B Genius C Miracle 120 150 Profit 8940 2 3 LHS 36 100 198 3 4 9 D E F <= <= <= RHS 90 100 198 G Microsoft Excel 12.0 Sensitivity Report Adjustable Cells Final Reduced Cell Name Value Cost $B$3 Quantity Genius 12 0 $C$3 Quantity Miracle 50 0 Objective Coefficient 120 150 Allowable Increase 80 1E+30 Allowable Decrease 120 60 Constraint R.H. Side 90 100 198 Allowable Increase 1E+30 32 72 Allowable Decrease 54 48 48 Constraints Cell $D$7 $D$8 $D$9 Name Stand Coil LHS Heavy Duty Coil LHS IC Boards LHS Final Value 36 100 198 Shadow Price 0 30 30 25. What is the allowable increase for the RHS value of the constraint “Heavy Duty Coil”? A. 32 B. 30 C. 48 D. 72 26. What is the allowable decrease for the RHS value of the constraint “IC board”? A. 32 B. 30 C. 48 D. 72 27. What is the shadow price for the “IC board” constraint in the above sensitivity analysis? A. 32 B. 30 C. 48 D. 72 10 The next three questions are based on the following case: An ad campaign for a new snack chip will be conducted in a limited geographical area and can use TV time, radio time, and newspaper ads. Information about each medium is shown below. Medium Cost Per Ad # Reached TV Radio Newspaper 500 200 400 10000 3000 5000 Exposure Quality 30 40 25 If the number of TV ads cannot exceed the number of radio ads by more than 4, and if the advertising budget is $10000, develop the model that will maximize the number reached and achieve an exposure quality if at least 1000. Define variables as follows: Let, T = the number of TV ads R = the number of radio ads N = the number of newspaper ads 28. What is the appropriate objective function? A. Min.10000T + 3000R + 5000N B. Min.30T + 40R + 25N C. Max.10000T + 3000R + 5000N D. Max.30T + 40R + 25N 29. What does the constraint 500T + 200R + 400N 10000 capture? A. Exposure requirement B. Reach requirement C. Budget restriction D. Objective function 30. The restriction on TV ads relative to radio ads is captured by the constraint: A. T - R 4 B. T - R > 4 C. T – 4 R > 0 D. T – 4 R < 0 11 Please answer the next four questions based upon the case given below and the attached MS Excel output: Mamma Mia Coffee Inc., one of the largest coffee producing companies in Italy, produces two types of coffees. Coffee 1 and Coffee 2 are produced by processing raw coffee beans. Up to 103.33 lb of raw coffee beans may be purchased at a cost of $18/lb. One pound of raw coffee beans can be used to produce either 1.5 lb of Coffee 1 or 0.55 lb of Coffee 2. Using a pound of raw beans to produce 1.5 lbs of Coffee 1 requires 3.0 hours of labor and to produce 0.55 lb of Coffee 2 requires 2.5 hours of labor. A total of 280 hours of labor are available, and at most 160 lbs of Coffee 1 and Coffee 2 taken together can be sold. Not more than 80 lbs of Coffee 2 and not more than 50 lbs of Coffee 1 can be sold. Coffee 1 sells for $45/lb, and Coffee 2 sells for $57/lb. (Yes, they are that expensive; they are imported Baba Budan coffees from the famed Nilgiri Hills plantations). Let, B = lbs of raw beans processed C1 = lbs of raw beans used to produce Coffee 1 C2 = lbs of raw beans used to produce Coffee 2 To maximize profit, Mamma Mia Coffee Inc. should solve the following LP: Max. (45×1.5)C1 + (57×0.55) C2 – 18 B s.t. B > C1 + C2 (Constraint 1) 3.0 C1 + 2.5 C2 < 280 (Constraint 2) B < 103.33 (Constraint 3) 1.5 C1 + 0.55 C2 < 160 (Constraint 4) 0.55 C2 < 80 (Constraint 5) 1.5 C1 < 50 (Constraint 6) C1, C2, B > 0 Using the Excel output shown on the next page, answer the following questions. 31. If Coffee 1 sold for $47/lb, then the new optimal profit would_________. A. stay the same B. increase by @ $33.33 C. increase by @ $100 D. increase by $67.5 12 32. Next month, the shipment of raw beans is going to be limited to 100 lbs. due to a change in packaging standards. What is the new optimal profit? A. @ $2571 B. @ $2598 C. @ $2581 D. @ $2540 33. Considering the current optimal production plan, what is the most that Mamma Mia Inc. should be willing to pay for another hour of labor? A. $18 B. $28 C. $22 D. Nothing 34. What would be the new optimal profit of Mamma Mia Inc., if they found out that market conditions dictate at most 40 lbs. of Coffee 1 being sold henceforth? A. $2560.4 B. $2574.5 C. $2343.5 D. $241 ANSWER REPORT: Target Cell (Max) Cell $D$5 Name Profit Original Value 0 Final Value 2584.5 Original Value 0 0 0 Final Value 33.33 70 103.33 Adjustable Cells Cell $A$2 $B$2 $C$2 Name C1 C2 B Constraints Cell Name $E$8 Constraint 1 $E$9 Constraint 2 $E$10 Constraint 3 $E$11 Constraint 4 $E$12 Constraint 5 Cell Value 0.00 275 103.33 88.50 38.50 Formula $E$8>=$G$8 $E$9<=$G$9 $E$10<=$G$10 $E$11<=$G$11 $E$12<=$G$12 13 Status Binding Not Binding Binding Not Binding Not Binding Slack 0.00 5 0 71.50 41.50 $E$13 Constraint 6 50.00 $E$13<=$G$13 Binding 0 SENSITIVITY REPORT: Adjustable Cells Cell $A$2 $B$2 $C$2 Name C1 C2 B Final Value 33.333 69.997 103.330 Reduced Cost 0.000 0.000 0.000 Objective Coefficient 67.5 31.35 -18 Allowable Increase 1E+30 36.15 1E+30 Allowable Decrease 36.15 13.35 13.35 Final Value 0.00 275 103.33 88.50 38.50 50.00 Shadow Price -31.35 0.00 13.35 0.00 0.00 24.10 Constraint R.H. Side 0 280 103.33 160 80 50 Allowable Increase 70 1E+30 2 1E+30 1E+30 15.025 Allowable Decrease 2 5 70 71.5 41.5 50 Constraints Cell $E$8 $E$9 $E$10 $E$11 $E$12 $E$13 Name Constraint 1 Constraint 2 Constraint 3 Constraint 4 Constraint 5 Constraint 6 14