gameStop Corp. (GME) analysis & evaluation

advertisement

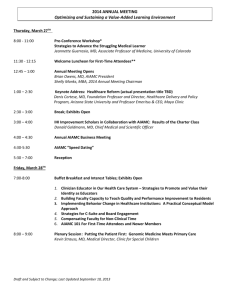

GAMESTOP CORP. (GME) ANALYSIS & EVALUATION Jonathan Jaeger August 15, 2013 UW-Milwaukee BUS ADM 600 Data & Factual Information Collection GameStop (GME) Corporation falls into the investment sector called consumer discretionary, more specifically specialty retail and consumer electronics. According to NPD Group, Inc., a market research firm, the electronic game industry was approximately a $13 billion market in the United States in 2012. (GME 10-K, 2013) Other firms that fall into this category and/or are close competitors include; Best Buy (BBY), H.H. Gregg (HGG), and RadioShack (RSH). In this analysis I will be using GME as the focal firm and the other three firms to draw comparisons within the industry. Overall GME is a very well-run firm with solid senior leadership which has a grasp on changing global segments and upcoming concerns. The last 52-week stock prices are indicative of the firms current market position, GME has had an outstanding run, starting at $15.75 and increasing to nearly $50, an impressive gain by any standard. This gain has come before the lagging release of two new video gaming platforms, the new XBOX ONE and PlayStation 4. You many ask why this is such an impressive feat? The answer lies in the chart below, which displays the cyclical track history of GME stock price compared to new platform release. The release of new platforms and product lines has historically spurred on additional sales; in fact GME has already collected revenue in the form of pre order sales for these new systems and related products. Realizing this trend, it is possible that intelligent investors are getting ahead of the anticipated increased leap in stock price. Alternatively, if the sales are less than expected than GME could be in for a drastic decrease in stock price. This brings up the high short interest that the company also has, nearly 31% as of July 12, 2013. This short interest represents a large amount of people whom believe that GME stock is overvalued right now and is going to decline in the near future. Prior to July the industry was on edge waiting to hear from both Sony and Microsoft if their new platforms would offer replay of older games. If the new platforms wouldn’t have the capability to play old games, the company’s bottom line would be drastically reduced and would cripple stores. GME and other second tier retailers were elated with to hear that both platforms will offer replay of older games on their systems. (Zimmerman, 2013) The announcement spurred a 7.8% stock surge and meant that GME could continue operations as normal and shift focus back to other company planning. In light of the delayed platform releases and potential console changes, GME became aware of their potential to fail in the market if they didn’t revise their business model. The relationship between GameStop and console developers is good, however, in the business world companies are always trying to cut costs and increase revenues. A cyclical industry that relies so heavily on new consoles leaves a concern for future returns and sustainability. To overcome this problem GME has dug deep into their pockets and rapidly engaged in market acquisitions worldwide. They have implemented systems and started to offer additional products, including the resale and repair of smartphones and tablets. The revenue that GME recognized from related sales and repairs in FY 12’ was $1.5 billion. This number is inflated due to reporting of the “other” segment which includes PC entertainment and other software, digital products and currency, mobile products, including tablets and refurbished mobile devices, accessories and revenues associated with Game Informer magazine and the Company’s PowerUp Rewards program. Like many other companies including Best Buy (BBY), GME started a paid loyalty program in 2010, which allows its customers to apply credit to their account based on past purchases. The PowerUp Rewards program has 22.3 million members, 7.9 million of which are paid members. These paid members received a monthly issue of Game Informer, GME’s own magazine, which recognizes additional advertising revenue and free promotion for their company. The decision to expand business into the tablet and smartphone segment can be derived from a report by the Entertainment Software Association (ESA), which estimates that the average U.S. household owns at least one game console, PC or smartphone. This information provided an avenue for diversification and additional revenues. Additionally, 49% of U.S. households own on average two game consoles. These aforementioned trends are expected to continue and should play directly into GameStop’s business model. Industry Competition One of GME’s rival companies, RadioShack is currently engulfed in a downward spiral and looking for any way to recover from poor planning, failed ventures, and an identity crisis. This makes it clear that not all companies are created equally and set for boundless success; even companies like RadioShack which have experienced years of triumph are susceptible to economic downturns and poor planning. According to Wall Street Journal writer, Drew Fitzgerald, the RadioShack CFO has stepped down and his company has continued to liquidate assets in an attempt to pay off long term debt that will come due near the end of 2013. This is one sure sign that a company is in financial trouble, another is when a company suspends long running dividends and aren’t expanding into new financial ventures. In comparison, GME introduced quarterly dividends and has acquired multiple new business ventures. The first time quarterly dividends started in FY 12’ and totaled $1.10 per share annually. Other problems that RadioShack faces are low inventory turnover, excessive product markdowns, and poor cash flows. Poor cash flows comprise a company’s ability to invest in new products and opportunities, shift their focus, and to pay short term debt. RSH can say they want to carry fewer products but in reality, they probably cannot afford to purchase or hold these products either. RadioShack’s last ditch effort to save their entrenched company involves marketing their highest gross profiting products and eliminating lowest grossing products in their stores. The chart below depicts the steep decline in consumer discretionary stock prices and specifically specialty retail stock prices. While the entire sector is attempting to revamp their business model, some companies have been more successful than others. RSH was and is very poorly positioned, BBY was in a tough position last year, and GME and HH Gregg are best positioned at this time. While Best Buy isn’t in as bad of a position as RSH and has seen a 128% gain YTD in 2013, it was facing an identity crisis and struggling to escape the “showrooming” effect, where customers come to play and touch products before seeking alternative places to purchase. In an attempt to survive, BBY struck contracts with Microsoft and Samsung, which carve out unique kiosk areas within existing Best Buy stores. The inventive strategy by Best Buy will generate sq. ft. leasing revenue but may not be enough to keep them above water and looking at a situation similar to RadioShack in the future. BBY took additional actions which included selling 50% stake in its European businesses, closing unsuccessful stores nationwide and focusing on smaller stores, shifting to online retail, and hiring/training better sales staff (Jakab, 2013). While competitors downsized their companies, GME conversely has shifted its business to include more sectors, including pre-owned games, cell phone resale and repair, tablet resale/repair, media player resale and digital content. In 2012, this new segment offered 27.4% or 2.4 B to GameStop’s revenue. This section of revenue also has the highest gross profit margin at 48.1%, significantly higher than total gross profit of 29.8%. GME’s international segments include 6,602 Company-operated stores in the United States, Australia, Canada and Europe and have continued to produce positive revenue for the firm. These international extensions have done so well, GME plans to expand their global footprint. GME isn’t totally invulnerable to poor decision making, in 2012 it did record a goodwill impairment loss of $627 million, leaving GME with 1.4 billion in goodwill. $467 million of the impairment loss was attributed to the acquisition of MicroMania, a French based video game retailer. MicroMania’s trade name was impaired due to revenue forecasts that had declined since the initial valuation (Pg. 42, GME 10-K). Firm Performance Comparison Below is the 5-yr stock price history for RadioShack, and GameStop (RSH; & GME). After that there is a comparison of all four firms stock prices on one graph, comparing them latterally and longitutnally. 5-Yr Stock Price History- Radio Shack, Corp (RSH) 5-Yr Stock Price History- GameStop, inc (GME) 5-Yr Four Company History (BBY; HGG; RSH; & GME) . VRINE & SWOT Analysis The VRINE model is used to determine if your company or product can sustain a competitive advantage in an industry. It is comprised of valuable, rare, inimitable/nonsubstitutable, and exploitable. In an industry like consumer discretionary which relies so heavily on a strong economic standing and loyal customer base, having a valuable resource or capability is a must. GME does have a valuable and distinguishable brand name and convenient locations. It competes in a small niche market and relies heavily on customers for supplies and 3rd party companies for the product base. GameStop (GME) Distribution Network Valuable Brand Recognition Early Arriver Advantage Rare Product-NO Service- YES Product-Absolutely Inimitable Service- Attainable, but difficult Non-substitutable Few Exploitable Absolutely GME has many business strategies in place and already working hard for them, including; being the industry leader position, existing contracts, great standing with other gaming industry leaders, which leads to bargaining power and leverage, and finally their outstanding brand recognition worldwide. Not everything about GameStop is good however, the chart above makes it quite obvious that this business model if not free from competition. The business is easy to start up and the products they sell are available and not rare. Having said that, the barrier to entry within this market are quite steep due to companies like Wal-Mart and Target whom also offer video games, PC games and software, and accessories. These companies have such small margins and order in bulk, which blocks out much of the competition. Luckily for GME, they established themselves early enough in the market and built a competitive advantage by establishing and exploiting their supply channels. GME drove a stake in between itself and megastores (Wal-Mart) by choosing to cater to niche clientele who appreciate a knowledgeable staff which possess a noticeable appreciation for gaming. This strategy was a cornerstone decision which helped successfully establishing GME and energizes customers to return. GME has become even better at exploiting their resources and capabilities, introducing an online interface which allows customers to trade or exchange games for cash, other games, or in store credit. Their new online store front is well organized and enhanced for customer interaction. This exploitation of resources and capabilities contributes to maintaining their sustainable competitive in an aggressive and changing specialty retail market. Strengths Loyalty Program- Magazine Subscription add-on Inventory Management System Recent Acquisitions Two Large Distribution Centers with Strategic locations Debt Free- Last 2 yrs. Opportunities Mobile/Casual/Browsing/Social Gaming 3rd Party Products Online Game Trading Interface Expand Mobile Business Further investment in Inventory Management System Weaknesses Heavily rely on Asian distributors Overpayment of MicroMania Short Interest in Stock Mobile/Casual/Browsing/Social Gaming Dense US Revenue Concentration Internal Threats Delayed Release of Gaming Platforms Economic Outlook directly correlates to consumer discretionary spending Mobile/Casual/Browsing/Social Gaming Piracy IT Security- Data Breaches Online Game Content External Five Forces Analysis The five forces framework was designed as an industry analysis tool and strategic development which will evaluate if a company is attractive in a given market. It is similar to SWOT analysis but conveniently consists of five factors which help make businesses more profitable and aware of industry changes. The five forces include: threat of new entrants to the market, threat of substitute products/services, bargaining power of customer, bargaining power of suppliers, and intensity of competition within an industry. For the specialty retail industry, GME is currently well positioned in a dangerous niche, however, this could quickly deteriorate if the economy crashes again or the new gaming systems are a failure. The threat of new entrants is quite limited, given the fierce competition that it would face. There are many small startup gadget repair operations that are stated every day, with limited overhead and similar technical skills. The trust and brand recognition that GameStop commands in the market is a valuable asset. The name alone conveys what the company does for a business and the large chain that spans the US and international markets are invaluable. Customers love it when they can travel across the country and the same business is there and will honor loyalty programs, returns, exchanges, and familiar service and products. Additionally, this industry isn’t a highly profitable business in and of itself; therefor it isn’t attractive to new incumbents. The threat of substitute products or service within this market is a problem; the products that GME offer are exactly the same as that which is offered at rock bottom prices at Wal-Mart, online, and hundreds of other stores worldwide. Where GME differs is the reselling, refurbishing, and exchange of older console games. More than anything, loyal customers look forward to interacting with other loyal gamers and a knowledgeable staff that is often equally into gaming. Bargaining power in the specialty retail industry is skewered in GME’s favor. GME offers to buy old games from customers at low prices and resells them with a markup. There are limited other stores that offer any better prices or a better selection to exchange from. To further handcuff customers, the loyalty program was implemented and keeps customers coming back to use saved points from previous transactions. The suppliers in this industry are interestingly enough the consumers themselves, known as a consumer supply chain. (Chasan, 2013) GME provides the storefront and money up front for the exchange, but customers provide a portion of the merchandise. Saying this, the customer lacks the right to haggle for prices, but can elect to privately sell their game on an online media terminal. GME purchased Buy MyTronics in March of 2012, which filled their void in online retailing of mobile devices and tablets. Their acquisition of Kongregate, in August of 2010 eliminated their weaknesses in mobile/casual/browser/social gaming. By purchasing Kongregate GME has an online and mobile gaming site that hosts 74,199 games and generates 15 million unique visitors per month. The success of this site is generated from selling advertising space and virtual currency to advance in free gameplay. Determining which game will striking it rich in the world of mobile gaming is quite hard to pin point, however, this is a good start for GME. The latest addition is Spawn Labs; a game streaming service, which could become a large revenue source for GME if it proves itself not only reliable but also has a user friendly interface. The market is quite intense and there is limited room for price fixing and customers are price elastic. Right now all companies are looking for any way to save money and customers aren’t any different. Most consumers enjoy the convenience of online transactions and quickly evaluating the best valued product. GME’s closest direct competitors include; Best Buy, Wal-Mart, and Amazon. In comparison to Best Buy, GME is positioned well in a more specific and niche market, limiting their overhead and product variety. Final Recommendations Based on the SWOT analysis and analytical analysis of GME, I believe that the company is destined for an upside of an additional $10-15 stock jump following the initial introduction of the new consoles. Six to twelve months later the stock will deprecate down and settle around $40-47. The next quarter will have a huge bearing on the next year and most likely longer, until the next platform release. There are a few avenues that GameStop senior managers could consider in order to maintain their competitive advantage within the intensely competitive industry. As explained earlier, the majority of threats and concerns have already been addressed by GameStop; they have attempted to eliminate their weaknesses by diversifying, through acquisitions and expanding their markets and product lines and eliminating under producing stores globally. The constant threat of information technology security has been mitigated with the use of secure technology and the GameStop brand is a good platform to build customer trust upon. The online gaming content and internet sales are substantially upgraded from years past and continue to provide customers the convenience and competitive pricing they desire. The final recommendation that I can provide for GameStop’s top managers is to continue to stay vigilant and adapt to the every changing consumer market and evolving technology. Data Analysis Sources This research report is a combination of data research, graphical analysis, logical considerations, and my personal forward looking opinions. The below listed websites, SEC Financial Reports, and Analyst Reports were the sources in which helped derive the information within this report. Articles 1. Fitzgerald, D., & Zimmerman, A. (2013, April 23). Latest loss raises hurdles for radioshack. Wall Street Journal. Retrieved from http://online.wsj.com/article/SB10001424127887324874204578440363579 665432.html?KEYWORDS=radioshack 2. Jakab, S. (2013, May 20). Best buy’s comeback story worth a read. Wall Street Journal. Retrieved from http://online.wsj.com/article/SB10001424127887323463704578495353955 994718.html?KEYWORDS=best buy 3. Chasan, E. (2013, May 22). Gamestop CFO: Bartering helps fill the gap between new consoles. CFO Report-Wall Street Journal. Retrieved from http://blogs.wsj.com/cfo/2013/05/22/gamestop-cfo-bartering-helps-fill-thegap-between-new-consoles/?KEYWORDS=GameStop 4. Zimmerman, A. (2013, June 11). Gamestop investors cheer sony’s embrace of used games. Wall Street Journal. Retrieved from http://online.wsj.com/article/SB10001424127887323495604578539613330 793012.html?KEYWORDS=GME 5. Fitzgerald, D. (2013, July 23). Radioshack pushes to clear inventory. Wall Street Journal. Retrieved from http://online.wsj.com/article/SB10001424127887324783204578623472213 498886.html?cb=logged0.28164506307803094 6. Fitzgerald, D., & Jones, K. (2013, August 1). Junk-rated debt is lowered another notch, boosting pressure on retailer. . Retrieved from http://online.wsj.com/article/SB10001424127887324635904578642552575 601708.html?KEYWORDS=radioshack Graphs RadioShack http://finance.yahoo.com/charts?s=RSH#symbol=rsh;range=5y;compare=;indicator=volu me;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=undefined; GameStop http://finance.yahoo.com/charts?s=GME#symbol=gme;range=5y;compare=;indicator=vol ume;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=undefined; -RSH; GME; BBY; & HGG 5yr compared stock price history http://finance.yahoo.com/charts?s=HGG#symbol=hgg;range=5y;compare=bby+gme+rsh; indicator=volume;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=undefi ned; 10-K Filings and Financial Reports GameStop https://research.ameritrade.com/wwws/stocks/secfilings/filing.asp?data=B64ENCeyJEb 2N1bWVudEtleSI6IjEzNi0wMDAxMTkzMTI1MTMxNDA0NDMtN0RCSFFSQkg0MlR UUjlGMzVQS0hOOVYxSE8iLCJGT1JNQVQiOiJIVE0iLCJGT1JNX1RZUEUiOiIxMC1 LIiwiQ0FURUdPUlkiOiJBbm51YWwgRmluYW5jaWFscyIsIkRvY3VtZW50RGF0ZSI6Ij IwMTMtMDQtMDMgMjA6MzA6MTEiLCJEb2N1bWVudERhdGVfZiI6IjA0LzAzLzIwM TMiLCJBTUVOREVEIjpmYWxzZSwiQU1FTkRFRF9mIjoiIn0= https://www.google.com/finance?q=GME&ei=UP_eUeiSJseBrAGQ0gE https://wwws.ameritrade.com/ RadioShack https://www.google.com/finance?q=NYSE%3ARSH&fstype=ii&ei=dhHfUajOJ4KGrgHQ xQE https://research.ameritrade.com/wwws/stocks/secfilings/filing.asp?data=B64ENCeyJEb 2N1bWVudEtleSI6IjEzNi0wMDAwMDk2Mjg5MTMwMDAwMTAtMVRNVTczNDU0T UkzNUNKVFFIRUNWTTRQTksiLCJGT1JNQVQiOiJIVE0iLCJGT1JNX1RZUEUiOiIx MC1LIiwiQ0FURUdPUlkiOiJBbm51YWwgRmluYW5jaWFscyIsIkRvY3VtZW50RGF0Z SI6IjIwMTMtMDItMjYgMTI6MDk6MDciLCJEb2N1bWVudERhdGVfZiI6IjAyLzI2LzI wMTMiLCJBTUVOREVEIjpmYWxzZSwiQU1FTkRFRF9mIjoiIn0= https://www.google.com/finance?q=NYSE%3ARSH&fstype=ii&ei=dhHfUajOJ4KGrgHQ xQE Best Buy 10-K reports http://phx.corporate-ir.net/phoenix.zhtml?c=83192&p=irol-reportsannual HH Gregg 10-K reports http://www.sec.gov/Archives/edgar/data/1396279/000119312512244215/d340850d10k.ht