Copyright Notice. Each module of the course manual may be viewed online, saved

to disk, or printed (each is composed of 10 to 15 printed pages of text) by students

enrolled in the author’s accounting course for use in that course. Otherwise, no part of

the Course Manual or its modules may be reproduced or copied in any form or by any

means—graphic, electronic, or mechanical, including photocopying, taping, or

information storage and retrieval systems—without the written permission of the

author. Requests for permission to use or reproduce these materials should be mailed

to the author.

Module 11

Table of Contents

a.

I.

II.

III.

IV.

V.

©2009

Assignments

Liabilities

Definitely Determinable Liabilities

Estimated Liabilities

Contingent Liabilities

Payroll Liabilities

Craig M. Pence. All rights reserved.

Instructions:

Click on any of the

underlined titles in the

table of contents to be

directed to that section

of the module. Click

on the <back> symbol

to return to the table of

contents.

2

Accounting Course Manual

Module 11 Assignments

Many assignments are

done on CengageNow.

Click here for information

and instructions.

(a). Module 11 Reading Assignment:

Read this document from its beginning to the end. Read the textbook from

the beginning of chapter 11 to the end.

(b). Online CengageNow “Study Tools:”

Select “Study Tools” in CengageNow, and

Play the CengageNow “Lectures” for all parts of the chapter.

View all “Animated Examples” for all parts of the chapter.

You are welcomed to use any of the other resources on CengageNow,

but they are not assigned. All other activities are optional.

(c). Online CengageNow “Assignments:”

Select “Assignments” in CengageNow, and work as many of the

Practice Problems as you feel you need to work in order to fully

understand the material. Practice problems are not scored and do not

affect your grade. Next, complete the Assigned Problems in

CengageNow. These assigned problems are scored and recorded and will

affect your grade.

(1). Practice Problems 11:

Exercises #11-2, 4, 6, 8, 11, 18

Problems #11-1A and 11-2A

Note: Practice exercises and problems may be worked on CengageNow by selecting

“Module 11 Practice” from the assignments list, or they may be done with paper and

pencil. If they are done on CengageNow, answers will be displayed when the problem is

submitted for correction. If done on paper, the solutions to the practice exercises can be

found on the Moodle course site.

(2). Assigned Problems 11 to be done on CengageNow:

Problems #11-1B and 2B.

Note: Assigned problems must be done on CengageNow. Select “Module 11 Assignment”

from the assignments list. Hint: Remember that problems 11-1A and 11-2A are similar to

the assigned problems, and that the solutions to these problems are available on the

Moodle course page. Refer to them and use them as a guide if you run into trouble with

the assigned problems.

(3). Examination 1 over modules 8 through 11 is now due.

After finishing the assigned problems on CengageNow and taking examination 1,

proceed to Module 12.

©2009 Craig M. Pence. All rights reserved.

Accounting Course Manual

3

Module 11 Summary

I.

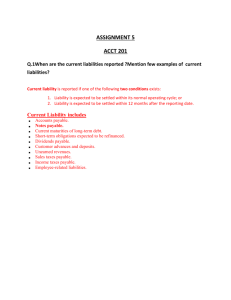

Liabilities are defined as legal obligations for the future payment of assets or

the future performance of services. Current liabilities are obligations that will

be satisfied within one year or less.

A.

If material, the notes to the financial statements will disclose details

regarding the current liabilities (the name of the lender, the interest rate,

special credit arrangements, etc.)

B.

Current liabilities may be definitely determinable liabilities (no

uncertainty exists regarding the amount or the payment date), estimated

liabilities (a liability definitely exists but the amount and/or payment

date is not known with certainty), or contingent liabilities (a liability

does not exist now but will if a particular event happens in the future).

<back>

II.

Definitely Determinable Current Liabilities:

A.

Accounts payable -- the trade accounts introduced earlier in our

course.

B.

Notes payable – promissory notes.

1.

The company may establish a line of credit with its bank (a

guarantee that loans up to a maximum amount will be approved) to

ensure liquidity. A promissory note is signed when the company

borrows against its line of credit.

2.

Notes Payable is the account used to record obligations

documented by signed promissory notes.

3.

The same rules regarding the determination of maturity dates,

maturity values are applied to notes payable as were previously

discussed regarding notes receivable (see Module 8).

C.

Entries for Notes:

1.

When the note is issued, the Notes Payable account is credited:

Cash (or Equipment, etc.)

Notes Payable

$100,000

$100,000

To record the issuance of a $100,000, 12%, 30-day note.

©2009 Craig M. Pence. All rights reserved.

4

Accounting Course Manual

2.

When paid at maturity, the entry is:

Notes Payable

Interest Expense

Cash

$100,000

$ 1,000

$101,000

To record the payment of note with interest ($100,000 x 12% x

30/360 = $1,000).

3.

If an adjusting entry for accrued interest expense is made and is not

reversed, the entries for the adjustment and the final payment of

the note are:

Interest Expense

Interest Payable

$X

$X

To adjust for accrued interest.

Notes Payable

Interest Payable

Interest Expense

Cash

$X

$X

$X

$X

To record payment of note.

D.

Discounted Notes Payable. Normally, the interest rate is stated on the

face of the note. This is referred to as an interest-bearing note payable

and it is accounted for as shown above. However, the interest may simply

be included in the face value of the note with no interest rate stated on the

face of the note at all. This is referred to as a non-interest bearing, or a

discounted note payable.

1.

When interest is included in the face value, the proceeds from the

note will be less than the face value. The difference is the discount,

or what will become interest expense over the life of the loan. IF the

loan will mature during the current accounting period, the entry to

record the origination of the note can be made as follows:

Cash (or other asset)

Interest Expense

Notes Payable

$100,000

$1,000

$101,000

To record the issuance of a discounted $100,000, 12%, 30-day note.

2.

If the loan is recorded as shown above, the payment of the note at

maturity will be recorded as illustrated below. The debit to interest

expense has already been made in the previous entry, so no

additional entry to interest expense is necessary.

©2009 Craig M. Pence. All rights reserved.

Accounting Course Manual

Notes Payable

Cash

5

$101,000

$100,000

To record the payment a $100,000, 12%, 30-day discounted note.

E.

When the discounted note will not be paid within the current accounting

period, the entry to record the origination of the note will be more

complicated. The debit to Interest Expense cannot be made, as shown

above, because the expense has not yet been incurred. In this case, a

Discount on Notes Payable account is debited instead:

Cash (or other asset)

$100,000

Discount on Notes Payable

$1,000

Notes Payable

$101,000

The Discount account is a contra-account to Notes Payable, and is

subtracted from the balance in Notes Payable to determine

the carrying value of the note. When interest expense has

been incurred, the discount account is credited and Interest

Expense is debited. The entry to record the payment of the

note above would be:

Notes Payable

$101,000

Cash

$101,000

Interest Expense

$1,000

Discount on Notes Payable

$1,000

E.

The Current Portion of Long-Term Debt represents any part of a

long-term liability that must be satisfied within the coming year. This

occurs when a long-term liability (such as a car loan) is paid in monthly

installments. In this case, the next 12 monthly payments represent a

current liability, but the remainder of the payments are long-term. In these

cases, the current portion of the balance in the liability account will be

reported under Current Liabilities. The remainder of the balance in the

long-term liability account will be reported under the Long-Term

Liabilities heading on the balance sheet.

F.

Payroll liabilities represent another definitely determinable liability.

They are discussed in depth in Part V below.

<back>

III. Estimated liabilities are recorded when it is known that a liability exists

but the amount is uncertain. Examples include the following cases:

©2009 Craig M. Pence. All rights reserved.

6

Accounting Course Manual

A.

Vacation pay expense and liabilities are incurred throughout the year as

employees work and earn the right to take paid vacations. The expense

must be recorded along with the liability for its payment evenly through

the year in order to match revenues and expenses.

B.

Pensions and other post-retirement benefits are provided to

employees as a part of their wage packages, and they are therefore

"earned" each day that the employees work just as vacation pay is earned.

Therefore, these future costs should be recognized in the same way that

salaries and vacation pay expenses are recognized and recorded as an

expense incurred in the period.

1.

Defined contribution plans provide for a contribution to the

retirement plan in the current period that is expected to be

sufficient to provide for the future obligation when it arises. There

will be nothing more required of the employer, no matter how little

has actually accumulated in the fund when employees retire. This

only requires a debit to Pension Expense and a credit to Cash or

to a liability account if current year's payment has not yet been

made.

2.

Defined benefit plans guarantee an amount to employees when

they retire. The company now makes contributions that it hopes will

provide for the future guaranteed payments from the fund. As

expectations regarding these costs change, it may become apparent

that too little has been contributed to meet the future obligations. If

this happens and the company cannot or prefers not to make up the

deficit in the current period, a long-term liability must be recorded.

The amount is credited to the Unfunded Pension Liability

account, with a debit to Pension Expense.

3.

Other post-retirement benefits arising from health care

guarantees and other benefits are accounted for in the same way as

pension plans. If under-funded at present, a liability is recorded.

<back>

IV.

Contingent Liabilities are obligations that will result contingent upon

some other event occurring. For example, a company being sued will suffer losses

if it loses the case, so it will have an obligation to pay damages contingent upon

its loss of the case in court. Contingent liabilities are recorded in the accounts

only when their occurrence is deemed to be probable and the amount of the

liability can be reasonably estimated.

A.

The entry requires a debit to an expense or loss account and a credit to a

liability account for the estimated amount of the loss.

©2009 Craig M. Pence. All rights reserved.

Accounting Course Manual

B.

C.

V.

7

If the loss is not probable or cannot be reasonably estimated, the

contingency is disclosed in the footnotes to the statements, if material, and

not in the accounts (that is, no entry is made).

Product warranty liabilities arise from the warranty provided by

companies to guarantee their products for a period of time, and represent

a contingent liability. By the end of the period, not all of the products sold

in the period that will be returned for warranty repairs will have gone bad.

In order to match expenses and revenues, it is necessary to record

warranty expense and the product warranty liability based upon estimates

of the cost that will be incurred when the units are returned.

<back>

Payroll liabilities occur through withholdings from employee's wages,

benefit programs that the employer provides to supplement the employees'

wages, and because payroll taxes are levied against the employer.

A.

Accounting for wage payments requires the computation and withholding

of numerous items (Federal and state income tax withholdings, social

security (FICA) withholdings, and other items such as medical insurance

premiums, retirement fund contributions, etc. If only income taxes and

social security taxes are withheld, the entry to record the payroll is as

follows:

Wages Expense

Federal Income Tax Withholdings Payable

State Income Tax Withholdings Payable

FICA Taxes Payable

Wages Payable

B.

$X

$X

$X

$X

Employer's must pay taxes based upon their payrolls. These include a

FICA payment to match the employee's payment and state (SUTA) and

Federal (FUTA) unemployment taxes. The entry is as follows:

Payroll Tax Expense

FICA Taxes Payable

SUTA Taxes Payable

FUTA Taxes Payable

C.

$X

$X

$X

$X

$X

If the employer pays for medical insurance coverage, pays into a pension

plan program, or makes other payments to provide payroll benefits to the

employees, the entry is as follows:

Benefits Expense

Medical Insurance Payable

Pension Contributions Payable

©2009 Craig M. Pence. All rights reserved.

$X

$X

$X

8

Accounting Course Manual

D. Employers operating under manual accounting systems are likely to employ a

Payroll Register (a special journal similar to the purchases journal, but

dedicated to accounting for payroll costs instead of merchandise purchases)

and a Check Register (another special journal similar to the Cash Payments

journal, but used for employee wage payments).

E. For those who are interested in becoming proficient in payroll practices, much

more information about payroll accounting, payroll taxes, and tax return

preparation is available in HCC’s Payroll Administration (ACCT 116) course.

In addition to providing students with practical bookkeeping/payroll job

skills, this course prepares students for professional certification through the

American Payroll Association (www.americanpayroll.org).

<back>

-END-

©2009 Craig M. Pence. All rights reserved.