English

advertisement

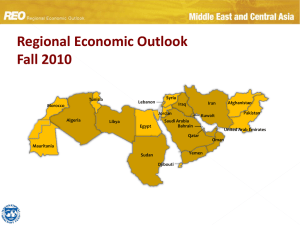

Regional Economic Outlook May 25, 2010 Outline Global Outlook MENAP Overview • Oil Exporters • Oil Importers Multi-speed recovery Recovery so far Recovery ahead • Proceeding at varying speeds • Steep falls in activity not followed by quick rebounds • Subdued growth prospects for many advanced economies • Solid growth prospects for many emerging economies Global financial markets have recovered faster than expected Global Stocks (Morgan Stanley MSCI Stock Price Indices in U.S. Dollars, MER Weighted; 2007 = 100) Sovereign and Corporate Bond Spreads (Basis points) 1 Averages of BB-B US, BB-B Euro, and BBB Japan corporate bond spreads. Capital flows have returned to emerging markets after sudden stop Emerging Market External Bond and Equity Issuance (Billions of U.S. dollars) Bank credit remains hard to come by in many countries Private Credit Growth (Annualized percent change of 3mma over previous 3mma) Banks need to rebuild capital Source: Bank of England, European Central Bank, and the Federal Reserve Board. World economy set for a further recovery at varying speeds Real GDP Growth (Percentage growth from previous year) Fading fiscal stimulus Less inventory restocking will hold back growth later in 2010 and 2011 Global financial crisis is leaving lasting scars on output levels Global GDP (Index, 2006=100) Global Policy Challenges Devise credible exit strategies—medium-term fiscal consolidation plans urgently needed Repair and reform financial systems Combat unemployment Manage capital flows MENAP Oil Exporters Tunisia Lebanon West Bank & Gaza Morocco Syria Afghanistan Iran Iraq Jordan Pakistan Kuwait Algeria Libya Egypt Saudi Arabia Bahrain Qatar United Arab Emirates Oman Mauritania Yemen Sudan Djibouti Oil Exporters: Key Messages Recovery is underway, driven by rising oil demand and continued supportive policies Continue stimulus where there is fiscal room, to boost non-oil sector activity Barring signs of overheating, accommodative monetary policy is appropriate to mitigate the current credit bust Capital flows are recovering, but greater differentiation of sovereign risk can be expected, following Dubai World and Greece events Rising oil prices have spurred recovery in exports and local stock markets Merchandise Trade and Crude Oil Prices Stock Markets (Billions of U.S. dollars unless otherwise indicated) (Indices: August 2008 = 100) 110 160 140 Exports 100 140 Imports 90 KWT QTR SAU DUB ABU IRN Crude oil; Dated Brent, WTI, and Dubai Fateh ($/barrel, right scale) 80 120 BHR 120 100 100 80 70 80 60 60 50 40 40 20 60 40 20 Dubai World 30 Dec-07 Jun-08 Dec-08 Jun-09 0 Dec-09 0 Aug-08 Nov-08 Feb-09 May-09 Aug-09 Nov-09 Greece Feb-10 May-10 Source: IMF, Direction of Trade Statistics; IMF, International Financial Statistics. Source: Bloomberg. Exports are recovering from early 2009 lows Stock markets have risen, even after Dubai World event Overall fiscal balances will also improve, even with continued stimulus Government Fiscal Balance Government Expenditure (Percent of GDP) (Percent of GDP) 30 40 GCC 25 GCC Non-GCC Non-GCC MENAP Oil Exporters MENAP Oil Exporters 20 30 15 20 10 5 10 0 0 -5 2008 2009 …as oil-related revenues rise Sources: National authorities; and IMF staff estimates. 2010 2008 2009 2010 Looking to 2010, recovery will continue Real GDP Growth (Percent) External environment is projected to be favorable to the oil sector 8 6 4 Non-oil sector will continue to be buoyed by accommodative macro policy 2 0 Oil GDP -2 Non-oil GDP -4 -6 2005 2006 2007 2008 Source: National Authorities; and IMF staff estimates. 2009 2010 2011 Overall future growth rates to remain lower than precrisis, but more sustainable External balances are projected to improve Current Account Balances (Billions of U.S. dollars unless otherwise indicated) …as oil prices and crude oil production rise in 2010 Sources: National authorities; and IMF staff estimates. Oil price uncertainty going forward WTI Oil Price Prospects1 (U.S. dollars per barrel) 200 95% confidence interval 180 86% confidence interval 68% confidence interval 160 Futures 140 120 100 80 60 40 20 Jan-07 Aug-07 Mar-08 Oct-08 Sources: Bloomberg; and IMF staff calculations. 1Derived from prices of futures options on May 17, 2010. May-09 Dec-09 Jul-10 Feb-11 Sep-11 Apr-12 0 Nov-12 Clouding the horizon: sluggish post-crisis credit growth Credit and Deposit Growth1 Inflation (PPP GDP weighted year-on-year growth rates, percent) (Consumer price index, year-on-year growth, percent) 36 30 Credit to private sector 32 25 BHR OMN IRN SAU IRQ SDN KWT UAE LBY YMN Deposits 28 20 24 15 20 10 16 5 12 0 8 -5 4 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 -10 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Sources: National Authorities; and IMF, International Financial Statistics. 1Excludes Iran, Iraq, and Libya due to data limitations. Sources: National authorities. Credit growth has slowed appreciably …and inflation generally not a concern Jan-10 Slow credit growth is likely to persist Real credit surrounding credit booms (Percent change) 60% Real credit growth (Year-on-year) Historical median 50% Saudi Arabia 2008 boom 40% United Arab Emirates 2008 boom 30% 20% 10% 0% -10% -4 -2 0 2 4 6 8 10 12 Quarters Historical patterns show protracted period of sluggishness following booms Sources: IMF, International Financial Statistics; and staff calculations. Note: Unweighted average of real credit growth around boom years identified between 1983 and 2008. Credit was deflated by the CPI index. Boom year in shaded area. 14 16 Capital inflows: boom, bust, and partial recovery Capital Flows International Issuance (Percent of GDP) (Billions of U.S. dollars) 40 30 200 Emerging markets total (right scale) MENAP Oil Exportrers Equity Inward FDI Syndicated Loans 30 20 2008 10 2009 Change in portfolio and other investment liabilities 150 External Bonds 20 100 10 50 -10 MENAP oil exporters 2009 2008 2007 2006 2005 2004 2003 2007 2006 2005 2004 2003 0 Emerging and developing economies 0 0 2003 04 05 06 07 08 09 Dubai World event led to disruption in bond issuance Sources: IMF, World Economic Outlook. Large increase in inflows to the Gulf up to 2007, followed by reversal of mainly nonFDI flows… …while international issuance has begun to recover, concentrated in bonds and in the Gulf MENAP Oil Importers Tunisia Lebanon West Bank & Gaza Morocco Syria Afghanistan Iran Iraq Jordan Pakistan Kuwait Algeria Libya Egypt Saudi Arabia Bahrain Qatar United Arab Emirates Oman Mauritania Yemen Sudan Djibouti Oil Importers: Key Messages The region is slowly recovering from last year’s slowdown Obstacles to growth ahead and room for stimulus is narrowing Policy focus will need to shift to medium-term structural agenda Trade is rising along with the global rebound Investment and bank credit are still subdued Persistent weakness in EU demand and competition from other emerging markets Governments facing high debt will need to cut back on fiscal expansion High inflation in some countries Raising growth and creating employment is again at center stage Developing capital markets can help revive credit and investment Structural reforms key to improving competitiveness International trade is mending… Merchandise Trade in U.S. dollars1 External Receipts (Annual percent change of 3-month moving average) (Billions of U.S. dollars) 100 Exports 120 80 Imports 100 2008 60 2009 2010 proj. 80 40 60 20 40 0 20 -20 -40 Dec-07 0 Jun-08 Dec-08 Jun-09 Dec-09 Export of goods Tourist receipts¹ Remittances² FDI Sources: National authorities; and Haver Analytics. ¹ Egypt, Jordan, Lebanon, Morocco, Pakistan, and Tunisia. Sources: IMF, World Economic Outlook; National authorities; and IMF staff estimates. ¹ Excludes Afghanistan, Mauritania, and Pakistan. 2Excludes Afghanistan and Djibouti. Trade is recovering after the sharp fall during the global crisis But expansion will be slow, with exports and FDI still well below 2008 levels …and financial markets have rebounded Stock Market Indices Sovereign Bond Spreads (January 1, 2007 = 100) (Basis Points) 240 1,000 2,500 Ranges since January 1, 2007 200 Latest (16-May-10) 800 160 EGY LBN MAR TUN EMBIG PAK (right scale) 2,000 600 1,500 400 1,000 200 500 120 80 40 0 EGY JOR LBN MAR PAK TUN MSCI¹ 0 Jan-09 0 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Source: Bloomberg. 1Morgan Stanley Capital International Index, emerging markets. Source: Bloomberg. Stocks are up, but - aside from Tunisia still well below earlier highs Bond spreads have narrowed over the past year; little impact so far from Greece But credit and capital inflows still sluggish Bank Credit to the Private Sector International Issuance (Year-on-year growth, in percent) (Billions of U.S. dollars) 35 12 Jun-08 200 Emerging markets total (right scale) MENAP Oil Importers Feb-10 30 Equity 9 25 Syndicated Loans 150 External Bonds 20 15 6 100 3 50 10 5 0 0 -5 DJI EGY JOR LBN MAR PAK TUN 0 2003 04 05 06 07 08 09 Source: National Authorities and IMF staff calculations. Source: Dealogic. Credit growth has fallen sharply in several countries Capital inflows to the region have been slow to come back and equity still lagging Growth picking up, but falling short of other EMs 10 12 Real GDP Growth (Percent) 10 10 China Developing Asia 8 8 8 6 6 India AFG EM Total LEB EM Total 6 4 4 2 0 -2 2 4 MENAP Oil importers EGY MRT JOR SYR DJI TUN MAR Sub-Saharan Africa PAK MENAP Oil Importers Western Hemisphere Emerging and developing economies 0 Advanced economies Central & East. Europe -4 2005 2006 2007 2008 2009 2010 Region is rebounding, but less so than comparators Source: National Authorities; and IMF staff estimates. 2011 -2 2 Trade linkages to Europe highest in the Maghreb Europe share of total merchandise exports, 2009 (Percent) LBY TUN MAR DZA AZE ARM KAZ GEO EGY MRT SYR TKM IRQ PAK IRN TJK LBN QAT DJI SAU UZB KWT AFG UAE JOR KGZ OMN BHR SDN YMN 0 10 20 30 Sources: Direction of Trade Statistics, IMF 40 50 60 70 80 Limited room for further policy stimulus Prices Fiscal Deficit and Public Debt, 2010 (Annual percent change) (Percent of GDP) 160 Lebanon Public debt (Percent of GDP) 140 120 100 Mauritania 80 Egypt 60 Pakistan Tunisia 40 Jordan Morocco EM Average Syria 20 0 0 2 4 6 8 10 12 Fiscal deficit (Percent of GDP) Sources: National Authorities. End-2010 Inflation pressures mount in several countries, limiting room for monetary policy Sources: National Authorities; and IMF staff estimates. High public debt levels constrain fiscal policy options 14 Competitive challenges are again at the fore Exports Per Capita Competitiveness Indicators (Percent of world average) (Latest rankings) 40 0 More competitive MENAP oil importers 35 Ease of Doing Business (Ranking among 183 countries) 40 Emerging and developing economies 30 25 20 15 10 1990 1995 2000 2005 2010 TUN PAK 80 EGY JOR 120 SYR MAR MENAP Oil Importers average 160 Emerging and developing economy average MRT 200 140 120 100 80 60 40 20 Global Competitiveness Index (Ranking among 134 countries) Source: IMF, World Economic Outlook. Note: Excludes oil exports. Sources: World Bank; and World Economic Forum. Exports continue to underperform Business environment mostly lagging 0 Unemployment looms large Unemployment and Growth1 (Percent) High unemployment 16 8 14 7 12 6 10 5 8 4 6 Large structural component Government jobs not the solution 3 Spillovers from a tepid recovery in Europe 2 Weakened prospects for exports and remittances Impact on development aid? Unemployment rate 4 Real GDP growth (right scale) 2 1 0 0 1990 1993 1996 1999 Sources: National Authorities; and IMF staff estimates. 1Egypt, Jordan, Morocco, and Tunisia. 2002 2005 2008 Policy Priorities Oil Exporters Oil Importers Maintain fiscal and monetary stimulus as conditions permit Structural reforms to improve competitiveness Fiscal stimulus: until private-sector activity regains momentum Growth and job creation will have to come from the private sector Monetary support/regulatory policy: balance goal of supporting credit growth with that of financial stability Focus on enhancing business environment, labor market flexibility, and education systems Ensure smooth process of cleanup of bank balance sheets: upfront recognition of losses and bank recapitalization if needed Gear fiscal and monetary policy to creating supportive conditions: strengthening revenue, scaling back subsidies, and addressing NPLs Develop local capital markets to provide alternatives to bank credit Please visit the IMF’s website Full report: http://www.imf.org/external/pubs/ ft/reo/2010/MCD/eng/mreo0510.htm What do you think? Make your point on the related blogs: http://blog-imfdirect.imf.org