Review! - Mr. Zedan's Classes

advertisement

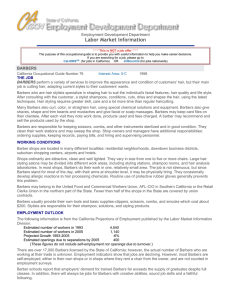

1. Explain what the value of marginal product is? 2. Firms hire to the point where what = what? 3. Labor Output MPL VMPL Wage Marginal Profit 0 0 --- --- --- --- 1 100 $300 $150 2 220 $150 3 350 $150 4 400 $150 5 380 $150 What is the price of the good? What is the Marginal Product of labor of the third worker? What is the marginal profit of the 5th worker? 4. Labor Output MPL VMPL Wage Marginal Profit 0 0 --- --- --- --- 1 100 $300 $150 2 220 $150 3 350 $150 4 400 $150 5 380 $150 How many people would this firm hire? 5. Draw what would happen for the market for apple pickers if the price of apples went up? (draw the graph for both market of apple pickers and the VMP graph) 6. How does elasticity of a product affect the labor market for the same product? 7. Describe the difference between a diminishing marginal product of labor and a negative marginal product of labor. Why would a profit-maximizing firm always choose to operate where the marginal product of labor is decreasing (but not negative)? 8 A union brings a higher wage to a factory, what happens to the level of employment of that factory? Why? 9. Many teachers have advanced educational degrees, yet they have lower average earnings that other individuals with similar educational levels. A potential explanation for the differences in earnings is what? 10. What do minimum wage laws do to the market for labor? 11. A nurse who specializes in cleaning bed pans is typically paid a higher wage than a nurse who does patient paperwork. This can be partially explained by what? 12. Mr. Wicker, a teacher, is considering where he will work. Two recruiters show up at his college in search of summer teachers. Recruiter A is looking for workers to teach in a disaster relief agency. Recruiter B is looking for a teacher to teach near the entrance to a famous national park. Mr. Wicker is carefully considering the options that each recruiter presents. On the basis of knowledge obtained in his economics class, Mr. Wicker concludes what about the relationship between utility and pay of these two options? 13 What is human capital? Can you give me an example? 14. What is an example of technology that increases human efficiency? What is an example of human replacing technology? What does each do to the demand for labor? 15. Assume that the labor market for barbers is competitive and that it is differentiated into two groups: barbers who are bald (or going bald) and those who have a full head of hair. Assume that the barbers in this market have identical haircutting ability, regardless of whether they are bald or not. Currently the equilibrium wage in the bald barber market is lower than that in the nonbald market. Further assume that the market for haircuts is competitive. If consumers do not discriminate between bald barbers and barbers with hair, then what shops are the most profitable? 16. Assume that the labor market for barbers is competitive and that it is differentiated into two groups: barbers who are bald (or going bald) and those who have a full head of hair. Assume that the barbers in this market have identical haircutting ability, regardless of whether they are bald or not. Currently the equilibrium wage in the bald barber market is lower than that in the nonbald market. Further assume that the market for haircuts is competitive. If consumers do not discriminate between bald barbers and barbers with hair, then what happens to wages of each barber type? 17. What is an example of discrimination in the labor market? Please also offer an explanation why. 18. What are the three main intellectual models for redistributing income, per the book? 19. What is the poverty rate (the idea, not the actual number)? 20. What would have to change in a country to adjust the poverty line? 21. What would be a good formula for a negative income tax? 22. Does the market distribute efficiently or equally? Why? 23 Assume that the government proposes a negative income tax that calculates taxes owed by the following formula, Taxes Owed = (1/3 Income) - $10,000. Compute the tax that would be owed given each level of income. $120,000 $90,000 $60,000 $30,000 $0