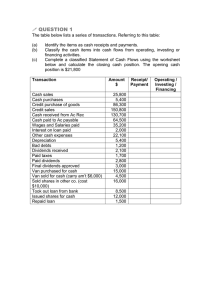

Cash flow staement of Premium and Mount Albert bookstore

advertisement

Suggested Solution Exercise 1 Premium Products Ltd Statement of Cash Flow for the year ended 31 December 2008 $ $ Cash flows from operating activities Cash was provided from: Receipts from customers 1,479,401 Dividends Received 2,250 1,481,651 Cash was applied to: Payments to suppliers 1,106,098 Other expenses paid 224,475 Interest paid 15,500 Income tax paid 64,000 1,410,073 Net cash inflows from operating activities 71,578 Cash flows from investing activities Cash was provided from: Sale of Office Equipment 13,200 Cash was applied to: Purchase of Office Equipment Purchase of Motor Vehicles 20,500 6,900 Net cash outflow from investing activities (14,200) Cash flows from financing activities Cash was provided from: Issue of Shares 30,000 Cash was applied to: Repayment of mortgage Dividend paid 45,000 37,500 Net cash inflows from financing activities (52,500) Net increase in cash held Add cash at start of year Balance at end of year 1.Cash from Operating Expenses Advertising Audit Fees Printing and Postage Wages paid Other Operating Expenses plus Accrued wages (beg) 4,878 5,372 10,250 42,750 9,000 1,050 167,700 6,025 226,525 8,500 less Accrued Wages (end) Cash from Operating Expenses 10,550 224,475 2. Office Equipment has had a net increase of $5,500 over the year. This change has come about because of the disposal of an asset which had cost the business $15000. The increase in the office equipment account is due to the purchase of equipment at a cost of $20,500. 3. The equity position has increased by a total of $273,558 over the year. This has come about through an increase in retained earnings, an increase in the asset revaluation reserve and an issue of shares to shareholders. While the issue of shares does reflect a cash increase, the asset revaluation is a non-cash transaction and will not affect the cash balance. The increase in retained earning reflects the profit in the business less any dividends paid. From the Cash from Operating Activities it can be seen that more cash is paid to suppliers during the period than COGS. This is an indication of the build up of inventory over the year. This increase in inventory will contribute to the increase in equity while at the same time explain the reduced cash balance. Exercise 2 Mt Albert Bookstores Statement of Cash Flows for the year ended 30 September 2008 $ $ $ Cash flows from operating activities Cash was provided from: Receipts from customers 192,500 Cash was applied to Payments to suppliers Other operating expenses (131,300) (17,000) Interest paid (1,500) Tax (7,000) (156,800) Net cash flow from operating activities 35,700 Cash flow from investing activities Cash was provided from Sale of assets 3,000 3,000 (17,000) (17,000) Cash was applied to Purchase of PPE (14,000) Net cash flow from investing activities Cash flows from financing activities Cash was provided from Loan 15,000 15,000 (33,200) (33,200) Cash was applied to Drawings Net cash flow from financing (18,200) Net change in cash held 3,500 Cash at 1 October 2007 (10,000) Closing cash at 30 September 2008 (6,500)