Chapter 3: Hedging strategies using futures

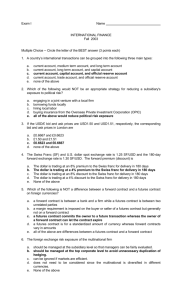

advertisement

Hedging Strategies Using Futures Chapter 3 0 HEDGERS OPEN POSITIONS IN THE FUTURES MARKET IN ORDER TO ELIMINATE THE RISK ASSOCIATED WITH THE SPOT PRICE OF THE UNDERLYING ASSET 1 Spot price risk Pr Sj St t j time 2 HEDGERS PROBLEM: TO OPEN A LONG HEDGE OR A SHORT HEDGE? There are two ways to determine whether to open a short or a long hedge: 3 1. A LONG HEDGE OPEN A LONG FUTURES POSITION IN ORDER TO HEDGE THE PURCHASE OF THE PRODUCT AT A LATER DATE. THE HEDGER LOCKS IN THE PURCHASE PRICE. A SHORT HEDGE OPEN A SHORT FUTURES POSITION IN ORDER TO HEDGE THE SALE OF THE PRODUCT AT A LATER DATE. THE HEDGER LOCKS IN THE SALE PRICE 4 2. A LONG HEDGE OPEN A LONG FUTURES POSITION WHEN THE FIRM HAS A SHORT SPOT POSITION. A SHORT HEDGE OPEN A SHORT FUTURES POSITION WHEN THE FIRM HAS A LONG SPOT POSITION. 5 Example: A LONG HEDGE Date Spot market Futures market t St = $800/unit Contract to buy Gold on k. Ft,T = $825/unit -25 long one gold futures for delivery at T k Buy the gold Sk = $816/unit Short one gold futures for delivery at T. Fk,T = $842/unit -26 Basis 1 T Amount paid: or 816 + 825 – 842 = $799/unit 825 + (816 – 842) = $799/unit 6 Example: A SHORT HEDGE Date Spot market Futures market t St = $800/unit Contract to sell Gold on k, Ft,T = $825/unit -25 short one gold futures for delivery at T k Sell the gold Sk = $784/unit Long one gold futures for delivery at T. Fk,T = $812/unit -28 Basis 3 T Amount received: 784 + 825 – 812 = $797/unit or 825 + (784 – 812) = $797/unit 7 NOTATIONS: t<T t = current time; T = delivery time F t,T = THE FUTURES PRICE AT TIME t FOR DELIVERY AT TIME T. St = THE SPOT PRICE AT TIME t. k= THE DATE UPON WHICH THE FIRM TRADES THE ASSET IN THE SPOT MARKET. k≤T Sometimes t = 0 denotes the date the hedge is opened. 8 THE HEDGE TIMING k = is the date on which the hedger conducts the firm spot business and simultaneously closes the futures position. This date is almost always before the delivery month; k ≤ T. Today Open the hedge: open a futures position Trade spot and Close the futures position Delivery t k T Time 9 THE HEDGE TIMIMG Date k is (almost) always before the delivery month. WHY? 1. Often k is not in any of the delivery months available. 2. From the first trading day of the delivery month, the SHORT can decide to send a delivery note. Any LONG with an open position may be served with this 10 delivery note. Spot and Futures prices over time Commodities and assets are traded in the spot and futures markets simultaneously. Thus, the relationship between the sport and futures prices: At any point in time And Over time Is of great importance for traders. 11 The Basis The basis at any time point, j, is the difference between the asset’s spot price and the futures price on j. BASISj = SPOT PRICEj - FUTURES PRICEj Notationally: Bj = Sj - Fj,T j < T. When discussing a basis, one must specify the futures in question, i.e., a specific delivery month. Usually, however, it is understood that the futures is for the nearest month to delivery. 12 A LONG HEDGE TIME t SPOT Contract to buy FUTURES LONG Ft,T B Bt SHORT Fk,T Bk Do nothing k BUY Sk T delivery Actual purchase price = Sk + Ft,T - Fk,T = Ft,T + [Sk - Fk,T] = Ft,T + BASISk 13 A SHORT HEDGE TIME t SPOT Contract to sell FUTURES SHORT Ft,T B Bt LONG Fk,T Bk Do nothing k SELL Sk T delivery Actual selling price = Sk + Ft,T - Fk,T = Ft,T + [Sk - Fk,T] = Ft,T + BASISk 14 In both cases, Long hedge and short hedge the hedger’s purchase/sale price, when the hedge is closed on date k, is: Ft,T + BASISk This price consists of two portions: a known portion: and a random portion: the We return to this point later. Ft,T BASISk 15 ALSO NOTICE: t k T The purchase/sale price when the hedge is closed on date k is: Ft,T + BASISk Which may be rewritten: = Ft,T + BASISk + St – St = St – [St – Ft,T - Bk] = St + [Bk – Bt] 16 Spot prices and futures prices over time The key to the success of a hedge is the relationship between the cash and the futures price over time: Statistically, Futures prices and Spot prices of any underlying asset, co vary over time. They tend to co move “together” ; not in perfect tandem and not by the same amount, nevertheless, these prices move up and down together most of the time, during the 17 life of the futures. Open close Long hedge Short hedge the hedge Fk,T Ft,T Sk a success a failure Loss on the hedge St Fk,T Sk a failure a success Loss on the hedge 18 Example: A LONG HEDGE TIME t SPOT St= $3.40 Do nothing k BUY Sk=$3.80 FUTURES LONG BASIS Ft,T=$3.50 -$.10 SHORT F k,T=3.85 -$.05 T delivery Actual purchase price: NO hedge: $3.80 With hedge: $3.45 (Successful hedge) 19 Example: A LONG HEDGE TIME t SPOT St= $3.40 Do nothing k BUY Sk=$3.00 FUTURES LONG BASIS Ft,T=$3.50 -$.10 SHORT F k,T=3.05 -$.05 T delivery Actual purchase price: NO hedge: $3.00 With hedge: $3.45 (Unsuccessful hedge)20 The basis upon delivery: BT = 0 On date k, the basis is Bk = Sk - Fk,T k < T. If k coincides with the delivery date, however, k = T. The basis is: BT = ST - FT, T at T. BUT, FT,T is the futures price on date T for delivery on date T, which implies that: FT,T = ST BT = 0. 21 Convergence of Futures to Spot over the life of the futures Futures Price Spot Price Spot Price Futures Price Time (a) Time (b) 22 Basis Risk The Basis is the difference between the spot and the futures prices. I.e., the Basis is a RANDOM VARIABLE. Thus, Basis risk arises because of the uncertainty about the Basis when the hedge is closed out on k. The basis, however, is the difference of two random variables and thus, the Basis is LESS RISKY than each price by itself. Moreover, we do know that BT = 0 upon delivery. 23 Generally, the basis fluctuates less than both, the cash and the futures prices. Hence, hedging with futures reduces risk. Basis risk exists in any hedge, nonetheless. Sk Pr Bk Ft,T St t BT = 0 Bt k T time 24 We showed that for both types of hedge A SHORT HEDGE or A LONG HEDGE, The price received/paid by the hedger: Ft,T + BASISk This price consists of two parts: Part one: Ft,T is KNOWN when the hedge is opened. Part two: BASISk is risky. 25 Conclusion: At time t, WITHOUT HEDGING cash-price risk. WITH HEDGING, basis risk. Hedging with futures is nothing more than changing the firm’s spot price risk Into a smaller risk, namely, The basis risk. 26 A CROSS HEDGE: When there is no futures contract on the asset being hedged, choose the contract whose futures price is most highly correlated with the spot asset price. NOTE, in this case, the hedger creates a two components basis: one component associated with the asset underlying the futures and one component associated with the spread between the two spot prices. 27 A CROSS HEDGE: Let S1t be the spot asset price at time t. Remember! - This is the asset that the hedger is trying to hedge; e.g. jet fuel. Let S2t be the spot price at time t of the asset underlying the futures. E.g., natural gas. This, of course, is a different asset and that is why this hedge is called a CROSS HEDGE 28 A CROSS HEDGE TIME CASH FUTURES t Contract to trade S1 Do nothing Ft,T(2) k Trade for S1K Fk,T(2) T delivery PAY/RECEIVE= S1K + Ft,T(2) - Fk,T(2) = Ft,T(2) +[S2k - Fk,T(2)] +[S1k - S2k] = Ft,T(2) + BASIS(2)k + SPREADK 29 Arguments in Favor of Hedging Companies should focus on the main business they are in and take steps to minimize risks arising from interest rates, exchange rates, and other market variables 30 Arguments against Hedging • Explaining a situation where there is a loss on the hedge and a gain on the underlying can be difficult. • Shareholders are usually well diversified and can make their own hedging decisions. 31 Delivery month? MOSTLY, the hedge is opened with a futures for the delivery month closest to the firm’s spot trading of the asset, or the nearest month beyond that date. The key factor in choosing the futures’ delivery month is the correlation between the spot and futures prices or price changes. Statistically, in most cases, the spot price highest correlation is with the nearest delivery month futures price, which is closest to the firm’s cash activity. 32 The number of Futures to use in the hedge Open a hedge. Questions: Long or Short? Delivery month? Commodity to use? How many futures to use in the hedge? 33 HEDGE RATIOS, NOTATION: NS = The number of units of the commodity to be traded in the SPOT market. NF = The number of units of the commodity in ONE FUTURES CONTRACT. n = The number of futures contracts to be used in the hedge. h = The hedge ratio. 34 HEDGE RATIOS: Open a hedge. Question: Given that the firm has a contract to trade NS units of the underlying commodity on date k in the spot market and given that one futures covers NF units of the underlying commodity: How many futures to use in the hedge? i.e., what is n? 35 HEDGE RATIOS, DEFINITION: The number of units in the futures position h The number of units in the spot position nN F h NS NS nh . NF The hedge ratio, h, determines the number of futures to hold, n. 36 THE NAÏVE HEDGE RATIO: h = 1. The total number of units covered by the futures position = nNF , exactly covers the number of units to be traded in the spot market = NS. nN F h 1 NS NS n NF 37 Examples: NAÏVE HEDGE RATIO: h = 1. 1. A firm will sell NS = 75,000 barrels of crude oil. NYMEX WTI: NF = 1,000 barrels. SHORT: n = 75,000/1,000 = 75 NYMEX futures. 38 2. A firm will buy NS = 200,000 bushels of wheat. CBT wheat futures: NF = 5,000. LONG: n = 200,000/5,000 = 40 CBT futures. 39 3. A firm will sell NS = 3,600 ounces of gold. NYMEX gold futures: NF = 100 ounces. SHORT: n = 3,600/100 = 36 CBT futures. 40 How to open a long hedge with multiple future spot trading? A Strip. DATE SPOT MARKET Sep1,07 Contract to buy 75,000bbls of WTI crude oil. on: Oct 1,07; Nov 1,07; Dec 1,07; Jan 2,08. 41 A STRIP. A STRIP is a hedge in which there are several long (or several short) positions opened simultaneously with equal time span between the delivery months of the positions. Each one of these futures exactly hedges a specific future trade in the spot market 42 Open a long STRIP with h = 1 DATE SPOT MARKET S FUTURES MARKET F FUTURES POSITIONS Sep1,07 contract to 92.00 buy 75,000bbls on Oct 1,07; Nov 1,07; Dec 1,07; Jan 2, 08. Long 75 NOV 07 93.00 long 75 NOV 07 Long 75 DEC 08 93.50 long 75 DEC 08 Long 75 JAN 08 93.85 long 75 JAN 08 Long 75 FEB 08 94.60 long 75 FEB 08 43 Date SPOT MARKET S FUTURES MARKET Sep1,07 contract to 92.00 buy 75,000bbls Long Long Long Long Oct1,07 buy 75,000bbls 93.00 Nov1,07 buy 75,000bbls 75 75 75 75 NOV 2007 DEC 2007 JAN 2008 FEB 2008 F FUTURES POSITIONS 93.00 93.50 93.85 94.60 long 75 NOV 2007 long 75 DEC 2007 long 75 JAN 2008 long 75 FEB 2008 short 75 NOV 07 93.10 long 75 DEC 2007 long 75 JAN 2008 long 75 FEB 2008 92.90 short 75 DEC 07 93.05 long 75 JAN 2008 long 75 FEB 2008 Dec1,07 buy 75,000bbls 94.00 short 75 JAN 08 94.15 long 75 FEB 2008 Jan2,08 buy 75,000bbls 94.75 short 75 FEB 08 94.95 NO POSITION The average price for the un hedged strategy : (93+92.90+94+94.75)/4 = 93.660 The average price for the hedged strategy: 93.00 + (93.00 - 93.10) = 92.90 93.50 + (92.90 – 93.05) = 93.35 93.85 + (94.00 – 94.15) = 93.609 94.60 + (94.75 - 94.95) = 94.40 44 93.5625 ROLLING THE HEDGE FORWARD Lack of sufficient liquidity in contracts for later delivery months may cause firms to hedge a long-term business trade employing shorter term hedges. In this case, the shorter term hedges must be rolled over until the firm trade in the cash market. 45 Roll over hedge with h = 1 DATE SPOT MARKET DEC, 07 contract to sell S 89.00 FUTURES MARKET F FUTURES POSITIONS Short 100 NYMEX WTI; 88.20 100,000bbls on Futures for delivery on JAN, 09. MAY 08 SHORT 100 MAY 08 Fs. And Roll over the hedge on APR 2008 And AUG 2008 46 Date SPOT MARKET DEC, 07 contract to S FUTURES MARKET 89.00 sell 100,000 bbls F short 100 MAY WTI FUTURES POSITIONS 88.20 Oct1,07 buy 75,000bbls Short 100 MAY 2008 APR 08 long 100 MAY 2008 Short 100 SEP 2008 87.40 87.00 Short 100 SEP 2008 AUG 08 Long 100 SEP 2008 Short 100FEB 2009 86.50 86.30 Short 100 FEB 2009 Long 100 FEB 2009 85.90 NO POSITION JAN, 09 sell 100,000bbls 86.00 The selling price without the rolling hedge: $86.00/barrel The selling price with the rolling hedge: $87.70/barrel $86.00 + (88.20 – 87.40) + (87.00 – 86.50) + (86.30 – 85.90) = 87.70. 47 Other hedge ratios. Suppose that the relationship between the spot and futures prices over time is: Spot Futures case one: $1 $2 Case two: $1 $0.5 Clearly, the Naïve hedge ratio is not appropriate in these cases. 48 THE MINIMUM VARIANCE HEDGE RATIO OBJECTIVE: To minimize the risk associated with the hedge RISK = VOLATILITY. THE VOLATILITY MEASURE: THE VARIANCE 49 THE MINIMUM VARIANCE HEDGE RATIO Restating the hedge goal, OBJECTIVE: Given that the firm will trade NS units in the spot market, find the number of futures, n* THAT MINIMIZES THE VARIANCE OF THE CHANGE OF THE HEDGED POSITION’S VALUE. 50 NOTATIONS t = St = k = T = Fj,T= The hedge opening date. Spot market price. The hedge closing date. The futures delivery date. The futures price on date j for delivery at T. t ≤ j ≤ T. 51 NOTATIONS n = h = NF = NS = The number of futures contracts used in the hedge. The hedge ratio. The number of units of the asset in one contract. The number of units of the asset to be traded spot on k. 52 FROM THE GENERAL RELATIONSHIP BETWEEN n and h (SLIDE 36) the optimal number of futures, n* is determined by h*: NS n h . NF * * Thus, we find h* and thereby determine the optimal number of futures to be held in the hedge, n*. 53 Derivation of the result: The initial and terminal hedged position values: VPt = StNS +nNFFt,T VPk = SkNS +nNFFk,T The position value change: (Vp) = VPk - VPt = (SkNS +nNFFk,T) - (StNS +nNFFt,T) = NS(Sk- St) +nNF(FK,T - Ft,T). 54 Rewriting the last result: (VP) = NS(Sk- St) +nNF(Fk,T - Ft,T). [ ] (VP) = NS (Sk- St) +[nNF/NS](Fk,T - t,T) [ ] (VP) = NS (Sk- St) +h(Fk,T - Fy,T) PROBLEM: Find h* so as to minimize the Variance of (VP). 55 VAR(VP) = NS2 VAR[(Sk- St) +h(Fk,T - Ft,T)] = NS2[VAR(S)+VAR(hF)+2COV(S;hF)] = NS2 [VAR(S)+h2VAR(F)+2hCOV(S;F)]. Set: d[VAR(VP)]/dh = 0: 2h*VAR (F) + 2COV(S; F) = 0. h* = - COV(S;F)/VAR(F) 56 THE MINIMUM RISK HEDGE RATIO IS: cov( S; F) h* . var( F) σ ΔS n * NF h* - ρΔS,ΔF . σ ΔF NS NS n h . NF 57 This result can be rewritten as: cov(S; F) h* . var(F) σS n * N F h* - ρS,F . σF NS NS n h . NF 58 The negative sign in the formula for h*, only indicates that in the hedge position the SPOT and the FUTURES positions are in opposite directions. If the hedger is short spot, the hedge is long. If the hedger is long spot, the hedge is short. 59 EXAMPLE 1: A company will buy 800,000 gallons of diesel oil in 2 months. It opens a long cross hedge using NYMEX heating oil futures. An analysis of price changes over a 2 month interval yields: (ΔS) = 0.025; (ΔF)=0.033;and ρ(ΔS;ΔF) = 0.693. The risk minimizing hedge ratio: h* = -(.693)(0.025)/0.033 = -0.525. One NYMEX heating oil contract is for NS = 42,000 gallons, so Long n* = (0.525)[800,000/42,000] 60 = 10futures. Notice that in this case, a NAÏVE HEDGE ratio would have resulted in taking a long position in: n* = 800,000/42,000 = 19 futures. Taking into account the correlation between the spot price changes and the futures price changes, allows the use of The minimum variance hedge ratio and thus, n* = 10 futures. Of course, if the correlation and the standard deviations take on other values the risk-minimizing hedge ratio may 61 require more futures than the naïve ratio. EXAMPLE 2: A firm will buy 1 million gallons of jet fuel in 3 months. The firm chooses to long cross hedge with NYMEX heating oil futures. σ(S)=0.04, σ(F)=0.02; ρ(S;F) = 0.42. The optimal hedge ratio: h* = - (0.42)(0.04)/(0.02) = - 0.84. Thus, to minimize the risk long 20 futures: n* = (0.84)[1,000,000/42,000] = 20.62 h* , using Regression: DATA: n+1 weeks. S1 F1,t S1 F1 S2 F2,t S2 F2 S3 F3,t S3 F3 . . . . . . . . . . . . . . Sn Fn Sn+1 Fn+1,t ΔS α βΔF e i β h* i i i1,2, ..., n. 63 EXAMPLE 3. Hedging for copper: A STRIP. On SEP 4, 2005 A U.S. firm has a contract to purchase NS = 1,000,000 pounds of copper on the first trading day of each of the following months: FEB 06, AUG06, FEB07 and AUG07. The firm decides to hedge these purchases with NYMEX copper futures. One NYMEX copper futures is for: NF = 25,000 pounds of copper. Following a regression analysis, the firm decides to use: h* = - 0.7. 64 Date: SEP 04 2005 Spot price: USD2.72/pound Futures prices, USD/pound were: For Delivery: MAR 2006 2.723 SEP 2006 2.728 MAR 2007 2.716 SEP 2007 2.695 65 How to open the long Strip: The number of futures to LONG is: n* = (0.7)[1,000,000/25,000] = 28. All prices are USD/pound. Date SPOT SEP 05 contract Do nothing FUTURES MARKET F FUTURES POSITIONS Long 28 MAR 2006 2.723 Long 28 MAR 2006 Long 28 SEP 2006 2.728 Long 28 SEP 2006 Long 28 MAR 2007 2.716 Long 28 MAR 2007 Long 28 SEP 2007 2.695 Long 28 SEP 2007 66 The following prices have materialized on the first trading days of the given months: All prices are USD/pound DATE SEP05 FEB06 AUG06 FEB07 AUG07 SPOT 2.72 2.69 2.65 PRICE Futures prices for delivery 2.77 MAR06 2.723 2.691 SEP06 2.728 2.702 2.648 MAR07 2.716 2.707 2.643 2.767 SEP07 2.695 2.689 2.642 2.765 2.88 2.882 67 Date SPOT MARKET FUTURES MARKET F FUTURES POSITIONS SEP 05 NOTHING Long 28 MAR 2006 2.723 long 28 MAR 2006 Long 28 SEP 2006 2.728 long 28 SEP 2006 Long 28 MAR 2007 2.716 long 28 MAR 2007 Long 28 SEP 2007 2.695 long 28 SEP 2007 Feb 06 buy 1M units 2.69 short 28 MAR 06 2.691 long 28 SEP 2006 long 28 MAR 2007 long 28 SEP 2006 Aug 06 buy 1M units 2.65 short 28 SEP 06 2.648 long 28 MAR 2007 long 28 SEP 2007 Feb 07 buy 1M units 2.77 short 28 MAR 07 2.767 long 28 SEP 2007 Aug 07 buy 1M units 2.88 short 28 SEP 07 2.882 NO POSITION The average price for the un hedged strategy : (2.69+2.65+2.77+2.88)/4 = $2.7475/pound The average price for the hedged strategy: (.3)2.69 + (.7)(2.69 + 2.723 – 2.691) = 2.7124 (.3)2.65 + (.7)(2.65 + 2.728 – 2.648) = 2.7060 (.3)2.77 + (.7)(2.77 + 2.716 – 2.767) = 2.7343 (.3)2.88 + (.7)(2.88 + 2.695 – 2.882) = 2.7498 $2.725625/pound 68 Cost saving: 4M[2.7457 – 2.7256625] = $127,500. Stock index futures. Foreign currency futures. In each case, we first describe the SPOT MARKET And then analyze the FUTURES MARKET. 69 STOCK INDEX FUTURES The first stock index futures began trading in 1982 on the KCBT. The underlying was the VALUE LINE INDEX. Soon afterwards, the CBT, tried to launch a DJIA futures. It lost its court battle with the Dow Jones Co. and could not establish that futures. Instead, it started trading futures on the MAJOR MARKET INDEX, the MMI. Today, Stock Index Futures are traded on dozens of different indexes. 70 STOCK INDEXES (INDICES) A STOCK INDEX IS A SINGLE NUMBER BASED ON INFORMATION ASSOCIATED WITH A PORTFOILO OF STOCKS. A STOCK INDEX IS SOME KIND OF AN AVERAGE OF THE PRICES AND THE QUANTITIES OF THE SHARES OF THE STOCKS THAT ARE INCLUDED IN THE PORTFOLIO THAT UNDERLYING THE INDEX. 71 STOCK INDEXES (INDICES) THE MOST USED INDEXES ARE A SIMPLE PRICE AVERAGE AND A VALUE WEIGHTED AVERAGE. 72 STOCK INDEXES - THE CASH MARKET A. AVERAGE PRICE INDEXES: DJIA, MMI: N = The number of stocks in the index Sj = Stock j market price; j = 1,…,N. D = Divisor S I= ; j D j = 1,..., N. Initially, D = N and the Index is set at an agreed upon level. To assure continuity, the Divisor is adjusted over time. 73 EXAMPLES OF INDEX ADJUSMENTS STOCK SPLITS: 2 FOR 1: (S1S2 ,..., SN ) / D1I1 1. 2. 1 (S1 S2 ,...,SN ) / D 2 I1 2 Before the split: (30 + 40 + 50 + 60 + 20) /5 = 40 I = 40 and D = 5. An instant later: (30 + 20 + 50 + 60 + 20)/D = 40 The new divisor is D = 4.5 74 CHANGE OF STOCKS IN THE INDEX 1. (S1S2 (ABC) ,..., SN ) / D1I1 2. (S1S2 (XYZ) ...SN ) / D2 I1 Before the change: (31 + 19 + 53 + 59 + 18)/4.5 = 40 I = 40 and D =4.5. An instant later: (30 + 150 + 50 + 60 + 20)/D = 40 The new divisor is D = 7.75 75 A STOCK DIVIDEND DISTRIBUTION Firm 4 distributes 40% stock dividend. Before the distribution: (32 + 113 + 52 + 58 + 25)/7.75 = 36.129 D = 7.75. An instant later: (32 + 113 + 52 + 34.8 + 25)/D = 36.129 76 The new divisor is D = 7.107857587. STOCK # 2 SPLIT 3 FOR 1. Before the split: (31 + 111 + 54 + 35 + 23)/7.107857587 = 35.7351 An instant later: (31 + 37 + 54 + 35 + 23)/D = 35.73507 The new Divisor is D = 5.0370644. 77 ADDITIONAL STOCKS 1. (S1S2 ,...,SN ) / D1I1 2. (S1S2 ,...,SN SN+1 ) / D2 I1 Before the stock addition: (30 + 39 + 55 + 33 + 21)/5.0370644 = 35.338 An instant later: (30 + 39 + 55 + 33 + 21 + 35)/D = 35.338 D = 6.0275. 78 A price adjustment of Altria Group Inc. (MO), (due to a distribution of Kraft Foods Inc. (KFT) shares,) was effective for the open of trade on trade date April 2, 2007.As a result, the new divisor for the DJIA became: D = 0.123051408. The last revision of the DJIA’s Divisor was on AUG 2007 and the Divisor was set at: D = 0.123017848 79 VALUE WEIGHTED INDEXES S & P500, NIKKEI 225, VALUE LINE NS I N S tj tj t j 1,2,......, n Bj Bj B = SOME BASE TIME PERIOD Initially: t=B The initial value of the Index is set at an 80 arbitrarily chosen value: M. ** The S&P500 index base period was 1941-1943 with initial value: M = 10. ** The NYSE index base period was Dec. 31, 1965 with initial value: M = 50. ** The NASDAQ composite index base period was FEB 5 1971 With initail value: M = 100. 81 The rate of return on ANY PORTFOLIO: The return on a PORTFOLIO in any period t, is: the weighted average of the individual stocks returns. The weights are the percentages of the stocks value in the portfolio. R Pt w tjR tj. w tj N tjStj N S tj tj Vtj VtP . 82 The Rate of Return on a portfolio VPt +1VPt N t +1jSt +1j N tjStj R Pt VPt N tjStj R Pt N S N tjStj t +1j t +1j N S ; tj tj but, N t +1j N tj. Thus, R Pt N (S S ) N S tj t +1j tj tj tj 83 St 1j Stj N tjStj S tj , R Pt N tjStj N S R . Rewrite N S tj tj tj this as : tj tj N tjStj R tj , or N tjStj Vtj R tj . Finally, VtP N tjStj Vtj w tj . R Pt w tjR tj. N tjStj VtP 84 THE BETA OF A PORTFOLIO THEOREM: Consider a portfolio consisting of shares of N stocks. The portfolio’s BETA is the weighted average of the stock’s betas. The weights are the dollar value weights of the stocks in the portfolio. R 85 THE BETA OF A PORTFOLIO Proof: We use a well diversified index as a proxy portfolio for the market portfolio. R Let: P denote the portfolio underlying the Index, I. Let: j denote the individual stock in the portfolio. j = 1, 2, …,N. 86 By the definition of BETA: COV(R P ; R M ) βP . VAR(R M ) The Index is a proxy for the Market : COV(R P ; R I ) βP . VAR(R I ) From the previous theorem : R P w jR j, βP COV([ w jR j ]; R I ) VAR(R I ) . 87 Recall that th e covariance is a linear operator, thus : βP w COV(R ; R ) , or : j j I VAR(R I ) COV(R j ; R I ) βP w j w jβ j. VAR(R I ) 88 STOCK PORTFOLIO BETA STOCK NAME PRICE FEDERAL MOUGUL MARTIN ARIETTA IBM US WEST BAUSCH & LOMB FIRST UNION WALT DISNEY DELTA AIRLINES P = 18.875 73.500 50.875 43.625 54.250 47.750 44.500 52.875 SHARES 9,000 8,000 3,500 5,400 10,500 14,400 12,500 16,600 VALUE 169,875 588,000 178,063 235,575 569,625 687,600 556,250 877,725 3,862,713 WEIGHT BETA .044 .152 .046 .061 .147 .178 .144 .227 1.00 .80 .50 .70 1.1 1.1 1.4 1.2 (.044)(1.00) + (.152)(.8) + (.046)(.5) + (.061)(.7) + (.147)(1.1) + (.178)(1.1) + (.144)(1.4) + (.227)(1.2) = 1.06 89 A STOCK PORTFOLIO BETA STOCK NAME BENEFICIAL CORP. CUMMINS ENGINES GILLETTE KMART BOEING W.R.GRACE ELI LILLY PARKER PEN P PRICE 40.500 64.500 62.000 33.000 49.000 42.625 87.375 20.625 SHARES 11,350 10,950 12,400 5,500 4,600 6,750 11,400 7,650 VALUE 459,675 706,275 768,800 181,500 225,400 287,719 996,075 157,781 3,783,225 WEIGHT BETA .122 .187 .203 .048 .059 .076 .263 .042 .95 1.10 .85 1.15 1.15 1.00 .85 .75 = .122(.95) + .187(1.1) + .203(.85) + .048(1.15) + .059(1.15) + .076(1.0) + .263(.85) + .042(.75) = .95 90 Sources of calculated Betas and calculation inputs Example: ß(GE) 6/20/00 Source ß(GE) Value Line Investment Survey 1.25 NYSECI Weekly Price 5 yrs (Monthly) Bloomberg 1.21 S&P500I Weekly Price 2 yrs (Weekly) Bridge Information Systems 1.13 S&P500I Daily Price 2 yrs (daily) Nasdaq Stock Exchange 1.14 Media General Fin. Svcs. (MGFS) Quicken.Excite.com 1.23 MSN Money Central 1.20 DailyStock.com 1.21 Standard & Poors Compustat Svcs S&P Personal Wealth 1.2287 S&P Company Report) 1.23 Index Data S&P500I Horizon Monthly P ice 3 (5) yrs S&P500I Monthly Price 5 yrs (Monthly) S&P500I Daily Price 5 yrs (Daily) S&P500I Monthly Price 5 yrs (Monthly) Charles Schwab Equity Report Card 1.20 S&P Stock Report AArgus Company Report 1.23 1.12 Market Guide YYahoo!Finance 1.23 Motley Fool 1.23 91 STOCK INDEX FUTURES 1. The monetary value of ONE CONTRACT is: (THE INDEX VALUE)($MULTIPLIER) or (I)($m) 2. Accounts are settled by CASH SETTLEMENT 92 A Stock Index Futures • Can be viewed as an investment asset paying a dividend yield • The futures price and spot price relationship is therefore Ft.T = Ste (r–q )(T-t) . q = the annual dividend yield on the portfolio represented by the index 93 A Stock Index Futures • For the formula to be true it is important that the index represents an investment asset • In other words, changes in the index must correspond to changes in the value of a tradable portfolio • The Nikkei index viewed as a dollar number does not represent an investment asset 94 STOCK INDEX HEDGING Stock index hedgers may use the NAÏVE hedge ratio, h = 1. Mostly, however, hedgers use the minimum variance hedge ratio. In this case, the underlying asset is a stock index; actually the portfolio that underlie the index. Thus, the parameter that relates the spot asset and the index is the Beta of the spot asset’s with the Index. Remember: The index is the proxy for the Market portfolio. 95 RECALL THAT THE MINIMUM VARIANCE HEDGE RATIO IS: cov( S; F) h* . var( F) σ ΔS h * - ρΔS,ΔF σ ΔF n * NF . NS NS n h . NF 96 S Sk - St = = rS St St F Fk,T - Ft,T = = rF Ft,T Ft,T ΔS = St rS ΔF = Ft,T rF COV(St rS , Ft,T rF ) COV(S; F) h*= VAR( F) VAR(Ft,T rF ) COV(rS , rF ) [St Ft,T ] h*= 2 VAR(r F ) Ft,T 97 COV(rS , rF ) [St Ft,T ] h*= 2 VAR(r F ) Ft,T COV(rS , rF ) St St h*= -β . VAR(r F ) Ft,T Ft,T NS St N S Spot Value at t n* h* β -β NF Ft,T N F Futures Value at t VS n β VF * 98 STOCK PORTFOLIO HEDGE STOCK NAME PRICE FEDERAL MOUGUL MARTIN ARIETTA IBM US WEST BAUSCH & LOMB FIRST UNION WALT DISNEY DELTA AIRLINES βP 18.875 73.500 50.875 43.625 54.250 47.750 44.500 52.875 SHARES 9,000 8,000 3,500 5,400 10,500 14,400 12,500 16,600 VALUE 169,875 88,000 178,063 235,575 569,625 687,600 556,250 877,725 3,862,713 WEIGHT BETA .044 .152 .046 .061 .147 .178 .144 .227 1.00 .80 .50 .70 1.1 1.1 1.4 1.2 = .044(1.00) + .152(.8) + .046(.5) + .061(.7) + .147(1.1) + .178(1.1) + .144(1.4)+ .227(1.2) = 1.06 99 TIME CASH MAR.31 VS = $3,862,713 FUTURES SEP SP500I FUTURES. F = 1,052.60. VF = 1,052.60($250) = $263,300 3,862,713 n = - 1.06 = - 16. 263,300 * SHORT 16 SEP SP500I Fs. JUL.27 VS = $3,751,307 LONG 16 SEP SP500I Fs F = 1,026.99 GAIN = (1,052.60 - 1,026.99)($250)(16) = $102,440.00 TOTAL VALUE $3,853,747.00 100 ANTICIPATORY HEDGE OF A TAKEOVER A firm intends to purchase 100,000 shares of XYZ ON DEC.17. DATE SPOT FUTURES NOV.17 S = $54/SHARE MAR SP500I FUTURES IS F = 1,465.45 β = 1.35 VF = 1,465.45($250) VS = (54)100,000 = $5,400,000 = $366,362.50 5,400,000 n = - 1.35 = - 20 366,362.50 * LONG 20 MAR SP500I Futures. DEC.17 S = $58/SHARE SHORT 20 MAR SP500I Futures PURCHASE 100,000 SHARES. F = 1, 567.45 COST = $5,800,000 Gain: 20(1,567.45 - 1,465.45)$250 = $510,000 $5,800,000 - $510,000 = $52.9/SHAR E Actual purchasing price: 100,000 101 HEDGING A ONE STOCK PORTFOLIO SPECIFIC STOCK INFORMATION INDICATES THAT THE STOCK SHOULD INCREASE IN VALUE BY ABOUT 9%. THE MARKET IS EXPECTED TO DECREASE BY 10%, HOWEVER. THUS, WITH BETA = 1.1 THE STOCK PRICE IS EXPECTED TO REMAIN AT ITS CURRENT VALUE. SPECULATING ON THE UNSYSTEMATIC RISK, WE OPEN THE FOLLOWING STRATEGY: TIME SPOT FUTURES JULY 1 OWN 150,000 SHARES S = $17.375 VS = $2,606,250 β = 1.1 DEC. IF PRICE F = 1,090 VF = 1,090($250) = $272,500 2,606,250 n = - 1.1 = - 11 272,500 * SHORT 11 DEC. SP500I Futures SEP.30 S = $17.125 V = $2,568,750 LONG 11 DEC SP500I Futures F = 1,002. Gain: $250(11)(1,090 - 1,002) = $242,000 102 ACTUAL V = $2,810,750. An increase of about 8% MARKET TIMING USING BETA When we believe (speculate) that the market trend is changing, we can change the beta of our portfolio. We may purchase high beta stocks and sell low beta stocks, when we believe that the market is turning upward; or purchase low beta stocks and sell high beta stocks, when we believe that the market is moving down. Instead we may try to change the beta of our spot position by using the INDEX FUTURES 103 The Minimum Variance Hedge Ratio in our case is: h* = -(VS/VF). Assume that the current position is a portfolio with current spot market value of VS and n stock index futures. Then: The BETA of the spot position may be altered from its current value, , to a Target Beta = T, buying or selling n futures: VS n* [β T β] . VF 104 Proof: VP VS nVF Δ(VP ) Δ(VS ) n * (VF ) Δ(VP ) Δ(VS ) Δ(VF ) Δ(VS ) VF Δ(VF ) n* n* . VS VS VS VS VS VF DEFINE Δ(VP ) rP ; VS Δ(VS ) rS ; VS VF ErP ErS n * ErF ErT VS and Δ(VF ) rF . VF 105 Again : VF E(rT ) E(rS ) n * E(rF ). VS Following the CAPM, we can write : E(rT ) rf β T [E(rM ) rf ] and E(rS ) rf β[E(r M ) rf ] and E(rF ) E(rM ) rf . Notice that in the last equation F is a futures on the index and thus, it' s β 1. Hence, it requires no initial outlay and no opportunit y cost is needed in the furmula. 106 VF E(rT ) E(rS ) n E(rF ) VS * VF rf β[E(r M ) rf ] n [E(rM ) rf ] VS * rf β T [E(rM ) rf ] * and solve for n : VS n* [β T β] VF 107 MARKET TIMING HEDGE RATIO (page 66) The rule: In order to change the BETA of the spot position from to T, the stock index futures may be used as follows: If β T β; we wish to reduce β to β T VS SHORT n* [β β T ] contracts . VF If β T β; we wish to increase β to β T LONG VS n* [β T β] contracts . VF 108 MARKET TIMING HEDGE; EN EXAMPLE STOCK NAME PRICE BENEFICIAL CORP. CUMMINS ENGINES GILLETTE KMART BOEING W.R.GRACE ELI LILLY PARKER PEN 40.500 64.500 62.000 33.000 49.000 42.625 87.375 20.625 SHARES 11,350 10,950 12,400 5,500 4,600 6,750 11,400 7,650 VALUE 459,675 706,275 768,800 181,500 225,400 287,719 996,075 157,781 3,783,225 WEIGHT BETA .122 .187 .203 .048 .059 .076 .263 .042 .95 1.10 .85 1.15 1.15 1.00 .85 .75 β(portfolio) = .122(.95) + .187(1.1) + .203(.85) + .048(1.15) + .059(1.15) + .076(1.0) + .263(.85) + .042(.75) = .95 109 The portfolio manager speculates that the market has reached a turning point and is on its way up. The idea is that in this case it is possible to increase the portfolio’s Beta employing Stock Index futures. Suppose that the portfolio manager wishes to increase the current Beta from β = .95 to βT = 1.25. 110 TIME SPOT FUTURES AUG.29 V = $3,783,225. DEC SP500I Fs = 0.95. = 1,079.8($250) = $269,950 3,783,225 n * = (1.25 - .95) =4 269,950 LONG 4 DEC SP500I Futures NOV.29 V = $4,161,500 F = 1,154.53 SHORT 4 DEC SP500I Futures GAIN (1,154.53 - 1,079.8)(250)(4) = $74,730 TOTAL PORTFOLIO VALUE $4,236,230 THE MARKET INCREASED ABOUT 7% AND THE PORTFOLIO VALUE INCREASED ABOUT 12% 111 FOREIGN CURRENCY: THE SPOT MARKET EXCHANGE RATES: THE PRICE OF ONE CURRENCY IN TERMS OF ANOTHER CURRENCY IS THE EXCHANGE RATE BETWEEN THE TWO CURRENCIES. 112 SPOT EXCHANGE RATES: THERE ARE TWO QUOTE FORMATS: 1. S(USD/FC) = THE NUMBER OF USD IN ONE UNIT OF THE FOREIGN CURRENCY. 2. S(FC/USD) = THE NUMBER OF THE FOREIGN CURRENCY UNITS IN ONE USD. 113 1 S(FC /FC ) = 1 2 S(FC /FC ) 2 1 Example : S(USD/EUR) = 1.4821 S(EUR/USD) .67476 1 1 = 1.4821 S(USD/EUR) S(EUR/USD) .67476 114 WHEN WE HAVE BID AND ASK QUOTES : 1 S(FC/USD) ASK S(USD/FC) 1 S(FC/USD) BID S(USD/FC) S(GBP/USD) S(USD/GBP) S(USD/GBP) S(GBP/USD) ASK BID ASK BID BID ASK GBP.5USD, buy ONE USD pay .50GBP. USD2.00/G BP, sell ONE GBP get USD2. USD2.083/ GBP, buy ONE GBP pay USD2.0 83. GBP.480/USD, sell ONE USD get .48GBP. 115 BUY USD PAY GBP S(GBP/USD)ASK S(USD/GBP)BID = GBP 0.50 = USD 2.083 RECEIVE S(GBP/USD)BID S(USD/GBP)BID = GBP 0.48 = GBP 2.000 USD GBP SELL 116 CURRENCY CROSS RATES LET FC1, FC2 AND FC3 DENOTE THREE DIFFERENT CURRENCIES. IN THE ABSENCE OF ARBITRAGE : S(FC1/FC3) S(FC1/FC2) = S(FC2/FC3) S(FC3/FC2) = S(FC3/FC1) 117 CURRENCY CROSS RATES – DEC 17.07 (www.x-rates.com) USD GBP CAD EUR MXN USD 1 2.01400 0.989609 1.439200 0.0920801 GBP 0.496524 1 0.491364 0.714597 0.045720 CAD 1.010500 2.035151 1 1.454310 0.093047 EUR 0.694830 1.399380 0.687611 1 0.063980 MXN 10.860109 21.87230 10.747300 15.629900 1 118 CURRENCY CROSS RATES EXAMPLE: FC1 = USD; FC2 = MXN; FC3 = GBP. USD GBP USA 1 2.01400 UK 0.496524 1 MEX 10.860109 21.87230 MXN 0.0920801 0.045720 1 119 CURRENCY CROSS RATES EXAMPLE Let FC1 USD; FC2 MXN; FC3 GBP. S(GBP/MXN) S(USD/MXN) = S(GBP/USD) S(USD/GBP) = . S(MXN/GBP) 120 CURRENCY CROSS RATES EXAMPLE S(GBP/MXN) S(GBP/USD) S(USD/GBP) S(MXN/GBP) 0.045720. 0.496524. 2.014000. 21.872300. S(GBP/MXN) 0.045720 0.092080. S(GBP/USD) 0.496524 S(USD/GBP) 2.014000 0.092080. S(MXN/GBP) 21.872300 121 AN EXAMPLE OF CROSS SPOT RATES ARBITRAGE COUNTRY USD GBP CHF U.S.A 1.0000 1.5640 0.5580 U.K 0.6394 1.0000 0.3546 SWITZERLAND 1.7920 2.8200 1.0000 THEORY : S(GBP/USD) = S(CHF/USD) S(GBP/CHF) BUT : 0.6394 = 1.8031 1.7920 0.3546 SIMILARLY : BUT : S(USD/GBP) = S(CHF/GBP) S(USD/CHF) 1.5640 = 2.8029 < 2.8200 0.5580 122 THE CASH ARBITRAGE ACTIVITIES: Start: End. USD1,000,000 USD1,006,134 0.6394 0.5580 GBP639,400 CHF1,803,108 2.8200 123 Forward rates, An example: GBP DEC 17, 2007 SPOT USD1.997200/GBP 1 Month forward USD1.995300/GBP 2 Months forward USD1.993760/GBP 3 Months forward USD1.992010/GBP 6 Months forward USD1.986500/GBP 12 Months forward USD1.972630/GBP 2 Years USD1.947750/GBP 124 forward FOREIGN CURRENCY CONTRACT SPECIFICATIONS CURRENCY SIZE MINIMUM FUTURES CHANGE USD/FC CHANGE F JAPAN YEN 12.5M .000001 USD12.50 CANADIAN DOLLAR 100,000 .0001 USD10.00 62,500 .0002 USD12.50 SWISS FRANC 125,000 .0001 USD12.50 AUSTRALIAN DOLLAR 100,000 .0001 USD10.00 MEXIAN PESO 500,000 .000025 USD12.50 BRAZILIAN REAL 100,000 .0001 USD10.00 EURO FX 125,000 .0001 USD12.50 BRITISH POUND * MUST CHECK FOR DAILY PRICE LIMITS * CONTRACT MONTHS FOR ALL CURRENCIES: MARCH, JUNE, SEPTEMBER, DECEMBER * LAST TRADING DAY: FUTURES TRADING TERMINATES AT 9:16 AM ON THE SECOND BUSINESS DAY IMMEDIATELY PRECEEDING THE THIRD WEDNESDAY OF THE CONTRACT MONTH. * DELIVERY BY WIRED TRASFER. 3RD WEDNESDAY OF CONTRACT MONTH 125 SPECULATION: TAKE RISK FOR EXPECTED PROFIT AN OUTRIGHT NAKED POSITION WITH CANADIAN DOLLAS: t - MARCH 1. S(USD/CD) = .6345 <=> S(CD/USD) = 1.5760 T- SEPTEMBER F(USD/CD) = .6270 <=> F(CD/USD) = 1.5949 SPECULATOR: “THE CD WILL NOT DEPRECIATE TO THE EXTENT IMPLIED BY THE SEP. FUTURES. INSTEAD, IT WILL DEPRECIATE TO A PRICE HIGHER THAN USD.6270/CD.” TIME MAR 1 CASH DO NOTHING FUTURES LONG n, CD SEP FUTURES AT USD.6270/CD AUG 20 DO NOTHING SHORT n, CD SEP FUTURES AT USD.6300/CD PROFIT = (USD.6300/CD - USD.6270/CD)(CD100,000)(n) = USD300(n). 126 HEDGING IN THE FOLLOWING EXAMPLES WE USE THE NAÏVE HEDGE RATIO: h = 1. Two ways: 1. n = NS/NF 2. n = VS/VF 127 BORROWING U.S. DOLLARS SYNTHETICALLY ABROAD OR HOW TO BEAT THE DOMESTIC BORROWING RATE A U.S. FIRM NEEDS TO BORROW USD200M FROM MAY 25, 2003 TO DECEMBER 20, 2003, FACES THE FOLLOWING DATA: BID ASK SPOT: USD1.25000/EUR USD1.25100/EUR DEC FUTURES: USD1.25850/EUR USD1.26000/EUR ITALY: 6.7512% 6.9545% (365-day year) USA: 8.6100% 8.75154% (360-day year) Interest rates: 128 TIME SPOT FUTURES MAY 25 (1) BORROW EUR160,000,000 LONG 1,332 DEC EUR FUTURES FOR FOR 6.9545% FOR 209 DAYS (2) EXCHANGE THE EUR INTO INTO USD200,000,000 AND USE F = 1.26000 166,500,000 n = 1,332 125,000 THIS SUM TO FINANCE THE PROJECT DEC 20 LOAN VALUE ON DEC. 20 160,000,000e(0.069545)(209/365) = EUR166,500,000 TAKE DELIVERY OF EUR166,500,000 PAYING USD209,790,000 REPAY THE LOAN. THE IMPLIED REVERSE REPO RATE FOR 209 DAYS = 1 209,790,000 ln[ ] = .0823, or 8.23%. 209/360 200,000,000 129 EXAMPLES OF HEDGING FOREIGN CURRENCY EXAMPLE 1: A LONG HEDGE. ON JULY 1, AN AMERICAN AUTOMOBILE DEALER ENTERS INTO A CONTRACT TO IMPORT 100 BRITISH SPORTS CARS FOR GBP28,000 EACH. PAYMENT WILL BE MADE IN BRITISH POUNDS ON NOVEMBER 1. RISK EXPOSURE: IF THE GBP APPRECIATES RELATIVE TO THE USD THE IMPORTER’S COST WILL RISE. TIME SPOT FUTURES JUL. 1 S(USD/GBP) = 1.3060 LONG 46 DEC BP FUTURES CURRENT COST = USD3,656,800 FOR F = USD1.2780/GBP DO NOTHING NOV. 1 h 1; 3,656,800 n= = 46 62,500(1.2780) S(USD/GBP) = 1.4420 SHORT 46 DEC BP FUTURES COST = 28,000(1.4420)(100) FOR F = USD1.4375/GBP = USD4,037,600 PROFIT: (1.4375 - 1.2780)62,500(46) = USD458,562.50 ACTUAL COST = USD3,579,037.50 130 EXAMPLE 2: A LONG HEDGE ON MARCH 1, AN AMERICAN WATCH RETAILER AGREES TO PURCHASE 10,000 SWISS WATCHES FOR CHF375 EACH. THE SHIPMENT AND THE PURCHASE WILL TAKE PLACE ON AUGUST 26. TIME SPOT FUTURES MAR. 1 S(USD/CHF) = .6369 LONG 30 SEP CHF FUTURES CURRENT COST 10,000 (375)(.6369) F(SEP) = USD.6514/CHF AUG. 25 = USD2,388,375 CONTRACT = (.6514)125,000 DO NOTHING = USD81,425. S=USD.6600/CHF SHORT 30 SEP CHF FUTURES BUY 10,00 WATCHES FOR F(SEP) = USD.6750/CHF (375)(.6600)(10,000) PROFIT(.6750 - .6514)125,000(30) TOTAL $2,475,000. = USD88,500. 2,388,375 n= = 30 81,425 ACTUAL COST USD2,386,500 131 EXAMPLE 3: A LONG HEDGE ON MAY 1, AN ITALIAN EXPORTER AGREES TO SELL 1,000 SPORTS CARS TO AN AMERICAN DEALER FOR USD50,000 EACH. THE SHIPMENT AND THE PAYMENT WILL TAKE PLACE ON OCT 26. TIME SPOT FUTURES MAY. 1 S(EUR/USD) = .87000 LONG 298 DEC EUR FUTURES CURRENT VALUE: F(DEC) = USD1.17EUR = EUR43,500,000 43,500,000 n= = 348 125,000 S=EUR.81300/USD SHORT 348 DEC EUR FUTURES DELIVER THE CARS FOR F(DEC) = USD1.29000/EUR PAYMENT: EUR40,650,000. PROFIT(1.29 – 1.17)(125,000)(348) OCT. 26 =USD5,220,000 ACTUAL PAYMENT IN EUR: 40,650,000 + 5,220,000(.813) = EUR44,893,860. 132 EXAMPLE 4: A LONG HEDGE: PROTECT AGAINST DEPRECIATING DOLLAR ON MAY. 23, AN AMERICAN FIRM AGREES TO BUY 100,000 MOTORCYCLES FROM A JAPANESE FIRM FOR JY202,350 . Payment and delivery will take place on DEC 20. CURRENT PRICE DATA: ASK BID SPOT: USD.007020/JY USD.007027/JY (142.4501245) 142.3082396) USD.007190/JY USD.007185/JY DEC FUTURES: ON DECEMBER 20 THE FIRM WILL NEED THE SUM OF JY20,235,000,000. TODAY, THIS SUM IS VALUED AT 20,235,000,000(.007027) = USD142,191,345 N = USD142,191,345/(JY12,500,000)(USD.007190/JY) = 1,582. 133 TIME CASH FUTURES MAY 23 DO NOTHING LONG 1,582 JY FUTURES FOR V = USD142,191,345 F(ask) = USD.007190/JY S = USD.0080/JY SHORT 1,582JY Fs. BUY MOTORCYCLES FOR USD.0080/JY FOR USD161,880,000 PROFIT: (.0080-.00719)12,500,000(1,582) CASE I: DEC 20 = USD16,017,750 NET COST: USD161,880,000 - USD16,017,750 = USD145,862,250. CASE II: DEC 20 S = USD.0065/JY SHORT 1,582 JY Fs. BUY MOTORCYCLES FOR USD.0065/JY USD131,527,500 LOSS: (.00719-.0065)12,500,000(1,582) = USD13,644,750 NET COST: USD145,172,250. 134 EXAMPLE 5: A SHORT HEDGE A US MULTINATIONAL COMPANY’S ITALIAN SUBSIDIARY WILL GENERATE EARNINGS OF EUR2,516,583.75 AT THE END OF THE QUARTER - MARCH 31. THE MONEY WILL BE DEPOSITED IN THE NEW YORK BANK ACCOUNT OF THE FIRM IN U.S. DOLLARS. RISK EXPOSURE: IF THE DOLLAR APRECIATES RELATIVE TO THE EURO THERE WILL BE LESS DOLLARS TO DEPOSIT. TIME CASH FEB. 21 S(USD/EUR) = 1.18455 FUTURES F(JUN) = USD1.17675/EUR CURRENT SPOT VALUE F = 125,000(1.17675) = USD147,093.75 = USD2,981,019.28 n = 2,981,019.28/147,093.75 = 20. DO NOTHING SHORT 20 JUN EUR FUTURES MAR 31 S(EUR/USD) = 1.1000 DEPOSIT 2,768,242.125 LONG 20 JUN EUR FUTURES F(JUN) = USD1.10500 PROFIT: (1.17675 -1.10500)125,000(20) = USD179,375 TOTAL AMOUNT TO DEPOSIT USD2,947,617.125 135