Implications of AASB Decision Residual Value Decision

advertisement

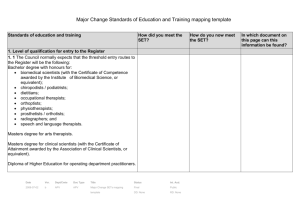

Implications of AASB’s Residual Value Decision David Edgerton FCPA Director Quality + Expertise + Flexibility + Innovation = Confidence & Real Value www.apv.net Outline • • • • Background and context Key points of the decision What it means Issues and solutions www.apv.net Background and context • Oct 2014 Question to AASB • Assets subject to renewal – Recognition that ‘value is preserved’ and ‘costs saved’ through recycling – Different practices adopted – Was there need to change definition of RV? • AASB – Tentative Decision (Feb 2015) – Final decision May 2015 www.apv.net AASB Research and Outreach • Board identified two approaches • View One (RV = zero) • View Two (RV = cost saved through recycling) www.apv.net View One Comp 1 Comp 2 www.apv.net View Two Depreciable Amount Residual Value Residual (non-depreciable) www.apv.net Key points of the decision • RV is the amount received as consideration when control is relinquished. • Therefore likely to be nil or insignificant www.apv.net However • Assets need to be appropriately componentised • If components renewed – split into short and long life components and depreciate separately • Furthermore – Components do not have be physically identifiable www.apv.net In addition • Subject to materiality: OK to use RV as the separate component and using blended depreciation rates • Concept of depreciation is different for valuation than for financial reporting – valuation and depreciation expense are not linked www.apv.net For example: 20m dredged channel A D Long Depreciation Short Fair Value Replacement Cost Valuation www.apv.net What it Means www.apv.net If Current Assume Zero RV • Does not mean your depreciation expense is correct ! • Most likely over-stated • Need to consider whether you need to split between short-life and long-life components www.apv.net Assume: Example Component A Component B Total 40,000 40,000 40 1,000 60000 0 60,000 30 2,000 100,000 Component A Component B Total 25,000 15,000 40,000 15,000 45,000 60,000 100,000 Short-Life Gross Residual Value Depreciable Amount Useful Life Depreciation Expense 25,000 0 25,000 40 625 15,000 0 15,000 30 500 1,125 Long-Life Gross Residual Value Depreciable Amount Useful Life Depreciation Expense 15,000 0 15,000 100 150 45,000 0 45,000 100 450 600 Replacement Cost Residual Value Depreciable Amount Useful Life Depreciation Expense However: Component A Component B Replacement Cost Short-Life Long-Life Total Variance 3,000 Cost of Renewal 25,000 15,000 775 950 1,725 -22.5% -52.5% -42.5% www.apv.net Different Approach = Different Results Traditonal APV Traditonal Straight-Line (Consumption Based) (no split & standard UL) Straight-Line (split & standard UL) Straight-Line (split & tailored UL) Buildings 1,328,438 1,706,734 1,179,427 984,381 Roads 5,550,968 9,480,961 6,372,157 5,250,801 Water & Sewerage 3,214,552 3,933,271 3,391,687 2,807,050 10,093,958 15,120,966 10,943,271 9,042,232 Total www.apv.net If Currently Adopt RVs … • Need to reassess split between short-life and long-life parts • Need to reassess short UL • Need to depreciate the long-life part (not previously depreciated) • Long-Life UL may be greater than service life of the greater asset • Consider materiality www.apv.net Issues and solutions www.apv.net Assumptions • Split between short & long? – If not done – then do – If used RV – adopt as default • Useful life long? – Detailed discussions with asset managers – Long life – 150, 200, 300 ??? • Useful life short? – Is it fixed or a normal range? – What will be impact of improved asset management? www.apv.net Registers • Do you need to increase lines in asset registers? • What would you call them? • Do you need separate AMS and FAR? www.apv.net Valuations v Depreciation • Are they linked ? • Should they be? • Potential errors if so – Valuations grossly under-stated or – Depreciation grossly over-stated • Impact on KPIs? • Even if valuation done recently…. Depreciation expense may no longer stack up ! www.apv.net Questions / Discussion David Edgerton FCPA Email: David@apv.net Web: www.apv.net Mob: 0412 033 845 Work: (07) 3221 3499 www.apv.net