Equity investments – minority passive

advertisement

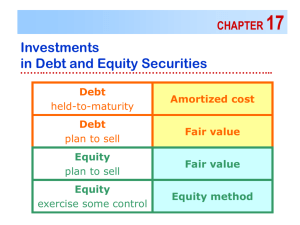

Agenda Items to be covered: • Equity investments • Debt investments © 1999 by Robert F. Halsey Introduction The Area of Controversy - before the current accounting standard was enacted investments in equity and debt securities were recorded at historical cost with no adjustment for changes in their market value. This reflected the feeling that historical cost was free form bias and, therefore, would not inject subjectivity into the financial statements. Now, some debt and equity investments are reported at market value on the balance sheet. Since these securities have known market values (we can look up the price of a stock in the Wall Street Journal), we can use market values without risk of creating bias in the balance sheet. This standard met the needs of the investment community which desired current market values as well as the accounting community which desired to protect the integrity of financial statements. © 1999 by Robert F. Halsey The following is a general roadmap of the accounting for marketable securities: Securities available for sale (Unrealized gains and losses to stockholder's equity) Passive - market method Trading securities (Unrealized gains and losses to Income Statement) Minority Significant Influence Equity method Degree of Ownership Purchase method Majority Consolidate Pooling-of-interests method © 1999 by Robert F. Halsey Equity Investments (no significant influence) At acquisition, the securities are recorded at their cost (including taxes, brokerage fees), which is equal to their market price on the day they are purchased. Subsequent to acquisition – Record dividends received as dividend income – At each statement date, report the securities at their market value through the use of a security fair value adjustment account – Changes in market value are reflected in net income if the securities are classified as “trading” and bypass the income statement if they are classified as “available-forsale” Upon disposition, the difference between the proceeds received and the cost of the securities is recorded as a gain or loss on sale. © 1999 by Robert F. Halsey The accounting for changes in market value depends on how the securities are classified by the company: If the securities are classified as “Trading”, changes in their market value are reflected in the net income of the company. Stockholder’s equity changes by the change in retained earnings. The company’s profitability, therefore, fluctuates with changes in the market value of its investments. If the securities are classified as “Available-For-Sale”, Changes in their market value are reflected as a direct debit or credit to stockholder’s equity and are not run through the income statement. A separate stockholder’s equity account is reflected on the balance sheet to recognize changes in the market value of the firm’s investment portfolio. © 1999 by Robert F. Halsey Here is an example from Aetna’s annual report: Notice the reduction of stockholder’s equity relating to “Accumulated other comprehensive income”. © 1999 by Robert F. Halsey The statement of Stockholder’s Equity provides additional information relating to this other comprehensive loss. The after-tax amount is 833.4M and most of this relates to unrealized losses in the company’s investment portfolio: © 1999 by Robert F. Halsey The schedule provided in the notes reveals that total unrealized losses exceed unrealized gains: © 1999 by Robert F. Halsey Why do we account for changes in market value differently depending on the classification of the securities? The original standard contemplated that all changes in market value would be reflected in earnings, but the banking industry was concerned that increased volatility in earnings would undermine confidence in the banking system. So, the current standard reflected a compromise by FASB which would allow current market values to be reflected on the balance sheet, but not increase the volatility of the earnings for those firms not actively trading in the securities. © 1999 by Robert F. Halsey Debt Investments Recall accounting for bonds... At acquisition: Record the bond at its market price as of the date of sale (recall how to price bonds ) During the bond’s life: Amortize the premium or discount using the effective interest method and reflect the amortization as interest expense together with the cash interest paid. Upon retirement: Compare selling price with carrying value and record a gain or loss on retirement as the difference. The accounting for debt investments is just the same. © 1999 by Robert F. Halsey What about changes in market values? Recall that the value of marketable bonds will vary with market interest rates. That is when interest rates rise then the value of your investment will fall. Should these value changes be reflected in financial statements? The FASB has answered this question -- IT DEPENDS… On management’ intent. The current accounting standards provide for three classifications of debt investments, each with its own set of accounting rules. © 1999 by Robert F. Halsey 1. Held to maturity -- companies can elect to account for their debt investments as “held to maturity” if they have both the positive intent and the ability to hold these investments to maturity. 2. Trading -- debt securities accounted for using this classification are purchased and held primarily for resale in the near term to generate income from short term price changes. 3. Available for sale -- these are debt securities not classified as Held To Maturity or Trading. They are securities that the firm intends to hold and possibly sell if the “price is right”, but does not intend to “trade” in their short-term price movements. © 1999 by Robert F. Halsey Here are the accounting rules related to these classifications… For the Held To Maturity classification, use historical cost (amortize any discount or premium and record the difference between the proceeds and the carrying value of the securities as a gain or loss on sale). The rationale for this accounting treatment is a follows: if a security is held to maturity, changes in its value due to market fluctuations are not relevant, because at maturity, the firm will receive the face amount regardless of intervening price changes. For both the Trading and Available-For-Sale classifications, the securities are reported at their market value on the statement date. The difference in the accounting for these securities relates to the treatment of changes in market value. © 1999 by Robert F. Halsey The remainder of the accounting classifications is identical to that for equity securities: If the securities are classified as “Trading”, changes in their market value are reflected in the net income of the company. Stockholder’s equity changes by the change in retained earnings. The company’s profitability, therefore, fluctuates with changes in the market value of its investments. If the securities are classified as “Available-For-Sale”, changes in their market value are reflected as a direct debit or credit to stockholder’s equity and are not run through the income statement. A separate stockholder’s equity account is reflected on the balance sheet to recognize changes in the market value of the firm’s investment portfolio. © 1999 by Robert F. Halsey The End © 1999 by Robert F. Halsey