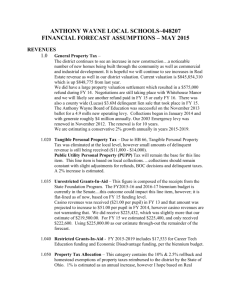

Forecast FY16 - Cardinal Local School District

advertisement

Five Year Forecast FY 2016 In Five “Easy Steps” Presented By Merry Lou Knuckles, Treasurer Five Year Forecast – Step by Step The Five-Year Forecast is a Report mandated by state law and focused on the General Fund. It is completed twice in each fiscal year, October and May. This report is based on the Permanent Appropriations and Certified Revenues as approved by the County Auditor in October and the expected tax revenues approved at the Tax Budget hearing in February. Basically, this is a tool to help Districts plan for future goals, projects and potential deficits. It is not an exact science. The information is continually changing so the best known information is used, keeping in mind things can change shortly after you complete and approve the document. Five Year Forecast – Step by Step The Five-year Forecast is a look at the various budget components of the General Fund. The General Fund is the main operating fund of the District. Majority of the tax revenues received by the District are part of the General Fund. All other funds of the District have specific purposes. The Forecast summarizes the various revenue sources and expenditure categories within the General Fund. Step1 - Gather Information Forecast worksheets are prepared to bring all the required information together to analyze it and project out the necessary current fiscal year budget and the next four fiscal years’ budgets. Known facts drive the forecast process and include tax budget information, negotiated contracts, future goals and purchases, tax levies expiring, new tax levies needed, insurance premium increases, increases in specific expenditures such as special education services, the phasing out of state revenues, and other items affecting our financial picture. These factors and the percentage of change from the last three years are used to calculate the forecasted amounts entered into the forecast worksheet and final forecast report. Step 2 - Review Our Revenues Revenues received by the General Fund: Property tax revenues School foundation settlements Tangible personal property loss value make up Homestead and rollback Medicaid reimbursements Pay-to-participate fees, tuition, interest, student fees, rentals, and other miscellaneous revenues Step 2 - Review Our Revenues, cont. 8.61% 1.34% Revenues General Property Taxes Unrestricted State Grants in Aid Restricted State Grants in Aid Property Tax Allocation 18.72% All Other Revenues 6.54% 18.87% 45.91% OperatingTransfers Step 2 - Review Our Revenues, cont. Tax Revenues – 45.91% Largest source of revenues for the General Fund - it is based on levies passed by the residents of our District and 3.5 of the 4.5 mills of inside millage. Four voted continuing operating levies dating back to before 1976 and one voted operating levy from 2002 that must be renewed every five years – our 9.7 mill levy. Only the inside millage will see an increase in collections if there is an increase in property valuation. The rest can only collect a specified amount of dollars as voted in on the original ballot. A new or replacement levy or an emergency levy is the only other way to get increased revenues. Money voted on in one calendar year is not collected until the following calendar year. Step 2 - Review Our Revenues, cont. Unrestricted State Grants-in-Aid – 18.87% School foundation settlement payments State support monies - two payments a month through the school foundation settlement based on the latest formula. With Each new bi-enium budget from the State, the formula for the school foundation monies can and has changed. We are expecting a decrease in this funding as of right now. Commercial Activity Tax (CAT) revenues and Ohio lottery monies are used to make these settlement payments. Step 2 - Review Our Revenues, cont. Restricted State Grants-in-Aid – 6.54% Special education payments such as Catastrophic costs, excess tuition (SF-14, SF14-H) and career tech are part of our foundation payments. In FY 2015 we submitted $1.725 million in special education costs that qualified for consideration as catastrophic cost reimbursements. We received $349,910. We received $56,013 in FY 2015 from the Medicaid reimbursement program through the Ohio Department of Job & Family Services. Beginning in February 2013 we started receiving our share of casino revenues. We received $61,469 in FY 2015. During our FY 2014 audit, the state auditors requested we move the Metzenbaum Pass-thru funds from Misc to Restricted State. We received $345,325 in FY 2015. All previous years on forecast were also adjusted. Step 2 - Review Our Revenues, cont. Property tax allocation – 18.72% Tangible personal property tax loss value make- up payments To make Ohio more business-friendly the tangible personal property tax paid by businesses on their inventory and machinery was eliminated and replaced with the commercial activity tax (CAT) based on gross sales. During the transition period the District is receiving less in make-up payments than previously received in TPP tax revenues. For FY 2016, the governor vetoed excluding the phase out of the TPP make-up payments from the current budget bill. Therefore we are expecting a reduction of approximately $230,000 in these revenues. Homestead and rollback payments Property owners get a relief on their tax bills in the form of homestead and rollback deductions, as reflected on their tax bills. The state makes up that loss of property tax revenues to the District through state monies. Step 2 - Review Our Revenues, cont. Other revenues – 8.61% The largest portion of this revenue is for tuition paid by other Districts for open enrollment – approximately $661,000. We currently have 121 students attending from other Districts. Other revenues includes pay-to-participate fees, rentals, donations, village income tax sharing, and revenues that do not fit in any other category. Transfers – 1.34% Each year the General Fund will need to transfer money from the main fund to the energy conservation debt payment special cost center and the bus purchase special cost center for principal and interest payments. This transfer “reserves” the money for payment purposes within the general fund. The corresponding transfer out is included in the expenditures. Step 3 - Review Our Expenditures Expenditure Categories For The General Fund: Also known as appropriations (the budget) in the forecast. Personal services Benefits Purchased services Materials and supplies Capital outlay Other Principal and interest Transfers Step 3 - Review Our Expenditures, cont. 0.99% 2.54% 2.08% 0.51% Expenditures 3.53% 21.78% 22.28% 46.29% Personal Services Benefits Purchased Services Materials and Supplies Capital Outlay Other Principal and Interest Transfers Step 3 - Review Our Expenditures, cont. Personal Services – 46.29% Includes salaries and wages for teachers, nurses, secretaries, classroom aides, custodians, mechanics, maintenance, bus and van drivers, bus aides, cashiers, technology, principals, Superintendent, superintendent’s secretary, treasurer, assistant treasurer/payroll, accounts payable and board members. Salaries for the certified and classified staff are based on the negotiated agreements. Salaries for the administration and confidential staff are based on a board approved salary schedule. Also, included are substitutes, supplementals, and severance/termination payments. Step 3 - Review Our Expenditures, cont. Personal Services, cont. – Certified Salaries represent 61.15% of total personal services costs – 83 teachers on staff. Classified Salaries represent 16.48% - 61 on staff. Administrative Salaries represent 7.27% - 7 on staff. Confidential Salaries represent 6.46% - 9 on staff. Supplemental Salaries represent 3.04% - 83 contracts. Retirement Payouts represent 3.00%. Substitute Salaries represent 2.37%. Board Member Salaries represent .23%. Step 3 - Review Our Expenditures, cont. Benefits – 22.28% STRS and SERS are 14% of salaries and wages. Medical (hospitalization and prescription) and dental insurances are through Aetna through October. As part of the savings negotiated with the last union contracts, all employees pay a higher portion of the premium and have a higher deductible to meet each year. Our renewal in November 2015 will be with United Health Care. We are expecting approximately a 22% increase in medical premiums and an 8% increase in dental. (Less than the 39% increase quoted from Aetna) Medicare costs will increase as older employees retire and new employees are hired. The District qualified for group rating again and should see a discount on worker’s comp premiums in FY 2016. Step 3 - Review Our Expenditures, cont. Purchased Services – 21.78% Professional services are those services provided to the District by outside sources. The largest of these services is for special education needs outside of the regular classroom, nearly $1,299,800 in the current budget. Next is tuition paid to other schools for : open enrollment $484,900, community/online schools - $346,100 and postsecondary education - $54,300. We currently have 112 students enrolled outside the District Utility costs should continue to see some relief due to the energy conservation project that was completed in fiscal year 2012. Other services include insurance, legal, technical, training and repairs. Step 3 - Review Our Expenditures, cont. Materials and Supplies – 2.54% Includes, office supplies, classroom materials, software and computer supplies, library books, newspapers, periodicals, maintenance and repair supplies, bus supplies, diesel and regular fuel and tires. Capital Outlay - .99% Includes purchases of new and replacement equipment, and vans and buses for the District. The District entered into lease agreements for five new buses, the savings from the repair costs of the aging fleet will help make the lease payments. Other Expenditures – 2.08% Includes the various fees charged to the District from banks, the county ESC, the board of elections, the county auditor, the county treasurer and the state auditors for their services. Step 3 - Review Our Expenditures, cont. Debt payments - .51% The energy conservation project is being paid for by 0% interest QSCP bonds. The principal and interest payments are paid from the savings on the utility bills due to the upgrades and replacements of heating equipment, the hvac units and lighting. The District purchased five new buses through a lease/purchase agreement. Transfers Out – 3.53% Each year the general fund has to transfer money to the food service fund to help with the operation of the three cafeterias and to avoid a deficit cash balance at year-end. The corresponding transfer out within the general fund for the energy conservation debt and the bus lease payments are recorded here. The net effect is $0. The Board has agreed in the first forecast to hold $150,000 in a Budget Reserve in efforts to carry that money over into the next fiscal year. Step 4 – Analyze Data Information and support documentation for any known facts are collected to make the necessary assumptions to build the Forecast for the next four fiscal years. Assumptions are your best guesses at the time you are putting the Forecast together to show what the next five fiscal years may hold for the District. Any known changes and cuts for the next fiscal year are included in the assumptions and figures. This information is entered into the worksheet to prepare the calculations in order to review and analyze the figures. Then the final figures from the worksheet are entered into the final Five-Year Forecast document. Step 4 – Analyze Data, cont. Review the forecasted data to see just where the District could be in the next five years based on current known information. If any of the costs in our current appropriations budget increase beyond our current revenue budget, we will end the fiscal year in a deficit cash situation. The 9.7 mill levy passed in November, 2012 is up for renewal in 2017 at the latest in order to receive the associated revenues in 2018. This is reflected in the Forecast. On the Forecast a reduction in tax revenues is shown on line 1.010 in FY 2018 forward to show the levy expiring. And the new tax revenues are shown on line 11.020 to show the renewal of the levy and the affects of the levy on our finances. Step 4 – Analyze Data, cont. The District has decided to put a 2 mill permanent improvement levy on the ballot for November 3, 2015. This levy will bring in much needed monies for the repair and upkeep of our buildings, including roofs, parking lots and windows among other items. We would also be able to purchase computers and educational software, upgrade our computer systems and make the bus lease/purchase payments from these monies. This levy would generate approximately $600,000 annually for five years. A home with the assessed valuation $100,000 would pay $72 a year or $6 a month. Step 4 – Analyze Data, cont. Currently these costs are being paid with the monies collected from 1 mill of inside millage, which is normally collected in the General Fund. The Board voted to move .5 mills of inside millage to the PI fund in 2007 and another .5 mills in 2008 to set aside money for the needed repairs and upkeep of school property. When this PI levy passes in November, the Board has agreed to move the 1 mill of inside millage currently funding these items back to the General Fund for operating purposes. This movement of revenues is reflected on line 13.020 of the Forecast. Step 4 – Analyze Data, cont. The Board, Superintendent and Treasurer review the data on the Forecast document to guide the discussions for the coming fiscal year and the next four years. Each Section of the Forecast tells a different story and when they are looked at all together it paints the picture for Cardinal Local Schools and where they are heading. Of course, it is all based only on assumptions derived from the best information available at the time the Forecast was put together. Change is inevitable! Step 5 – The Forecast The BIG PICTURE starts at line 10.010 of the Forecast for this fiscal year and the following four fiscal years. Line 10.010 shows our cash balance as of June 30th for this fiscal year at a positive $42,343. (Remember $150,000 has been “set-aside” in transfers out.) Sound Fiscal Management is to have a Unencumbered Cash Balance at the end of the fiscal year equal to one month’s expenditures. Based on this Forecast information we should be ending our fiscal year with $1,136,333 for an ending Unencumbered Cash Balance . (Total Expenditures divided by 12) We are forecasting a positive ending cash balance through fiscal year 2017. Fiscal years 2018-2020 reflect the affect of the 9.7 mill levy expiring in 2017. Step 5 – The Forecast, cont. Another important line to look at is line12.010, Fund Balance June 30 or our ending cash balance after the renewal levy is accounted for. Here we are not showing a deficit until FY 2020. This means, all things considered, the very latest new money will be needed by January of 2019 in order to continue to operate at the current estimated levels for the District. This is depending on how long we can stretch out our budget, if revenues are not cut drastically at the state level and if costs don’t spiral out of control. Our current needs-based budget is helping us to stretch our dollars even farther then before. Step 5 – The Forecast, cont. Line 15.010 Unreserved Fund Balance – June 30: The line shows the affects of the potential levy renewal (9.7 mills) and the potential inside millage movement (1 mill). Based on our best information as of October 5, 2015, we would see a positive ending cash balance all the way through FY 2020. This shows why it is important to pass the 2 mill PI levy in November 2015 and renew the 9.7 mill levy by January 2018 to keep our cash balance positive. Step 5 – The Forecast, cont. Some major issues for future years – State funding is a huge unknown factor for all school Districts, which can have a positive or negative change in formula each time in the state two-year budget. Any new unfunded mandates will be detrimental to the District. Participation in the STRAIGHT A Grant has brought in some needed technology and digital learning opportunities to the District. We will need to stay current with this programming. Changes in curriculum may require additional resources. Union contract negotiations will begin in Spring 2016. Step 5 – The Forecast, cont. Some major issues for future years – Health care costs are based on experience history and we have had a lot of medical activity in the last few years. Originally we were given a 39% or $750,000 plus annual increase in our health care premiums. We were able to change brokers and insurance carriers to receive significant savings. The Affordable Care Act has put huge burdens on employers to provide adequate health care coverage and to report various information to the federal government and the IRS. We must include the total cost of the insurance premiums on the employees’ W-2’s and file eligibility reports for all variable hour employees (part-time, substitutes, coaches). Step 5 – The Forecast, cont. Some major issues for future years – Special education costs are always a moving target as far as the budget is concerned. We are required to provide services to meet the needs of the students educated in our District and for our students educated in other locations. We currently have 160 employees and about 35 substitutes, along with 1,185 students to take care of within our budgeted resources. We continue to review our needs based budgeting practices. “Is it a need or a want?” If is it a want, we encourage looking for outside sources to help fund that request. Grants, Booster groups, PTA’s and outside donations. Step 5 – The Forecast, cont. We will continue working to provide the best possible education with our available resources – both monetary and personnel. Be Our Guest! It is important for the District to serve up a better than good education to its students and the community. Any Questions?? Please look for the Five Year Forecast and corresponding Assumptions on the District website later this week. Please contact the Merry Lou Knuckles, Treasurer at 440-632-0261, ext. 1002 or merrylou.knuckles@cardinalschools.org