Miscellany - Duke University

advertisement

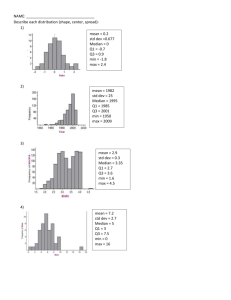

MISCELLANY Xiaoyang Zhuang Economics 201FS Duke University March 16, 2010 Price Series ONE-MINUTE PRICE DATA Alcoa. DuPont . The world’s leading producer of aluminum. A diversified scientific company. April 9, 1997 – December 30, 2010 3404 data points Aligned Returns Series * ^ FIVE-MINUTE RETURNS DATA (OVERNIGHT RETURNS EXCLUDED) (*) October 10, 2008, 9:40 - 9:50: Standard & Poor’s revised the firm’s outlook from “stable” to “negative” after markets closed on October 9. [$11.76 11.82 12.43 12.54 13.09 $13.00 12.53 12.40 12.29 12.25 $12.04] DuPont. (^)May 6, 2010, 14:40 – 14:50: Flash crash. [$36.60 $34.10 $35.44] Alcoa. Contents 1. Separating Market Microstructure Noise from the Price Process 2. Using Overnight Returns to Predict (Next-Day) Price Reversal Contents 1. Separating Market Microstructure Noise from the Price Process 2. Using Overnight Returns to Predict (Next-Day) Price Reversal Volatility Series ANNUALIZED, DAILY, ONE- AND FIVE-MINUTE REALIZED VOLATILITY DATA where t the day index, M is the number of intervals per day, and ∆ is the sampling interval size. Market Microstructure Noise MOTIVATING QUESTION Given one-minute stock price data, is it possible to disentangle actual volatility from market microstructure noise? THE IDEA •(*) The difference between realized volatilities calculated using x- and y-minute (x < y) returns data should be due to finite sample considerations and microstructure noise: where RVolt,x-minute is the realized volatility on day t calculated using x-minute returns data; A is the difference due to finite sample considerations; and εmicrostructure is the difference due to microstructure noise. •The Percent of RVolt,xmin Not Accounted for by RVolt,(x+6)min seems to stabilize when x ≥ ~6 (as we will see). •Could the stabilized value serve as an estimator of finite sample considerations as the sampling frequency changes? (RVolt,1min - RVolt,6min)/ (RVolt,1min) Percent of RVolt,1min Not Accounted for by RVolt,6min SAMPLE STATISTICS: AA mean(Percent) = 6.30 median(Percent) = 6.95 std(Percent) = 13.12 range(Percent) = [-57.40 50.55] SAMPLE STATISTICS: DD mean(Percent) = 8.00 median(Percent) = 8.24 std(Percent) = 13.73 range(Percent) = [-50.40 78.56] (RVolt,6min - RVolt,11min)/ (RVolt,6min) Percent of RVolt,6min Not Accounted for by RVolt,11min SAMPLE STATISTICS: AA mean(Percent) = 2.59 median(Percent) = 2.68 std(Percent) = 12.55 range(Percent) = [-62.97 52.65] SAMPLE STATISTICS: DD mean(Percent) = 3.62 median(Percent) = 3.55 std(Percent) = 12.56 range(Percent) = [-51.31 45.26] (RVolt,11min - RVolt,16min)/ (RVolt,11min) Percent of RVolt,11min Not Accounted for by RVolt,16min SAMPLE STATISTICS: AA mean(Percent) = -0.79 median(Percent) = -0.45 std(Percent) = 14.76 range(Percent) = [-56.30 53.01] SAMPLE STATISTICS: DD mean(Percent) = -0.28 median(Percent) = 0.22 std(Percent) = 14.82 range(Percent) = [-85.91 59.17] (RVolt,16min - RVolt,21min)/ (RVolt,16min) Percent of RVolt,16min Not Accounted for by RVolt,21min SAMPLE STATISTICS: AA mean(Percent) = 0.82 median(Percent) = 1.16 std(Percent) = 16.03 range(Percent) = [-71.70 57.39] SAMPLE STATISTICS: DD mean(Percent) = 1.16 median(Percent) = 1.79 std(Percent) = 16.15 range(Percent) = [-78.41 49.66] Can the mean of stable Percent values (i.e. x ≥ ~6) serve as an estimator of finite sample considerations? Contents 1. Separating Market Microstructure Noise from the Price Process 2. Using Overnight Returns to Predict (Next-Day) Price Reversal Overnight Returns and (Next-Day) Price Reversal MOTIVATING QUESTION Given that a stock loses value in afterhours trading, how will the stock perform in the first 15 minutes after the market opens the following morning? PROCEDURE Define t as the day index. 1. For each stock, consider every case in which the overnight return is negative: i.e. [pricet,15:59 pricet+1,9:35] = [x y], where x > y 2. Compute a = max([pricet+1,9:36 pricet+1,9:37 ... pricet+1,9:50]). 3. Plot each (negative) overnight return against its corresponding Price Reversal, where Price Reversal = log(a) – log(pricet+1,9:35) Overnight Returns and (Next-Day) Price Reversal SAMPLE STATISTICS: AA mean(Reversal) = 0.4281% median(Reversal) = 0.2552% % of Reversal data points exceeding 0: 74.8 SAMPLE STATISTICS: DD mean(Reversal) = 0.3441% median(Reversal) = 0.2309% % of Reversal data points exceeding 0: 77.0