Template - Product Analysis - University of Colorado Boulder

advertisement

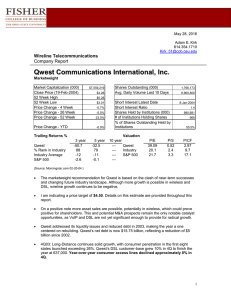

Advanced Corporate Finance University of Colorado-Boulder Leeds School of Business October 7, 2009 Joseph J. Euteneuer Executive Vice President & CFO Qwest Communications 1 Agenda • Background / The Business Environment • The “Street’s” Perspective • Creating Shareholder Value • Balanced Approach to Capital and Investing • September 2009 Bond Offering • Asset Strategic Review 2 Qwest’s Business Qwest14-state Local Service Area Qwest POPs VoIP Deployed Cities 3 September 15, 2008 Crisis on Wall Street as Lehman Totters, Merrill Is Sold, AIG Seeks to Raise Cash —Fed Will Expand Its Lending Arsenal in a Bid to Calm Markets; Moves Cap a Momentous Weekend for American Finance By Carrick Mollenkamp, Susanne Craig, Serena Ng and Aaron Lucchetti A1 Euteneuer to Lead Qwest’s Finances By Roger Cheng B5 Qwest Communications International Inc. hired former XM Satellite Radio and Comcast Corp. executive Joseph Euteneuer to serve as chief financial officer… The American financial system was shaken to its core on Sunday. Lehman Brothers Holdings Inc. faced the prospect of liquidation, and Merrill Lynch & Co. agreed to be sold to Bank of America Corp…. 4 The Business Environment Post 9/15 Total US Consumer Confidence Index: 3Q06 - 2Q10E U.S. Unemployment Rate: 2008 - 2011E 12.0% 10.0% 100 8.0% 80 6.0% 60 4.0% 40 2.0% 0 0.0% Source: the Conference Board and NIPA; Moody’s Economy.com 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 20 3Q 06 4Q 06 1Q 07 2Q 07 3Q 07 4Q 07 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 CC Index (1985 = 100) 120 US Source: Bureau of Labor Statistics: Current Population Survey; Moody's Economy.com U.S. Business Bankruptcy Filings: 3Q06 – 2010E 1.4 80,000 70,000 1.2 60,000 National 0.8 50,000 40,000 30,000 0.6 20,000 0.4 10,000 0.2 0 3Q 0 4Q 6 0 1Q 6 0 2Q 7 0 3Q 7 0 4Q 7 0 1Q 7 0 2Q 8 0 3Q 8 0 4Q 8 0 1Q 8 0 2Q 9 0 3Q 9 0 4Q 9 0 1Q 9 1 2Q 0 10 Building Permits - National (M) Single Family Homes - Building Permits 2006 - 2010E 1.0 US last qtr view 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 Source: Bureau of Census: Form C-404; Moody's Economy.com Source: Office of US District Courts; Moody’s Economy.com 5 The Street’s Perspective of Q 6 6 2009 Total Qwest Guidance 2008 2009 Guidance 2009 Consensus Revenue $ 13,475 n/a $ 12,367 External Adj. EBITDA $ 4,547 $4,250 - $4,400 $ 4,351 CapEx $ 1,777 $1,700 or less $ 1,629 Normalized Free Cash Flow $ 1,439 $1,500 - $1,600 $ 1,561 Qwest is on track to meet Guidance and Analyst Consensus in 2009 7 7 7 Bank of America, David Barden – Key Points Buy/$5.00 Positive view of Qwest is based on several factors: 1. Management focus on extracting value is a positive 2. Potential for enhanced returns to shareholders – Increased the probability of Qwest fully pre-funding the potential put of its convertible senior notes in 2010 3. Expect another wave of consolidation to emerge in 12 to 18 months 4. Valuation is attractive – 8 Qwest’s EBITDA multiple is the lowest in the sector while its ‘09E FCF yield of 21% is among the highest 8 Morgan Stanley, Simon Flannery – Key Points Hold/No Price Target Investment Conclusion • Successfully tapped the credit markets, partially addressing its short-term maturity profile, easing concerns over its dividend sustainability • The company has the ability to sustain its dividend: – – – – Substantial cash on hand Strong cash generation A ~$945M undrawn credit facility (as of July 29) Capital budget flexibility • Revenue Generating Unit (RGU) growth, and its impact on revenue growth, is the bigger obstacle for the stock • Without the stabilization in RGU trends, it may be harder to attract longer-term investors 9 9 Goldman Sachs, Jason Armstrong – Key Points Sell/$2.75 • Revenue pressure making margin gains difficult to hold • The glimmer of hope in AT&T/Verizon results around a consumer wireline inflection was not present at Qwest • We still expect 2010 revenues to decline another 3.4% • This will lead to 150 bp in 2010 margin pressure, with an EBITDA decline of 7.4% to $4.0 bn • Tough balancing act ahead – Peers have invested in video, which appears to be stabilizing line loss, Qwest line loss stepped up another 50 bp QoQ • Comparisons versus AT&T and Verizon in consumer are likely to become even more unfavorable given the current trajectory • Attempts at structural value creation through monetizing certain assets seems unlikely as shown through the recent unsuccessful auction of the company’s backbone business 10 10 Creating Shareholder Value Sustainable Free Cash Flow “Growth” 11 11 Shareholder Value Theoretically how share price is determined: Revenue – OpEx = EBITDA EBITDA – Capex – Interest – Working Capital = FCF FCF *Perception Value = Total Value Total Value – Net Debt (Debt-Cash) = Equity Value Equity Value/Shares Outstanding = Share Price Increasing Shareholder Value Return on Investment Capital Weighted Average Cost of Capital Sustainable Free Cash Flow Growth The value of a company is determined by its expected discounted Free Cash Flow 12 *Perception Value - Shorthand metric to reflect the expected Discounted cash flows of a business, discount rate (including risk) and expected cash flows growth. 12 Analyst Estimates for Q Feb-09 Adj EBITDA Bank of America BMO Citi Goldman Sachs JP Morgan Morgan Stanley Oppenheimer Thomas Weisel UBS Wells Fargo Analyst Consensus Max Estimate Min Estimate Budget Guidance $ 4.24 $ 4.31 4.28 4.17 4.21 4.11 4.22 4.34 4.14 4.28 Adj FCF 1.49 1.39 1.42 1.33 1.44 1.36 1.40 1.43 1.32 1.65 Sep-09 Implied Perception Value* 12.9x 13.8x 15.9x 12.5x 12.1x 15.2x n/a 13.1x 13.9x n/a 4.20 1.40 13.9x 4.31 4.11 4.40 4.2 to 4.4 1.65 1.32 1.50 1.4 to 1.5 15.9x 12.1x 13.0x Price Target $ $ Adj EBITDA 4.00 $ 4.00 6.00 2.50 3.00 4.93 n/a 3.75 3.50 n/a Adj FCF 4.33 $ 4.34 4.40 4.34 4.33 4.36 4.32 4.32 4.41 4.42 1.59 1.23 1.59 1.59 1.65 1.55 1.51 1.50 1.55 1.69 Implied Perception Value* 13.2x 16.4x 13.8x 10.7x 13.7x n/a n/a 12.9x 12.2x n/a 4.19 4.35 1.56 13.0x 6.00 2.50 4.42 4.30 4.40 4.25 to 4.4 1.72 1.23 1.50 1.5 to 1.6 16.4x 10.7x 13.0x Price Target $ $ 5.00 4.50 5.50 2.75 6.00 n/a n/a 4.00 3.80 n/a 4.61 6.00 2.75 * Implied Perception Value is defined as Q Enterprise value divided by the analyst's adjusted FCF estimate 13 13 Perception Value Models Bank of America Valuation Model Implied Total FCF x Perception = Value Value 1,591 x 13.2 = 20,942 Total Value 20,942 Equity Value 8,615 - Net Debt = - 12,327 = ∕ Shares = ∕ 1,723 = Equity Value 8,615 Total Value 17,065 Price Target $ 5.00 Equity Value 4,738 - Net Debt = - 12,327 = ∕ Shares = ∕ 1,723 = Equity Value 4,738 Price Target $ 2.75 David Barden’s Perception of Q: Jason Armstrong’s Perception of Q: • Confident that Q will resolve debt towers through refinancing • Intense revenue pressure • Meaningful results in business markets • Consumer access line loss should continue to slow as FTTN matures 14 Goldman Sachs Valuation Model Implied Total FCF x Perception = Value Value 1,589 x 10.7 = 17,065 • Views IXC auction as a positive indication that Q is exploring value - Large wholesale disconnects - Mass markets pressure intensified • Unfavorable FTTN trajectory • Unsuccessful IXC auction 14 Perception Value Sensitivity Analysis $ $ $ $ $ $ $ $ $ $ $ FCF 1,800 1,750 1,700 1,650 1,600 1,561 1,500 1,450 1,400 1,350 1,300 11.4x $ 4.76 $ 4.42 $ 4.09 $ 3.76 $ 3.43 $ 3.17 $ 2.77 $ 2.44 $ 2.11 $ 1.78 $ 1.45 11.6x $ 4.96 $ 4.63 $ 4.29 $ 3.95 $ 3.62 $ 3.35 $ 2.94 $ 2.61 $ 2.27 $ 1.93 $ 1.60 11.8x $ 5.17 $ 4.83 $ 4.49 $ 4.15 $ 3.80 $ 3.54 $ 3.12 $ 2.78 $ 2.43 $ 2.09 $ 1.75 12.0x $ 5.38 $ 5.03 $ 4.69 $ 4.34 $ 3.99 $ 3.72 $ 3.29 $ 2.94 $ 2.60 $ 2.25 $ 1.90 Enterprise Perception Value Multiple 12.2x 12.4x 12.6x 12.8x $ 5.59 $ 5.80 $ 6.01 $ 6.22 $ 5.24 $ 5.44 $ 5.64 $ 5.85 $ 4.88 $ 5.08 $ 5.28 $ 5.47 $ 4.53 $ 4.72 $ 4.91 $ 5.10 $ 4.17 $ 4.36 $ 4.55 $ 4.73 $ 3.90 $ 4.08 $ 4.26 $ 4.44 $ 3.47 $ 3.64 $ 3.81 $ 3.99 $ 3.11 $ 3.28 $ 3.45 $ 3.62 $ 2.76 $ 2.92 $ 3.08 $ 3.25 $ 2.40 $ 2.56 $ 2.72 $ 2.87 $ 2.05 $ 2.20 $ 2.35 $ 2.50 13.0x $ 6.43 $ 6.05 $ 5.67 $ 5.29 $ 4.92 $ 4.62 $ 4.16 $ 3.79 $ 3.41 $ 3.03 $ 2.65 13.2x $ 6.64 $ 6.25 $ 5.87 $ 5.49 $ 5.10 $ 4.80 $ 4.34 $ 3.95 $ 3.57 $ 3.19 $ 2.80 13.4x $ 6.84 $ 6.46 $ 6.07 $ 5.68 $ 5.29 $ 4.99 $ 4.51 $ 4.12 $ 3.73 $ 3.34 $ 2.96 13.6x $ 7.05 $ 6.66 $ 6.26 $ 5.87 $ 5.47 $ 5.17 $ 4.69 $ 4.29 $ 3.90 $ 3.50 $ 3.11 13.8x $ 7.26 $ 6.86 $ 6.46 $ 6.06 $ 5.66 $ 5.35 $ 4.86 $ 4.46 $ 4.06 $ 3.66 $ 3.26 = August 2008 (H = $4.01, L = $3.43) 15 15 Perception Value Sensitivity Analysis $ $ $ $ $ $ $ $ $ $ $ FCF 1,800 1,750 1,700 1,650 1,600 1,561 1,500 1,450 1,400 1,350 1,300 11.4x $ 4.76 $ 4.42 $ 4.09 $ 3.76 $ 3.43 $ 3.17 $ 2.77 $ 2.44 $ 2.11 $ 1.78 $ 1.45 11.6x $ 4.96 $ 4.63 $ 4.29 $ 3.95 $ 3.62 $ 3.35 $ 2.94 $ 2.61 $ 2.27 $ 1.93 $ 1.60 11.8x $ 5.17 $ 4.83 $ 4.49 $ 4.15 $ 3.80 $ 3.54 $ 3.12 $ 2.78 $ 2.43 $ 2.09 $ 1.75 12.0x $ 5.38 $ 5.03 $ 4.69 $ 4.34 $ 3.99 $ 3.72 $ 3.29 $ 2.94 $ 2.60 $ 2.25 $ 1.90 Enterprise Perception Value Multiple 12.2x 12.4x 12.6x 12.8x $ 5.59 $ 5.80 $ 6.01 $ 6.22 $ 5.24 $ 5.44 $ 5.64 $ 5.85 $ 4.88 $ 5.08 $ 5.28 $ 5.47 $ 4.53 $ 4.72 $ 4.91 $ 5.10 $ 4.17 $ 4.36 $ 4.55 $ 4.73 $ 3.90 $ 4.08 $ 4.26 $ 4.44 $ 3.47 $ 3.64 $ 3.81 $ 3.99 $ 3.11 $ 3.28 $ 3.45 $ 3.62 $ 2.76 $ 2.92 $ 3.08 $ 3.25 $ 2.40 $ 2.56 $ 2.72 $ 2.87 $ 2.05 $ 2.20 $ 2.35 $ 2.50 = August 2008 (H = $4.01, L = $3.43) 16 13.0x $ 6.43 $ 6.05 $ 5.67 $ 5.29 $ 4.92 $ 4.62 $ 4.16 $ 3.79 $ 3.41 $ 3.03 $ 2.65 13.2x $ 6.64 $ 6.25 $ 5.87 $ 5.49 $ 5.10 $ 4.80 $ 4.34 $ 3.95 $ 3.57 $ 3.19 $ 2.80 13.4x $ 6.84 $ 6.46 $ 6.07 $ 5.68 $ 5.29 $ 4.99 $ 4.51 $ 4.12 $ 3.73 $ 3.34 $ 2.96 13.6x $ 7.05 $ 6.66 $ 6.26 $ 5.87 $ 5.47 $ 5.17 $ 4.69 $ 4.29 $ 3.90 $ 3.50 $ 3.11 13.8x $ 7.26 $ 6.86 $ 6.46 $ 6.06 $ 5.66 $ 5.35 $ 4.86 $ 4.46 $ 4.06 $ 3.66 $ 3.26 = November 2008 (H = $3.38, L = $2.28) 16 Perception Value Sensitivity Analysis $ $ $ $ $ $ $ $ $ $ $ FCF 1,800 1,750 1,700 1,650 1,600 1,561 1,500 1,450 1,400 1,350 1,300 11.4x $ 4.76 $ 4.42 $ 4.09 $ 3.76 $ 3.43 $ 3.17 $ 2.77 $ 2.44 $ 2.11 $ 1.78 $ 1.45 11.6x $ 4.96 $ 4.63 $ 4.29 $ 3.95 $ 3.62 $ 3.35 $ 2.94 $ 2.61 $ 2.27 $ 1.93 $ 1.60 11.8x $ 5.17 $ 4.83 $ 4.49 $ 4.15 $ 3.80 $ 3.54 $ 3.12 $ 2.78 $ 2.43 $ 2.09 $ 1.75 12.0x $ 5.38 $ 5.03 $ 4.69 $ 4.34 $ 3.99 $ 3.72 $ 3.29 $ 2.94 $ 2.60 $ 2.25 $ 1.90 Enterprise Perception Value Multiple 12.2x 12.4x 12.6x 12.8x $ 5.59 $ 5.80 $ 6.01 $ 6.22 $ 5.24 $ 5.44 $ 5.64 $ 5.85 $ 4.88 $ 5.08 $ 5.28 $ 5.47 $ 4.53 $ 4.72 $ 4.91 $ 5.10 $ 4.17 $ 4.36 $ 4.55 $ 4.73 $ 3.90 $ 4.08 $ 4.26 $ 4.44 $ 3.47 $ 3.64 $ 3.81 $ 3.99 $ 3.11 $ 3.28 $ 3.45 $ 3.62 $ 2.76 $ 2.92 $ 3.08 $ 3.25 $ 2.40 $ 2.56 $ 2.72 $ 2.87 $ 2.05 $ 2.20 $ 2.35 $ 2.50 = August 2008 (H = $4.01, L = $3.43) 13.0x $ 6.43 $ 6.05 $ 5.67 $ 5.29 $ 4.92 $ 4.62 $ 4.16 $ 3.79 $ 3.41 $ 3.03 $ 2.65 13.2x $ 6.64 $ 6.25 $ 5.87 $ 5.49 $ 5.10 $ 4.80 $ 4.34 $ 3.95 $ 3.57 $ 3.19 $ 2.80 13.4x $ 6.84 $ 6.46 $ 6.07 $ 5.68 $ 5.29 $ 4.99 $ 4.51 $ 4.12 $ 3.73 $ 3.34 $ 2.96 13.6x $ 7.05 $ 6.66 $ 6.26 $ 5.87 $ 5.47 $ 5.17 $ 4.69 $ 4.29 $ 3.90 $ 3.50 $ 3.11 13.8x $ 7.26 $ 6.86 $ 6.46 $ 6.06 $ 5.66 $ 5.35 $ 4.86 $ 4.46 $ 4.06 $ 3.66 $ 3.26 = November 2008 (H = $3.38, L = $2.28) = April 2009 (H = $4.06, L = $3.42) 17 17 Perception Value Sensitivity Analysis $ $ $ $ $ $ $ $ $ $ $ FCF 1,800 1,750 1,700 1,650 1,600 1,561 1,500 1,450 1,400 1,350 1,300 18 11.4x $ 4.76 $ 4.42 $ 4.09 $ 3.76 $ 3.43 $ 3.17 $ 2.77 $ 2.44 $ 2.11 $ 1.78 $ 1.45 11.6x $ 4.96 $ 4.63 $ 4.29 $ 3.95 $ 3.62 $ 3.35 $ 2.94 $ 2.61 $ 2.27 $ 1.93 $ 1.60 11.8x $ 5.17 $ 4.83 $ 4.49 $ 4.15 $ 3.80 $ 3.54 $ 3.12 $ 2.78 $ 2.43 $ 2.09 $ 1.75 12.0x $ 5.38 $ 5.03 $ 4.69 $ 4.34 $ 3.99 $ 3.72 $ 3.29 $ 2.94 $ 2.60 $ 2.25 $ 1.90 Enterprise Perception Value Multiple 12.2x 12.4x 12.6x 12.8x $ 5.59 $ 5.80 $ 6.01 $ 6.22 $ 5.24 $ 5.44 $ 5.64 $ 5.85 $ 4.88 $ 5.08 $ 5.28 $ 5.47 $ 4.53 $ 4.72 $ 4.91 $ 5.10 $ 4.17 $ 4.36 $ 4.55 $ 4.73 $ 3.90 $ 4.08 $ 4.26 $ 4.44 $ 3.47 $ 3.64 $ 3.81 $ 3.99 $ 3.11 $ 3.28 $ 3.45 $ 3.62 $ 2.76 $ 2.92 $ 3.08 $ 3.25 $ 2.40 $ 2.56 $ 2.72 $ 2.87 $ 2.05 $ 2.20 $ 2.35 $ 2.50 13.0x $ 6.43 $ 6.05 $ 5.67 $ 5.29 $ 4.92 $ 4.62 $ 4.16 $ 3.79 $ 3.41 $ 3.03 $ 2.65 13.2x $ 6.64 $ 6.25 $ 5.87 $ 5.49 $ 5.10 $ 4.80 $ 4.34 $ 3.95 $ 3.57 $ 3.19 $ 2.80 13.4x $ 6.84 $ 6.46 $ 6.07 $ 5.68 $ 5.29 $ 4.99 $ 4.51 $ 4.12 $ 3.73 $ 3.34 $ 2.96 13.6x $ 7.05 $ 6.66 $ 6.26 $ 5.87 $ 5.47 $ 5.17 $ 4.69 $ 4.29 $ 3.90 $ 3.50 $ 3.11 = August 2008 (H = $4.01, L = $3.43) = November 2008 (H = $3.38, L = $2.28) = April 2009 (H = $4.06, L = $3.42) = September 2009 (H = $3.72, L = $3.34) 13.8x $ 7.26 $ 6.86 $ 6.46 $ 6.06 $ 5.66 $ 5.35 $ 4.86 $ 4.46 $ 4.06 $ 3.66 $ 3.26 18 Perception Value Sensitivity Analysis $ $ $ $ $ $ $ $ $ $ $ FCF 1,800 1,750 1,700 1,650 1,600 1,561 1,500 1,450 1,400 1,350 1,300 19 11.4x $ 4.76 $ 4.42 $ 4.09 $ 3.76 $ 3.43 $ 3.17 $ 2.77 $ 2.44 $ 2.11 $ 1.78 $ 1.45 11.6x $ 4.96 $ 4.63 $ 4.29 $ 3.95 $ 3.62 $ 3.35 $ 2.94 $ 2.61 $ 2.27 $ 1.93 $ 1.60 11.8x $ 5.17 $ 4.83 $ 4.49 $ 4.15 $ 3.80 $ 3.54 $ 3.12 $ 2.78 $ 2.43 $ 2.09 $ 1.75 12.0x $ 5.38 $ 5.03 $ 4.69 $ 4.34 $ 3.99 $ 3.72 $ 3.29 $ 2.94 $ 2.60 $ 2.25 $ 1.90 Enterprise Perception Value Multiple 12.2x 12.4x 12.6x 12.8x $ 5.59 $ 5.80 $ 6.01 $ 6.22 $ 5.24 $ 5.44 $ 5.64 $ 5.85 $ 4.88 $ 5.08 $ 5.28 $ 5.47 $ 4.53 $ 4.72 $ 4.91 $ 5.10 $ 4.17 $ 4.36 $ 4.55 $ 4.73 $ 3.90 $ 4.08 $ 4.26 $ 4.44 $ 3.47 $ 3.64 $ 3.81 $ 3.99 $ 3.11 $ 3.28 $ 3.45 $ 3.62 $ 2.76 $ 2.92 $ 3.08 $ 3.25 $ 2.40 $ 2.56 $ 2.72 $ 2.87 $ 2.05 $ 2.20 $ 2.35 $ 2.50 13.0x $ 6.43 $ 6.05 $ 5.67 $ 5.29 $ 4.92 $ 4.62 $ 4.16 $ 3.79 $ 3.41 $ 3.03 $ 2.65 13.2x $ 6.64 $ 6.25 $ 5.87 $ 5.49 $ 5.10 $ 4.80 $ 4.34 $ 3.95 $ 3.57 $ 3.19 $ 2.80 13.4x $ 6.84 $ 6.46 $ 6.07 $ 5.68 $ 5.29 $ 4.99 $ 4.51 $ 4.12 $ 3.73 $ 3.34 $ 2.96 13.6x $ 7.05 $ 6.66 $ 6.26 $ 5.87 $ 5.47 $ 5.17 $ 4.69 $ 4.29 $ 3.90 $ 3.50 $ 3.11 = August 2008 (H = $4.01, L = $3.43) = November 2008 (H = $3.38, L = $2.28) = April 2009 (H = $4.06, L = $3.42) = September 2009 (H = $3.72, L = $3.34) 13.8x $ 7.26 $ 6.86 $ 6.46 $ 6.06 $ 5.66 $ 5.35 $ 4.86 $ 4.46 $ 4.06 $ 3.66 $ 3.26 19 Perception Value Sensitivity Analysis $ $ $ $ $ $ $ $ $ $ $ FCF 1,800 1,750 1,700 1,650 1,600 1,561 1,500 1,450 1,400 1,350 1,300 20 11.4x $ 4.76 $ 4.42 $ 4.09 $ 3.76 $ 3.43 $ 3.17 $ 2.77 $ 2.44 $ 2.11 $ 1.78 $ 1.45 11.6x $ 4.96 $ 4.63 $ 4.29 $ 3.95 $ 3.62 $ 3.35 $ 2.94 $ 2.61 $ 2.27 $ 1.93 $ 1.60 11.8x $ 5.17 $ 4.83 $ 4.49 $ 4.15 $ 3.80 $ 3.54 $ 3.12 $ 2.78 $ 2.43 $ 2.09 $ 1.75 12.0x $ 5.38 $ 5.03 $ 4.69 $ 4.34 $ 3.99 $ 3.72 $ 3.29 $ 2.94 $ 2.60 $ 2.25 $ 1.90 Enterprise Perception Value Multiple 12.2x 12.4x 12.6x 12.8x $ 5.59 $ 5.80 $ 6.01 $ 6.22 $ 5.24 $ 5.44 $ 5.64 $ 5.85 $ 4.88 $ 5.08 $ 5.28 $ 5.47 $ 4.53 $ 4.72 $ 4.91 $ 5.10 $ 4.17 $ 4.36 $ 4.55 $ 4.73 $ 3.90 $ 4.08 $ 4.26 $ 4.44 $ 3.47 $ 3.64 $ 3.81 $ 3.99 $ 3.11 $ 3.28 $ 3.45 $ 3.62 $ 2.76 $ 2.92 $ 3.08 $ 3.25 $ 2.40 $ 2.56 $ 2.72 $ 2.87 $ 2.05 $ 2.20 $ 2.35 $ 2.50 13.0x $ 6.43 $ 6.05 $ 5.67 $ 5.29 $ 4.92 $ 4.62 $ 4.16 $ 3.79 $ 3.41 $ 3.03 $ 2.65 13.2x $ 6.64 $ 6.25 $ 5.87 $ 5.49 $ 5.10 $ 4.80 $ 4.34 $ 3.95 $ 3.57 $ 3.19 $ 2.80 13.4x $ 6.84 $ 6.46 $ 6.07 $ 5.68 $ 5.29 $ 4.99 $ 4.51 $ 4.12 $ 3.73 $ 3.34 $ 2.96 13.6x $ 7.05 $ 6.66 $ 6.26 $ 5.87 $ 5.47 $ 5.17 $ 4.69 $ 4.29 $ 3.90 $ 3.50 $ 3.11 = August 2008 (H = $4.01, L = $3.43) = November 2008 (H = $3.38, L = $2.28) = April 2009 (H = $4.06, L = $3.42) = September 2009 (H = $3.72, L = $3.34) 13.8x $ 7.26 $ 6.86 $ 6.46 $ 6.06 $ 5.66 $ 5.35 $ 4.86 $ 4.46 $ 4.06 $ 3.66 $ 3.26 20 Shareholder Value Theoretically how share price is determined: Revenue – OpEx = EBITDA EBITDA – Capex – Interest – Working Capital = FCF FCF *Perception Value = Total Value Total Value – Net Debt (Debt-Cash) = Equity Value Equity Value/Shares Outstanding = Share Price Increasing Shareholder Value Return on Investment Capital Weighted Average Cost of Capital Sustainable Free Cash Flow Growth The value of a company is determined by its expected discounted Free Cash Flow 21 *Perception Value - Shorthand metric to reflect the expected Discounted cash flows of a business, discount rate (including risk) and expected cash flows growth. 21 Simplify our Focus to Drive Shareholder Value Shareholder Value Revenue Administrative / Operating Expense Capital New Customers Acquisition Cost Shared Support Capital Spending Existing Customers Service Cost 3rd Party Payments PP&E Efficiency ARPU – Wallet Share Facility Cost Expectations Working Capital Efficiency Execution Perfecting the Customer Experience 22 Balanced Approach to Capital and Investing 23 23 Comparative Balance Sheet QWEST COMMUNICATIONS INTERNATIONAL INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) June 30, 2009 December 31, 2008 (Dollars in millions) ASSETS Current assets: Cash and cash equivalents................................................................. $ 1,796 $ Other................................................................................................. 2,252 Total current assets............................................................................... 4,048 Property, plant and equipment—net and other..................................... 16,178 Total assets........................................................................................... $ 20,226 $ 565 2,405 2,970 17,171 20,141 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Current portion of long-term borrowings ......................................... $ Accounts payable and other.............................................................. Total current liabilities......................................................................... Long-term borrowings—net................................................................. Other..................................................................................................... Total liabilities..................................................................................... Stockholders' equity ............................................................................ Total liabilities and stockholders' equity.............................................. $ 24 1,085 $ 2,703 3,788 13,038 4,451 21,277 (1,051) 20,226 $ 820 3,033 3,853 12,735 4,939 21,527 (1,386) 20,141 24 Balance Investment in Growth with Returns to the Shareholder 2009 Investment and Return- $2.8B (estimated) In millions of dollars $528 $549 $1,700 Capex Dividend Share Repurchase Debt Repurchase • We started paying dividends in February 2008 – The first dividend paid since 2001 • We announced a $2B stock buy back program in October 2006 – Repurchased $1.8B through December 2008 – Still have authorization to buy $.2B • We spent $1.8B in 2008 on CAPEX – Estimated CAPEX is $1.7B or less in 2009 25 25 Qwest Debt Maturity Schedule $ in Millions 3,389 Unregulated QCII and QCF (pay down) Regulated QC (re-finance) 2,168 2,151 1,900 950 Notes: 26 • Convertible notes shown as a maturity in 2010 given investors’ put rights • $945 million un-drawn revolver matures in October 2010 • Paid down $562M QCF notes due August 3, 2009 • Information above excludes any potential pension funding starting in 2011 26 2009 – 2011 Quarterly Debt Maturity Schedule $2.6B in Debt maturities within 90 days – “The Elephant” $1,600 $1,200 $801 $800 $1,265 $825 $400 $500 $525 $403 $0 1Q10 27 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 Unregulated QCII and QCF (pay down) Regulated QC (re-finance) 4Q11 27 So – How Do You Eat an Elephant? In the 90 day period between Nov. 2010 and Feb. 2011, Qwest has $2.6 Billion Debt Maturing (The “Elephant”) $2.6 Billion = $.8 Billion Combined with cash on hand and expected cash flow generation, we need to finance approximately $800 Million to finish the meal. 28 … One Piece at a Time 28 28 September 2009 Bond Offering 29 29 Capital Markets Seize Up High Yield Bonds ($ in billions) Investment Grade Corporate (Non-Financial) Bonds ($ in billions) Upcoming Annual Maturities Annual New Issuance Upcoming Annual Maturities Annual New Issuance $181 $165 $158 $799 $143 $112 $518 $40 03 $707 $680 04 05 Source: Citi Syndicate 06 07 08 $51 09 $62 10 $502 $505 04 05 $517 $484 $440 $71 11 03 06 07 08 09 10 11 Source: Citi 30 30 Qwest Yields and High Yield Market Issuance Heightened LBO Activity “Cheap Money” – unlikely to return to these levels ($ in bn) Current yields are comparable to 2008 (pre-Lehman) levels Heavy issuance volume 9/16/08 Lehman files for bankruptcy $14 3/9/09 S&P 500 2009 low 22.0% 21.255% 20.0% $12 18.0% $10 16.0% $8 14.0% $6 12.0% $4 10.0% $2 8.0% 8.59% $0 6.0% 1/3/06 4/3/06 7/3/06 10/3/06 1/3/07 4/3/07 7/3/07 10/3/07 Weekly HY Issuance 1/3/08 4/3/08 7/3/08 10/3/08 1/3/09 4/3/09 8/18/09 7/3/09 YTW on QCII 7.5% Senior Notes due '14 31 September 14th – Why did Qwest launch a bond offering? Financing Transaction • On September 14th, Qwest launched and priced a $550m high yield bond offering • Price of 98.244%, coupon of 8.0% and yield of 8.375% Rates increase Now Rates decrease Pay rate as of 9-14 (8.375%)1 Opportunity cost could have paid lower rate Re-finance decision Rates increase Later Pay higher rate (could be 20%+) Rates decrease Pay lower rate1 1 Best rate issued since 2002 is in the low 7% range 32 32 September 14th – Why did Qwest launch a bond offering? • Funding need – Debt maturities in 2010/2011 that exceed FCF less dividends • Improved market environment – Equity and bond market were greatly improved • S&P 500 up 54% from low of 676 on March 9, 2009 to 1,043 as of Sept. 11, 2009 • High yield market has also rallied (bond prices up and yields down) – Qwest’s 7.5% note due 2014 trading yield improved to 8.2% (Sept. 11) down from a high of approximately 20% in December 2008 • Decision – Raise capital now or at a later date in 2009 or 2010 • Waiting = taking a position that interest rates will fall or remain flat • Not waiting = protection against rising interest rates – Chance to opportunistically re-finance a portion of funding requirement (dollar cost average) – Cost is negative carry (the interest cost on new debt raised prior to the maturity of the old debt) 33 33 Asset Strategic Review 34 34 Introduction – Opportunity Qwest Communications International Inc. (“QCII”) Unregulated parent company traded on the NYSE “Q” with a state-of-the-art nationwide fiber optic network and advanced product offerings Regulated Regional Bell Operating Company (RBOC) telecom provider in 14 western states with a significant customer base: • Third largest local telephone company • 10.9 million access lines • 2.9 million high-speed Internet subscribers • 853K video subscribers Potential Opportunity • Qwest received an unsolicited inquiry from a company that was interested in purchasing assets (property plant & equipment, customers, revenue and employees) • The assets in question were not a separate standalone business unit with financial statements Qwest Corporation 14-state Local Service Area Qwest POPs VoIP Deployed Cities Qwest Central Offices 1) As of Q2 2009 35 Unsolicited Offer for Assets - Summary • Company receives an unsolicited offer from a buyer • Corporate governance issues – Board has a fiduciary duty to the shareholders to evaluate an acquisition proposal • Internal and external counsel consulted • Meetings with management, the board of directors and consultants / advisors • Comprehensive review of the assets and operations undertaken • Decision to run competitive bidding process • Outside advisors engaged to manage process • Evolution of offers concluded the asset was more valuable to Qwest shareholders • No disclosure requirement until an actual agreement is reached 36 Identify the Specific Assets – Due Diligence Process Physical Assets Customer Assets • Detailed process to identify specifically what physical assets the buyer was interested in • Detailed process to identify what customer contracts and revenues would be included in the sale • For example: fiber in the ground from city A to city B, etc. • Many lawyers reviewing contracts • Audited financial statements needed to be created Human Capital • Detailed process to identify the employees that would be included in the sale of assets • Separation of related assets (e.g., real estate, PCs, e-mail networks, etc.) Goal is to determine what assets would be sold and, therefore, the cash flow stream that would be leaving the company in exchange for a purchase price 37 Valuation – Value to a Buyer of Assets Considerations Asset Purchase Revenue FCF • Buyer will estimate future cash flows Not actual numbers / For illustrative purposes only 3000 2500 2,200 2,100 2,000 2,400 2,300 2000 1500 1000 800 900 1,000 1,100 1,200 • Identification of synergies is typically a significant value driver • For example, elimination of duplicative overhead 500 0 2010 2011 2012 2013 2014 NPV (net present value) of the cash flows discounted at the company’s WACC (weighted average cost of capital) is the value of purchasing the assets inclusive of synergy value 38 Valuation – Value of Retaining Assets Considerations Asset Sale Revenue 3000 FCF Not actual numbers / For illustrative purposes only • Review of assets and operations 2,800 2,600 2,400 2500 2,200 2,000 2000 1500 1,000 1,100 1,200 1,300 1,400 1000 • Sale of assets may involve dis-synergies • For example, corporate overhead allocated over a smaller revenue base • Separation of assets involves transaction costs 500 0 2010 2011 2012 2013 2014 NPV (net present value) of the cash flows discounted at the company’s WACC (weighted average cost of cost of capital) is the value of retaining the assets plus the avoided transaction costs and dis-synergies 39 Evaluation of the Purchase Offer Consideration • Currency utilized could be: • Cash • Stock • Debt • Commercial agreements • Combination of the above • Terms & conditions of contract Execution Risk Financial Markets Risk • Time to close • Impact to the business between announcement and closing • Regulatory risk – sale may be delayed or blocked by the government • Time and cost to extract the assets (e.g., billing systems) • Evaluation of the buyer’s ability to raise financing • Shareholder perception of the offer • Exposure on debt pricing A purchase proposal can be very simple or extremely complex 40 Conclusion •Value of retaining the assets was greater than purchase price proposed by the buyer 41 Conclusion Qwest Completes Strategic Review of Long Distance Network Asset Company Reaffirms Full Year 2009 Guidance DENVER, June 8, 2009 — Qwest Communications International Inc. (NYSE: Q) and its Board of Directors today announced the outcome of its strategic review of its long distance network asset. After receiving unsolicited indications of interest from potential purchasers of Qwest's long distance network asset, the company and its Board of Directors undertook a comprehensive review of this asset and its operations. Following this review, the company commenced a competitive bidding process. Although there was significant interest in this process from prospective buyers, the company and its Board of Directors have determined that the long distance network asset holds far more value to Qwest shareholders and is more strategically important to Qwest and its customers than is the alternative of pursuing a transaction. Qwest reaffirms its guidance for the full year 2009, expecting adjusted free cash flow to be $1.4 to $1.5 billion, full year adjusted EBITDA of $4.2 to $4.4 billion, inclusive of an expected increase in non-cash pension and OPEB expense of $200 million, and capital expenditures of $1.8 billion or lower. “Qwest remains confident in its outlook for 2009 and the ability of its business to continue to perform,” said Edward A. Mueller, chairman and chief executive officer of Qwest. “At the same time, we are committed to taking steps that will benefit our shareholders, customers and employees in every decision we make. We have always taken a disciplined, prudent approach to assessing our business in this ever changing industry. The review we conducted confirmed that our nationwide network is a tremendous asset and delivers best-in-class telecommunications services to businesses and government agencies throughout the country. We are committed to serving those valued customers and remain focused on increasing shareholder value and perfecting the customer experience." Second Quarter 2009 Earnings Call The Company will announce its second quarter 2009 financial and operational highlights on Wednesday, July 29, 2009, at 7 a.m. EDT. Qwest management will host a conference call at 9 a.m. EDT on the same day to discuss the company’s perspective on the results and answer questions. 42 43