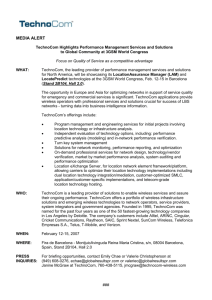

Alltel - Fisher College of Business

advertisement

Telecommunications Stock presentation March 8, 2005 David Lazarus Dongjun(Donny) Ma Outline • • • • • Sector Recap SIM holding and performance Analysis on stocks Candidates in future Recommendation Business Trends • • • • • • • • • Deregulation Price Wars Oligopolies M&A (US and International) Voice over Internet (VoIP) Wireless Video MP3/Internet/Camera Phones Fiber Optic Cable Video on Demand Sector Outlook • Market Cap: $360 Billion • Local and Long Distance Phone Services, Wireless Networks, Internet/Broadband Services, Directory Publishing, Business Services • Voice over Internet (VoIP) increasing market share • Industry depends on low interest rates to fuel heavy capital expenditures Consolidation Continues… •Consolidation has led to fewer carriers in local phone markets. Soon there will be just 3 or 4 large telecom providers of local phone service. •Wireless providers are also looking for partners, as large capital expenditures force them to seek economies of scale through acquisitions. Verizon Communications • • • • • • Verizon Communications Inc. is a provider of communications services with four operating segments: Domestic Telecom, Domestic Wireless, Information Services and International Domestic Telecom services principally represent Verizon's telephone operations that provide local telephone services in 29 states and the District of Columbia Domestic Wireless products and services include wireless voice and data services and equipment sales across the United States International segment has wireline and wireless communications operations and investments primarily in the Americas 100 Billion Market Cap, $71 Billion in sales Currently in talks to purchase MCI for $6.7 Billion Business Segments Segment Information StockVal ® VERIZON COMMUNICATIONS CORP (VZ) FY 2003 Business Segment Sales $M Sales % Profits $M Profits % Domestic Telecom 39,602 58.1% 3,335 47.5% Domestic Wireless 22,489 33% 1,083 15.4% Information Services 4,114 6% 1,206 17.2% International 1,949 2.9% 1,392 19.8% Total Geographic Segment Domestic Other 68,154 100% 7,016 100% Sales $M Sales % Profits $M Profits % 65,303 96.4% 2,449 3.6% Information services is only 6% of sales, yet makes up 17% of profits. Total 67,752 100% 100% Wireless is 33% of sales and accounts for only 15% of profits! Price History (5 yr) VERIZON COMMUNICATIONS CORP (VZ) 74 StockVal® 69 PRICE 36.2 DATE 02-25-2005 64 64 60 60 56 56 52 49 46 52 49 46 42 40 42 40 37 37 34 32 34 32 30 The Ohio State University 30 Fisher College of Business 28 28 2000 2001 2002 2003 2004 2005 +2 +2 +1 +1 0 0 -1 -1 -2 -2 PRICE MOMENTUM INDEX (OVERBOUGHT/OVERSOLD) MCI Deal Announced Verizon vs S&P 100 (3yr) StockVal® TOTAL RETURN COMPARISON FEB 2002 = 100 S&P 100 COMPOSITE INDEX (SP1) VERIZON COMMUNICATIONS CORP (VZ) ANNUAL RATE +1.2% -4.4% CUMULATIVE +3.6% -12.8% 110 02/28/02 - 02/28/05 105 SP1 100 96 92 88 VZ 84 80 76 73 70 67 64 61 58 2002 2003 2004 Verizon Compared to Telecom (3yr) TOTAL RETURN WITH REINVESTMENT COMPARISON StockVal® FEB 2002 = 100 S&P TELECOM SERVICES SECTOR (S50) VERIZON COMMUNICATIONS CORP (VZ) ANNUAL RATE -2.7% -4.4% CUMULATIVE -7.9% -12.6% 105 02/28/02 - 02/28/05 100 95 S50 90 VZ 86 82 78 74 70 66 63 60 57 54 2002 2003 2004 Verizon Compared to Telecom (2yr) TOTAL RETURN WITH REINVESTMENT COMPARISON StockVal® FEB 2003 = 100 S&P TELECOM SERVICES SECTOR (S50) VERIZON COMMUNICATIONS CORP (VZ) ANNUAL RATE +18.6% +6.7% CUMULATIVE +40.6% +13.7% 152 02/28/03 - 02/28/05 146 141 S50 136 131 126 121 116 VZ 112 108 104 100 96 92 Q1/03 Q2/03 Q3/03 Q4/03 Q1/04 Q2/04 Q3/04 Q4/04 Q1/05 Revenue growth and earnings flat… Income Statement StockVal ® VERIZON COMMUNICATIONS CORP (VZ) FYE Dec 2003 % Chg 2002 % Chg 2001 % Chg 2000 % Chg 1999 67752.0 1 67304.0 1 66713.0 4 64236.0 11 57823.0 2797.0 -11 3130.0 -4 3276.0 -6 3490.0 33 2616.0 4761.0 -24 6258.0 129 2731.0 -85 17819.0 35 13168.0 Taxes 1252.0 -22 1597.0 -26 2147.0 -69 7009.0 44 4872.0 Net Income Reported ($ Mil) 3077.0 -25 4079.0 949 389.0 -97 11797.0 43 8260.0 Net Income Adjusted 7283.0 -14 8449.0 -4 8768.0 4 8463.0 14 7445.0 EPS Reported 1.11 -26 1.49 964 0.14 -97 4.31 45 2.97 EPS Adjusted 2.62 -15 3.08 -4 3.21 4 3.09 15 2.68 2789000 2 2745000 1 2730000 0 2737000 -1 2777380 1.54 0 1.54 0 1.54 0 1.54 0 1.54 Revenues ($ Mil) Cost of Goods & Services Gross Profit S G & A Expense R&D Expense Interest Expense Pre-Tax Income Shares Outstanding (Thou) Dividends Common (Per Shr) Dividends Preferred ($ Mil) 2004: 2.79 2005E: 2.55 2006E: 2.66 0.0 0.0 0.0 0.0 0.0 Margins falling… StockVal ® Prospective Growth & Margin Check VERIZON COMMUNICATIONS CORP (VZ) Price 36.200 02/25/05 Percent Change Quarter Revenue REV RPS EARN EPS Actual Year Profit EPS Ago Margin % Momentum % SF REV EPS Mar 03 16,490.0 1 -1 -3 -5 0.69 0.73 11.6 +2 +1 -5 Jun 03 16,829.0 0 -1 -11 -13 0.68 0.78 11.3 0 0 -13 Sep 03 17,155.0 0 -1 -12 -13 0.67 0.77 10.9 +1 0 -14 Dec 03 17,278.0 1 1 -31 -30 0.57 0.82 9.1 0 +1 -35 Mar 04 17,136.0 4 3 -17 -17 0.57 0.69 9.3 0 +4 -18 Jun 04 17,838.0 6 5 -5 -6 0.64 0.68 10.1 +1 +6 -6 Sep 04 18,206.0 6 6 -4 -4 0.64 0.67 9.9 0 +6 -5 Dec 04 18,263.0 6 4 15 12 0.64 0.57 9.9 0 +6 +12 +5 T4Q 71,443.0 5 4 -4 -5 2.49 Mar 05 E 18,093.5 6 5 6 5 0.60 0.57 9.4 +5 Jun 05 E 18,676.3 5 4 1 0 0.64 0.64 9.7 +5 0 Sep 05 E 19,005.8 4 4 2 2 0.65 0.64 9.7 +4 +2 Dec 05 E 19,147.9 5 5 2 2 0.65 0.64 9.6 +5 +2 74,923.5 5 4 3 2 2.54 F4Q E Point-to-Point Growth Rates (%) Years REV RPS EARN 9.8 9.6 Long-Term Growth Rate Estimates (%) Median Estimate EPS 5.0% 1 5 4 -4 -5 Number of Estimates 3 2 1 -7 -8 Standard Deviation 10 5 4 4 -1 -2 Default GRE Estimate 2.0% 10 4 4 3 2 Analyst GRE Estimate 2.0% 15 3 3 4 3 20 4 3 4 3 Expected Report Date 04/27/05 6 Cash flows uncertain… Cash Flow Analysis StockVal ® VERIZON COMMUNICATIONS CORP (VZ) FYE Dec 2003 % Chg 2002 % Chg Net Income Reported ($ Mil) 3077.0 -25 4079.0 Accounting Adjustment 4206.0 -4 4370.0 7283.0 -14 13617.0 20900.0 Capital Expenditures 11884.0 -9 Free Cash Flow Adjusted 9016.0 4 Dividends Common ($ Mil) 4295.1 Free Cash Flow After Dividends 4720.9 Net Income Adjusted Depreciation & Amort Cash Flow Adjusted Net Cash From Operations 2001 % Chg 2000 % Chg 1999 949 389.0 -97 -48 8379.0 11797.0 43 8260.0 -3334.0 -309 8449.0 -4 8768.0 -815.0 4 8463.0 14 7445.0 2 13290.0 -2 -4 21739.0 -2 13523.0 10 12261.0 24 9890.0 22291.0 8 20724.0 20 17335.0 13061.0 -29 8678.0 121 18369.0 4 17633.0 36 13013.0 3922.0 27 3091.0 -28 2 4227.3 1 4322.0 4204.2 0 4215.0 -1 6 4450.7 4277.2 -282.2 75 -1124.0 44.8 22482.0 2 22099.0 13 19526.0 23 15827.0 -7 17017.0 Net Cash From Investing -12246.0 -80 -6800.0 68 -21324.0 -33 -16055.0 8 -17420.0 Net Cash From Financing -10959.0 26 Other Cash Flows Change In Cash & Equiv -14809.0 1973.0 -1048.0 0.0 0.0 0.0 0.0 0.0 -723.0 490.0 175.0 -1276.0 1329.0 180 1732.0 Capital expenditures totaled $13.3 billion in 2004, compared with $11.9 billion in 2003. In 2005, overall capital spending is expected to increase approximately 10 % to $14.6 billion! And this stock is not cheap… First Call FY1 Mean Estimate StockVal® VERIZON COMMUNICATIONS CORP (VZ) N D J 2003 F M A M J J A S O N D J 2004 F M A M J J A S O N D J 2005 F M A M J J A S O N D HI LO ME CU GR 42 40 38 36 34 42 32 37 36 -5.0% 01-03-2003 02-25-2005 32 PRICE HI LO ME CU GR 2.9 2.8 2.7 2.6 2.5 2.95 2.43 2.64 2.55 -6.3% 01-31-2003 02-25-2005 2.4 FY1 MEAN ESTIMATE (FYE DEC 2005) HI LO ME CU 15 14 13 12 15.9 11.7 14.1 14.2 01-31-2003 02-25-2005 11 FY1 PE RATIO On a positive note… • Dividend yield of 4.36 % • # 2 in US wireless market with 44 million customers • Merger with MCI will increase business-access lines to 18.5 million • Leader in high speed wireless internet and video services • This company is making money, although earnings growth is expected to be only 2 - 4% • Should be one of the few left standing DCF Analysis VZ (000,000s) FY04 3,077 13,617 (11,884) Net income Depreciation Capital expenditures Free Cash Flow of Firm $ DCF Terminal Value $ 136,937 $ $ 95,000 2,769 34.31 $ $ 1.00 4.24% 5.19% 9.43% 2,769 36.42 100,847 Value of VZ Total Value of Equity # of shs outstanding (mill) Value of One Share Cost Of Equity Beta Risk Free Rate (10 yr treasury) Mkt Risk Premium CAPM = Expected return=R(f)+beta (Mkt Prem) # of shs outstanding (000,000's) Recent Price (3/4/05) Current Mkt Value of Equity ($ mill) Long term rate of growth Mkt Premium Recent Price Div/Sh (2004) Long term rate of growth K Mkt Premium (K-Risk Free Rate) 5,504 $ 5.20% $ $ 36.42 1.54 5.20% 9.43% 5.19% FY03 3,509 13,617 (11,884) 5,242 $ FY02 4,661 13,290 (11,984) 5,967 $ FY01 590 13,657 (17,371) (3,124) $ FY00 10,810 12,261 (17,633) 5,438 Recommendation • Reduce ALLTEL --Stock performance ALLTEL CORPORATION (AT) 76 PRICE 57.3 DATE 02-25-2005 QR 3.0 NET 4.5% 71 StockVal® 66 EPS Lagged 1-Year 61 61 57 57 53 50 53 50 46 46 43 43 40 40 37 35 37 35 32 30 32 30 The Ohio State University Fisher College of Business 28 28 2001 2002 THE G-MODEL IR 3.89 K 5.11 K' 0.00 NE 3.55 PE 16.2 WPE 15.1 WP 53 AP -7% Expected Return 1-Yr 3.89 5.11 0.00 3.71 15.5 15.1 56 -2% 0% 2003 First Call Data Mean Estimate Change High Low Total # Up # Down House Estimate PE Ratio 2004 2005 2005 3.44 +2% 3.54 3.24 24 9 13 2006 3.68 +7% 4.02 3.34 16 6 4 2007 3.80 +3% 4.04 3.56 2 0 0 16.6 15.6 15.1 2006 Normalized Earnings FYE December 2005 3.52 2006 3.68 2007 3.85 2008 4.02 2009 4.20 2010 4.39 2011 4.59 2012 4.79 Alltel --Financial Analysis (1) Income Statement StockVal ® ALLTEL CORPORATION (AT) FYE Dec 2004 % Chg 2003 % Chg 2002 % Chg 2001 % Chg 2000 Revenues ($ Mil) 8246.1 3 7979.9 12 7112.4 8 6615.8 5 6308.9 Cost of Goods & Services -12 1369.1 3449.7 4 3317.1 13 2930.3 8 2707.7 Gross Profit 4796.4 3 4662.8 11 4182.1 7 3908.1 S G & A Expense 1524.2 2 1498.1 16 1297.0 8 1201.1 • R&D Expense Interest Expense 369.2 -6 393.8 6 371.0 32 281.6 -1 284.3 1592.0 4 1534.1 13 1360.3 -17 1631.0 -49 3208.0 565.3 -3 580.6 14 510.2 -22 653.0 -51 1325.3 Net Income Reported ($ Mil) 1046.2 -21 1330.1 44 924.3 -13 1067.0 -45 1928.8 Net Income Adjusted Pre-Tax Income Taxes 1038.1 9 954.4 5 906.9 -1 913.3 31 699.1 EPS Reported 3.39 -20 4.25 44 2.96 -13 3.40 -44 6.08 EPS Adjusted 3.37 10 3.05 5 2.90 0 2.91 32 2.20 308400 -1 312800 0 312300 0 313500 -1 317200 1.49 5 1.42 4 1.37 3 1.33 3 1.29 0.1 0 0.1 0 0.1 0 0.1 0 0.1 Shares Outstanding (Thou) Dividends Common (Per Shr) Dividends Preferred ($ Mil) • Expansion trend in sales, but slow down in 2004 (Sector is declining) Solid operating margin 24% (Sector is 15% in 2003) Alltel --Financial Analysis (2) Balance Sheet StockVal ® ALLTEL CORPORATION (AT) FYE Dec Cash & Equivalents ($ Mil) Accounts Receivable Inventories Other Current Assets Total Current Assets Plant & Equipment Gross Accumulated Depreciation Plant & Equipment Net Other Long-Term Assets Total Long-Term Assets Total Assets Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Long-Term Liabilities Total Long-Term Liabilities Total Liabilities Minority Interest Preferred Equity Common Equity Total Equity Total Liab & Equity 2004 % Chg 2003 % Chg 2002 % Chg 2001 % Chg 2000 484.9 912.7 156.8 62.4 1616.8 15836.3 8288.2 7548.1 7438.8 14986.9 16603.7 -26 3 28 5 -6 6 14 -1 2 0 0 657.8 890.0 122.1 59.2 1729.1 14909.9 7289.1 7620.8 7311.2 14932.0 16661.1 389 -13 -12 -90 -7 4 8 1 7 4 3 134.6 1018.3 138.5 577.1 1868.5 14320.1 6756.4 7563.7 6812.4 14376.1 16244.6 58 -18 -15 108 6 9 7 12 72 34 30 85.3 1241.2 163.8 277.5 1767.8 13082.0 6300.7 6781.3 3951.6 10732.9 12500.7 27 -3 -32 39 -1 8 13 4 5 4 3 67.2 1273.6 239.9 200.0 1780.7 12113.4 5564.4 6549.0 3757.5 10306.5 12087.2 448.2 225.0 787.1 1460.3 5352.4 1715.1 947.2 8014.7 9475.0 -7 -19 7 -2 -4 21 -17 -2 -2 479.8 277.2 735.7 1492.7 5581.2 1417.7 1147.3 8146.2 9638.9 16 -44 -17 -17 -9 27 -4 -4 -6 413.7 494.7 882.3 1790.7 6145.4 1115.4 1195.0 8455.8 10246.5 -21 859 24 39 59 51 14 50 48 522.1 51.6 711.4 1285.1 3861.5 738.0 1050.3 5649.8 6934.9 -24 -24 -6 -15 -16 240 62 3 -1 688.4 68.3 759.2 1515.9 4611.7 217.0 647.2 5475.9 6991.8 0.3 7128.4 7128.7 16603.7 -25 2 2 0 0.4 7021.8 7022.2 16661.1 0 17 17 3 0.4 5997.7 5998.1 16244.6 0 8 8 30 0.4 5565.4 5565.8 12500.7 -20 9 9 3 0.5 5094.9 5095.4 12087.2 • • • Significant increase in cash since 2003. Need at least 1 billion cash to acquire Western. Will be less liquid in short-term. Alltel --Financial Analysis (3) Cash Flow Analysis StockVal ® ALLTEL CORPORATION (AT) FYE Dec % Chg 2002 % Chg 2001 % Chg 1330.1 44 924.3 -13 1067.0 -45 1928.8 -375.7 -2056 -17.4 89 -153.7 88 -1229.7 9 954.4 5 906.9 -1 913.3 31 699.1 1299.7 4 1247.7 14 1095.5 1 1082.0 9 988.4 2337.8 6 2202.1 10 2002.4 0 1995.3 18 1687.5 Capital Expenditures 1157.7 -3 1194.4 -2 1213.2 -3 1250.6 7 1164.7 Free Cash Flow Adjusted Net Income Reported ($ Mil) Accounting Adjustment Net Income Adjusted Depreciation & Amort Cash Flow Adjusted 2004 % Chg 2003 1046.2 -21 -8.1 98 1038.1 2000 1180.1 17 1007.7 28 789.2 6 744.7 42 522.8 Dividends Common ($ Mil) 459.5 3 444.2 4 427.9 3 417.0 2 409.2 Free Cash Flow After Dividends 720.6 28 563.5 56 361.3 10 327.7 188 113.6 Net Cash From Operations 2466.8 0 2474.7 3 2392.2 27 1882.1 26 1496.3 Net Cash From Investing -1258.4 1 -1265.9 72 -4494.6 -953 -427.0 66 -1264.3 Net Cash From Financing -1381.2 -13 -1218.2 -1479.5 -707 -183.4 Other Cash Flows Change In Cash & Equiv 2079.5 -0.1 532.6 465 94.3 91 49.3 4830 1.0 -172.9 523.2 633 71.4 187 24.9 -50 49.6 • Solid operating cash flow in accordance with stable operating income -- Quality of core earnings Alltel --Valuation Analysis (Absolute Multiple) ALLTEL CORPORATION (AT) Price 57.3 2001 2002 2003 StockVal® 2004 2005 2006 24 HI LO ME CU 21 18 15 22.5 12.1 16.0 16.5 • P/E, P/S and P/Cash at average position in 4-yr. • PEG at relatively higher position 02-23-2001 02-25-2005 12 PRICE / YEAR-FORWARD EARNINGS 4 HI LO ME CU 3 3.4 1.1 1.9 2.5 2 02-23-2001 02-25-2005 1 PRICE / YR-FORWARD EPS ESTS / GRE 4 HI LO ME CU 3 3.10 1.73 2.10 2.14 2 02-23-2001 02-25-2005 1 PRICE / SALES 12 HI LO ME CU 10 8 6 11.4 5.8 7.5 7.5 02-23-2001 02-25-2005 4 PRICE / CASH FLOW ADJUSTED Alltel --Valuation Analysis (Relative Multiple) ALLTEL CORPORATION (AT) Price 57.3 2001 2002 2003 StockVal® 2004 2005 2006 1.5 HI LO ME CU 1.2 0.9 0.6 0.3 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) M-Wtd 2.0 02-23-2001 02-25-2005 HI LO ME CU 1.6 1.2 0.8 0.4 PRICE / YR-FORWARD EPS ESTS / GRE RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) 1.8 1.4 1.2 1.61 0.53 0.97 0.92 02-23-2001 02-25-2005 HI LO ME CU 1.6 1.21 0.55 0.96 1.00 1.76 1.09 1.43 1.43 02-23-2001 02-25-2005 1.0 PRICE / SALES RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) M-Wtd 2.0 1.8 1.6 1.4 1.2 PRICE / CASH FLOW ADJUSTED RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) M-Wtd HI LO ME CU 1.87 1.25 1.43 1.44 02-23-2001 02-25-2005 • • All on average level Correctly priced relative to sector More on Alltel 63 ALLTEL CORPORATION (AT) PRICE 57.3 DATE 02-25-2005 62 StockVal ® 61 61 60 60 59 59 58 58 57 57 56 56 55 55 54 54 53 8/04 9/04 10/04 11/04 12/04 1/05 2/05 53 3/05 5724 60 Day Av g. Volume 1,979 4770 4770 3816 3816 2862 2862 1908 1908 954 • On Jan 6, 2005, the company announced to acquire Western Wireless (WWCA) 954 0 0 Volume in Thousands of Shares 44 WESTERN WIRELESS CORPORATION (WWCA) PRICE 39.2 DATE 02-25-2005 42 StockVal ® 40 40 38 38 36 36 34 34 32 32 30 30 28 28 26 26 24 8/04 9/04 10/04 11/04 12/04 1/05 2/05 24 3/05 • This event became major driver of the stock performance in short run 12000 60 Day Av g. Volume 2,527 10000 10000 8000 8000 6000 6000 4000 4000 2000 2000 0 0 Volume in Thousands of Shares • Deal to be closed in mid-year After combined • Fifth-largest U.S. wireless company • coverage over one-fourth of the United States' population • 10 billion revenue • 10 million domestic wireless customers in 33 states customers • 1.6 million international wireless in six countries • 3 million wireline customers in 15 states. Detail of the deal • Purchase price: $ 39.25 per share 0.535 shares of Alltel stock plus $9.25 in cash for each Western share. • Western shareholders will have an option for all cash or all stock subject to proration. • Deal to be closed in mid-year WWCA current price is $ 39.30, with P/E (forward) of 18.28 which is a little bit higher than Alltel’s Is it a good deal for Alltel? Western Wireless 84 WESTERN WIRELESS CORPORATION (WWCA) PRICE 39.2 DATE 02-25-2005 StockVal® 48 28 28 16 16 10 10 6 6 4 4 2 2 The Ohio State University Fisher College of Business 1 2002 2003 Price Change % Diff SP5 1-Day 0.95 0.02 1-Week 1.92 1.04 4-Weeks 4.03 0.89 QTD 33.92 33.97 YTD 33.92 33.97 2004 59.59 50.59 2003 246.42 220.03 2002 -81.24 -57.87 FYE Dec 2003 EPS -0.08 2001 First Call Data Mean Estimate Change High Low Total # Up # Down House Estimate PE Ratio 2004 2005 2004 1.52 NMN 1.65 1.46 5 0 4 2005 2.13 +40% 2.87 1.52 9 2 5 2006 2.02 -5% 2.25 1.78 2 1 0 25.8 18.4 19.4 2006 Data Page # 1 Revenues ($Mil) Market Value ($Mil) Shares Out (Mil) Daily Volume (Thou) Daily Volume ($Mil) Dividend Estimate Payout Ratio Retention Rate Dividend Yield 1,823 3,922 100.0 2,527 99.1 None 1 $2.5 to $39 1400% return in 2.5 years !!! Western Wireless Income Statement StockVal ® WESTERN WIRELESS CORPORATION (WWCA) FYE Dec Revenues ($ Mil) Cost of Goods & Services 2003 % Chg 2002 % Chg 2001 % Chg 2000 % Chg 1999 1501.3 27 1186.6 14 1038.0 24 835.0 33 626.8 583.6 22 479.3 23 391.2 74 224.8 37 164.6 Gross Profit 917.7 30 707.3 9 646.8 6 610.1 32 462.2 S G & A Expense 473.0 19 398.4 -4 416.6 41 296.1 35 220.0 158.6 1 6 152.2 52 • Loss in 2002 and 2001, because of one-time or special charge • Rapid growth in sales • Solid operating margin R&D Expense Interest Expense Pre-Tax Income Taxes 156.7 -3 161.9 36.9 -92.1 36 -143.6 65.4 -148.8 100.0 -35.0 123.3 0.0 0.0 0.0 Net Income Reported ($ Mil) -0.3 100 -185.7 -20 -155.1 65.4 -148.8 Net Income Adjusted -9.8 92 -115.1 -2 -113.1 42.8 -48.1 EPS Reported 0.00 -2.35 -19 -1.97 0.81 -1.94 EPS Adjusted -0.12 92 -1.46 -1 -1.44 0.53 -0.63 82824 5 78955 0 78625 Shares Outstanding (Thou) Dividends Common (Per Shr) Dividends Preferred ($ Mil) 0.00 0.00 0.00 -2 80303 0.00 5 76775 0.00 Western Wireless Balance Sheet StockVal ® WESTERN WIRELESS CORPORATION (WWCA) FYE Dec 2003 % Chg 2002 % Chg 2001 % Chg 2000 % Chg 1999 Cash & Equivalents ($ Mil) Accounts Receivable Inventories Other Current Assets Total Current Assets Plant & Equipment Gross Accumulated Depreciation Plant & Equipment Net Other Long-Term Assets Total Long-Term Assets Total Assets 128.6 215.8 30.2 23.1 397.7 1834.8 932.9 901.9 1222.2 2124.0 2521.7 106 35 23 -57 32 15 26 5 -2 1 5 62.4 160.0 24.5 53.3 300.2 1595.0 739.4 855.6 1243.2 2098.8 2399.0 38 9 -28 -24 1 19 42 4 -1 1 1 45.1 147.3 33.8 70.4 296.5 1344.6 521.7 823.0 1250.9 2073.9 2370.4 94 31 96 25 42 42 42 41 4 16 19 23.3 112.1 17.2 56.1 208.7 949.6 367.9 581.7 1206.0 1787.7 1996.5 -46 48 78 85 32 59 62 57 46 50 48 42.7 75.8 9.7 30.3 158.6 596.7 227.2 369.5 824.4 1194.0 1352.6 Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Long-Term Liabilities Total Long-Term Liabilities Total Liabilities Minority Interest Preferred Equity Common Equity Total Equity Total Liab & Equity 100.7 47.3 234.8 382.8 2172.9 151.0 39.6 2363.4 2746.2 22.1 70 -67 12 -7 -6 25 182 -4 -4 -3 59.4 141.9 209.6 410.9 2317.1 120.7 14.0 2451.8 2862.7 22.7 -27 174 -21 3 5 314 1734 62 114 15 17 25 13 19.6 2.8 164.2 186.6 1926.4 0.0 0.0 1926.4 2113.0 22.2 64 -54 9 8 -9 80.9 51.7 266.2 398.8 2215.6 0.0 30.2 2245.8 2644.6 25.1 33 38 1444 11.9 0.0 73.9 85.8 1450.0 0.0 0.0 1450.0 1535.8 1.4 -246.6 -246.6 2521.7 49 49 5 -486.4 -486.4 2399.0 -63 -63 1 -299.3 -299.3 2370.4 -116 -116 19 -138.7 -138.7 1996.5 25 25 48 -184.7 -184.7 1352.6 122 117 33 • Improved in liquidity Western Wireless Cash Flow Analysis StockVal ® WESTERN WIRELESS CORPORATION (WWCA) FYE Dec 2003 % Chg 2002 % Chg 2001 Net Income Reported ($ Mil) -0.3 100 -185.7 -20 -155.1 65.4 -148.8 Accounting Adjustment -9.4 70.6 68 42.0 -22.6 100.7 -9.8 92 -115.1 -2 -113.1 42.8 276.4 13 244.2 14 214.6 67 128.2 20 Net Income Adjusted Depreciation & Amort Cash Flow Adjusted % Chg 2000 % Chg 1999 -48.1 106.7 266.6 106 129.2 27 101.5 -41 171.0 192 58.6 Capital Expenditures 250.1 -17 300.4 -21 378.2 44 262.6 56 168.2 Free Cash Flow Adjusted 38 -276.8 -202 -91.5 16 -109.6 16.6 -171.3 Dividends Common ($ Mil) 0.0 0.0 Free Cash Flow After Dividends 16.6 -171.3 38 -276.8 -202 -91.5 16 -109.6 100 72.9 -56 167.0 74 95.7 0.0 0.0 0.0 Net Cash From Operations 324.1 122 145.9 Net Cash From Investing -180.6 41 -304.3 30 -432.9 33 -644.3 -38 -467.1 Net Cash From Financing -84.9 171.7 -55 381.7 -17 457.8 11 412.0 Other Cash Flows Change In Cash & Equiv 7.6 85 4.1 9999 0.0 0.0 0.0 66.2 281 17.3 -20 21.8 -19.5 40.5 • Solid operating cash in-flow Western Wireless WESTERN WIRELESS CORPORATION (WWCA) Price 39.2 2001 2002 2003 2004 StockVal® 2005 2006 1.8 HI LO ME CU 1.5 1.2 0.9 0.6 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) M-Wtd 8 02-23-2001 02-25-2005 HI LO ME CU 6 4 2 99.90 + 0.74 0.92 1.13 99.90 + 0.16 0.46 0.48 02-23-2001 02-25-2005 0 PRICE / YR-FORWARD EPS ESTS / GRE RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) 2.0 HI LO ME CU 1.5 1.0 0.5 1.89 0.12 0.88 1.42 02-23-2001 02-25-2005 0.0 PRICE / SALES RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) M-Wtd 4 HI LO ME CU 3 2 1 4.87 0.43 1.31 1.60 02-23-2001 02-25-2005 0 PRICE / CASH FLOW ADJUSTED RELATIVE TO S&P TELECOM SERV. SECTOR COMPOSITE A (SP-50) M-Wtd • Multiples at relatively higher position Pro Forma Combined Financial Measures Western Wireless (Pre-Synergy) OIBDA for the twelve months ended December 31: (Dollars in millions) Operating income under GAAP* Depreciation and amortization* OIBDA* 2005 445.0 292.0 $ 737.0 2006 509.0 310.0 $ 819.0 $ $ ALLTEL $ 991.7 720.5 1,712.2 Western Wireless $ 321.3 256.1 577.4 *-Amounts based on average of Wall Street analyst estimates (Merrill Lynch, Bear Stearns and Lehman Brothers. Segment OIBDA for the twelve months ended September 30, 2004: (Dollars in millions) Wireless segment income under GAAP Depreciation & amortization Wireless OIBDA Wireline segment income under GAAP Depreciation & amortization Wireline OIBDA Communications support services segment income under GAAP Depreciation & amortization Communications support services OIBDA Total Business Segments OIBDA Adjusted OIBDA for Western Wireless International Operations for the nine months ended September 30: (Dollars in millions) International operations segment income under GAAP Depreciation and amortization Stock-based compensation, net Adjusted OIBDA for international operations 927.2 520.5 1,447.7 66.4 35.1 101.5 $ 3,261.4 2003 (37.2) 51.4 $ 14.2 $ - $ 577.4 2004 67.0 66.4 11.3 $ 144.7 $ Pro Forma $ 1,313.0 976.6 2,289.6 % of total 59.6% 927.2 520.5 1,447.7 37.7% 66.4 35.1 101.5 $ 3,838.8 2.6% 100.0% Valuation on Acquisition • Synergy: Revenue: opportunity to increase penetration; opportunity to offer high-value service plans; expanded roaming relationships Operating expenses: corporate overhead; IT operations; network operations; sales and marketing; handset/network purchasing Operating synergies: $50M-$60M in 2006, $60M-$70M in 2007, and $70M-$80M in 2008 • Special charge for restructuring in 2005 • Fair acquisition? Some analysts estimate that the stand-alone value of WWCA is around $39 per share Summary on Alltel • Cost of acquiring Western is close to fair value, at least close to its stand-alone value • Market over-reacted to this acquisition, but it will take time for the market to get the confidence back • Restructuring cost in short run, synergy in long run. Less surprise before second quarter of 2006. • Unlikely to surge before the acquisition is closed— limit potential in 1-year horizon Recommendation– sell 50% Look For Other Candidates Portrait of Targets of acquisition: • Wireless, long distance business or international business • Attractive customer base • Improving (or stable) operating cash flow—solid business operation • Middle or large market cap. Look for Potential Targets (1) 330 Public companies in Telecom Service sector •Market cap >2 billion •Excluding ADRs •Not involved large M&As recently 13 companies qualified •Business Analysis 4 companies They are: BCE,CTL,CZN,USM •Financial Analysis •Detail Business analysis 1 candidate to watch USM Look for potential targets (2) Ticker Name Market Cap Sales P/E P/S P/Cash BLS BellSouth Corporation 46,948.04 20,300.00 13.86 2.35 6.73 BCE BCE Inc. (USA) 22,095.86 15,882.99 18.5 1.38 5.61 TU TELUS Corporation (USA) 10,670.63 6,273.75 23.79 1.68 5.76 RG Rogers Communications Inc. (USA) 10,029.79 4,641.05 NA 1.42 6.66 TDS Telephone & Data Systems 4,841.64 3,720.39 117.51 1.33 6.72 CTL CenturyTel, Inc. 4,483.91 2,407.37 13.83 1.95 5.59 CZN Citizens Communications 4,432.90 2,202.04 53.65 1.86 6.24 AMT American Tower Corporation 4,330.61 769.86 NA 5.37 37.5 USM United States Cellular Corporation 4,218.55 2,837.62 39.59 1.52 7 TLWT Telewest Global, Inc. 4,044.95 2,430.63 NA 1.67 7.42 NIHD NII Holdings, Inc. 3,934.26 1,174.80 NA 3.54 72.98 CCI Crown Castle International Corp. 3,633.36 696.44 NA 5.18 NA SSI SpectraSite Inc. 2,927.59 337.475 71.95 9.51 22.23 Analysis on USM --Profile United States Cellular Corporation (USM) Seventh-largest wireless service provider A business unit of Telephone and Data Systems, Inc. [AMEX: TDS], which owns 82% of the company 4,409,000 customers in 26 states 182 majority-owned wireless licenses CDMA technology Analysis on USM --Segment (IN THOUSANDS) 2003 2002 1,984,671 1,682,020 1,408,253 Inbound roaming 221,737 255,443 272,361 Long-distance and other 217,381 161,430 145,771 2,423,789 2,098,893 1,826,385 158,994 98,693 68,445 2,582,783 2,197,586 1,897,830 Retail service Service Revenues Equipment sales Total Operating Revenues 2001 Analysis on USM --Balance sheet Balance Sheet StockVal ® UNITED STATES CELLULAR CORP (USM) FYE Dec 2003 % Chg 2002 % Chg 2001 % Chg 2000 % Chg 1999 Cash & Equivalents ($ Mil) Accounts Receivable Inventories Other Current Assets Total Current Assets Plant & Equipment Gross Accumulated Depreciation Plant & Equipment Net Other Long-Term Assets Total Long-Term Assets Total Assets 9.8 287.0 71.0 56.3 424.1 3441.2 1267.3 2173.9 2325.7 4499.5 4923.6 -34 -9 28 -17 -6 12 20 7 5 6 5 14.9 315.3 55.5 67.7 453.3 3085.6 1051.8 2033.8 2212.8 4246.6 4699.8 -49 27 -1 -6 12 37 26 43 14 27 25 28.9 247.4 56.0 71.6 404.0 2253.0 833.7 1419.3 1935.9 3355.2 3759.2 -77 13 15 315 -1 25 27 24 -1 9 7 124.3 219.0 48.8 17.3 409.4 1801.4 655.8 1145.6 1946.2 3091.8 3501.2 -37 12 63 -32 -9 14 29 7 -3 0 -1 197.8 195.7 30.0 25.3 448.8 1579.3 508.3 1071.0 2014.5 3085.5 3534.2 Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Long-Term Liabilities Total Long-Term Liabilities Total Liabilities Minority Interest Preferred Equity Common Equity Total Equity Total Liab & Equity 285.6 108.0 188.3 581.9 1144.3 443.0 198.1 1785.5 2367.4 60.1 -7 -79 11 -41 42 23 139 43 6 9 306.9 505.2 169.1 981.2 806.5 359.4 82.7 1248.6 2229.7 55.1 56 91 45 70 100 -7 877 56 62 19 196.8 264.0 116.4 577.1 403.2 388.3 8.5 799.9 1377.1 46.4 -7 380 -11 45 -10 9 -82 -6 10 33 212.3 55.0 131.0 398.3 448.8 357.8 46.8 853.3 1251.7 34.9 44 64 75 -18 -11 8 -14 3 -15 147.1 0.0 79.9 227.0 546.3 402.0 43.3 991.6 1218.6 41.0 2496.2 2496.2 4923.6 3 3 5 2415.0 2415.0 4699.8 3 3 25 2335.7 2335.7 3759.2 5 5 7 2214.6 2214.6 3501.2 -3 -3 -1 2274.6 2274.6 3534.2 Need cash! Analysis on USM --Annual Report Operating income decreased 58% in 2003 and 11% in 2002. Due to: Loss on impairment of intangible assets Increased costs of acquiring, serving and retaining U.S. Cellular’s customers, Ongoing development of the Chicago market Losses on assets held for sale related to the exchange and sale transactions entered into with AT&T Wireless Increased costs related to the acquisition of and subsequent brand launch in the Chicago market. Will TDS SELL USM ? In 2003, USM contributes to TDS: • Provides 74.8% of TDS' consolidated revenues • Provides 52.8% of TDS’ consolidated operating income Will TDS SELL USM ? Your industry keeps on consolidating. Would you sell U.S. Cellular? I’m not the guy that would consider it. The company is heavily owned by TDS, and they would make that decision. As of right now and as far as I know, there is no interest in selling. I’m not advising them to do that. But I’ve worked in industry long enough that I’ve had three companies acquired out from under me. So I know the realities of life. If somebody decides they got an offer they can’t refuse, I’m sure that the TDS board would give it consideration, and so would our board. --JOHN ROONEY, CEO of USM April, 2004 Recommendation on Sector • Underweight • S&P 500: • SIM: 3.1% 4.7% • Reduce to 2.0% Recommendation Sell sector to underweight: • Sell 50% Alltel • Sell 50% Verizon Watch: • USM • Nokia