File - Katherine P. Geis

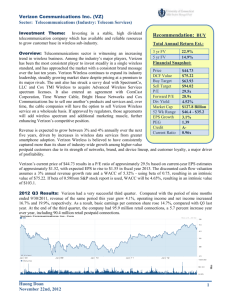

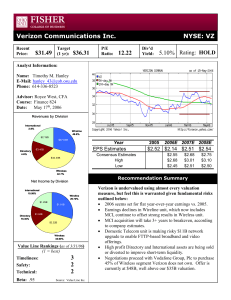

advertisement

Financial Statement Analysis Final Project _________________________________________________________ Verizon Communications Produced By: Katie Geis Sarah Caughey Verizon Communications Inc. is a global provider of telecommunication services, Internet and media entertainment. A brief history traces Verizon’s beginning back to 1995 when it was known as Bell Atlantic Mobile. In 2000, Vodafone, AirTouch and Bell Atlantic Corporation merged, under the name “Verizon Wireless,” a $90-billion joint venture. Over the decades, Verizon acquiesced several smaller corporations, slowly building up its empire. Today, Verizon wireless is the United State’s second largest wireless phone provider with 23.4% of the market share, behind AT&T who holds 30.5% of the market share. They serve a total of 94.1 million U.S. customers, with over 139 million wireless and broadband customers throughout the world. The company operates through two segments, Wireline and Domestic Wireless. The Wireline segment provides “voice, Internet access, broadband video and data, Internet protocol network, network access, long distance, and other services in the United States and internationally” Yahoo finance. The Domestic Wireless segment offers wireless voice and data services; and sells equipment in the United States. The company serves private consumers, businesses, and government customers, as well as carriers. As of December 31, 2010, its network covered a population of approximately 292 million and served the previously stated 94.1 million customers within the industry. The wireless communications industry has grown drastically in the past three decades. Cell phones have become the number one source of interaction for people using wireless communication in the United States. The industry has many firms and can, to some extent, be considered a perfectly competitive industry. The industry does, however, have two firms that make up the majority of the market share: Verizon and ATT&T. Both firms have become great competitors, working vigorously to gain control of the industry. Verizon Communication’s Management Discussion and Analysis is focused on the future and how to use their networks to differentiate them from competitors. They do this by having the largest 3G network and recently upgrading to a faster and more reliable 4G LTE network. Management expects continuing losses in the Wireline segment as customers are moving away from having primary land line phones. They do, however, anticipate future customer growth as a result of the introduction of smartphones, like the iPhone 4. Verizon’s number of total customers increased 5.6% from 2009 to 2010, average revenue per customer per month also increased 17.3%. The revenue per customer increasing reflects the increase in smart phones and the revenue received from those customers. The data plans that smart phones require are more expensive and very profitable. The growing market for data capable devices will continue to cause declines in overall average voice revenues because customers are finding more creative ways to optimize the value of their communications, i.e. texting and using data instead of voice to communicate. Management’s focus going forward will be to expand wireless data offerings and promote sales of smart phones and other data capable devices, because that is their fastest growing segment. The projections for the 2011 pro forma income statement and balance sheet air on the conservative side. We focused heavily on historical financial statements and took into account trends and economic environment. First and foremost to determine the projection for revenue we examined Verizon’s customer increase and revenue per customer increase. Verizon’s number of total customers increased 5.6% from 2009 to 2010, average revenue per customer per month also increased 17.3%. Keeping this in mind we looked at what percentage of these were cell phone customers, about 3%. Currently about 30% of Verizon’s cell phone user’s own a smart phone, management projected that this number would increase to about 50% by the end of the year, could possibly be higher with the introduction of the iPhone 4 and 4S. As discussed by management, smart phone users generate about twice the revenue that standard phone users do. For 2011, I projected there would be a 7% increase in wireless customers as the economy is stabilizing and consumers have more confidence. Close to 50% of these new consumers will be smart phone users, therefore their generated revenue will be even higher, I project this will add 9% to wireless revenues. The other aspects of their business will likely gain 1.5% or less, I rounded this down to a flat 1% because of the already declining operations of their other businesses. All of that added together makes the 10% revenue growth rate we projected. The pro forma income statement numbers were determined mostly by looking at historical data. The common size percentages of revenues were all consistent over the past three years so determining the projections was not difficult. The balance sheet projections were not as consistent so we preformed a trend analysis to help look at the changes in assets, liabilities and owner’s equity over the last three years. I focused more on the numbers from 2008 and 2009 because 2010 had a decrease in revenue and our projections support an increase in revenue.