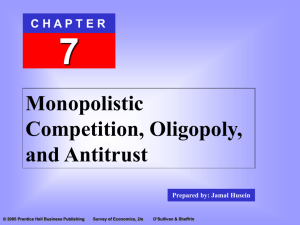

Oligopoly and Strategic Behavior

advertisement

CHAPTER 12 Oligopoly and Strategic Behavior 1 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin 1 Oligopoly An oligopoly is a market with just a few firms. Economists use concentration ratios to measure the degree of concentration, or just how few firms exist in a market. 2 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Oligopolies in the United States Beverages Music Tobacco Phone Service Cars Coca-Cola (45%) Universal/ Polygram (26%) Philip Morris (49%) AT&T/TCI (47%) General Motors (29%) Pepsi (31%) Warner Music (18%) RJR Nabisco (24%) Bell Atlantic/GTE (24%) Ford (25%) Cadbury Schweppes (14%) Sony Music (17%) Brown and Williamson (15%) SBC/Ameritech (18%) Daimler Chrysler (16%) EMI Group PLC (13%) MCI WorldCom (12%) BMG Entertainment (12%) 3 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Concentration Ratios in Selected Manufacturing Industries Industry Four-firm Concentration Ratio (%) Eight-firm Concentration Ratio (%) Cigarettes 93 Not available Guided missiles and space vehicles 93 99 Beer and malt beverages 90 98 Batteries 87 95 Electric bulbs 86 94 Breakfast cereals 85 98 Motor vehicles and car bodies 84 91 Greeting cards 84 88 Engines and turbines 79 92 Aircraft and parts 79 93 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin 4 Strategic Behavior The key feature of an oligopoly is that firms act strategically. Firms in an oligopoly are interdependent. The actions of one firm affect the profits of the other firms. 5 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Barriers to Entry in an Oligopoly Most firms in an oligopoly earn economic profit, yet additional firms do not enter the market, for three reasons: Economies of scale large enough to generate a natural oligopoly but not a natural monopoly Government barriers to entry Substantial investment in an advertising campaign in order to enter the market 6 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Oligopolistic Firms A duopoly is a market with two firms. A cartel is a group of firms that coordinate their pricing decisions, often charging the same price for a particular good or service. The arrangement under which two or more firms act as one, coordinating their pricing decisions, is also known as price fixing. The equilibrium price and quantity in the oligopolistic market depend on the strategic behavior of the firms in the oligopoly. 7 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Cartel Pricing In a cartel arrangement, two firms act as one. In this case, they split the market output—each serving 75 passengers per day, and charge $400 per ticket. The firms also split the profit. Each firm earns $7,500 = [(400-300) x 150]/2. 8 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Duopoly Pricing When two firms compete against one another, they end up serving 100 passengers each, at a price of $350. Each firm earns a profit of $5,000, compared to a profit of $7,500 if they had acted as one firm. 9 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Duopoly Versus Cartel Pricing The duopoly produces more output and charges a lower price than the cartel. 10 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Game Tree A game tree provides a visual representation of the consequences of alternative strategies. Firms can use it to develop pricing strategies. 11 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Cartel and Duopoly Outcomes in the Game Tree 12 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Outcome of Underpricing Jack captures large share of market Jill captures large share of market © 2001 Prentice Hall Business Publishing Jill: Low Price Jack: High Price Price $350 $400 Quantity 170 10 Average cost $300 $300 Profit per passenger $50 $100 13 $1,000 Total profit Economics: Principles and Tools, 2/e $8,500 O’Sullivan & Sheffrin The Dominant Strategy Irrational for Jack to choose high price Jack chooses the low price when Jill chooses the high price. 14 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Dominant Strategy Jack chooses the low price when Jill chooses the low price. Irrational for Jack to choose high price © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e Dominant Strategy: Jack chooses the low price regardless of Jill’s choice.15 O’Sullivan & Sheffrin The Duopolists’ Dilemma Knowing that Jack will choose the low price no matter what, will Jill choose the high price or the low price? Irrational for Jill to be underpriced. © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e Jill will choose the low price, and the trajectory of the game is X to Z to 4. 16 O’Sullivan & Sheffrin The Duopolists’ Dilemma The duopolists’ dilemma is that although both firms would be better off if they chose the high price, each firm chooses the low price. 17 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Prisoners’ Dilemma The prisoners’ dilemma is the duopolists’ dilemma. Although both criminals would be better off if they both kept quiet, they implicate each other because the police reward them for doing so. 18 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Guaranteed Price Matching To eliminate the incentive for underpricing, one firm can guarantee that it will match its competitor’s price. How will Jack respond to Jill’s price-matching policy? Choose the high price: Jack matches Jill’s high price in which case both will earn maximum (cartel) profits. Choose the low price: if Jack chooses the low price, Jill will match the low price and both firms will earn minimum (duopoly) profits. Therefore, Jack has no reason to choose the low price. 19 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Guaranteed Price Matching Price matching eliminates the duopolists’ dilemma and makes cartel profits and pricing possible, even without a formal cartel. Guaranteed price matching leads to higher prices. It guarantees that consumers will pay the high price! 20 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Repeated Pricing When firms play the price-fixing game repeatedly, price fixing is more likely because firms can punish a firm that cheats on a price-fixing agreement. 21 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Retaliation for Underpricing Schemes to punish Jack if he underprices: Duopoly price: Jill also lowers price; abandons the idea of cartel profits, and settles for duopoly profits which are better than the profits when she is underpriced by Jack. Grim Trigger: Jill drops her price to the level that will result in zero economic profit. Tit-for-tat: Jill chooses whatever price Jack chose the preceding month. 22 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Tit-for-Tat Response to Underpricing Jill chooses whatever price Jack chose the preceding month. After Jack lowers price, profits sink to the duopoly level. Jack increases price in the fourth month, which restores the cartel pricing in the fifth month. 23 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Price Leadership Price leadership is an arrangement under which a group of firms selects a firm to serve as a price leader, observes the price chosen by the leader, and then matches it. 24 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Price Leadership The problem with an implicit pricing agreement is that price signals sent by the leader may be misinterpreted. Firms could interpret a price cut in two ways: A change in market conditions, in which case firms just match the lower price and price fixing continues Underpricing, in which case a price war may be triggered, destroying the price-fixing agreement 25 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Kinked Demand Curve The kinked demand curve is an oligopoly model of price leadership that assumes the worst about how other firms will respond to price changes. 26 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Kinked Demand Curve After the initial price of $6, the firm has two options: Increase price: the other firms will not change their prices and quantity will decrease by a large amount (elastic) Decrease price: the other firms will decrease their prices, so quantity will increase only by a small amount 27 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Kinked Demand Curve The demand curve of the typical firm has a kink at the prevailing price. It is relatively flat for higher prices, and relatively steep for lower prices. There is little evidence that oligopolistic firms really act this way—that firms will not go along with a higher price but only match a lower price. 28 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Entry Deterrence by an Insecure Monopolist An insecure monopolist fears the entry of a second firm, and could react in one of two ways: A passive strategy: allow the second firm to enter the market An entry-deterrence strategy: try to prevent the firm from entering The threat of entry will force the monopolist to act like a firm in a market with many firms, picking a low price and earning a small profit. 29 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Passive Strategy If Jane adopts a passive strategy, it will allow Dick to enter the market, and each will earn the duopoly profits of $5,000 each. 30 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Entry-deterrence Strategy Jane can prevent Dick from entering by incurring a large investment and committing herself to serving a large number of customers at a low price. If Dick enters anyway, market output will be very large and the firms will lose $1,300 each. 31 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Insecure Monopolist Strategy If Jane produces a large quantity and Dick stays out, Jane’s profits will be $12,600. 32 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Game Tree for the Entry Game In order to keep Dick from entering, will Jane choose to serve a small or a large quantity of customers? 33 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Outcome of the Entry-deterrence Game If Jane is passive and chooses a small quantity, Dick will enter. If Jane chooses a large quantity, Dick would suffer losses, thus he would stay out. 34 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin The Outcome of the Entry-deterrence Game—Limit Pricing © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e Jane’s profit is higher if she maintains the insecure monopoly position by choosing a large quantity. The strategy of picking a price lower than the normal monopoly price to deter entry is know as limit pricing. 35 O’Sullivan & Sheffrin Entry Deterrence and Contestable Markets The threat of entry will force a monopolist to charge a price that is closer to the one that would occur in a market with many firms. The threat of entry underlies the theory of market contestability. Firms can enter or leave a contestable market when the cost of entry is insignificant. In the extreme case of perfect contestability, firms can enter and exit at zero cost, and the market price would be the same as the perfectly competitive price. 36 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin Characteristics of Different Types of Markets 37 © 2001 Prentice Hall Business Publishing Economics: Principles and Tools, 2/e O’Sullivan & Sheffrin