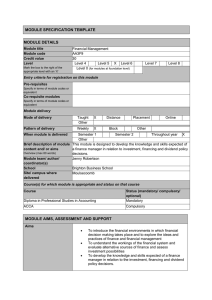

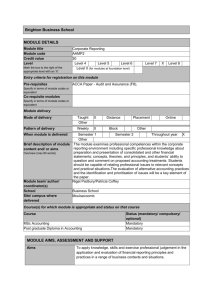

Brighton Business School MODULE DETAILS Module title

advertisement

Brighton Business School MODULE DETAILS Module title Module code Credit value Level Mark the box to the right of the appropriate level with an ‘X’ Performance Management AA3F5 30 Level 4 Level 5 X Level 6 Level 0 (for modules at foundation level) X Level 7 Level 8 Entry criteria for registration on this module Pre-requisites Specify in terms of module codes or equivalent Co-requisite modules Specify in terms of module codes or equivalent Module delivery Mode of delivery Taught Other X Distance Placement Pattern of delivery Weekly X Block Other When module is delivered Brief description of module content and/ or aims Overview (max 80 words) Module team/ author/ coordinator(s) School Site/ campus where delivered Online Semester 1 Semester 2 Throughout year X Other The module addresses itself to the areas of business planning, reporting and control, developing and expanding upon topics first studied in F2. Problem solving, with its associated skills in numeracy, is seen as the area of major importance. Discursive topics are seen as a foundation for module P5, Advanced Performance Management. AJ Cilliers Business School Moulsecoomb Course(s) for which module is appropriate and status on that course Course Diploma in Professional Studies in Accounting ACCA Status (mandatory/ compulsory/ optional) Mandatory Compulsory MODULE AIMS, ASSESSMENT AND SUPPORT Aims To provide a link between paper F2 Management accounting and paper P5 Performance Management. To develop the knowledge gained from paper F2, thereby enabling students to apply management accounting techniques in various business environments, for the purposes of analysis, interpretation, and the management of business performance. Learning outcomes On completion of this module students hould be able to: Subject-specific: To identify and implement appropriate methods and techniques To understand the significance and meaning of measures calculated. To be aware of the differing needs of management with respect to commercial and not-for-profit organisations. To have a strong grasp of human behaviour in relation to performance management. To select and apply alternative methods of analysis, including financial, quantitative, and qualitative approaches. To co-ordinate aspects of planning control and reporting in not-for-profit organisations. To display a high level of competence in the analysis and manipulation of data in time-constrained situations. Cognitive Content Demonstrate numeracy skills, including the ability to manipulate financial and other numerical data and appreciate the algebraic and statistical concepts at an appropriate level. Demonstrate skills in the use of communications and information technology. Specialist cost and management accounting techniques 1. 2. 3. 4. 5. Activity Based Costing Target Costing Life Cycle Costing Throughput Accounting Environmental Accounting Decision Making Techniques 1. 2. 3. 4. 5. Cost-Volume-Profit Analysis Limiting Factor Analysis, including Linear Programming Pricing Decisions Short-Term Decisions (Relevant Cost Analysis) Risk and Uncertaintly Budgeting 1. 2. 3. Objectives of Budgeteary Control Budgetary Systems Quantitative Analysis in Budgeting Standard Costing and Variance analysis 1. 2. 3. Budgeting and Standard Costing Variance Analysis Behavioural Aspects of Standard Costing Performance Measurement and control 1. 2. 3. 4. Performance Measurement Divisional Performance Measures Transfer Pricing Performance Management Models Learning support Indicative Reading The latest editions of: Blocher, T., Chen, K., and Lin, T. Cost Management: A Strategic Emphasis. BPP Learning Media. ACCA Paper F5: Performance Management Study Text. Drury, C. Management and Cost Accounting. Garrison, R., Noreen, E. and Brewer P. Managerial Accounting. Horngren, C. Management and Cost Accounting. Journals: Accounting, Organisations and Society. Harvard Business Review. Journal of Management Accounting Research (USA) Management Accounting Research (UK) All students benefit from: Studentcentral Online Library Resources (e-journals and e-books) Library facilities Teaching and learning activities Details of teaching and learning activities The basis of the presentation of new material will be by the use of lectures supported by course notes, student research and workshops. Workshops: These will support the lectures. Students will be given ‘seen’ questions to prepare for each workshop and will be expected to thoroughly research and read around the topics and prepare detailed answers to the workshop questions. These will be both discursive and problem solving questions. The aim of the workshops is to ensure knowledge and understanding of the subject and to encourage critical and analytical thinking. ‘Unseen’ questions will also be handed out in the workshop, to be completed by students during the workshop, with individual guidance from the tutor as required. Student learning will be supported through e-learning with the provision of materials made available through studentcentral. Allocation of study hours (indicative) Study hours Where 10 credits = 100 learning hours SCHEDULED This is an indication of the number of hours students can expect to spend in scheduled teaching activities including lectures, seminars, tutorials, project supervision, demonstrations, practical classes and workshops, supervised time in workshops/ studios, fieldwork, and external visits. 44 GUIDED INDEPENDENT STUDY All students are expected to undertake guided independent study which includes wider reading/ practice, follow-up work, the completion of assessment tasks, and revisions. 256 PLACEMENT The placement is a specific type of learning away from the University. It includes work-based learning and study that occurs overseas. N/A TOTAL STUDY HOURS 300 Assessment tasks Details of assessment on this module For the syllabus of Performance Management it is considered extremely difficult for students to research and report upon practical industrial and commercial scenarios. The setting of the project with supplied data would lead to a situation where it is deemed to be a single correct solution. The project is designed to encourage students to research material from all areas of the syllabus. The course assessment will demand skills in report writing on a specified topic which by it’s nature will necessitate research and information drawn from a wide range of sources including material from other modules. A weighting of 25% is considered to be adequate considering the fact that both computational and discursive solutions are required in the examination. Types of assessment task1 Examination: a three hour closed book examination. The examination will carry a weighting of 75%. % weighting Indicative list of summative assessment tasks which lead to the award of credit or which are required for progression. (or indicate if component is pass/fail) WRITTEN Written exam 75% COURSEWORK Written assignment/ essay, report, dissertation, portfolio, project output, set exercise 25% PRACTICAL Oral assessment and presentation, practical skills assessment, set exercise N/A EXAMINATION INFORMATION Area examination board Diploma in Professional Studies in Accounting Refer to Faculty Office for guidance in completing the following sections External examiners Name Position and institution Date appointed Date tenure ends Refer to Studentcentral QUALITY ASSURANCE Date of first approval Only complete where this is not the 1 Set exercises, which assess the application of knowledge or analytical, problem-solving or evaluative skills, are included under the type of assessment most appropriate to the particular task. first version Date of last revision Only complete where this is not the first version Date of approval for this version October 2014 Version number 2 Modules replaced AA205 Specify codes of modules for which this is a replacement Available as free-standing module? Yes No X