are you investment ready?

advertisement

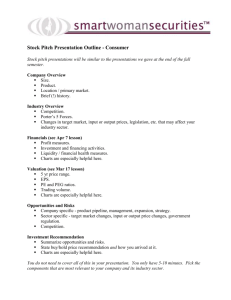

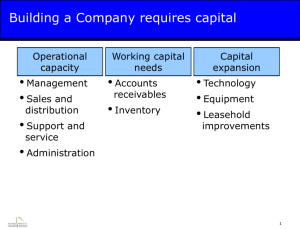

Are you investment ready? Jeff Harriman, Capital Markets Specialist Agenda: • • • • • Types of capital What do investors look for in you? What should you look for in an investor? Raising capital process – intro Importance of books and records discussion incl.: • Structure, IP, presentation skills, pitch • Financials, valuation, & term sheet Vocabulary • • • • • • • • Accredited Investor Exemptions Tranches Seed round Mezzanine Bootstrap Cap table Angel Term Sheet Redemption Feature Venture Capitalist Due Diligence First round Intellectual property Patent Articles of Incorporation Types of capital The life cycle of a business involves a number of stages of growth and development. Investors refer to the types of capital by the term that describes these stages of growth in a business, e.g. ‘start-up’. Funding can also be referred to as stages, rounds or tranches, e.g. ‘first round’ or ‘early stage’. Types of capital • Pre-seed/R&D: – Expand the concept – Advance product development • Seed: – Continued research and product development Types of capital • Start-up: – The company is being set up or in business for a short time – No commercial product – No track record • Expansion/Mezzanine: – The company is established – Requires capital for further growth and expansion – The company may or may not have made a profit at this stage What do investors look for in you? • • • • • • • • • • Is the company being set up or in business for a short time? Business opportunity in superior product High growth potential Global prospects Sustainable competitive advantage Quality management team Previous investors Existing customers and partners Realistic and alternative exit strategies Professional business practices What do investors look for in you? No track record • • • • • Passion Openness Trust Understanding of what the companies goals are Can your innovation be patented? What should you look for in an investor? Know what attributes you are looking for in an investor: • Passive vs. active • Mentor/board member vs. hands-on management role • Industry knowledge – expertise in your field • Track record as investor • Trustworthy (get referrals from other investee companies) • Contacts and networks • Long term relationship – someone you get along with • Capacity for follow-on funding • Enthusiastic • Ethical Process of raising capital The capital raising process is a long one, usually taking 3-6+ months. A fairly formal process is followed. Business angels tend to be quicker and more relaxed about this process. Process of raising capital • • • • • • • • • • • Introduction to venture capitalist or business angel First meeting – produce your executive summary Site inspection – Investment brief submitted Introduction to the management team – sign confidentiality agreement Business plan submitted Valuation Negotiation and acceptance of the term sheet Due diligence and documentation First round received Follow-up funding Exit Let’s get to it • • • • • • • • • Preparation Structure Intellectual property Pitch Financials Valuation Due diligence Term sheet Presentation Preparation • • • • • What is needed What format Anticipation Follow-up When do you become an annoyance Structure • • • • • • • Articles of incorporation Issued and authorized Shareholders agreement Employment contracts How many shareholders? Minute books Share structure Intellectual property • • • • • • Patents, trademarks and trade secrets Licensing arrangements Who developed? Defensibility Contractors IP Muggings Pitch • • • • • • • Develop a pitch Adapt it to the audience Practice, practice, practice Listen to others Record yourself Ask for advice Keep it brief Financials • • • • • • Historic financials are what they are Analyze your balance sheet What are industry norms? How are your ratios? Are they realistic? Put yourself in their shoes Financials • • • • • • Cash flow statements 13 to 20-week projections Ability to meet obligations Sales funnel that has been qualified and weighted Where is the risk? Do your financials actually tell the story you wish to tell? Due diligence • • • • • • Cash flow statements Preparing for the inquisition Make it a business process Aids in preparing a business for sale Gives investors comfort A very valuable exercise Stages of due diligence • • • • • • • Deal screening Interest assessment Letter of interest Detailed due diligence Term sheet Final legal documentation Cashing the cheque Valuation • • • • • • Valuation in early stage is a negotiation Realism Selling the future IRRs Venture capital method Scorecard method Valuation • The best way to cut your ROI in ½ is by investing at 2X the valuation • Valuations <$2Million are less likely to have any down rounds • Investing at the right valuation is better protection than antidilution • Local valuations are primary consideration but all markets are affected by national trends • Follow-on investors are not always local • Entrepreneurs have limited knowledge of valuation Term sheet • • • • • Lays out deal structure Is generally open to negotiation Is not a letter of commitment May have additional hurdles to overcome Many different formats Term sheet The investment agreement: • Sets out the terms – “we will invest $ into your company in exchange for % of the company” • Sets out the conditions precedent – “Here are the things that have to happen between now and when we close in order for us to close.” • Defines the close – “Here are all the other things we need in place in order to close.” What Many Angels insists on • • • • • • • • • • Price protection Redemption feature Board seat Drag along, tag along rights Right of first refusal on selling of shares Conversion of shareholder loans Financial reporting and access rights Tax credit application Confidentiality Other legal stuff… Raising capital is a humbling experience. It can be a lot like banging your head against a wall…repeatedly. After a while you get numb to the pain and focus on success…If you survive. Thank you for your participation! • More information – www.fcnb.ca • Contact FCNB – 866 933-2222 (toll free in NB) – 506 658-3060