syllabus - Budapest Business School

Course title:

Course code:

Status:

Contact hours:

Credits:

Prerequisites:

Course unit leader:

Tutor(s):

Aims and objectives

BUDAPEST BUSINESS SCHOOL

C

OLLEGE OF

F

INANCE AND

A

CCOUNTING

– D

EPARTMENT OF

F

INANCE

1149 B

UDAPEST

, B

UZOGÁNY ST

.

10-12.

/ FAX : +36-1-4696697

SYLLABUS

Corporate Finance

Corporate Finance

VAPU1K0EPZP

Core – Finance and Accounting Module

2+2

5

Introduction into Corporate Finance

Tasi, Péter assistant professor

Office number: B12 e-mail address: tasi.peter@pszfb.bgf.hu

---

In accordance with the general disciplines of the B.A studies, this course in Corporate Finance focuses on how companies invest in real assets and how they raise the money to pay for these investments. The course offers a basic framework for systematically thinking about most of the important financial problems that both firms and individuals are likely to confront. It applies modern finance to give students a working ability to make financial decisions.

Learning outcomes

Understanding of investment decisions, ability to choose and calculate an adequate investment criteria at financial decisions.

Ability to recognise the meaning of risk, understanding why diversification reduces risk, distinguishing between different types of risk.

Ability to give explanation of the fair pricing of the issued securities.

Understanding of the role and problems in capital structuring.

1

Ability to construct a simple financial planning model and to develop a short-term financial plan that meets the firm’s need for cash.

Ability to explain why it makes sense for companies to merge and estimate the gains and costs of mergers to the acquiring company.

Course description

During this course, students are expected to gain a general insight in financial decisions, and within, the role of investment criteria, the scope of financial planning and special financial situation of the company.

Methodology

This subject (Corporate Finance) indicates the distinctive role of lectures and seminars as well, both of them will be carried in each week during the semester.

Course schedule

Consultation ( each week for 2+2 hours )

Topic

1 st

week Goals and Governance of the Firm

Investment and Financing Decision; Forms of Business Organization;

Goals of the Corporation; Maximization of Market Value

2 nd week Net Present Value and Other Investment Criteria

NPV Rule; Payback, IRR, PI; Evaluation of Mutually Exclusive

Projects; Capital Rationing

3 rd

week Investment Decisions with Discounted Cash Flow Analysis

Identifying Cash Flows; Calculating Cash Flow: Capital Investment,

Investment in Working Capital, Operating Cash Flow

4 th

week Project Analysis

Capital Budget and Project Authorization; Sensitivity and Scenario

Analysis; Break-Even Analysis; Real Options

5 th week Risk, Return, Opportunity Cost of Capital and Capital Budgeting

Measuring Risk; Risk and Diversification; Measuring Market Risk;

Total Risk and Market Risk; The Capital Asset Pricing Model;

Company vs. Project Risk

6 th

week The Weighted Average Cost of Capital; Company Valuation

Measuring Capital Structure; Calculating Required Rates of Return as

Expected Returns; Calculating the WACC; Interpreting the WACC;

Valuing Entire Businesses

7 th

Financing

Creating Value with Financing Decisions; Corporate Debt,

2

Convertible Securities; Venture Capital, IPOs, Seasoned Offerings

8 th

Debt Policy and Payout Policy

Capital Structure and Modigliani-Miller’s Argument; Payout Policy;

Increasing and Reducing Value with Dividends

9 th

Long-Term Financial Planning

Financial Planning Models, Pitfalls in Model Design; External

Financing and Growth

10 th

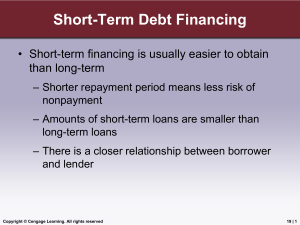

Short-Term Financial Planning and Working Capital Management

Links between Long-Term and Short-Term Financing; Working

Capital; Cash Budgeting; A Short-Term Financial Plan; Sources of

Short-Term Financing; The Cost of Bank Loans; Accounts Receivable and Credit Policy; Inventory Management; Cash Management

11 th Mergers, Acquisitions and Corporate Control

Motives and Reasons for Mergers; The Mechanics of a Merger;

Evaluating Mergers

12 th

Measuring Corporate Performance

Measuring Value, Profitability and Efficiency; Analyzing the Return on

Assets; Measuring Leverage, Liquidity; Financial Ratios

Course policies

1.) Students are invited for compulsory attendance on the lectures and seminars.

2.) Preparation of a home assignment during the semester and its’ presentation on the seminars

Assignments

Written exam : At the end of the semester, a written exam is closing the course. The exam divides by two parts: a) Theoretic part includes closed tests and some definition. b) Practical part includes simple test exercises and general problems to be solved by students independently.

Assessment and grading

grades will be given according to the following pattern:

written exam: 85 points

3

home assignment and presentation: 15 points

the points (percentages) corresponding to marks from 1-5:

0-59%

60-69%

70-79%

80-89%

90-100% fail pass satisfactory good excellent

Compulsory readings

Brealey, Richard A.; Myers, Stewart C. and Marcus, Alan J.: Fundamentals of Corporate

Finance. Sixth Edition (McGraw-Hill/Irwin, 2009)

Recommended readings

(Note: these are recommended, students are not required to read them, since these may not form part of the assessment.)

Bodie, Zvi; Kane, Alex and Marcus, Alan J.: Investments. Sixth Edition (McGraw-Hill/Irwin,

2006)

Bruner, Robert F.: Case Studies in Finance. Fourth Edition. (McGraw-Hill Higher Education,

2003)

4