Merlin Biosciences Fund III

advertisement

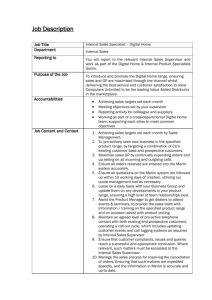

Life Science Investing in Greece Opportunities and Perspectives Salvatore D’Orsa Investment Director Athens 17th June 2004 Merlin Biosciences Limited 33 King Street St. James’ London, SW1Y 6RJ Tel: +44 (0)20 7811 4000 Merlin Biosciences is regulated by FSA Life Sciences in Greece: The Infrastructure • 14 Universities operating in the fields of human and veterinary diagnostics, therapeutic systems, immunology and bioinformatics • 4 High quality scientific institutions: • The Hellenic Pasteur Institute • The Alexander Fleming Foundation for Basic Biological Research • The Institute of Molecular Biology and Biotechnology • The Ioannina Biomedical Research Institute • 3 Science Parks : • The Technology Park of Thessaloniki • The Science and Technology Park of Crete • The Patra Science Park 2 Life Sciences in Greece: The Challenges • Develop intellectual property protection • Facilitate technology transfer • Attract international private finance in competition with European peers • Retain skilled management • Raise visibility: put Greece on the EU life sciences map 3 Market Update on the EU Biotech Sector • UK Biotech Index up 25% in the last twelve months • IPO window is selectively open in some countries • Consolidation ongoing • Good biotech companies are raising VC finance • Leading venture capital funds are raising finance • Funds still cautious in certain countries (i.e. France and Germany) Source: Bloomberg UK Biotech Index Jan 2003-Jun 2004 4 Life Sciences in Greece: Investment Opportunities • Drug discovery and development • Speciality pharmaceuticals • Generics • Medical devices • Diagnostics • Enabling tools, IT and data services 5 Life Sciences in Greece: Attractive for Venture Investing Greek Development Law supports incentives in: * – manufacturing innovative products – providing high technology services – software development – R&D applications In Biotechnology incentives are targeted to: – hiring experienced R&D personnel – developing incubators – promoting industrial research – commercialising applied R&D – promoting technology transfer. Source: ELKE, Hellenic Centre for Investment 6 The Merlin Funds Merlin is a specialist in life science venture capital managing funds in excess of €450m Merlin committed Fund I 1997 vintage Fund II • • • • • • 2000 vintage • • Fund III • • 2002 vintage • • • Merlin delivered UK focus Concept and early-stage 8-10 companies 5-7 year hold • 8 UK companies • 22 products in clinical trials • 6 are ready for exit European focus Early- to mid-stage 20-25 companies 3-5 year hold • 23 European companies 44 products in clinical trials >11 are ready for exit European focus Mid- to late-stage Value investing 8-10 companies 3-5 year hold • • • 7 6 European companies – All good value – All with revenue/uplift The Merlin Venture Team Professor Sir Christopher Evans OBE, DSc Chairman Founder of Merlin in 1996 and has over twenty-five years experience in life sciences. He was the founder of Chiroscience, Celsis, Enzymatix, and several other companies. Mr Jeff Iliffe Finance Director Co-founder and Finance Director of Enviros Group Limited and the life sciences corporate broking team at WestLB Panmure. He is a Chartered Accountant and has a BSc Honours in Accounting and Financial Analysis from the University of Warwick. Mr Mark Clement Chief Executive Co-founder and Finance Director of Celsis International plc and has over twenty years in life sciences. He founded and ran a corporate finance consultancy for several years, and is a Chartered Accountant and Fellow of the Securities Institute. He has a BSc Honours in Economics from the University of Birmingham. Mr Niilo Santasalo Was a senior investment banker at PCA Corporate Finance and in business development in life science companies. He has an MBA in Strategy and Finance from Helsinki University of Technology, as well as a BSc (Eng) from Helsinki Institute of Technology. Mr Salvatore D'Orsa Was a healthcare investment banking associate at Goldman Sachs International. He also worked in the corporate headquarters of SmithKline Beecham. He has an MBA from the Harvard Business School and a BS with honours in Business Administration from Bocconi University, Milan. Dr Rony Douek Was a Senior Associate at Apax Partners. He has also worked at Procter & Gamble, for McKinsey and in the Investment Banking team of Goldman Sachs. He has an MBA from the Harvard Business School, a PhD and MEng (Hons) in Chemical Engineering from Imperial College London. Mr Jason Rushton Mark Docherty Worked previously at Arthur Andersen and is a Chartered Accountant. He has a BEng (Hons) in Mechanical Engineering from Sheffield University. Was a management consultant with PA Consulting in the Healthcare Group. He also worked in drug discovery with Eli Lilly. He has an MSc in Immunology and a BSc (Hons) in Anatomy from the University of Birmingham. 8 Merlin Portfolio Company Examples Drug development Regenerative medicine Performance Enhanced Medicines Cardiac monitoring Reproductive healthcare Vaccines Vascular therapy Chemical genomics Cancer and chronic infectious disease Bio-therapeutics Biomedical technology DNA biopharmaceuticals Drug discovery in pain and obesity Cancer vaccines Anti-infectives Cancer therapy Drug delivery Drug design Pain management Cancer therapeutics Chemical proteomics Antibody therapies 9 Life Science Investing in Greece Opportunities and Perspectives Salvatore D’Orsa Investment Director Athens 17th June 2004 Merlin Biosciences Limited 33 King Street St. James’ London, SW1Y 6RJ Tel: +44 (0)20 7811 4000 Merlin Biosciences is regulated by FSA