us government regulation and anti-trust policy

advertisement

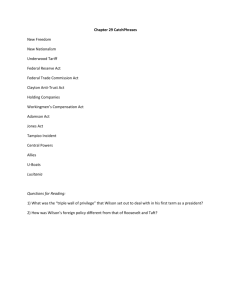

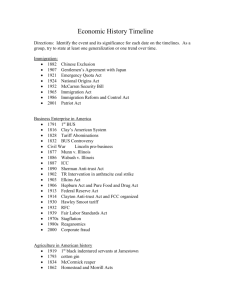

U.S. Regulation of Business (1) Overview (2) Anti-Trust Regulation Business, Government & Society Spring 2000 U.S. GOVT REGULATION: An Overview Cycles of regulation –periods of heavy regulation –followed by periods of deregulation Economic and political influences Federal regulatory agencies and commissions HISTORY: GOVT REGULATION OF BUSINESS IN THE US Justification for Government Regulation --the use of private property can be regulated to serve the public interest Prior to the 1880s most regulation of business took place at the state and local level Congress established the first modern regulatory agency in 1887 HISTORY OF GOVERNMENT REGULATION - Interstate Commerce Commission ** initially set railroad rates ICC was the first significant reaction to concerns regarding the detrimental effects of the concentration of ownership with higher prices and reduced output ICC in line with the constitution --right of federal government to regulate trade among the states HISTORY OF GOVERNMENT REGULATION Level of federal regulation remained low until the Great Depression in the 1930s The Depression (stock market “crash” and collapse of the banking industry) represented to many: -- “the failure of the free enterprise system” -- the problems with concentration of economic resources HISTORY OF GOVT REGULATION THE NEW DEAL (FDR): Vast System of Federal Economic Regulation attempted to alleviate detrimental effects of concentrated ownership and private market through: – Price control – Control over the entry of firms – Vested federal government with unprecedented authority to intervene in business affairs HISTORY OF REGULATON By the 1960s government regulation of prices and entry was commonplace in the transportation (railroads, trucking, airlines), communications (telephone services, radio, television), and “natural” utility (electricity, natural gas) industries SOCIAL REGULATION * Increased significantly starting late 1960s and continuing in the 1970s -- in the wake of Vietnam protests and emergence of environmental and consumer movements Scale & scope of regulatory activity expanded Fed govt imposed new controls on environmental pollution, the safety of the workplace & consumer products DEREGULATION Then came the late 1970s--Great Stagflation (double digit inflation and unemployment during the Carter administration) This undermined public confidence in the prevailing system of regulation From the late 1970s through the Reagan/Bush administrations there was a move to Deregulation and greater reliance on market forces ECONOMIC DEREGULATION Emanated from: -- the perceived failure of government regulation -- the value placed on the efficacy of free markets by Reagan/Bush administrations Removal of many price and entry restrictions in regulated industries DEREGULATION OF THE 1980s: Started with Carter accelerated with Reagan -Airline Industry & Trucking deregulation was supported by some, but not all, firms in the effected industries - particularly supportive were new and small firms who could now compete more effectively - however, many incumbent firms lost market share & profits - also, wages of unionized workers (e.g., Teamsters in trucking) in “protected” industries declined DEREGULATION OF THE 1980s * While economic regulation declined, social regulations (e.g., environmental, product safety, workplace) remained -- Interest groups and general public support remained high for social regulation US GOVERNMENT REGULATION IN SUMMARY * U.S. Government Regulation has been characterized as a “middle way” of relating government to industry -- somewhere between government control and more complete reliance on private markets * Cycles of Regulation and Deregulation affected by economic conditions, public interest and politics CURRENT REGULATORY ENVIRONMENT Clinton administration “middle ground” Support for social (e.g., equal employment opportunity, increased min. wage) and environmental regulation Economic deregulation of: (1) Telecommunications (2) Electrical Utilities (3) Banking/Financial Services Regulatory institutional arenas Most U.S. Government Regulations are implemented through independent commissions and agencies of the federal executive branch and state government Regulatory statutes and practices can be appealed to the courts to test their constitutionality and to ensure that agencies satisfy due process in their decision making FEDERAL REGULATORY AGENCIES --There are 60 autonomous federal agencies, some (e.g.,EPA) report directly to the President, bypassing cabinet secretaries -- There are also 20 independent regulatory commissions which do not report to the President (e.g., Fed Reserve System, FCC, CPSC) FEDERAL REGULATORY AGENCIES Independent Regulatory Commissions (IRCs) -- Commission members appointed by President and approved by Senate, terms are not coterminous with President (e.g, FEC) -- Lack continuing supervision of any of the formal branches of government -- Represent the “fourth branch of government” LISTING OF SOME FEDERAL AGENCIES AND IRCs “many familiar names” – INTERSTATE COMMERCE COMMISSION, (1887) IRC – FED RESERVE SYSTEM, (1913) IRC – FED TRADE COMMISION, (1914) IRC – FOOD AND DRUG ADM, (1931) AGENCY UNDER HHS EXAMPLES OF FEDERAL AGENCIES & IRCs SECURITIES AND EXCHANGE COMMISSION, (1934) IRC FEDERAL COMMUNICATIONS COMMISSION, (1934) IRC FEDERAL AVIATION AGENCY, (1948) agency under DOT EQUAL EMPLOYMENT OPPORTUNITY COMMISSION, (1965) IRC ENVIRONMENTAL PROTECTION AGENCY, (1970) IND. AGENCY ANTI-TRUST POLICY HISTORY JUSTIFICATIONS INSTITUTIONAL ARENAS EXEMPTIONS DIFFERENT APPROACHES: TRADITIONAL, “CHICAGO SCHOOL”, CURRENT POLICY MICROSOFT CASE (ROLE PLAYS) ANTI-TRUST POLICY HISTORY Anti-trust became an issue at the turn of the 20th century Concern about control of industry by single firm, “unnatural” monopoly & loss of economic efficiency -- resulting in reduction of output and rise in prices which worked against interests of consumers and detrimental to US economy ANTI-TRUST POLICY Monopoly as market failure justifying government intervention: -- price above MC -- output below efficient level -- loss of consumer surplus -- transfer of surplus to producers -- loss of efficiency in economy, as ** max (PS+CS) is not achieved ANTI-TRUST POLICY To promote economic efficiency govt. antitrust policy attempts to ensure entry and fair competition in industries with barriers to entry and anti-competitive practices Anti-trust policies (as with all govt regs) change over time and are strongly influenced by economics and politics The awarding of triple damages in anti-trust cases provides significant incentive for private firms to initiate cases Anti-Trust institutional arenas Anti-Trust laws are established by the U.S. Congress. However, laws are enforced mostly through the courts by private litigation & law suits -- in contrast with most govt regs where main I.A.s are agencies, commissions & legislatures Broad language of anti-trust acts leaves considerable room for interpretation for courts/judges/juries INSTITUTIONAL ARENAS Apart from the courts the enforcement of Anti-Trust is the responsibility of the DOJ Anti-Trust Div., FTC, the DOT (with airlines) and state attorney generals FTC has enforcement, investigation and regulatory role (e.g., Staples-Office Depot proposed merger) DOJ’s role in enforcement is through law suits brought to Federal Courts as in the Microsoft case Key Issues to consider in Anti-Trust - what is the relevant market? - market share of competitors? - prices, are they fair? - barriers to entry (capital costs, distribution chains, software platforms)? - is there international competition? - cost structure of industry (is it subject to increasing returns to scale?) - incentives to innovate ? - the effect of tech change on relevant market? Types of Anti-Competitive Behavior (1) Horizontal Restraint of Trade -- a division of market, which reduces competition and creates monopoly -- a single company dominates a market and/or industry Types of Anti-Competitive Behavior (2) Vertical Restraint of Trade examples: --resale price maintenance (manufacturer tries to control the retail price) -- exclusive dealing (e.g., Anheuser Bush) -- a single firm controls supply chain Types of Anti-Competitive Practices (3) Predatory Pricing -- firms price below marginal cost until other firms get driven out of business and then they price and profit as a monopolist -- most relevant in industries with high barriers to entry (e.g., airlines) MICROSOFT & ANTI-COMPETITIVE PRACTICES Microsoft has been accused of Horizontal and Vertical Monopoly practices -- MS dominates operating system (OS) market with MS DOS -- accused of unfairly using position in supply chain in browser competition with Netscape/American Online SOME EXEMPTIONS TO ANTI-TRUST -- Regulated Industries (e.g.., natural monopolies) -- Agricultural Cooperatives -- State Economic Activity (e.g., NH liquor monopoly) -- Major League Baseball (“it is a game”) -- Competitors working together to lobby the govt-- First Amendment right -- Unions (first thought to be unlawful combinations not serving the public good) SCHOOLS OF “THOUGHT” ON ANTI-TRUST (1) TRADITIONAL/STRUCTURALIST the dominant school until 1970s, emanated from populist tradition - social, political & econ justifications for breaking up large companies - concern with economic power leading to political power - concern with fairness and protection of consumer & small businesses SCHOOLS OF “THOUGHT” ON ANTI-TRUST (1) Traditional/Structuralist (continued) - “Per Se” rule -- few competitors reduced supply, increased price - most concerned with industry structure, i.e., the number of firms and market share SCHOOLS OF “THOUGHT” ON ANTI-TRUST (2) CHICAGO SCHOOL Started to dominate in late 70s, in Reagan and Bush administrations - Economic objectives emphasized - market efficiency is objective i.e., P=MC & max(PS+CS) - not concerned with distribution of income or equity - “Rule of Reason” Test-- does market operate as if competition was possible? SCHOOLS OF “THOUGHT” ON ANTI-TRUST (2) CHICAGO SCHOOL(continued) - barriers to entry, substitutes and international competition are considered - not concerned with social and political implications of concentration of economic resources GOVERNMENTAL POLICIES -- suggested by the different schools of thought (1) STRUCTURALISTS - active government role - promote an increased number of firms in industries - focus removing barriers to entry - break-up “per se” monopolies - restrict mergers that will result in market power (e.g., Staples-Office Depot, Microsoft and Intuit) SUGGESTED GOVERNMENTAL POLICIES (2) CHICAGO SCHOOL - minimal government anti-trust effort - government intervention often makes markets less competitive and less efficient - government can inhibit entry, e.g., govt regulation of trucking till the 1980s - private firm control of regulatory agencies can lead to “capture” - large firms and limited competition could be most efficient, particularly in capital intensive industries with increasing returns CURRENT ANTI-TRUST POLICIES Microsoft is the leading example Also in the news – Airline industry (American Airlines, ContinentalNorthwest) – Visa/MasterCard – Auction Houses Mix of traditional & Chicago views used, reflective of economic as leading, but not only concern Also the internationalization of anti-trust reg., e.g., EU vs. Boeing, Lonza vs. US MICROSOFT CASE ACCUSATIONS AGAINST MICROSOFT MICROSOFT --IT’S DEFENSE RULING