Pension Present Value Example

Acct 414 Prof. Teresa Gordon

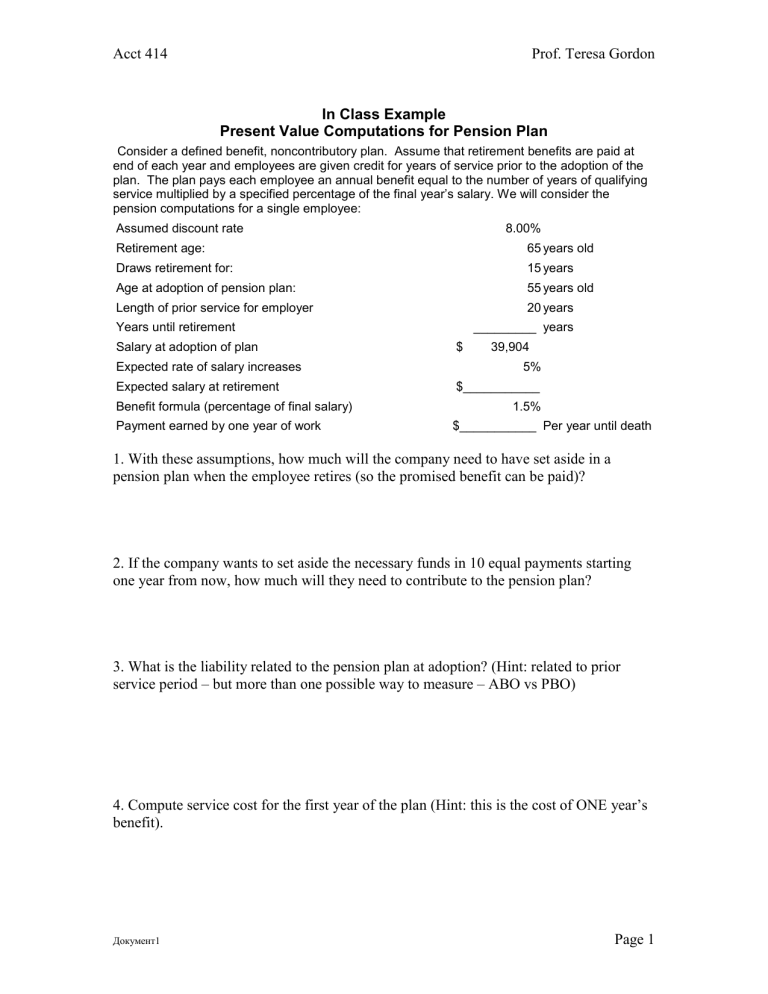

In Class Example

Present Value Computations for Pension Plan

Consider a defined benefit, noncontributory plan. Assume that retirement benefits are paid at end of each year and employees are given credit for years of service prior to the adoption of the plan. The plan pays each employee an annual benefit equal to the number of years of qualifying service multiplied by a specified percentage of the final year’s salary. We will consider the pension computations for a single employee:

Assumed discount rate

Retirement age:

Draws retirement for:

Age at adoption of pension plan:

Length of prior service for employer

Years until retirement

Salary at adoption of plan

Expected rate of salary increases

Expected salary at retirement

Benefit formula (percentage of final salary)

8.00%

65 years old

15 years

55 years old

20 years

_________ years

$ 39,904

5%

$___________

1.5%

Payment earned by one year of work $___________ Per year until death

1. With these assumptions, how much will the company need to have set aside in a pension plan when the employee retires (so the promised benefit can be paid)?

2. If the company wants to set aside the necessary funds in 10 equal payments starting one year from now, how much will they need to contribute to the pension plan?

3. What is the liability related to the pension plan at adoption? (Hint: related to prior service period – but more than one possible way to measure – ABO vs PBO)

4. Compute service cost for the first year of the plan (Hint: this is the cost of ONE year’s benefit).

Документ1 Page 1

Acct 414 Prof. Teresa Gordon

In Class Example – Accumulation and Distribution Schedules for PBO and Plan Assets a b c

8.00% d e f g

8.00% h i j k c+d-h+k

15

16

17

18

19

20

21

22

23

24

25

10

11

12

13

14

End of

Year

0

1

2

Age of

Employee

55

Service

Cost

Interest

Cost

Payments to Retiree

Projected

Benefit

Obligation

Fair Value of

Plan Assets

- 77,312 -

Return on

Plan Assets

Employer

Contribution to Pension

Plan

Payments to Retiree

Amortization

Net Pension of Prior

Cost

Service Costs Recorded

56 4,175 6,185 - 87,671 17,283 - 17,283 - 7,731 18,091

57 4,509 7,014 - 99,193 35,948 1,383 17,283 - 7,731 17,871

3

4

5

6

58 4,869 7,935 - 111,998 56,106 2,876 17,283 - 7,731 17,660

59 5,259 8,960 - 126,217 77,877 4,488 17,283 - 7,731 17,461

60 5,679 10,097 - 141,993 101,390 6,230 17,283 - 7,731 17,278

61 6,134 11,359 - 159,487 126,784 8,111 17,283 - 7,731 17,113

7

8

9

62 6,625 12,759 - 178,870 154,209 10,143 17,283 - 7,731 16,972

63 7,154 14,310 - 200,334 183,828 12,337 17,283 - 7,731 16,859

64 7,727 16,027 - 224,088 215,817 14,706 17,283 - 7,731 16,778

65 8,345 17,927 - 250,360 250,365 17,265 17,283 - 7,731 16,738

66 - 20,029 (29,250) 241,139 241,144 20,029 29,250

67 - 19,291 (29,250) 231,180 231,185 19,292 29,250

68 - 18,494 (29,250) 220,424 220,430 18,495 29,250

69 - 17,634 (29,250) 208,808 208,815 17,634 29,250

70 - 16,705 (29,250) 196,263 196,270 16,705 29,250

71 - 15,701 (29,250) 182,714 182,721 15,702 29,250

72 - 14,617 (29,250) 168,081 168,089 14,618 29,250

73 - 13,446 (29,250) 152,277 152,286 13,447 29,250

74 - 12,182 (29,250) 135,209 135,219 12,183 29,250

75 - 10,817 (29,250) 116,776 116,787 10,818 29,250

76 - 9,342 (29,250) 96,868 96,880 9,343 29,250

77 - 7,749 (29,250) 75,368 75,380 7,750 29,250

78 - 6,029 (29,250) 52,147 52,160 6,030 29,250

79 - 4,172 (29,250) 27,069 27,083 4,173 29,250

80 - 2,166 (29,250) (16) (0) 2,167 29,250

Документ1 Page 2

Acct 414 Prof. Teresa Gordon

Notes on computations.

The number in the BOX under PBO and FV of plan assets is the answer to the first question. It is the amount that will be needed at the date of retirement to make the promised payment to the employee assuming he works until retirement and all our assumptions are true.

The first number in the PBO (projected benefit obligation) column is the answer to the third question. It is what we owe immediately because the employee has already worked for us and is getting credit for past services. So we have an immediate obligation to give him at least ($65,000 * .015 * 20 years of prior service) per year from retirement age until he dies.

The subsequent PBO figures are computed as the balance forward + service cost + interest cost – payments to retiree. Interest cost is the discount rate times the PBO at end of previous year.

The first number in the Service cost column is the answer to the fourth question. It is the amount we would need to invest at the end of the first year of the pension plan to pay an additional year’s benefit ($65,000 * .015) to the employee from retirement age until he dies. We have only 9 years left to earn interest before he retires. Notice that the next year’s service cost is higher because we only have 8 more years to earn the necessary interest.

1. Annual payment = 29,250 (65,000 * .015 * 30) n= 15 years life expectancy i = 8% discount rate, FV = 0, PVA = 250,365

2. To determine the annual amount to fund the plan ($17,283 in this example), we take the amount we will need at retirement as the FV of an annuity, use n=number of years until retirement, and solve for the payment. If the plan will earn MORE or LESS than the discount rate, we have to figure what we’ll need in the plan assets at age 65 using the rate of return expected for the plan assets. Accordingly, the amount in PBO and the amount in the

Plan Assets at retirement will NOT be equal unless the discount rate = the expected rate of return on investments in the pension plan. However, we should still run out of plan assets and PBO should be zero at the expected date of death.

Plan assets are increased by contributions, decreased by payments to retirees, incre ased by “returns” (interest/dividends) earned on pension assets.

3. First need to determine FUTURE salary level: PV=41,900, i=5% salary increase rate, n=9 (number of years during which raises could be received),

Pmt=0, solve for FV=$65,000

Next, determine payments during retirement (based on prior service only) = 19,500 or ($65,000 * .015 * 20) n=15 years life expectancy, i=8%, FV=0, ordinary annuity

PVA at age 65 = 166,910, discounted to age 55 (i.e., deferred 10 years) = 77,312

(To compute the ABO at plan adoption, we would use current salary instead of $65,000 – however, GAAP assumes salaries will increase)

4. Service cost is based on working one more year: pmt = 975, i=8%, n=15 years (life expectancy), FV =0, the compute PVA at age 65 = $8,345.

We have only 9 years before retirement (he had to work a year to earn this benefit), so the value at age 56 is $4,175. ($8,345 = FV, pmt=0, n=9, i=8%, PV=?)

The service cost increases as we approach retirement because we have less time to "earn" money to pay the benefit.

Документ1 Page 3

Acct 414 Prof. Teresa Gordon

5 6 8

5

N=10

5

N=15

0

1. With these assumptions, how much will the company need to have set aside in a pension plan when the employee retires (so the promised benefit can be paid)?

Документ1 Page 4

Acct 414 Prof. Teresa Gordon

5

5

6

5

8

0

N=10

N=15

2. If the company wants to set aside the necessary funds in 10 equal payments starting one year from now, how much will they need to contribute to the pension plan?

Документ1 Page 5

Acct 414 Prof. Teresa Gordon

5 6 8

5

N=10

5

N=15

0

3. What is the liability related to the pension plan at adoption? (Hint: related to prior service period – but more than one possible way to measure – ABO vs PBO)

Документ1 Page 6

Acct 414 Prof. Teresa Gordon

5

5

6

5

8

0

N=10

N=15

4. Compute service cost for the first year of the plan (Hint: this is the cost of ONE year’s benefit).

Документ1 Page 7