Answers to Internet Exercises - Tex

advertisement

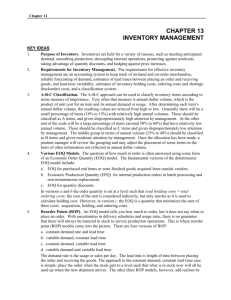

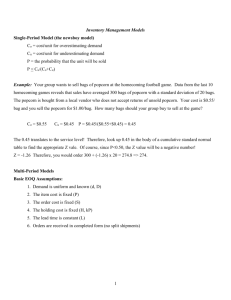

CHAPTER 12: INVENTORY MANAGEMENT Teaching Notes This is a fairly long quantitative chapter, and hence not all the topics can be covered in even two sessions. The models are for independent demand items such as finished goods, spare parts and supplies (the dependent demand items use MRP or JIT, and are covered in later chapters). Typical operations that use inventory control models are warehouses and storerooms. The basic models are the EOQ/ROP and Fixed Interval models. If time allows, the variations of EOQ, economic production quality and quantity discount may be covered. Another fairly important model is the single period (newsboy) model. Answers to Discussion and Review Questions 1. Inventories are held: 1. while items are being transported 2. to protect against stock-outs 3. to take advantage of economic lot sizes and quantity discount 4. to smooth seasonal demand or production 5. to decouple operations 6. to hedge against price increases 2. A company can reduce its needs for inventories by addressing the reasons (purpose) of inventories, as given in the previous question: a. reducing supplier delivery lead times (e.g., locate closer) and increasing delivery reliability b. cross-docking or eliminating the DC c. using faster and more reliable transportation mode d. e. f. g. h. i. j. k. l. m. 3. Establishing close long-term relationship with suppliers and customers Ensuring high quality material improving forecasting of demand and reducing forecast error reducing ordering time and cost by using tools such as EDI performing faster set ups smoothing out demand by demand management so need for seasonal production is reduced using preventive maintenance on equipment and machines training workers and accepting idle time smoothing out parts of production so need for decoupling inventory is reduced using Futures Markets to hedge the requirements, so that there is no need to hold inventory in anticipation of price hikes It is inappropriate to compare the inventory turnover ratios of companies in different industries because: structure of industries are different. In some industries, suppliers hold inventories for the customers. nature of products are different, resulting in different mode and time of transportation and storage. Grocery stores have high turnover ratio bec. groceries, especially fresh produce, are perishable. lead times are different depending on the production process, length of production run, etc. demand variabilities are different resulting in different levels of safety stock. demand seasonal patterns are different. Instructor’s Manual, Chapter 12 12-1 4. Effective inventory management requires safe storage and use of inventory a tracking system and replenishment models forecasts of demand and lead time (amounts and variabilities) inventory costs estimation a priority system (i.e., A-B-C classification). 5. Purchase lead time is the time interval between ordering and receiving the order. It is made of supplier order processing time, any production or purchase of the item by the supplier if not on hand, picking, packing, and shipment. 6. Bar codes allow quick and accurate identification of items and storage locations. 7. Holding (carrying) cost is the cost to keep an item in inventory, consisting of cost of money tied up in inventory and storage cost. Ordering cost is the cost of the actual placement of an order (not including the purchase cost), including the time of buyer, receiver, and accounts payable. Shortage cost is the cost of demand exceeding supply of inventory on hand; includes unrealized profit per unit, loss of goodwill, etc. 8. The A-B-C classification is sorting the inventory items according to annual dollar value (unit cost × annual volume), and calling the top 15-20% of stock keeping units (SKUs) accounting for about 70-80% of annual dollar value as A items, and bottom 50-60% of SKUs accounting for about 5-10% of annual dollar value as C items. The rest are called B items as they have controls that lie between the two extremes. 9. The total inventory-control cost-curve is relatively flat in the vicinity of the EOQ, so there is a range of values of order quantity for which the total cost is close to its minimum. The fact that the EOQ calculation involves taking a square root lessens the impact of data estimation errors. Also, errors may cancel each other out. 10. As holding inventory becomes more expensive, the company will order in smaller quantities (note H in the formula for EOQ). This will result in more frequent orders. 11. As machine setup time decreases, set up cost decreases, resulting in lower run size (note S in the EPQ), which results in lower average amount of WIP inventory. Overall inventory costs would decrease. Also lower WIP results in less confusion and better quality. 12. The EPQ model is similar to the EOQ model, except that instead of orders being received in a single delivery, units are received incrementally. This is because the production rate is finite. This results in some of the units being consumed before the maximum inventory level is reached. 𝑝 To compensate for this, EPQ is larger than EOQ by the proportion √𝑝−𝑑 where p = production rate and d = demand rate. 13. 12-2 Planned shortage would lead to lower holding cost. For example, many large retailers such as Sears Canada, Staples, and Home Depot do not stock big-ticket items. Or auto-part suppliers such as Canadian Tire would not stock low-demand items. As demand occurs, orders are placed. This is a form of planned shortage. Operations Management, 5/C/E 14. Safety stock is inventory held in excess of average/expected demand. Its purpose is to reduce the risk of stock-out due to variability in lead time and/or demand. 15. Safety stock should be large when large variations in lead time and/or usage/sales are present. Conversely, small variations in usage/sales and lead time require small safety stock. Safety stock should be zero when usage and lead time are constant, or when the service level is 50 percent (and hence, z = 0). 16. Lead time service level is the probability that demand will not exceed supply during a lead time. Lead time Service level determines the safety factor z, and safety stock is z × standard deviation of demand during a lead time (for the EOQ/ROP model). Therefore, increasing the LT service level requires increasing the amount of safety stock. 17. Annual service level (SLannual) is the percentage of annual demand filled (directly from inventories). It is related to z through the following two steps: 1. Calculate E ( z ) Q(1 SLannual ) dLT 2. Take the E(z) to Table 12-3 to determine the associated z value. 18. EOQ/ROP model orders a fixed quantity when inventory drops to or below the ROP. Fixed Interval model orders only after a fixed interval of time. EOQ/ROP is used for individual SKUs, whereas Fixed Interval model is used for a group of SKUs bought from the same supplier. 19. The Fixed Interval model orders each SKU at every order time, even if the order quantity is very small. However, it might cost less to order some items every two, three, or more order intervals than ordering them at every interval, because their holding cost may be less than the line-item ordering cost. The Coordinated Periodic Review model accommodates this by determining an order interval OI for reviewing every SKU and a multiple mi of OI for ordering SKUi. 20. The single period model is a model for ordering of perishables and other items with limited useful lives. It is appropriate for any SKU that is not carried over from one period to the next (i.e., unused or unsold items are salvaged). 21. Yes. When excess cost Ce is higher than the shortage cost Cs, SL = Cs / (Cs + Ce) will be less than 0.5 which means that Q = a value of demand less than its median. 22. Multi-echelon control uses echelon inventory (all inventory at a Distribution Center (DC) and retailers) for a DC, echelon demand (all POS customers’ demands), and echelon lead time (sum of LT of DC from its supplier and LT of retailers from DC) to make replenishment decisions. Distribution Requirement Planning plans distribution of shipments from a DC to retailers, given forecasts of customer demands at retailers and lead times from DC to retailers. Inventory optimization determines the location and size of inventory and promised lead times in a supply chain in order to meet customer-promised lead time at minimum total inventory holding cost. Instructor’s Manual, Chapter 12 12-3 Answers to Taking Stock Questions 1. a. If we buy additional amounts of a particular good to take advantage of quantity discounts, then we will save money on a per unit purchasing cost of the item. We will also save on ordering cost because we will order this item less frequently. However, as a result of ordering larger quantity, we will have to hold larger inventory, resulting in an increase in inventory holding cost, including the need for a larger storage space. b. Conducting inventory count once a quarter instead of once a year will result in an increase in labour cost. However, the more frequent counting would also lead to more timely detection of errors and improved inventory accuracy which in turn would lead to better customer service and lower cost. 2. Buyer, planner/expeditor, and inventory clerk would be directly involved in day-to-day inventory decisions. The materials manager, production planning and control manager, purchasing manager, and inventory manager would be involved in critical decisions, large contracts, setting goals, etc. Top management will be involved in deciding total inventory investment and customer service levels. 3. Technology has aided inventory management by providing: bar codes and scanners and RFID for identification, electronic communication for order picking, replenishment, and tracking trucks/shipments inventory software for storing data, tracking inventory position, forecasting, and making inventory replenishment decisions. 4. Use RFID, cameras, secure storerooms, employ a security guard to check employees leaving. Answers to Critical Thinking Exercises 1. Expansion of menu offerings has created problems for inventory management in a fast food restaurant because there are more ingredients and therefore more inventory items to keep, track, and order. The small storage spaces around the production lines in the compact kitchen (in order to be more efficient) may not have enough room for more items. 2. I’d look at the demand per day, the item’s profit margin, and degree of substitutability (would customers buy a substitute which is available?). Answers to Experiential Learning Exercises 1. (a) (b) (c) 2. (a) gas: EOQ/ROP model (b) groceries: Fixed Interval model (c) cash: EOQ/ROP model. Running out of gas has the highest shortage cost. 3. Generally, items are available on the shelves, display fridges, etc. Once in a while, the store runs out of a SKU. Some shelf locations don’t have price label. Sometimes, items get knocked down on the floor and are left there. Sometimes items are misplaced. Sometimes the shelf label doesn’t match the store computer price. The store can monitor these more closely and fix them faster. 12-4 groceries: gas: pocket money: shop once a week fill up as it is running out go to bank as it is running out Operations Management, 5/C/E Answers to Internet Exercises 1. ` Retail Pro’s Inventory Control & Management enables the following: Define an item, including several data fields, including special fields for serial no., whether it is a kit (package), a service or fee (non-stock) item, etc. Keep a memo for each transaction involving quantity, cost, or price, e.g., quantity adjustment Keep a history of transactions for each item, including the ability to drill down by store Update inventory balance Show commitments, open orders, layaways, transfers Issue point-of-sale customer receipt, check stock level, including across stores Show stats such as days of supply, inventory turns, etc. 2. Answers will vary. 3. a. b. c. 4. Conveyables can be moved using conveyers. E.g., a case of oil filters. Non-conveyable cannot be moved by conveyers. E.G., a gas grill. Paper and RF order picking systems Popup wheel, sliding shoe The automated library system of UBC stores about half (2 million) of its collection of books. The floor space is 9,600 ft2 with 4 aisles, each 61 pairs of bays long and 39 tiers high, for a total of 19,032 book bins. Each bin is 2 feet wide and 4 feet deep, with 4 heights: 6, 10, 12, and 16 inches. Each bin has dividers that make compartments. A max. of 500 pounds of books can be stored in each bin. Each aisle has one storage and retrieval machine that moves the bins between the front-of-aisle workstations and bays. Placing in and retrieving a bin out of a bay uses handles at each side of the bin and lasers for accurate positioning. The Dematic management software works with the library circulation software by tracking books in the bins. Instructor’s Manual, Chapter 12 12-5 5. SmartOps is an inventory optimization software that was bought by SAP. It determines the location and size of safety stocks (and reorder point) in a supply chain in order to minimize total inventory holding cost subject to meeting end-customer desired lead time and service level. SmartOps was purchased in 2007 to be used as a tool internally (Celestica has over 20 facilities worldwide) and for the supply chain management service that Celestica started to offer to its customers. SmartOps starts with end-customer demand forecasting, trying to increase forecast accuracy. Celestica has applied SmartOps to over 20 supply chains so far. Results show more than 10% inventory reduction (including excesses and obsoletes), visibility (and reduction in info. latency—e.g., two SAP’s in North America and Asia not communicating well) in the supply chain, lead time reduction (leading to more flexibility), and better customer service. Solutions to Problems 1. a. Step 1: Compute the Annual Dollar Value (= Unit Cost * Annual Volume) for each item: Item Unit Cost 1 2 3 4 5 6 7 $100 80 15 50 11 60 10 Annual Volume (00) 25 30 60 10 70 85 60 Annual Dollar Value $2,500 $2,400 $900 $500 $770 $5,100 $600 Step 2: Sort the data in descending order of Annual Dollar Value (ADV). Sum the ADV and compute the % ADV for each item. In this case, there should be only 1 A (1/7 = 14%) and 2 Bs (2/7 = 28%). 12-6 Item Unit Cost 6 1 2 3 5 7 4 60 $100 80 15 11 10 50 Annual Volume (00) 85 25 30 60 70 60 10 Annual Dollar %ADV Value $5,100 39.94% $2,500 19.58% $2,400 18.79% $900 7.05% $770 6.03% $600 4.70% $500 3.92% $12,770 A B B C C C C Operations Management, 5/C/E b. Q0 2 DS 2(4,500)36 180 units H 10 c. 2𝐷𝑆 𝑝 2(18,000)(100) 120 √ 𝑄𝑝 = √ =√ = 300(2) = 600 𝑢𝑛𝑖𝑡𝑠 √ 𝐻 𝑝−𝑑 40 120 − 90 2. PROBLEM NO. 12 - 2 Item 4021 9402 4066 6500 9280 4050 6850 3010 4400 2307 Monthly Usage Unit Cost 50 $1,400 300 $12 40 $700 150 $20 10 $1,020 80 $140 2,000 $15 400 $20 7,000 $25 1958 $14 Sort by Monthly $ v alue: Item 4400 4021 6850 4066 2307 4050 9280 3010 9402 6500 Monthly Usage Unit Cost 7,000 $25 50 $1,400 2,000 $15 40 $700 1958 $14 80 $140 10 $1,020 400 $20 300 $12 150 $20 % of cumul Monthly Monthly $ value $ value Class $17 5,000 47 .8% A $7 0,000 19.1% A $30,000 8.2% B $28,000 7 .7 % B $27 ,412 7 .5% B $11,200 3.1% C $10,200 2.8% C $8,000 2.2% C $3,600 1.0% C $3,000 0.8% C $366,412 A reasonable classification is given above. Its properties are: Class % cumul $ value % of SKUs A B C 66.9% 23.4% 9.9% 20% 30% 50% Instructor’s Manual, Chapter 12 12-7 3. a. PROBLEM NO. 12 - 3 Item K34 K35 K36 M10 M20 Z45 F14 F95 F99 D45 D48 D52 D57 N08 P05 Unit Cost Monthly Usage $10 200 $25 600 $36 150 $16 25 $20 80 $80 700 $20 300 $30 800 $20 60 $10 550 $12 90 $15 110 $40 120 $30 40 $16 500 Sort by Monthly $ v alue: Item Z45 F95 K35 P05 F14 D45 K36 D57 K34 D52 M20 F99 N08 D48 M10 Unit Cost Monthly Usage $80 700 $30 800 $25 600 $16 500 $20 300 $10 550 $36 150 $40 120 $10 200 $15 110 $20 80 $20 60 $30 40 $12 90 $16 25 Monthly $ value $56,000 $24,000 $15,000 $8,000 $6,000 $5,500 $5,400 $4,800 $2,000 $1,650 $1,600 $1,200 $1,200 $1,080 $400 $133,830 % of cumul Monthly $ value 41.9% 17 .9% 11.2% 6.0% 4.5% 4.1% 4.0% 3.6% 1.5% 1.2% 1.2% 0.9% 0.9% 0.8% 0.3% Class A A A B B B B B C C C C C C C A reasonable classification is given above. Its properties are: b. c. 12-8 Class % cumul $ value % of SKUs A B C 71.0% 22.2% 6.8% 33.3% 46.7% 20% He/she could exert most control on A items and least on C items. For example, A items could be ordered daily, Bs weekly, and Cs monthly. It might be important for some reason other than dollar value, such as cost of a stock-out, sole sourcing, becoming obsolete, etc. Operations Management, 5/C/E 4. D = 4,860 bags/yr. S = $10 H = $5 2DS H a. EOQ = = 2(4,860)10 = 139.4 bags, round to 139 5 b. Q / 2 = 139 / 2 = 69.5 bags c. D = Q 4,860 bags 139 bags/order d. TC = Q/2 H + = D Q 139 2 = 34.96 orders ≈ 35 orders S (5) + 4,860 (10) = 347.5 + 349.64 = $697.14 139 e. Using S = $15, EOQ = EOQ increases by Instructor’s Manual, Chapter 12 171 – 139 139 2(4,860)15 5 = 170.8 ≈ 171 = 23% 12-9 5. D = 10/day × 260 days/year = 2,600 packages/year S = $10, H = $1 a. EOQ = b. TC = TC228 = Q 2 228 (1) + 2 2DS H = H+ D S Q 2,600 228 2(2,600)10 = 228 packages 1 (10) = 114 + 114.04 = $228.04 c. Yes d. TC100 = 100 (1) + 2 2,600 (10) 100 = 50 + 260 = $310 Yes, the firm will save $310 - $228.04 = $81.96 per year 12-10 Operations Management, 5/C/E 6. D = (250 pots/month) × (12 months/year) = 3,000 pots / year Price = $2/pot, H = ($2)(0.30) = $0.60/unit/year S = $20, Current Q = 250 pots a. EOQ = 2DS = H b. TC447 = 447 2 2(3,000)20 = 447.2 447 pots 0.60 (.60) + 3,000 (20) 447 = 134.10 + 134.23 = $268.33 c. 250 3,000 (.6) (20) 2 250 = 75 + 240 = $315 TC 250 Therefore, the additional cost of using order size of 250 is: $315 – $268.33 = $46.67 Instructor’s Manual, Chapter 12 12-11 7. 800/month, so D = 12(800) = 9,600 pallets/year Price = $5 each H = 0.25 Price = 0.25($5) = $1.25/pallet/year S = $28 per order Current Q = 800 pallets TC800 = EOQ = TC658 = 800 9600 (1.25) + (28) = $500 + 336 = $836 2 800 2DS = H 2(9,600)$28 = 655.8 [round to 656] $1.25 656 9,600 (1.25) + (28) = 410 + 409.76 = $819.76 2 656 Savings of only $836 - $819.76 = $16.24 per year. 12-12 Operations Management, 5/C/E 8. D = 100/month, H = $2/unit/month, S = $55 a. EOQ = 2DS H EOQ = 2(100)55 = 74.16 2 round to 74 units Note: You can use monthly demand in EOQ, so long as H is also monthly. b. Discount of $10/order is equivalent to S - 10 = $45 (revised ordering cost) TC74 = 74 100 (2) + (55) = 74 + 74.32 = $148.32 per month 2 74 TC50 = 50 100 (2) + (45) = 50 + 90 = $140* per month 2 50 100 100 (2) + (45) = 100 + 45 = $145 per month 2 100 Yes, use order size of 50. TC100 = c. B = $5/unit/month Q 2 DS H B H B 2(100)(55) 2 5 = 87.75 round to 88 units 2 5 H 2 Qb Q 88 = 25.1 round to 25 units H B 25 Instructor’s Manual, Chapter 12 12-13 9. D = 27,000 jars/month Current Q = 4,000 jars H = $.01/unit/month S = $20 per order a. TC = (Q/2) H + (D/Q) S TC(4,000) = (4,000/2)($.01) + (27,000/4,000)($20) = 20 + 135 = $155 per month EOQ 2 DS 2(27,000)( 20) = 10,392.3 round to 10,392 jars H .01 TC(10,392) = (10,392/2)($.01) + (27,000/10,392)($20) = 51.96 + 51.96 = $103.92 Difference = $155 – $103.92 = $51.08 per month. b. EOQ 2 DS 2(27,000) S 4,000 H .01 Solving, S = $2.96. 12-14 Operations Management, 5/C/E 10. p = 500 kg/day d = 100 kg/day 300 days per year S = $12 H = $4/kg/year a. Qo = 2DS H D = 100 kg/day × 300 days/year = 30,000 kg/year p = p -d 2(30,000)12 4 500 = 474.34 [round to 474 kg] 500 -100 b. D / Qo = 30,000 / 474 = 63.29 or 63 runs/year (every approx. 5 days) c. Run length: Qo / p = 474 / 500 = 0.95 day (approx. 1 day) Instructor’s Manual, Chapter 12 12-15 11. p = 50 tonnes/day d = 20 tonnes/day 200 days/year S = $400 H = $200/tonne per year Bag = 100 kg D = 20 tonnes/day × 200 days/year = 4,000 tonnes/year a. Qo = 2DS H b. Imax = Q 163.30 (p - d) = (50 - 20) = 97.98 tonnes p 50 Avg inven: p = p-d 2(4,000)400 200 50 = 163.30 tonnes = 1,633 bags 50 - 20 Imax 97.98 = = 48.99 tonnes = 490 bags 2 2 c. Run length = d. Runs per year= Q P = 163.30 = 3.27 days 50 D 4,000 = = 24.5 Q 163.30 e. If S = $200, Q' 0 2 DS H p pd 2(4,000)200 50 =115.47 tonnes 200 50 20 Imax = (Q/p)(p - d) = (115.47/50)(50 - 20) = 69.28 tonnes Avg inventory = Imax/2 = 69.28/2 = 34.64 tonnes TC = (Imax/2)H + (D/Q)S TC(S = $400) = 48.99($200) + (4,000 /163.3)$400 = $9,798 + $9,797.92 = $19,595.92 TC(S = $200) = 34.64($200) + (4,000 /115.47)$200 = $6,928 + $6,928.21 = $13,856.21 Saving = $19,595.92 - $13,856.21 = $5,739.71 12-16 Operations Management, 5/C/E 12. p = 200/day d = 80/day Operating 5 days a week, 50 weeks a year S = $300 H = $10/unit/year D = 20,000 (250 days × 80 = 20,000) a. Qo = 2DS H p = p-d 2(20,000)300 10 200 200-80 = (1,095.44) ( 1.2910) = 1,414.2 or 1,414 units b. Run length = Q P = 1,414 = 7.07 days 200 c. p – d = 200 - 80 = 120 units per day d. Cycle length = Q0 / d = 1414 / 80 = 17.7 days Yes, after making this component for 7 days, we can set up for day and then make the other job for 8 days, then set up for a day and make this component again, and so on. Instructor’s Manual, Chapter 12 12-17 13. p = 800 units per day d = 300 units per day for 250 days; Therefore, D = 300 × 250 = 75,000/year Current Q = 2,000 units a. D/Q = 75,000/2,000 = 37.5 batches per year b. The number of units produced in two days = (2 days)(800 units/day) = 1,600 units The number of units used in two days = (2 days) (300 units/day) = 600 units Inventory buildup after the first two days of production = 1,600 - 600 = 1,000 units c. Imax = (Q/p)(p - d) = (2000/800)(800 - 300) = 1250 units Avg. inventory = Imax/2 = 1250/2 = 625 units d. Another job requires 4 days per cycle of hairdryers. Q 2,000 2.5 days P 800 Setup time per batch = 1/2 day Total time per batch = 2.5 + 0.5 = 3 days Cycle length = Q / d = 2,000 / 300 = 6.7 days No, after setup for half a day and making the heating element for 2.5 days, we only have 6.7 – 3 = 3.7 days to make the other component (3.7 < 4 days required). Production time per batch = 12-18 Operations Management, 5/C/E 14. D = 18,000 boxes/year i = 20% of unit cost (R) per year S = $32 a. EOQR=$1.10 = 2 DS iR 2(18,000)32 2,288.3 .20(1.10) boxes Bec. 2,288.3 < 10,000, this EOQ is not feasible. Try the next higher price $1.15: EOQR=$1.15 = 2 DS iR 2(18,000)32 2,238 .20(1.15) boxes Bec. 2,238 < 5,000, this EOQ is not feasible. Try the next higher price $1.20: EOQR=$1.20 = 2 DS iR 2(18,000)32 2,191 .20(1.20) boxes Bec. 2,000 < 2,191 < 4,999, this EOQ is feasible. Next, we need to compare the total cost of Q = 2,191 units with those of Q = 5,000 and Q = 10,000 units. 2,191 18,000 TC2,191 = (.20)(1.20) ($32) $1.20(18,000) = 2 2,191 262.92 262.89 21,600 $22,125.81 TC5,000 = 5,000 18,000 (.20)(1.15) ($32) $1.15(18,000) 2 5,000 = 575 + 115.2 + 20,700 = $21,390.20 TC10,000 = 10,000 (.20)(1.10) 18,000 ($32) $1.10(18,000) 2 10,000 = 1,100 + 57.6 + 19,800 = $20,957.60 [lowest] Hence, the best order quantity would be 10,000 boxes. Total Annual cost 2,191 5,000 10,000 Quantity b. D 18,000 1.8 orders per year Q 10,000 Instructor’s Manual, Chapter 12 12-19 15. Quantity Unit Price 1 - 399 $10 400 - 599 9 600 + 8 Operates 200 days a year D = 25 stones/day × 200 days/year = 5,000 stones/year S = $48 a. H = .30R EOQ$8 = 2(5,000)48 = 447.2 .30(8) Bec. 447.2 < 600, this EOQ is not feasible. Try the next higher price $9: EOQ$9 = 2(5,000)48 = 421.64 ≈ 422 .30(9) Bec. 400 ≤ 422 ≤ 599, this EOQ is feasible. Next, we need to compare the total cost of Q = 422 units with those of Q = 600: TC = Q D (.30R) + (S) + RD 2 Q TC422 = 422 [.30($9)] + 2 5,000 ($48) + $9(5,000) = 569.7 + 568.72 + 45,000 = $46,138.42 422 TC600 = 600 [.30($8)] + 2 5,000 ($48) + $8(5,000) = 720 + 400 + 40,000 = $41,120 [lower] 600 b. ROP = (25 stones/day) (6 days) = 150 stones. 16. Range D = 4,900 pulleys/ year 0 - 999 H = .2 R 1,000 - 3,999 S = $50 4,000 - 5,999 6,000 + EOQR=$4.85 = 2 DS iR R $5.00 4.95 4.90 4.85 2(4,900)50 710.7 .20(4.85) or 711 pulleys Bec. 711 < 6,000, this EOQ is not feasible. Try the next higher price $4.90: EOQR=$4.90 = 2 DS iR 2(4,900)50 707.1 .20(4.90) or 707 pulleys Bec. 707 < 4,000, this EOQ is not feasible. Try the next higher price $4.95: 12-20 Operations Management, 5/C/E EOQR=$4.95 = 2 DS iR 2(4,900)50 703.53 .20(4.95) or 704 pulleys Bec. 704 < 1,000, this EOQ is not feasible. Try the next higher price $5.00: EOQR=$5.00 = 2 DS iR 2(4,900)50 700 .20(5.00) pulleys Bec. 0 ≤ 700 ≤ 999, this EOQ is feasible. Next, we need to compare the total cost of Q = 700 units with those of Q = 1,000, Q = 4,000, and Q = 6,000 units. 700 4,900 TC700 = (.2)($5.00) + ($50) + $5.00(4,900) = 350 + 350 + 24,500 = $25,200 2 700 1,000 4,900 TC1,000 = (.2)($4.95) + ($50) + $4.95(4,900) = 495+245+24,255 = $24,995 lowest 2 1,000 4,000 4,900 TC4,000 = (.2)($4.90) + ($50) + $4.90(4,900) = 1,960+61.25+24,010 = $26,031.25 2 4,000 6,000 4,900 TC6,000 = (.2)($4.85) + ($50) + $4.85(4,900) = 2,910+40.83+23,765 = $26,715.83 2 6,000 Order 1,000 units at a time. TC 700 704 707 711 1,000 4,000 6,000 Quantity Instructor’s Manual, Chapter 12 12-21 17. D = 800 units/month × 12 = 9,600 units/year S = $40 H = .25 R For Supplier A: 2(9600)(40) Q13.6 475.27 (not feasible) (.25)(13.6) Q13.8 2(9600)(40) 471.81 (feasible, round to 472) (.25)(13.8) 9600 472 (40) (.25)(13.8) (13.8)(9600) 472 2 813.56 814.2 132, 480 TC472 $ 134,107.76 9600 500 (40) (.25)(13.6) (13.6)(9600) 500 2 768 850 130,560 TC500 TC500 TC500 $132,178 * For Supplier B: Q13.7 2(9600)(40) 473.53 (feasible, round to 474) (.25)(13.7) 9600 474 (40) (.25)(13.7) (13.7)(9600) 474 2 810.13 811.72 131,520 TC474 $133,141.85 Since $132,178 < $133,141.85, choose supplier A. The optimal order quantity is 500 units. 12-22 Operations Management, 5/C/E 18. S = $40 /order H = .40R per year D = 3600 boxes per year Q = 800 boxes (recommended) Range 1-199 200-800 801+ R $1.20 $1.10 $1.00 If the company decides to order 800, the total cost is as follows: TC = (Q/2)H + (D/Q)S + RD TC(800) = (800/2)(.4)($1.10) + (3,600/800)$40 + 3,600($1.10) = 176 + 180 + 3,960 = $4,316. Even though the inventory total cost curve is fairly flat around its minimum, when there are quantity discounts, there are multiple U-shaped total inventory cost curves, one for each unit price. Therefore, when the quantity changes from 800 to 801, we shift to a different total cost curve. If we take advantage of the quantity discount and order 801 units, the total cost is calculated as follows: TC(801) = (801/2)(.4)($1.00) + (3,600/801)$40 + 3,600($1.00) = 160.20 + 179.78 + 3,600 = $3,939.98 The order quantity of 801 is better than 800 because $3,939.98 < $4,316. However, the EOQ for R = $1.00 may have even lower cost: EOQ= 2 DS H 2(3,600)$40 848.53 .4($1) round to 849 boxes TC(849) = (849/2)(.4)($1.00) + (3,600/849)$40 + 3600($1.00) = 169.80 + 169.61 + 3,600 = $3,939.41 In fact, order size of 849 has a slightly lower total cost than 801 ($3,939.41 vs. $3,939.98). Instructor’s Manual, Chapter 12 12-23 19. Average daily usage = 800 m/day Lead time = 6 workdays Desired lead time service level = 95 percent. Safety stock Stock out prob. 1,500m .1 1,800m .05 2,100m .02 2,400m .01 ROP? Stock out risk should be at most 1.00 - 0.95 = 0.05. Therefore, safety stock = 1,800 m. ROP = d (LT) + safety stock = 800 (6) + 1,800 = 6,600 m 20. Expected demand during a LT = 300 units dLT = 30 units Demand during a LT ~ Normal a. SS? for 1% LT stock-out prob. z = 2.33 from Appendix B, Table B SS = z d LT = 2.33 (30) = 69.9 round to 70 units b. 2% stock out risk smaller z less SS 21. Expected dLT = 600 kg d LT = 52 kg Stock out risk = 4% z = 1.75 from App. B, Table B a. SS? SS = z d LT = 1.75 (52) = 91 kg b. 12-24 ROP = Average demand during a lead time + safety stock = 600 + 91 = 691 kg Operations Management, 5/C/E 22. d = 21 litres/wk d = 3.5 litres/wk Lead time SL = 90% LT = 2 days Open 7 days a week 90% 0 6 a. SL = 90 % z = 1.28 from App. B., Table B. ROP = d (LT) + z (d) LT = 21(2/7) + 1.28(3.5) b. OI = 7 days On hand = 8 litres Imax = d (OI + LT) + zd OI + LT 1.28 z-scale 8.39 litres (2/7) = 6 + 2.39 = 8.39 litres = 21(7 + 2)/7 + 1.28(3.5) (7+2)/7 = 27 + 5.08 = 32.08 round to 32 liters Q = Imax – on hand = 32 – 8 = 24 litres c. 1 day after order; from part a, ROP = 8.39 on hand now = ROP - 2 litres = 6.39 Prob (stock- out) in 2 days = ? 6.39 = 21 (2/7) + z (3.5) 2/7 0.39 = 1.87 z z = .2085 ~ .21 SL = .5832 from App. B, Table B Prob (stock out) = 1 - .5832 = .4168 or about 42% 23. d = 30 litres/day ROP = 170 litres LT = 4 days Stock out risk = 9% SS? to make stock-out risk = 3% First we need to determine 𝜎𝑑𝐿𝑇 Stock out risk = 9% z = 1.34 from App. B., Table B SS = ROP - d(LT) = 170 - 30 (4) = 50 litres SS = z 𝜎𝑑𝐿𝑇 50 = 1.34 𝜎𝑑𝐿𝑇 𝜎𝑑𝐿𝑇 = 37.31 litres Stock out risk = 3% z = 1.88 from App.B, Table B SS = z 𝜎𝑑𝐿𝑇 = 1.88(37.31) = 70.15 litres Instructor’s Manual, Chapter 12 12-25 24. 𝑑̅ = 85 capacitors/day 𝑑 = 5 capacitors/day ROP = 625 capacitors LT = 6 days LT = 1.1 days Prob. of stock-out? 2 ROP d ( LT ) z LT d2 d 2 LT 625 = 85 (6) z 6(5) 2 (85) 2 (1.1) 2 115 = 94.3 z z = 1.22 From App. B, Table B, SL = .8888 Therefore, prob. of stock-out = 1- .8888 = .1112 25. approx. 11% SL 96% d = 12 units- /day d = 2 units/day LT = 4 days LT = 1 day ROP? SL 96% Z > 1.75 from App. B, Table B 2 ROP d ( LT ) z LT d2 d 2 LT 12(4) 1.75 4(2) 2 (12) 2 (1) 2 > 48 + 22.14 = 70.14 or 70 units 12-26 Operations Management, 5/C/E 26. New LT = 3 days D = 4,500 litres per year 360 days/year d = 2 litres per day S = $10 H = .40R/litre/year Qty. 1 - 399 400 - 799 800+ Unit Price $2.00 1.80 1.60 a. Q? EOQ 2 DS H 2(4,500)(10) = 375 litres, not feasible. .4($1.60) EOQ 2 DS H 2(4,500)(10) = 353.55 litres, not feasible. .4($1.80) EOQ 2 DS H 2(4,500)(10) = 335.4 round to 335 litres. Feasible. .4($2) Need to calculate the TC of Q = 335, Q = 400, and Q = 800. TC = (Q/2)H + (D/Q)S + RD TC(335) = (335/2)(.4)($2.00) + (4,500/335)$10 + 4,500($2.00) = 134 + 134.33 + 9,000 = $9,268.33 TC(400) = (400/2)(.4)($1.80) + (4,500/400)$10 + 4,500($1.80) = 144 + 112.5 + 8,100 = $8,356.50 TC(800) = (800/2)(.4)($1.60) + (4,500/800)$10 + 4,500($1.60) = 256 + 56.25 + 7,200 = $7,512.25 [lowest] b. ROP? for risk of stock-out = 1.5% Risk of stock-out = 1.5% z = 2.17 from App. B, Table B 4,500 = 12.5 / day d= 360 ROP = d LT + z LT d = 12.5 (3) + 2.17 3 (2) = 37.5 + 7.52 = 45.02 round to 45 litres Instructor’s Manual, Chapter 12 12-27 27. d = 5 boxes/day d = .5 box/day LT = 2 days S = $10 H = $10/box/year a. EOQ? Assuming 250 workdays per year D = 5 boxes/day × 250 days/year = 1,250 boxes/year EOQ = 2DS = H b. ROP = 12 boxes Risk of stock-out? ROP = d (LT) + z Solving for z: 2(1250)(10) = 50 boxes 10 LT(d) ROP - d (LT) z= 12 - 5(2) = LT (d) 2 (.5) = 2.83 SL = .9977 from App. B, Table B, so risk of stock-out = 1 - .9977 = .0023 or 0.23% c. OI = 7 days Shortage risk? If Q = 36 boxes when on hand = 12 boxes Imax = 36 + 12 = 48 boxes Imax = d (OI + LT) + zd OI + LT 48 = 5(7 + 2) + z(.5) 7 + 2 3 = 1.5 z z = 2.0 SL = .9772 from App. B, Table B Therefore, shortage risk = 1 - .9772 = .0228 or 2.28% 12-28 Operations Management, 5/C/E 28. d = 8 kg d = 1 kg LT = 8 days LT = 1 day ROP? Stock-out risk of 10% SL = 100 – 10 = 90% z = 1.28 from App. B, Table B ROP = d (LT ) + z LT 2d + d 22LT = 8 (8) + 1.28 = 74.86 8(1)2 + 82(1)2 = 64 + 1.28(8.49) [round to 75 kg] 29. Open 360 days per year d = 10 rolls/day d = 2 rolls/day S = $10 H = $.40/roll per year LT = 3 days a. D = 10 rolls/day × 360 days/year = 3,600 rolls/year EOQ = 2DS = H 2(3,600)10 = 424.3 round to 424 rolls .40 b. Lead time SL of 96% z = 1.75 from App. B, Table B ROP = d (LT) + z LT(d) = 10(3) + 1.75 3(2) = 36.06 [round to 36] c. SLannual = 96% 𝜎𝑑𝐿𝑇 = 𝜎𝑑 √𝐿𝑇 = 2√3 = 3.46 E( z) Q(1 SLannual ) dLT 424 (1 .96) 4.90 3.46 Table 12-3 to get z, but E(z) = 4.90 is not in the table. However, note that for values of E(z) > 2.4, z = - E(z). Therefore, for E(z) = 4.90, z = -4.90. ROP = d (LT) + z 𝜎𝑑𝐿𝑇 = 10(3) - 4.90(3.46) = 13.05 [round to 13] Instructor’s Manual, Chapter 12 12-29 30. D = 1,200 cases/year S = $20 H = $3 per case/year SLannual = 99% 2 DS a. EOQ H b. 2(1,200)($20) = 126.49 round to 126 cases $3 Expected dLT = 80d LT = 5 ROP? E( z) Q(1 SLannual ) 126(1 .99) = .252 5 dLT From Table 12-3, z = 0.32 ROP = Expected dLT + zd LT = 80 + .32 (5) = 81.6 cases 31. 250 days a year d = 250 litres/day d = 14 litres/day H = $0.3/litre/year S = $10 LT = 1 day a. D = 250 litres/day× 250 days/year = 62,500 litres/year EOQ b. 2 DS H 2(62,500)($10) = 2,041.24 round to 2,041 litres $0.3 ROP? if SLannual = 99.5% E( z) Q(1 SLannual ) dLT 2,041 (1 .995) 14 1 = .729 E(z) = .729 → z = -0.54 from Table 12-3 (midpoint of E(z) = .712 and .740) ROP = d (LT) + z dLT = 250(1) - 0.54(14) = 242.44 12-30 Operations Management, 5/C/E 32. ROP = 18 units LT = 3 days Demand during last 10 days: 1 3 Day Units 2 4 3 7 4 5 5 5 6 6 7 4 8 3 9 4 10 5 SL? Mean and standard deviation of daily demand: 𝑑̅ = 4.6 (3−4.6)2 +(4−4.6)2 +(7−4.6)2 +⋯(5−4.6)2 10−1 𝜎𝑑 = √ = 1.265 ROP d (LT) z ( d ) LT 18 4.6(3) z (1.265) 3 18 = 13.8 + 2.191z 4.2 = 2.191z z = 1.92 From Appendix B, Table B, SL = 0.9726 = 97.26%. 33. Fixed Interval model SL = .98 OI = 14 days LT = 2 days Q? SL = .98 z = 2.055 from App. B, table B. Q = Imax – On hand = d (OI LT ) z d OI LT - on hand QK033 = 60(14 2) 2.055(5) 14 2 - 420 = 960 + 41.1 – 420 = 581.1 ≈ 581 QK144 = 50(14 2) 2.055(4) 14 2 - 375 = 800 + 32.88 – 375 = 457.88 ≈ 458 QL700 = 8(14 2) 2.055(2) 14 2 - 160 = 128 + 16.44 – 160 = -15.56 ≈ 0 (do not order) Instructor’s Manual, Chapter 12 12-31 34. 50 week/year P34 P35 4 weeks OI 60 units/week d 4 units/week d R $15 H (.30)(15) = $4.50 S $70 LT 2 weeks Stock-out Risk = 2.5% 70 units/week 5 units/week $20 (.30)(20) = $6.00 $30 2 weeks 2.5% D z = 70(50) = 3,500 1.96 a. = 60(50) = 3,000 1.96 From App. B, Table B. ROPP34 = d × LT+ z LTd ROPP34 = 60(2) + 1.96 2 (4) = 131.1 round to 131 units 2 DS H 2(3,000)($70) $4.50 b. EOQ c. Q? if on hand = 110 units Q = d (OI + LT) + z OI + LT d - on hand QP35 = 70 (4 + 2) + 1.96 =305.51 round to 306 units 4 + 2 (5) – 110 QP35 = 420 + 24 – 110 QP35 = 334 units 12-32 Operations Management, 5/C/E 35. a. PROBLEM NO. 12 - 35 Estimated Annual Demand 20,000 60,200 9,800 16,300 6,250 4,500 21,000 45,000 800 26,100 Item H4-010 H5-201 P6-400 P6-401 P7-100 P9-103 TS-300 TS-400 TS-041 V1-001 Sort by Annual $ value Estim ated Annual Item Demand TS-400 45,000 TS-300 21,000 P6-400 9,800 H5-201 60,200 P6-401 16,300 V1-001 26,100 P9-103 4,500 P7-100 6,250 H4-010 20,000 TS-041 800 Ordering Holding Cost Cost (%) 50 20 60 20 80 30 50 30 50 30 50 40 40 25 40 25 40 25 25 35 Annual Unit Price $ value $40.00 $1,800,000 $45.00 $945,000 $28.50 $27 9,300 $4.00 $240,800 $12.00 $195,600 $4.00 $104,400 $22.00 $99,000 $9.00 $56,250 $2.50 $50,000 $20.00 $16,000 $3,786,350 Unit Price $2.50 $4.00 $28.50 $12.00 $9.00 $22.00 $45.00 $40.00 $20.00 $4.00 % of cumul Annual $ value 48% 25% 7% 6% 5% 3% 3% 1% 1% 0% Class A A B B B C C C C C b. Item H4-010 H5-201 P6-400 P6-401 P7-100 P9-103 TS-300 TS-400 TS-041 V1-001 Estimated Annual Demand 20,000 60,200 9,800 16,300 6,250 4,500 21,000 45,000 800 26,100 Instructor’s Manual, Chapter 12 Ordering Holding Cost Cost (%) 50 20 60 20 80 30 50 30 50 30 50 40 40 25 40 25 40 25 25 35 Unit Price $2.50 $4.00 $28.50 $12.00 $9.00 $22.00 $45.00 $40.00 $20.00 $4.00 EOQ 2000.0 3005.0 428.2 672.9 481.1 226.1 386.4 600.0 113.1 965.5 12-33 36. Cost = $3.20 per dozen Rev = $4.80 per dozen Salvage = 4.80/2 = $2.40 per dozen Cs = Rev - Cost = $4.80 - $3.20 = $1.60 Ce = Cost - Salvage = $3.20 - $2.40 = $.80 Cs $1.60 1.6 SL = = = = .67 Cs + Ce $1.60 + $.80 2.4 Since this falls between the cumulative probabilities of .63 (x = 24) and .73 (x = 25), The larger should be chosen, i.e., make 25 dozen. doughnuts. The resulting service level = 73% 37. x Demand 19 20 21 22 23 24 25 26 27 28 29 P(x) .01 .05 .12 .18 .13 .14 .10 .11 .10 .04 .02 Cum. P(x) .01 .06 .18 .36 .49 .63 .73 .84 .94 .98 1.00 Cost = $100 per unit Holding cost = 145% of unit cost Cs = $8,000 per unit Demand ~ Poisson with mean 3.2 units a. Ce = $100 + 1.45($100) = $245 Cs $8,000 SL = = = .97 Cs + Ce $8,000 + $245 Using the Poisson probabilities, the minimum stocking level that will provide the desired service is 7 spares (cumulative probability = .983). [From Poisson Table with = 3.2] x Cum. Prob. 0 .041 1 .171 2 .380 3 .603 4 .781 5 .895 6 .955 7 .983 8 .994 9 .998 . . b. Cs range for 6 spares? 𝐶 𝑠 SL = 𝐶 +𝐶 𝑠 𝑒 𝐶 𝑠 . 955 ≥ 𝐶 +245 .955(Cs + 245) ≥ Cs .045 Cs ≤ 233.975 Cs ≤ $5,199.44 𝑠 𝐶 𝑠 . 895 < 𝐶 +245 .895Cs + 219.275 < Cs .105 Cs > 219.275 Cs > $2,088.33 𝑠 Therefore, carrying 6 spare parts is best if the shortage cost > $2,088.33 and ≤ $5,199.44. 12-34 Operations Management, 5/C/E 38. Cost = $4.20/kg Rev = $5.70/kg Salvage = $2.40/kg Normal demand d = 80 kg/day d = 10 kg/day Optimal stocking level? Cs = Rev - Cost = $5.70 - $4.20 = $1.50/kg Ce = Cost - Salvage = $4.20 - $2.40 = $1.80/kg $1.50 Cs $1.50 SL = = = = .4545 $3.30 Cs + Ce $1.50 + $1.80 SL = .4545 z = -0.114 from Appendix B, Table B (interpolate). Optimal stocking level = d + z d = 80 - 0.114(10) = 78.86 kg 39. Demand ~ Normal d = 40 litres/day d = 6 litres/day Ce = $0.35/litre Order quantity Q = 49 litres a. Cs = ? A stocking level of 49 litres translates into: z = Q - d = 49 - 40 = 1.5 d 6 z = 1.5 SL = 0.9332 from App. B, Table B. Cs Cs SL = Thus, 0.9332 = Cs + Ce Cs + $0.35 .9332 0 1.5 z-scale 40 49 quarts 0.9332(Cs + 0.35) = Cs 0.0668 Cs = 0.32662 Cs = $4.89 / litre b. At first it may seem a little high for the loss of profit from selling a litre of strawberries. However, customers may buy other items along with the strawberries (ice cream, whipped cream, etc.). Instructor’s Manual, Chapter 12 12-35 40. Demand is Poisson with mean of 6 cakes per day Cost = $9 per cake Rev. = $12 per cake Salvage value = $7 per cake Optimum stocking level? Cs = Rev - Cost = $12 - $9 = $3/cake Ce = Cost - Salvage = $9 - $7 = $2/cake SL = Cs = Cs + Ce $3 $3 + $2 = 0.6 Since 0.6 falls between the cumulative probability for demand of 5 and 6, the optimum stocking level is 6 cakes. [From Poisson Table with = 6.0] Demand Cum. Prob. 0 .002 1 .017 2 .062 3 .151 4 .285 5 .446 6 .606 . . . . 41. Cost = $3 per kg Salvage value = $2 per kg 8 burgers per kg Price of a burger = $2 Cost of a burger = $1 Demand ~ Normal (400kg, 50kg) Optimal order quantity? Cs = ($2 - $1)/burger × 8 burgers/kg = $8/kg Ce = Cost - Salvage = $3.00 - $2.00 = $1/kg Cs $8 SL = = = .8889 Cs + Ce $8 + $1 SL = .8889 z =1.22 (App. B, Table B) Optimal order quantity = + z = 400 + 1.22(50) = 461 kg .8889 0 400 12-36 1.22 z-scale 461 kg Operations Management, 5/C/E 42. Profit = $10 per machine per day Store has 4 machines a. Range for Ce = ? Cs = lost profit = $10 Demand Freq. 0 .30 1 .20 2 .20 3 .15 4 .10 5 .05 1.00 For four machines to be optimal, the SL ratio must be .85 < Cum. Freq. .30 .50 .70 .85 .95 1.00 $10 .95. $10 + Ce Re-writing the left inequality: 8.5 + .85 Ce < 10 .85 Ce < 1.5 Ce < $1.76 Re-writing the right inequality: 9.5 + .95 Ce 10 .95 Ce .5 Ce $.53 b. If Ce is too low, the number of machines should be decreased: the higher excess costs are, the lower SL becomes, and hence, the lower the optimum stocking level. 43. Cost = $200 per unit Salvage value = $50 per unit Shortage 2 days down time; down time cost = $400 per day Q? a. Ratio method: # of spares 0 1 2 3 Probability of Demand Cumulative Probability 0.10 0.10 0.50 0.60 0.25 0.85 0.15 1.00 Cs = Cost of stock out = ($400 per day) (2 days) = $800 Ce = Cost of excess inventory = Unit cost - Salvage Value = $200 - $50 = $150 𝐶𝑠 800 SL = 𝐶 +𝐶 = 800+150 = .842 𝑠 𝑒 Bec. 0.842 is between cumulative probabilities of 0.85 and 0.60, we need to order 2 spares. b. Tabular method: Stocking Level 0 1 2 3 Demand = 0 Prob. = 0.10 $0 .10(1)($150)=$15 .10(2)($150)=$30 .10(3)($150)=$45 Demand = 1 Prob. = 0.50 .50(1)($800)=$400 $0 .50(1)($150)=$75 .50(2)($150)=$150 Demand = 2 Prob. = 0.25 .25(2)($800)=$400 .25(1)($800)=$200 $0 .25(1)($150)=$37.50 Demand = 3 Prob. = 0.15 .15(3)($800)=$360 .15(2)($800)=$240 .15(1)($800)=$120 $0 Expected Cost $1,160 $455 $225* $233.50 Same answer: order 2 spares because the expected cost is the least for 2. Instructor’s Manual, Chapter 12 12-37 44. Cost = $33 per cake Rev. = $60 Salvage value = $30 for 1/3 of cakes; rest have 0 salvage value. Demand 0 1 2 3 Probability of Demand 0.15 0.35 0.30 0.20 Cumulative Probability 0.15 0.50 0.80 1.00 Cs = Cost of stock-out = Selling Price - Unit Cost = $60 - $33 = $27 Ce = Cost of excess inventory = Unit Cost - Salvage Value = $33 - $30(1/3) = $23 SL Cs 27 0.54 Cs Ce 27 23 Bec. the service level of 0.54 falls between cumulative probabilities of 0.50 and 0.80, the bakery should stock 2 wedding cakes. 45. No shows ~ Normal(18, 4.55) Profit per passenger = $99. If a passenger is bumped, the company pays that passenger $200. Number of tickets to overbook? Cs = $99, Ce = $200 for overbooking SL Cs 99 .3311 Cs Ce 99 200 Using Appendix B, Table B, .3311 falls closest to .3300 z = -0.44. 𝑆𝑜 = 𝜇 + 𝑧𝜎 = 18 + (−0.44)(4.55) = 15.998 = 16 overbooks 12-38 Operations Management, 5/C/E 46. D = 210(12) = 2,520 vaccines S = .5 ( $17/hr) = $8.5 per order Holding cost rate i = 8 + 8 = 16% per unit per year Price R = $16 per vaccine a. EOQ = 2 DS 2(2,520)($ 8.5) 129.36, round to 129 vaccines iR (.16)($ 16) b. LT = 2 days d =7 d = 2 Service level = 98% ROP = d . LT + z d z = 2.055 from App. B. Table B LT = 7(2) + 2.055(2)( 2 ) = 14 + 5.81 = 19.81 round to 20 vaccines. c. OI = 2 weeks 47. d OI LT = 7(14 + 2) + 2.055(2) 14 2 = 112 + 16.44 = 128.44, round 128 vaccines. i. Imax = d . (OI + LT) + z ii. On hand = 34 units Order quantity = Imax – on hand = 128 – 34 = 94 vaccines. D = 500 bottles/year S = $10 per order H = $1 per bottle per year B = $10 per bottle per year 2 DS H B 2(500)(10) 1 10 = 104.88 round to 105 units H B 1 10 a. Q b. H 1 Qb Q 105 = 9.55 round to 10 units H B 1 10 Instructor’s Manual, Chapter 12 12-39 48. Price = $12.99 per unit Cost = $6 per unit Demand (in 1000s) Prob. Cumul Prob. 90 .1 .1 100 .2 .3 110 .4 .7 120 .2 .9 130 .1 1.0 Salvage value = $5 per unit Q? Ce = cost – salvage value = $6 - $5 = $1 Cs = price - cost = $12.99 – $6 = $6.99 SL = Cs / (Cs + Ce) = $6.99 / ($6.99 + $1) = 0.875 Bec. 0.875 is just smaller than 0.9, the cumul prob. of 120(000) demand, choose Q =120(000). 49. D = 6.7 units per month R = $15 per unit i = 20% of unit cost per year S = $2 per order LT = 20 days 30 days in a month a. D = 6.7 (12) = 80.4 units Q 2 DS iR 2(80.4)( 2) 10.35 round to 10 units .2(15) b. 10 / 6.7 = 1.5 months or 45 days c. TC(10) = (Q/2)iR + (D/Q)S = (10/2)$3 + (80.4/10)$2 = $15 + $16.08 = $31.08 d. TC(7) = (7/2)$3 + (80.4/7)$2 = $10.50 + $22.97 = $33.47 TC(7) – TC(10) = $33.47 - $31.08 = $2.39 more expensive per year e. ROP = d (LT) = (6.7/30)20 = 4.47 round to 4 units f. 95% lead time service level = 5.14 units per month ROP? 95% service level z =1.645 from App. B, Table B. ROP d ( LT ) z LT 6.7(20 / 30) 1.645(5.14) (20 / 30) = 4.47 + 6.90 = 11.37 round to 11 units 12-40 Operations Management, 5/C/E 50. LT = 15 days R1 = $3.85, D1 = 5,767 units per year R2 = $7.54, D2 = 603 units per year 364 days a year a. S = $3.50, s = $0.50, i = 0.20 OI * b. 2 ( S ns ) i DjRj 2(3.50 2 .50) 0.041 .20(5,767 3.85 603 7.54) year or 15 days d1 = 138 per week 1 = 37 units per week On hand = 555 units Service level = 98.5% z = 2.17 from App B, Table B. Imax d1 (OI LT ) z1 OI LT 138(15 15) / 7 2.17(37) (15 15) / 7 = 591.43 + 166.22 = 757.67 round to 758 units Q = Imax – on hand = 758 – 555 = 203 units c. Use the forecast demand for the next 30 days = first 4 weeks plus 2/7 of week 5 Imax d1 (OI LT ) z 1 OI LT = 144.2 + 144.2 + 133.1 + 133.1 + 122(2/7) + 2.17(37) (15 15) / 7 = 589.46 + 166.22 = 755.7 round to 756 units Instructor’s Manual, Chapter 12 12-41 51. Forecast D = 27.48 units per month = 18.84 units per month LT = 14 days R = $1.40 per unit i = 20% of unit cost per year S = $1 per order Assume 30 days in a month a. D = 27.48(12) = 329.76 Q 2 DS 2(329.76)(1) 48.53 round to 49 units iR .2(1.40) b. 49/27.48 = 1.78 months or 53 days c. TC(49) = (Q/2)iR + (D/Q)S = (49 2)($.28) + (329.76 49)($1) = $6.86 + $6.73 = $13.59 d. Currently Q = 30 units TC(30) = (30 / 2)($.28) + (329.76 / 30)($1) = $4.20 + $10.99 = $15.19 TC(30) – TC(49) = $15.19 - $13.59 = $1.60 more expensive per year e. 97.5% service level z =1.96 from App B, Table B. ROP d ( LT ) z LT ( 27.48)(14 / 30) 1.96(18.84) 14 / 30 = 12.82 + 25.23 = 38.05 round to 38 units f. RP = 1 month or 30 days 97.5% service level z =1.96 Min d ( RP LT ) z RP LT 27.48(30 14) / 30 1.96(18.84) (30 14) / 30 = 40.30 + 44.72 = 85.02 round to 85 units Max = Min + EOQ = 85 + 49 = 134 units 12-42 Operations Management, 5/C/E 52. Forecast D = 7.25 units per month = 3.13 units per month R = $2.48 per unit i = 20% of unit cost per year LT = 14 days Service level = 97.5% z = 1.96 from App B, Table B. Assume 30 day months a. S = $1 per order Q 2 DS iR 2(7.25)(12)(1) 18.73 round to 19 units .2(2.48) ROP d ( LT ) z b. LT (7.25)(14 / 30) 1.96(3.13) 14 / 30 = 3.38 + 4.19 = 7.57 round to 8 units RP = 1 month or 30 days Min d ( RP LT ) z RP LT 7.25(30 14) / 30 1.96(3.13) (30 14) / 30 = 10.63 + 7.43 = 18.06 round to 18 units Max = Min + EOQ = 18 + 19 = 37 units c. i. Forecast for D2 = 2.23 per month R2 = $5.06 S + s = $3 s = $0.5 OI * 2 ( S ns ) i DjRj 2(2.50 2 .50) .20(7.25 12 2.48 2.23 12 5.06) = 0.3157 year or 113.65 or 114 days ii. On hand = 13 units Imax d (OI LT ) z OI LT 7.25(114 14) / 30 1.96(3.13) (114 14) / 30 = 30.93 + 12.67 = 43.61 round to 44 units Q = Imax – on hand = 44 – 13 = 31 units Instructor’s Manual, Chapter 12 12-43 53. Demand (in 1000s) Prob. Cumul Prob. 6 .1 .1 7 .2 .3 8 .4 .7 9 .2 .9 10 .1 1.0 60% hamburger, 40% hot dog Burger : cost = $2.25, price = $5.00 Hot dog: cost = $1.34, price = $4.00 Salvage value = $0 Q for burgers and hot dogs? Burgers: Ce = cost – salvage value = $2.25 - $0 = $2.25 Cs = price - cost = $5.00 – $2.25 = $2.75 SL = Cs / (Cs + Ce) = $2.75 / ($2.75 + $2.25) = .55 Bec. .55 is just smaller than .7 (cumul prob.), choose Q = 8,000 (.6) = 4,800 burgers. Hot dogs: Ce = cost – salvage value = $1.34 - $0 = $1.34 Cs = price - cost = $4.00 – $1.34 = $2.66 SL = Cs / (Cs + Ce) = $2.66 / ($2.66 + $1.34) = .665 Bec. .665 is just smaller than .7 (cumul prob.), choose Q = 8,000 (.4) = 3,200 hot dogs. 12-44 Operations Management, 5/C/E 54. S + s = $23 s = $3 i = .24 LT = 1 week 50-week year 7 days per week SKU Annual demand Unit cost 1 450 $8 2 2000 12.5 3 200 3.52 4 3000 33.3 demand × Cost $3,600 $25,000 $704 $99,900 Largest Annual demand × Unit cost is for SKU4 m4 = 1 𝑚1 = √𝐷 𝑠 𝐷4 𝑅4 1 𝑅1 𝑚2 = √𝐷 𝑠 𝑆+𝑠 𝐷4 𝑅4 2 𝑅2 𝑚3 = √𝐷 𝑠 𝑆+𝑠 𝐷4 𝑅4 3 𝑅3 𝑆+𝑠 3 = √3,600 3 99,900 23 = √25,000 99,900 23 3 99,900 = √704 23 = 1.90 round to 2 = 0.72 round to 1 = 4.30 round to 4 n 1 1 1 1 1 2 S s 2 20 3 j 1 m 56.5 j 2 1 4 1 OI * n .24 23, 600125, 000 4704199, 900 32, 379.84 i mjDjRj j 1 = .04177 years × 350 = 14.62 Instructor’s Manual, Chapter 12 round to 15 days 12-45 55. Forecast D = 44 cases per month Price = $120 per case S = $15 per order i = .15 LT = 2 days 2 DS iR 2(44 12)($15) 29.66 .15($120) (a) EOQ (b) TC = (Q/2)(iR) + (D/Q)S = (30/2)(.15)($120) + (44×12/30)($15) = 270 + 264 = $534 (c) SL = 96% z = 1.75 from Table B, App B, and ROP d ( LT ) z d (d) round to 30 cases d (monthly) = 16.82 cases, LT 44(2 / 30) 1.75(16.82) 2 / 30 2.93 7.60 10.53 round to 11 cases Fixed Interval model, OI = 2 weeks, SL = 94% z = 1.555 from Table B. App B, I max d (OI LT ) z d OI LT 44(14 2) / 30 1.555(16.82) (14 2) / 30 23.47 19.10 42.57 round to 43 cases 56. ROP for 1–litre bottles = 1 month demand On hand 1 litre Vodka = 144 cases D for Vodka = 312 cases per month S = $73.23 Cost = $29.31 per case i = .15 a. D = 312(12) = 3,744 EOQ b. 2 DS iR 2(3,744)($ 73.23) 353.16 0.15($29.31) round to 353 cases d (monthly) = 98 cases Supervisor produces for 2 months SL? OI = 1 month LT = negligible Imax = 2 months’ demand = 2(312) = 624 I max d (OI LT ) z d OI LT 624 312(1 0) z (98) 1 0 z = 312 / 98 = 3.18 Service level = 0.9993 From Table B, App B. 12-46 Operations Management, 5/C/E 57. Demand ~ Normal (2,150, 807) Price = $173 Cost = $130 Salvage value = $115 Q? Cs = $173 - $130 = $43 Ce = $130 - $115 = $15 Choose Q such that Prob (D ≤ Q) = Cs / (Cs + Ce) = 43 / (43 + 15) = .7414 z = .65 from Table B, App. B. Q = 2,150 + .65(807) = 2,674.55 round to 2675 units 58. D = 10,000 units per year S = $50 per order i = .20 per unit per year Order Quantity Range 1 - 500 units 501 - 750 751 - 1500 1501 - 2000 EOQ Unit Price $29.50 26.87 24.77 23.93 2 DS 2(10,000)($50) 457.1not in the range (≥ 1501) iR .20($23.93) Try a more expensive price range. Bec. EOQ only decrease as price increases, only EOQ of most expensive price will be in its range. EOQ 2(10,000)($50) 411.7 .20($29.50) Round to 412 TC = DP + (D/Q)S + (Q/2)iR Q 412 501 751 1501 Purchasing cost 10,000($29.50) = $295,000 10,000($26.87) = $268,700 10,000($24.77) = $247,700 10,000($23.93) = $239,300 Ordering cost (10,000/412)($50)= 1,213.59 (10,000/501)($50)= 998 (10,000/751)($50)= 665.78 (10,000/1501)($50)= 333.11 Holding cost (412/2)(.20)($29.50)= 1,215.40 (501/2)(.20)($26.87)= 1,346.19 (751/2)(.20)($24.77)= 1,860.23 (1501/2)(.20)($23.93)= 3,591.89 Total cost 297,429 271,044 250,226 243,225* Choose Q = 1501 Instructor’s Manual, Chapter 12 12-47 59. Currently: Q = 100 cases, R = $65 + $4.50 = $69.50. D ~ 100 cases per month = 1200 per year LT = 6-8 weeks Quantity discount: Q = 500, R = $50 + $2.50 = $52.50 Storage space cost = $400 per month i = 20% per unit per year S = $50 per order Q? TC(100) = (Q/2)iR + (D/Q)S + RD = (100/2)(.2)($69.50) + (1200/100)($50) + $69.95(1200) = $695 + $600 + $83,940 = $85,235 TC(500) = (Q/2)iR + (D/Q)S + RD + storage cost = (500/2)(.2)($52.50) + (1200/500)($50) + $52.50(1200) + $400(12) = $2,625 + $120 + $63,000 + $4,800 = $70,545 Yes, buy in full truckloads (Q = 500 cases) bec. $70,545 < $85,235. 60. unit = 50 kg bag of herbicide Price = $56.93 per unit Cost = $45.54 per unit Excess transportation cost for storage after season = $1.09 per unit i = 10% per year (charge only for .5 year) 10% of shortage will be lost, 90% incur $2.19 per unit expediting cost Demand 100 400 1500 Prob. .1 .5 .4 Cumul Prob. .1 .6 1.0 Q? Ce = cost of excess transportation + holding cost per unit = $1.09 + (.10/2)($45.54) = $1.09 + $2.28 = $3.37 per unit Cs = .10 (price – cost) + .90 (expediting cost) = .10 ($56.93 – $45.54) +.90 ($2.19) = $1.14 + $1.97 = $3.11 SL = Cs / (Cs + Ce) = $3.11 / ($3.11 + $3.37) = 0.48 Bec. 0.48 is just smaller than 0.6 (cumul prob.), choose Q = 400 units. 12-48 Operations Management, 5/C/E Answers to CAMECO PROMOTIONAL ITEMS Mini-case: LT = 2 weeks ~ 0.5 month OI = 2 months SL = 70% z = 0.525 from Table B. App B a Executive Sports Bag I max d (OI LT ) z d OI LT 12(2 0.5) 0.525(4) 2 0.5 = 30 + 3.32 = 33.32 round to 33 units Q = Imax – on hand = 33 – 0 = 33 units 33 > 25 = min order 33 units Retro Stainless Steel Mug I max d (OI LT ) z d OI LT 15(2 0.5) 0.525(2) 2 0.5 = 37.5 + 1.66 = 39.16 round to 39 units Q = Imax – on hand = 39 – 4 = 35 units 35 < 60 = min order 60 units Lava Pen I max d (OI LT ) z d OI LT 35(2 0.5) 0.525(6) 2 0.5 = 87.5 + 4.98 = 92.48 round to 92 units Q = Imax – on hand = 92 – 16 = 76 units 76 > 75 = min order 76 units Heavyweight Brushed Cotton Cap I max d (OI LT ) z d OI LT 60(2 0.5) 0.525(6) 2 0.5 = 150 + 4.98 = 154.98 round to 155 units Q = Imax – on hand = 155 – 6 = 149 units 149 > 72 = min order 149 units b. Heavyweight Brushed Cotton Cap D = 60(12) = 720 units per year i = 12% S = $50 Quantity range 72-143 144-239 240-575 EOQ Unit price $8.75 $7.95 $7.50 2 DS 2(720)($50) 282.84 iR .12($7.50) round to 283, in range (≥ 240) Because 283 is in the cheapest range, it follows that it is optimal. Instructor’s Manual, Chapter 12 12-49 Answers to CAMECO MINE SUPPLIES Mini-case: Code 20050008 20073791 20126073 20013742 Description Cable Hanger CAB826 Grinding Wheel 5” ¼” 5/8” All Metal Pyrolon Coveralls XL Blue w/ HD Elastic Oil Pressure Gauge 2-1/2” 0-200 PSI Price $2.99 $4.57 $8.05 $44.75 Lead time 5 days 6 8 14 Current Min 151 31 4 1 Current Max 250 50 75 3 RP = 3 days S = $10 per order i = 20% per year SL = 97.5% z = 1.96 from Table B. App B Cable Hanger Month Grinding Wheel Coveralls Oil Pressure Gauge Jan 0 44 3 0 Feb 150 57 1 0 Mar 75 61 0 0 Apr 100 28 0 0 May 0 102 26 0 Jun 0 53 0 0 Jul 100 97 26 0 Aug 75 27 25 0 Sep 0 27 66 0 Oct 0 74 9 0 Nov 0 31 0 0 Dec 0 25 2 0 500 54.70 626 27.26 158 19.88 0 0.00 Sum = std dev = Oil Pressure Gauge 2-1/2” 0-200 PSI Because this item was not demanded last year, it should not be reordered. In addition, after consultation with users, it may be dropped as a stocked item. Grinding Wheel 5” ¼” 5/8” All Metal Q Min 12-50 2 DS iR 2(626)(10) 117.03 round to 117 units .2( 4.57) d ( RP LT ) z RP LT Operations Management, 5/C/E 626(3 6) / 360 1.96(27.26) (3 6) / 30 = 15.65 + 29.26 = 44.91 round to 45 units Max = Min + EOQ = 45 + 117 = 162 units Current Min (31) is a little too low and current Max (50) is very low. Cable Hanger CAB826 Q Min 2 DS iR 2(500)(10) 129.3 round to 129 units .2( 2.99) d ( RP LT ) z RP LT 500(3 5) / 360 1.96(54.70) (3 5) / 30 = 11.11 + 55.36 = 66.47 round to 66 units However, several months had zero demand, and the others had very large demand. Normal distribution may not appropriate in this case. Looking at the individual demands on the left below, we can combine the quantities which occurred within 3 (RP) + 5 (LT) = 8 days in order to get a worst-case total during an 8-day period (table of the right). Given SL = 97.5%, we can omit the largest sum in the right table as a rare case where stock-out will be acceptable. Therefore, we use the second largest sum, 50+25 = 75, as the Min. (Note: 75 is not far from 66) Posting Date Feb 8 Feb 18 Feb 23 Mar 14 Mar 14 Mar 26 Apr 4 Apr 5 Apr 13 Apr 25 Jul 4 Jul 30 Aug 10 Aug 10 Cable Hanger Quantity 25 25 100 25 25 25 25 25 25 25 75 25 50 25 Posting Date Feb 8 Feb 18 + 23 Mar 14 + 14 Mar 26 Apr 4 + 5 Apr 13 Apr 25 Jul 4 Jul 30 Aug 10 + 10 Cable Hanger Quantity 25 25+100 25+25 25 25 + 25 25 25 75 25 50 + 25 Max = Min + EOQ = 75 + 129 = 204 units Current Min (151) is too high. Pyrolon Coveralls XL Blue w/ HD Elastic Q 2 DS iR 2(158)(10) 44.3 round to 44 units .2(8.05) Instructor’s Manual, Chapter 12 12-51 Min d ( RP LT ) z RP LT 158(3 8) / 360 1.96(19.88) (3 8) / 30 = 4.83 + 23.59 = 28.42 round to 28 units However, this item also has several months of zero demand. Normal distribution may not be appropriate in this case. Looking at the individual demands on the left below, we can combine the quantities which occurred within 3 (RP) + 8 (LT) = 11 days in order to get a worst-case total during an11-day period (table of the right). Given SL = 97.5%, we can omit the largest sum in the right table as a rare case where stock-out will be acceptable. Therefore, we use the second largest sum, 26, as the Min. (Note: 26 is not far from 28) Posting Date Jan 6 Jan 21 Feb 14 May 19 May 23 Jul 6 Jul 7 Jul 10 Aug 17 Sep 1 Sep 2 Sep2 Sep 3 Sep 8 Sep 18 Sep 23 Oct 1 Dec 7 12-52 Coveralls Quantity 2 1 1 1 25 2 10 14 25 2 2 2 6 50 2 2 9 2 Posting Date Jan 6 Jan 21 Feb 14 May 19 +23 Jul 6 + 7 + 10 Aug 17 Sep 1+2+2+3+8 Sep 18+23 Oct 1 Dec 7 Coveralls Quantity 2 1 1 1+25 2+10+14 25 2+2+2+6+50 2+2 9 2 Max = Min + EOQ = 26 + 44 = 70 units Current Min (4) is too low. Operations Management, 5/C/E