Chapter Twelve

advertisement

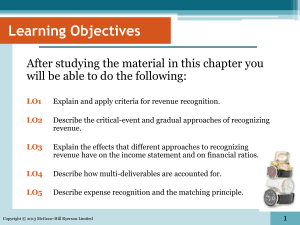

Electronic Presentations in Microsoft® PowerPoint® Prepared by James Myers, C.A. University of Toronto © 2010 McGraw-Hill Ryerson Limited Chapter 12, Slide 1 © 2010 McGraw-Hill Ryerson Limited Chapter 12 Accounting for Not-for-Profit Organizations and Governments Chapter 12, Slide 2 © 2010 McGraw-Hill Ryerson Limited Learning Objectives 1. 2. 3. 4. 5. 6. Describe the not-for-profit accounting practices currently mandated in the CICA Handbook Explain the use and the workings of a budgetary control system that uses encumbrances Prepare journal entries and financial statements using the deferred contribution method of recording contributions Prepare journal entries and financial statements using the restricted fund method Explain the purpose behind fund accounting Outline the basics of government financial reporting Chapter 12, Slide 3 © 2010 McGraw-Hill Ryerson Limited Introduction Not-for-profit organizations (NFPOs) are defined in the Handbook 4400.02 as: … entities, normally without transferable ownership interests, organized and operated exclusively for social, educational, professional, religious, health, charitable or any other not-for-profit purpose. A not-for-profit organization’s members, contributors and other resources providers do not, in such capacity, receive any financial return directly from the organization LO 1 Chapter 12, Slide 4 © 2010 McGraw-Hill Ryerson Limited Introduction NFPOs differ from profit-oriented organizations in the following ways: LO 1 In fulfilling their objectives, they typically provide services or goods to identifiable segments of society without the expectation of profit Their resources are provided by individual and government contributors without the expectation of gain or repayment; often these contributions have restrictions attached to them They have no readily identifiable ownership interests that can be sold, transferred, or redeemed They are governed by volunteers although some NFPOs also have paid employees Chapter 12, Slide 5 © 2010 McGraw-Hill Ryerson Limited The Basics of Fund Accounting Funding received by NFPOs can be categorized as unrestricted or restricted LO 1 Unrestricted resources can be used for any purpose consistent with the NFPO’s goals and objectives Restricted resources can only be used as specified by the external contributor, e.g. a donation may be received with a condition that it be spent in some specified manner Endowments are restricted donations that must be maintained in perpetuity by the organization, only the interest earned on the endowed funds can be spent Chapter 12, Slide 6 © 2010 McGraw-Hill Ryerson Limited The Basics of Fund Accounting Not for profit organizations require a mechanism to identify and track restricted funds. Fund accounting provides such a mechanism LO 5 Fund accounting comprises … a self-balancing set of accounts for each fund established by legal, contractual, or voluntary actions of an organization. Elements of a fund can include assets, liabilities, net assets, revenues, and expenses … Fund accounting involves an accounting segregation, although not necessarily a physical segregation, of resources. [Handbook 4400.02] Exhibit 12.1 illustrates a “General” unrestricted fund and a “Building” fund which is restricted Chapter 12, Slide 7 © 2010 McGraw-Hill Ryerson Limited The Basics of Fund Accounting LO 5 Chapter 12, Slide 8 © 2010 McGraw-Hill Ryerson Limited The Basics of Fund Accounting In many not-for-profit organizations, a basic objective of financial reporting is often the tracking of changes in each fund balance over the year and stewardship over fund resources Fund accounting provides a segregation of assets for a given purpose, a recognition of the set of separate operations which pertain to those assets, recognition of the equities which pertain to that fund, and complete classification by fund of revenue, expense and income accounts LO 5 Chapter 12, Slide 9 © 2010 McGraw-Hill Ryerson Limited The Basics of Fund Accounting The complete self balancing set of accounts for each fund removes the emphasis from the overall “bottom line” and places it more closely on the individual activity of each fund The total of assets less liabilities of the not-for-profit organization will equal the total of the fund balances, the same way that assets less liabilities equals owners’ equity in a profit-oriented business organization LO 5 Chapter 12, Slide 10 © 2010 McGraw-Hill Ryerson Limited The Basics of Fund Accounting The possible types of funds depends on the nature and objectives of the organization: In a university, for example, there are research funds, scholarship funds, residence funds, athletic funds, and others In a church, there may be mission funds, memorial funds, building funds, and operating funds An organization that uses fund accounting in its financial statements should provide a brief description of the purpose of each fund reported Funds established by the NFPO’s board of directors cannot be considered restricted because future boards can dispose of the fund. Only external restrictions apply LO 5 Chapter 12, Slide 11 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today The eight Handbook sections applicable to NFPOs are as follows: LO 1 Section 4400, “Financial Statement Presentation by Nor-for-profit Organizations” Section 4410, “Contributions – Revenue Recognition” Section 4420, “Contributions Receivable” Section 4430, “Capital Assets Held by Not-for-profit Organizations” Section 4440, “Collections Held by Not-for-profit Organizations” Section 4450, “Reporting Controlled and Related Entities by Not-for-profit Organizations” Chapter 12, Slide 12 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Section 4460, “Disclosure of Related Party Transactions by Not-for-profit Organizations” Section 4470, “Disclosure of Allocated Expenses by Not-for-profit Organizations” A number of other Handbook sections have limited applicability to NFPOs In 2010 the CICA expects to make a decision on the December 2008 Invitation to Comment, Financial Reporting by Not-for-Profit Organizations. LO 1 This would allow private-sector NFPOs to choose between IFRS and GAAP for private enterprises including the eight Handbook sections above. Public-sector NFPOs could choose between IFRS and the Public Sector Accounting Handbook Chapter 12, Slide 13 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Section 4420, “Contributions Receivable”: LO 1 Contributions are defined as “a non-reciprocal transfer to a notfor-profit organization of cash or other assets or a non-reciprocal settlement or cancellation of its liabilities” (4420.02) A contribution should be recognized as an asset when the amount to be received can be reasonably estimated and the ultimate collection is reasonably assured. Because pledges cannot be legally enforced, recognition should be delayed until cash is received, unless the organization can estimate collectibility rates based on historical results Chapter 12, Slide 14 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Section 4450, “Reporting Controlled and Related Entities by NFPOs” Establishes NFPO presentation and disclosure standards for control, significant influence and joint venture investments or economic interest type of relationship in other NFPOs or profitoriented organizations LO 1 Control over other NFPOs (for example by the ability to appoint the majority of their directors) can be reflected either by consolidation or by disclosure set out in paragraphs 4450.22 or 4450.26 Control over profit-oriented organizations can be reflected either by consolidation or by accounting using the equity method with disclosure described in paragraph 4450.32 Chapter 12, Slide 15 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Section 4450, “Reporting Controlled and Related Entities by NFPOs” (continued) Joint control can be reflected either by proportionate consolidation or accounting using the equity method Significant influence over another NFPO is reflected with disclosure since equity accounting is not possible in the absence of voting shares to determine percentage interest. Significant influence over a profit-oriented enterprise is reflected using the equity method of accounting Other economic interests are reflected by disclosure LO 1 Other economic interests exist if another NFPO holds resources for the reporting organization, or if the reporting organization is responsible for the other NFPO’s debts Chapter 12, Slide 16 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Section 4460, “Disclosure of Related Party Transactions by NFPOs” Related parties include those over which control, joint control, significant influence, or other economic interests exist. Section 4460 provides disclosure standards virtually identical to those set out in Section 3840 for profit-oriented enterprises Section 4430, “Capital Assets Held by NFPOs” LO 1 Requires that NFPOs capitalize and amortize all capital assets, but exempts small NFPOs with two-year average annual revenues less than $500,000 from doing so provided they disclose information about capital assets that are not capitalized and amortized Chapter 12, Slide 17 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Section 4440, “Collections Held by NFPOs” Collections consist of works of art and historical treasures that are for public exhibition, education, and research, and the proceeds from sale of which must be used to acquire similar items or to protect the remaining collection. Therefore collections are excluded from the definition of capital assets with the following choices of accounting permitted: LO 1 Expense when acquired Capitalize but do not amortize Capitalize and amortize The nature of the collection should be disclosed together with the accounting policy, the amount spent on the collection during the period, the proceeds from any sales of collection items, and a statement of how such proceeds were used Chapter 12, Slide 18 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Section 4470, “Disclosure of Allocated Expenses by NFPOs” When an NFPO classes its expenses by function on the statement of operations, it may need or want to allocate certain related expenses to those functions Certain expenses, however, may relate directly to more than one function, in particular fundraising expenses and general support expenses LO 1 When these two types of expenses are allocated to other functions, disclosure is required of the allocation accounting policy, the nature of the expenses, the basis on which the allocations have been made, the amounts of each that have been allocated, and the functions to which they have been allocated Chapter 12, Slide 19 © 2010 McGraw-Hill Ryerson Limited Not-for-profit Reporting Today Sections 4400 and 4410, “Financial Statement Presentation by NFPOs” and “Contributions – Revenue Recognition” LO 1 Restrictions on an organization’s resources should be clearly stated in the financial statements The matching concept for NFPOs must be applied in the measurement of yearly results. In NFPO matching for restricted revenues when the fund method of accounting is not used, expenses are recognized first and then revenues are matched to expenses Section 4410 defines the nature of unrestricted, restricted, and endowment contributions as discussed in a previous slide Chapter 12, Slide 20 © 2010 McGraw-Hill Ryerson Limited Financial Statements A NFPO must present the following financial statements: A statement of financial position (i.e. balance sheet) A statement of operations (i.e. statement of revenues and expenses) A statement of changes in net assets A statement of cash flows A fund basis can be used in one or more statement, but not necessarily on all statements The statement of financial position must show: LO 1 Current and non-current classification of assets and liabilities Net assets subject to endowments Internally restricted and externally restricted net assets Unrestricted net assets Chapter 12, Slide 21 © 2010 McGraw-Hill Ryerson Limited Financial Statements Prior to 2009 net assets invested in capital assets had to be shown as a separate component of net assets. There are now three options for reporting this item: Continue to report as a separate component of net assets Disclose in the financial statement notes Do not present or disclose separately The statement of operations will show the revenues and expenses for the period and may classify these by function LO 1 Other comprehensive income does not apply to NFPO’s Revenues and expenses will be shown separately, and not netted, when the NFPO acts as a principal in a transaction Chapter 12, Slide 22 © 2010 McGraw-Hill Ryerson Limited Financial Statements The statement of changes in net assets must show changes in each of the three net asset categories reflected on the statement of financial position The statement of cash flows must report changes in cash under the normal three classifications: LO 1 Cash flows from operations Cash flows from investing and Cash flows from financing activities Chapter 12, Slide 23 © 2010 McGraw-Hill Ryerson Limited Accounting for Contributions To capture the matching concept that is unique to NFPOs, the Handbook has defined two methods of accounting for contributions: - - the deferral method and the restricted fund method If an NFPO does not wish to report on a fund accounting basis, it will use the deferral method which shows all activities under one financial statement column If an NFPO reports on a fund accounting basis, it will normally choose the restricted fund method which provides a separate financial statement column for each activity as illustrated in Exhibit 12.1 LO 1, 3, 4 Chapter 12, Slide 24 © 2010 McGraw-Hill Ryerson Limited Accounting for Contributions The deferral method matches contributions revenues with related expenses LO 3 Unrestricted contributions are reported in income when received Endowment contributions are not shown on the operating statement because they are restricted in perpetuity Restricted contributions are matched against related expenses Restricted contributions for future expenses are deferred and recognized in revenue in the same periods as related expenses Restricted contributions for acquisition of capital assets are deferred and amortized to income on the same basis as the assets are depreciated; when the related asset is not depreciated (e.g. land) the restricted contribution is reflected on the statement of changes in net assets Chapter 12, Slide 25 © 2010 McGraw-Hill Ryerson Limited Accounting for Contributions The restricted fund method requires a NFPO to report a general fund, at least one restricted fund, and, if it has endowments or receives endowment contributions, an endowment fund LO 4 The restricted funds will be used to record externally restricted revenue as well as any restricted income generated from endowment fund investments The endowment fund, which must be maintained in perpetuity, will show only contribution revenue and no expenses The general fund reflects all unrestricted contributions and investment income including any unrestricted income generated from endowment fund investments. Using the deferral method, the general fund also reports restricted contributions and investment income for which no separate restricted fund exists Chapter 12, Slide 26 © 2010 McGraw-Hill Ryerson Limited Net Assets Invested in Capital Assets Net assets (or fund balance) may include a separate category called “Net assets invested in capital assets” LO 1 Net assets invested in capital assets represents resources spent on capital assets and therefore not available for future spending Under the restricted fund method, it equals the unamortized balance of all capital assets purchased from restricted and unrestricted resources, less any related debt Under the deferral method, it equals the unamortized balance of capital assets purchased from unrestricted resources, less any related debt Transfers to and from the net assets invested in capital assets balance (or fund) from unrestricted net assets (or general fund) are shown in the statement of changes in fund balances, not as revenues and expenses Chapter 12, Slide 27 © 2010 McGraw-Hill Ryerson Limited Donated Capital Assets, Materials, and Services A NFPO is required to record the donation of capital assets at fair value. If fair value cannot be determined, a nominal value will be used Under the deferral method the donation will be credited to deferred contributions-capital assets which will be amortized to future income as the asset is depreciated, or if the asset is not depreciable (e.g. land) it will be credited to net assets invested in capital assets A NFPO has the option of reporting or not reporting donated material and services; LO 1 Reporting is permitted only if fair value can be determined, and if materials and services would normally be used in the organization’s operations and would have been purchased if they have not been donated Chapter 12, Slide 28 © 2010 McGraw-Hill Ryerson Limited Donated Capital Assets, Materials, and Services The Handbook section makes it clear that the fair value of the services of volunteers are not normally recognized due to the difficulty in determining such value An organization would probably not record donated materials if it acts as an intermediary for immediate distribution and therefore will not retain the materials (e.g. food bank) LO 1 Chapter 12, Slide 29 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances Budgetary Control with Encumbrance and Commitment Accounting It is a common practice in not-for- profit organizations to set up the approved budget in the accounts LO 2 This practice permits actual expenditures to be tracked against budget, so that the difference may be tracked for management purposes Additional control is maintained by recording various expenditures when first approved, rather than when completed These approved expenditures, when recorded, are referred to as "encumbrances“. The related expected obligation is referred to as an "estimated commitment" Chapter 12, Slide 30 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances The recording of approved future expenditures in the accounts enables the computation of a "free" balance at any time LO 2 This free balance is the amount which may be expended on other contracts or purchases, as at that point in time This system also provides budgetary control with commercial enterprises, especially on large, fixed price projects (such as shipbuilding or large commercial construction projects) The encumbrances entered into are generally shown as expenditures (with the commitments shown as if liabilities) Chapter 12, Slide 31 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances LO 2 The free balance must be readily available in the accounts so that managers may promptly access this information when required for expenditure decisions Knowledge of the free balance (especially when it is limited) and associated planned expenditures for the remainder of the fiscal year helps not-for- profit organizations to meet budgetary objectives Accounts for outstanding encumbrances are netted and not reported in the NFPO’s external financial statements since encumbrances are executory contracts and not completed transactions Chapter 12, Slide 32 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances Setting up the Budget When the budget is approved by the directors, budgeted amounts are recorded in a separate set of "budgetary accounts” LO 2 normal debit and credit rules are reversed, and the budgeted surplus or deficit is also entered As expenditures are made, they are recorded in the normal manner Comparison of the approved budget with actual expenditures will indicate a free balance This system is supplemented by the recording of encumbrances Chapter 12, Slide 33 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances Encumbrances and Commitments LO 2 An additional layer of control is provided by generating an entry to a third set of accounts (using normal debit and credit rules) at the time a purchase order is issued or a contract is entered The estimated expenditure or encumbrance is debited to these accounts; the expected future obligation or commitment is credited The free balance in such a system is computed by comparing the budgeted expenditure limit to the total of actual expenditures plus encumbrances Chapter 12, Slide 34 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances LO 2 When goods are received or services are delivered, the related invoice will be recorded in the accounts On completion of the contract, the related encumbrance and commitment are reversed Discrepancies are investigated Expenditures should not be approved which exceed the free balance available for expenditure Chapter 12, Slide 35 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances Closing entries in Fund Accounting Systems In a not-for-profit organization, as with a business, all temporary accounts are closed at the end of the fiscal period: LO 2 Close the budgetary accounts, to provide for the "set up" of next year's budget Close outstanding encumbrances to expenditures for the period, so that encumbrances are charged against the budget in the year approved (entry is reversed at the beginning of the next period) Close actual revenue and expenditure accounts, updating the fund balances and clearing the accounts for the following year’s expenditures Chapter 12, Slide 36 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances Note that commitments are not reported in the balance sheet on the external financial statements; they may be disclosed in the notes to the financial statements. As the entry to close encumbrances was reversed, when invoices are actually received and expenditures entered, encumbrances are cancelled against commitments in the normal manner LO 2 Chapter 12, Slide 37 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances Example of Budgetary Control – the following is the summarized budget that was approved by the board of directors: Budgeted revenues (in detail) Budgeted expenses (in detail) Budgeted surplus LO 2 $900,000 890,000 $ 10,000 Chapter 12, Slide 38 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances If the organization records the budget in its accounting records, the following journal entry is made at the start of the fiscal year: Estimated revenues (control account) Appropriations (control account) Budgetary fund balance 900,000 890,000 10,000 At the end of the fiscal year the budget accounts are reversed as part of the closing journal entries and these amounts are not reflected in the organization’s external financial statements LO 2 Chapter 12, Slide 39 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances Example of Encumbrance Accounting Purchase order 3056A is issued for the acquisition of office supplies expected to cost $950. The journal entry to record the purchase order is: Encumbrances Estimated Commitments LO 2 950 950 Chapter 12, Slide 40 © 2010 McGraw-Hill Ryerson Limited Budgetary Control and Encumbrances When the supplies ordered are received at an invoiced cost of $954, the journal entries required are: Estimated commitments Encumbrances 950 Supplies expense Accounts payable 954 LO 2 950 954 Chapter 12, Slide 41 © 2010 McGraw-Hill Ryerson Limited Accounting for Governments Governments differ from businesses in many ways, principally that governments do not exist to make profit but to provide services and revenues are derived principally from taxation CICA’s Public Sector Accounting Board (PSAB) sets the standards for government accounting in the Public Sector Accounting Handbook, first issued in 1998 LO 6 The Public Sector Accounting Handbook applies to all governments in Canada and contains 30 sections and 7 accounting guidelines Requires four financial statements: consolidated statement of financial position, consolidated statement of operations, consolidated statement of change in net debt, and a consolidated cash flow statement Chapter 12, Slide 42 © 2010 McGraw-Hill Ryerson Limited