from operations

advertisement

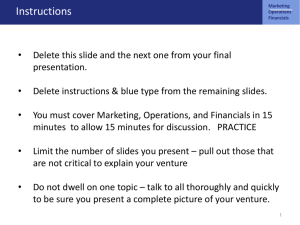

Instructions Marketing Operations Financials • Delete this slide and the next one from your final presentation. • Delete instructions & blue type from the remaining slides. • You must cover Marketing, Operations, and Financials in 15 minutes to allow 15 minutes for discussion. PRACTICE • Limit the number of slides you present – pull out those that are not critical to explain your venture • Do not dwell on one topic – talk to all thoroughly and quickly to be sure you present a complete picture of your venture. 1 Instructions Marketing Operations Financials • Feel free to change the font, but make sure it is legible. • Don’t use a font size less than 20 points—your audience will not be able to read it. • You can change the background and format, but make sure your slides are easy to read and cover the content. • We encourage you to use a light color for the background and a dark color for your text. • Be consistent in the punctuation of your slides. • Check your spelling. 2 Marketing Operations Financials Venture Name Here Venture Team Member Names Here Venture Description Marketing Operations Financials Company: Insert the complete first sentence of your venture description. First Product: Describe your first product (service). Target Market: Describe the target market for first product (service) and the size of this market. Future Products: Briefly describe future products (services) (Use your Idea Fair slide here) 4 Marketing Operations Financials Operations Venture Name Here Operations Strategy Marketing Operations Financials Materials: What are the important goods and raw materials you will need to create and deliver your products or services? Be sure to address: • Prices, shipping costs, and payment terms; • Minimum order sizes (is there a minimum required order size?); and • Estimated time between orders and deliveries. Your estimates should reflect the time required for: • Subcontractors to obtain needed materials; • Manufacturing (if relevant); and • Shipping from subcontractor to your firm (Modify the above elements if you need to better reflect the nature of your operations) 6 Operations Strategy Marketing Operations Financials Production: •Given your revenue estimates, how much will it cost you to produce the products or deliver the services that will generate these revenues? Be sure and include the cost of packaging. •How many labor hours will be required to produce these products or deliver these services? •How much will this labor cost? (These are recurring variable costs – not your startup or one time product development costs) 7 Operations Strategy Marketing Operations Financials If You Are Outsourcing Production or Services: •What is the rationale for outsourcing? •What are the costs (including costs of changes in your product line & the costs of vendor management)? •How will you ensure quality? •Timely delivery (production & shipping times) •What will you do if your supplier can’t deliver or goes bankrupt? Plan B? •How will you protect your intellectual property? 8 Operations Strategy Marketing Operations Financials Order Fulfillment • How will you fulfill orders from customers? • How much staff time will order fulfillment require? • What is the cost of preparing goods for shipping (materials and labor)? • What are shipping costs? • If you outsource order fulfillment, how much will this cost? How quickly will orders be filled? 9 Operations Strategy Marketing Operations Financials Customer Service • What customer services will you provide (e.g., training, user support, and handling complaints, returns, and repairs)? • How much will the provision of these services cost? • How much staff time will these services require per month? 10 Operations Strategy Marketing Operations Financials Team Members • Backgrounds • Fit • Roles and Responsibilities 11 Marketing Operations Financials Financial Model Venture Name Here Venture Team Member Names Here Key Assumptions Marketing Operations Financials 1. Size of target market + % of customers aware of your venture + % of those aware who you expect will buy from you 2. Your costs to produce a salable unit of your solution, the price your customer pays, the gross margin you get 3. The quantity of product/services you can make ready to sell each quarter, each year 4. Your costs to sell product in Year 1/2/3/4/5 5. Your sales growth each year. How fast you will reach new customers, how much you will grow revenue for each customer 13 Five Year Revenue Forecast Marketing Operations Financials For each revenue stream, forecast sales monthly for the first five years (monthly for Years 1 and 2, quarterly for Year 3, annually for Years 4 and 5). 1) List your total number of customers in each time period. 2) List the total units sold of each product or service in each time period. 3) Compute dollar sales of each product or service in teach time period Finally, for each time period, compute total revenues by summing the revenues from each of your revenue streams. 14 Marketing Operations Financials Startup Expenses DEPRECIABLE ASSETS Machinery/Equip/Office Computer & Related Equip Buildings Leasehold Improvements Other TOTAL EXPENSE ITEMS (short term) Supplies Legal & Accounting Rentals/Leases/Utilities Temp Employees/Contractors TOTAL WORKING CAPITAL (initial current assets) Supplies Inventory Product Inventories Prepaid Expenses TOTAL TOTAL STARTUP EXPENSES Operating Exp x 4 Months Prod/Serv Cost of Sales x 2 Months TOTAL ACCOUNTS PAYABLE Short Term Debt Long Term Debt Equity Investment Before Pmt of Expense Items TOTAL Your one-time development costs for your market ready solution • Equipment • Materials • Employee time • Outsourced services for product development • Rent & facility costs • Web design / software • Other things ? 15 Marketing Operations Financials Income Statement Year 1 Year 2 Year 3 Year 4 Year 5 NET SALES DIRECT COSTS CONTRIBUTION MARGIN CONTRIBUTION MARGIN % GENERAL & ADMIN COSTS Salaries/Consult/Fees Rent Marketing All Other Expenses Total G&A Expenses EBITDA EBITDA % Breakeven Revenue Cumulative Net Income Cum Net Inc – StartUp Costs Non Discount Payback (Yrs) 16 Marketing Operations Financials Balance Sheet Year 1 Year 2 Year 3 Year 4 Year 5 ASSETS Ending Cash Accounts Receivable Inventory Total Current Assets Real Estate Equip & Deprec Assets Net Fixed Assets TOTAL ASSETS LIABILITIES Accounts Payable Short Term Debt Long Term Debt Total Liabilities OWNER’S EQUITY Invest by Owner Retained Earnings Net Equity TOTAL LIAB + OWN EQTY 17 Marketing Operations Financials Statement of Cashflows Year 1 Year 2 Year 3 Year 4 Year 5 FROM OPERATIONS Net Income Change in Acct Receivables Change in Acct Payable Change in Prepaid Exp Change in Inventory Depreciation Net From Operations FROM INVESTING Purch of Real Estate Purch of Equip Net from Investing FROM FINANCING Invest by Owners Short Term Debt Long Term Debt Net From Financing NET CASH Beginning Cash Ending Cash 18