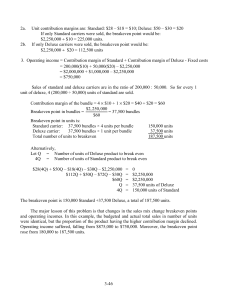

Additional Problems

advertisement

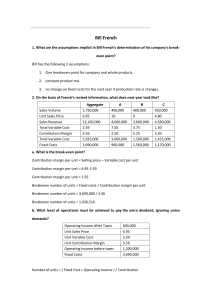

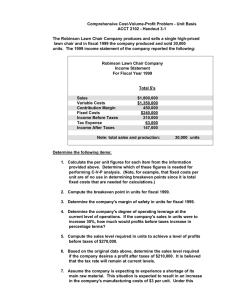

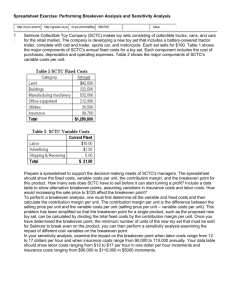

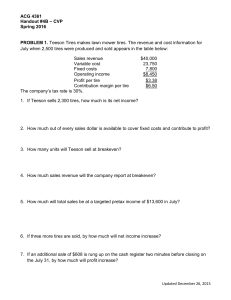

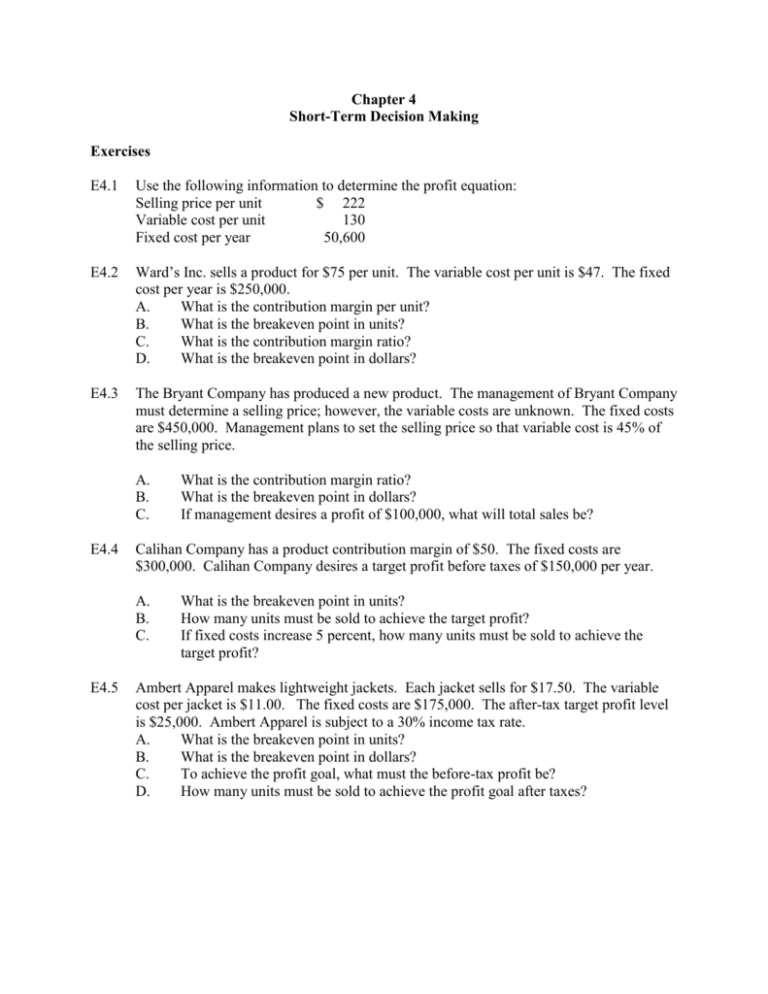

Chapter 4 Short-Term Decision Making Exercises E4.1 Use the following information to determine the profit equation: Selling price per unit $ 222 Variable cost per unit 130 Fixed cost per year 50,600 E4.2 Ward’s Inc. sells a product for $75 per unit. The variable cost per unit is $47. The fixed cost per year is $250,000. A. What is the contribution margin per unit? B. What is the breakeven point in units? C. What is the contribution margin ratio? D. What is the breakeven point in dollars? E4.3 The Bryant Company has produced a new product. The management of Bryant Company must determine a selling price; however, the variable costs are unknown. The fixed costs are $450,000. Management plans to set the selling price so that variable cost is 45% of the selling price. A. B. C. E4.4 Calihan Company has a product contribution margin of $50. The fixed costs are $300,000. Calihan Company desires a target profit before taxes of $150,000 per year. A. B. C. E4.5 What is the contribution margin ratio? What is the breakeven point in dollars? If management desires a profit of $100,000, what will total sales be? What is the breakeven point in units? How many units must be sold to achieve the target profit? If fixed costs increase 5 percent, how many units must be sold to achieve the target profit? Ambert Apparel makes lightweight jackets. Each jacket sells for $17.50. The variable cost per jacket is $11.00. The fixed costs are $175,000. The after-tax target profit level is $25,000. Ambert Apparel is subject to a 30% income tax rate. A. What is the breakeven point in units? B. What is the breakeven point in dollars? C. To achieve the profit goal, what must the before-tax profit be? D. How many units must be sold to achieve the profit goal after taxes? E4.6 Rush Company has the following cost-volume-profit relationships: Breakeven point in units 20,000 Variable cost per unit $7.50 Fixed cost per period $50,000 A. What is the contribution margin per unit? B. What is the selling price per unit? C. What is the total profit if 20,001 units are sold? E4.7 Backpackers, Inc. plans to manufacture packs for hiking and camping. The following costs are expected to be incurred in the manufacturing process. Determine whether each of the following costs is a product cost or a nonproduct cost. Use P for product cost and NP for nonproduct cost. __________ A. Cost of fabric __________ B. Cost of the factory building __________ C. Cost of advertising in various outdoor magazines __________ D. Cost of leather for trim __________ E. Cost of thread used to sew packs together __________ F. Cost of shelving to store production supplies __________ G. Salary of the chief executive officer __________ H. Cost of zippers __________ I. Wages of sales personnel (salary plus commission) __________ J. Cost of delivery vehicle __________ K. Cost of utilities used in the factory building __________ L. Cost of utilities used in the corporate office __________ M. Production supervisor’s salary __________ N. Setup costs to change production from one style pack to another __________ O. Research costs to design and develop pack __________ P. Property taxes on factory building E4.8 Chavez Co. produces and sells duffel bags that are priced at $60 each. Chavez has received a request for a special order for 500 duffel bags at a price of $48 each. The current unit cost to produce a bag is $32 (direct material, $20; direct labor, $8; and unitrelated overhead, $4). Chavez Co. has the capacity to produce the special order; however, one additional production run will be required costing $2,000. Should the order be accepted? Why or why not. E4.9 Whitney, Inc. manufactures a unique hand lotion formulated for extremely dry weather. It also makes the containers the lotion is sold in. Production costs for the 15,000 containers needed annually are as follow: Direct materials $35,000 Direct labor 15,000 Unit-related overhead 5,000 Product-sustaining overhead 6,000 Allocated facility-sustaining overhead 14,000 A supplier has offered to provide all 15,000 containers at a price of $4.50 per container. If Whitney, Inc. accepts the offer, it will rent the released space for an annual rental fee of $12,000. Should Whitney, Inc. make or buy the containers? E4.10 In addition to selling custom-designed jewelry, Darrah’s Jewelry Store also offers repair and appraisal services. After reading the following profit report, decide whether Darrah’s should drop the appraisal service. Revenues Cost of sales (service) Product margin Facility-sustaining costs Profit Jewelry Sales $90,000 45,000 $45,000 15,000 $20,000 Repair Service $45,000 25,000 $20,000 15,000 $ 5,000 Appraisals $5,000 1,000 $4,000 15,000 $(11,000)