ROle of IT Function Analysis Versus Development

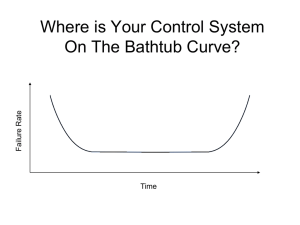

advertisement

ROLE OF THE IT FUNCTION: COSTS, ANALYSIS, DEVELOPMENT Based on materials by David Schuff IT’s impact on the bottom line Two things: Reduce costs Increase profit Increase revenue Everything else relates to one of these two things. Agree? Try it… Paying for IT How does a company pay for technology initiatives? Where does the money come from? So how do you know if it is worth it? Who pays? For the corporate network? For an application needed by a single department? For a new server intended to support that application? What if the department only needs 10% of that server’s capacity? What is the role of the “chargeback” in all of this? The Major “Functions” of the IT Function Operations Technical support Network planning and administration Application Development Software implementation What about “managing contracts”? Looking at the application development function Analysis/Design Development The business analysts Analysis The development team Design Development The Systems Development Life Cycle (SDLC) Business Requirements Technical Requirements Technical Design The SDLC What are its strengths? What are its weaknesses? When it is appropriate? What is the role of alternative development strategies? Rapid prototyping Joint application development Requirements Gathering Why is it important in the context of the SDLC (and software development in general)? How does it affect testing? From where do you get the requirements? What are the difficulties? Business Requirements versus Technical Requirements What is the difference? Which one is more important? Does it depend on who’s asking the question? Should the business unit review the technical specifications? The requirements “game” In reality, how are requirements used by vendors? By clients? What is the right level of detail? Can you have too much detail? Which party benefits from greater detail? Why do requirements change? Is this a bad thing? How should the client deal with these changes? The vendor? How do you build a set of requirements that “last?” The Wall What is “throwing requirements over the wall”? What is the implication of this in practice? Why do companies do it? How do you know if it is worth it? Cost justification Measures of cost and benefits Intangible costs versus tangible costs Techniques Net present value Expected value Net present value Consider a development project: Year 1: $20,000 expenditure Year 2: $5,000 savings Year 3: $7,500 savings Year 4: $7,500 savings Formula for NPV: SFV(1+i)-n Is it worth it? Do you break even: $20000 in spending versus $20000 in income? Consider a 5% discount rate (cost of capital): NPV = (-20000)(1.05)-0 + (5000)(1.05)-1 + (7500)(1.05)-2 + (7500)(1.05)-3 = -20000 + 4761.91 + 6802.72 + 6478.78 = -1956.59 So you would lose $1956.59 on this project! Expected value E(X) = xP(x) where x is the outcome and P(x) is the probability of that outcome Why raffles are bad deals (for players) Suppose there are 100 tickets at $1 and the prize is $50 E(X) = -1(1) + 50(.01) = -1 + .50 = -$.50 So on average you lose $.50 on every ticket Applying this to an IT project Is a security system worth the money? The system costs $10,000 and prevents all downtime If I do not have a backup system there is a 5% chance we’ll have 10 days of downtime 10% chance we’ll have 5 days of downtime 30% chance we’ll have 1 day of downtime Each day of downtime costs $10000 So… The computation… E(X) = -10000 + (100000)(0.05) + (50000)(.10) + (10000)(0.30) = -10000 + 5000 + 5000 + 3000 = $3000 So the expected value of investing in the system is $3,000 We save $3,000 by implementing the security system Another way of looking at it: The expected loss from not having the system is $13,000, which is more than the cost of the system But what if you have this scenario? There is a .01% chance you’ll have 10,000 hours of downtime That’s (0.0001)(10000)(10000) = $10,000 $10,000 is not a lot, but can you afford the $100,000,000 loss if it occurs? So what do you do to protect against that loss? Combining NPV and expected value NPV is discounted value of future cash flows But those cash flows might be uncertain So you could look at discounted values of expected future returns So now, given a 5% cost of capital: NPV = (E(Xyear1))(1.05)-0 + (E(Xyear2))(1.05)-1 + (E(Xyear3))(1.05)-2 + … = How do you compute E(Xyeary)?? Computing expected future cash flows Back to our security system example We claim there is a $3000 benefit in the second year This assumes 100% certainty in the outcome What should we use for the expected cash flow for year two if we are: 80% certain there will be a $3000 benefit 20% certain there will be a $1000 benefit Discussion Beyond Valuation: Options Thinking in Project Management Should IT projects include people from the business unit in the development process? In an business that uses technology (for example, a bank), is it more important to have People in IT with knowledge of the business… or People in the business units with knowledge of technology? More discussion Imagine you are a project manager for a technology initiative What skills are important to have in your team members (technical and otherwise)?