1

DEVELOPING PAYER RELATIONS

August 14, 2013

William J (Bill)TenHoor

AHP Healthcare Solutions

2

Objective

Gain a better understanding of

payers and the process of

making them your clients long

term

3

Telling the Payer Relations Story

1. Beginning

2.

Middle

3.

End

4

Why Focus on Payer Relations Now?

• The ACA implements an insurance based payment

system – many payers are now your potential clients

• Reliance on grants is increasingly less feasible

• Paradigm shift is occurring rapidly

From MH & SA to Behavioral Health to a Health Specialty (Behavioral Medicine?)

Care coordination, primary care integration and quality measures are essential

components of care delivery

Population health and wellness are key parts of delivery systems

Payment models are shifting from fee-for-service to pay-for-performance to risk

models like shared savings and related types of capitation

Insurers and providers are integrating within ACOs, creating the opportunity for

more friction free health systems

• Behavioral health has greater legitimacy and visibility

(parity) to leverage – one of the 10 Essential Benefits

• Tempest Fugit!

5

Beginning Steps

1. Prepare

2. Understand the payer

3. Define your value equation

4. Engage in a systematic sales process

5. Formalize your agreements in a contract

6. Sustain your success – learn from (and be

prepared for) setbacks along the way

6

1. Prepare

DEFINITIONS

1. It’s a journey

2. It’s a process

3. It’s a relationship

7

2. Understand Healthcare Payers

• What are the types?

• Commercial/Private

• For-profit (stock and mutual) and non-profits

• Public

• HMOs, PPOs, Indemnity Plans

• Why and when formed and how they have evolved

• Experience of the Blues and the depression

• Discover their values, brand, how regulated, PR,

operations, personnel

8

Health Insurance Is Not a Human Service

Characteristics

1

1. Pooling of losses

2. Payment for

random losses

3. Risk transfer

2

3

4. Indemnification for

illness

Insurer charges individual $250. to cover the risk of

extreme illness and/or potential bankruptcy

(Anticipated care cost ($200) + risk & overhead charge

($50) = premium)

9

The Payer Pie: Market Segments

Public Sector

• Medicaid and SCHIP

• Medicare

• SAMHSA/VA/DOD/HRSA

• State and Local Govt.

Private Sector

• Commercial and non-

profit Insurers

• Large and small group

• Individual

• Self-Insured Employers

• Individual Out-of-Pocket

• Also mention third

(MBHO) parties and

MSO/ASO entities

10

The Payer Pie: Health & BH Spending

Behavioral Health and Total Health

Spending: Public and Private Sector

Segments (in 2005 $)

Private

Public

$955

$760

$83

$52

MH/ SA $

Health $

Private

MH/ SA $

$52

Health $

$955

Public

$83

$760

• What our market

research tells us:

• MH/SA = 5.1% of

Private Health

Spending

• MH/SA is 9.9% of

Public Sector

Health Spending

• Conclusion:

Target Public

Sector Payers

First

• Source: (SAMHSA

2010; Kaiser

Report, 2011)

11

US BH Spending: $135 B

Other Private, 3%

Medicaid, 26%

Private Insurance, 24%

Out-of-Pocket, 1%

Medicare, 7%

Other State and Local,

21%

Other Federal, 7%

12

The Payer Pie: Public BH Spending

MH + SA Public Sector Spending Segments ($ in billions)

$35.0

• What our market

research tells us:

•

$31.1

$30.0

•

$25.0

•

$20.3

$20.0

•

$15.0

$10.0

$8.6

$7.9

$4.6

$5.0

$-

$5.7

•

$3.5

$1.5

Medicare

Medicaid

State& Local Gov

$31.1

SAMHSA/VA/DO

D

$5.7

MH

$8.6

SA

$1.5

$4.6

$3.5

$7.9

$20.3

•

Medicaid is the dominant

payer segment at 43%

State/Local Govt. is

important at 34%

State/Local Govt. is very

impt. for SA at 38%

SAMHSA contributes only

modestly to pie

Conclusion: Funding

from 4 public sector

segments enables

diversification

SA-only providers may

want/need MH services

also

13

ACOs as Payer Prospects

• Important as new ACA models (several hundred in operation)

• Combine payer and provider features

• Are being encouraged and incentivized

• Iowa is encouraging (cannot mandate) Medicaid Expansion members

to join ACOs

• What makes one a good prospect?

• Has status in the community

• Already has enrollment or may be new to the state

• Needs your services

• You have an opportunity for preference and even exclusivity

• References

• www.accountablecarenews.com

• http://www.ncsl.org/issues-research/health/accountable-care-organizations-health-costs.aspx

14

3. Define Your Value Proposition

• The promise of the value to be derived from your services

by a customer (both insurer and individual consumer)

• Is the customer satisfied?

• What is the “proof” of the customer experience?

• Requires ability to communicate the offering and the

associated features and benefits

• Differentiates the organization - positions it against

competition

• Who uses the value proposition

• The organization, internally, to ensure communication consistency

• Customers, partners, employees, other stakeholders

Proposition: Comorbidity & Chronic Conditions

Source: Wyatt Matas, 2013

16

4. Engage in a Systematic Sales Process

Don’t simply accept the perfunctory provider contract

route - Alternative Sales Process – Must be customized

Identify opportunities in the markets

Define best prospective clients (payer, ACO, hospital, FQHC, etc.)

Pre qualify and focus on the most qualified client first

1)

2)

3)

1)

4)

5)

6)

7)

8)

Internet, phone, face to face meeting (but this is not selling – see next slide)

Contact prospective payers to ensure interest and need

Make a sales presentation

Prepare and submit the proposal

Proposal follow-up

Close/Negotiate

• Adapted from Pete Frye’s “The Complete Selling System”

17

Example: Qualification and Pre-Qualification

• Following pleasantries, make a value statement –

• “We have care coordination services that ensure people with

substance use disorders regularly act on their problematic physical

health conditions as well as their substance issues”

• Reconfirm the value issues

• Does this prospect need our solution, want to do something about it,

and can we determine what we have to do to make the sale?

• Establish buying criteria, using and reconfirming informational

and knock-off questions

• Providers must be accredited, licensed, etc.

• Gain appropriate commitments

• Establish a written agenda (what has to happen to make the

sale)

• Identify a coach (an internal source for land mines, risks, etc.)

• Identify the next step and its objective

18

5. Formalizing the Agreement

• Agreements (contracts) consummate the deal

• Aspire to more than a traditional provider contract

• They are in many parts

• Key aspects of a contract

• Memorializes intention to create a legal obligation

• Mutual assent

• Involves offer and acceptance

• Remember, contracts represent large portion of asset

value of a service business, deserving appropriate

attention

19

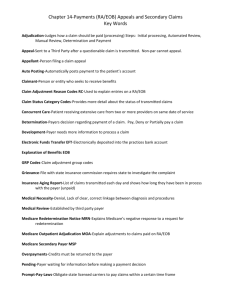

Many Important Parts

• Definitions – ensuring clarity

• Scope of covered (and non-covered) services

• Full capabilities of the provider, such as prevention/wellness

• Scope of license of providers

• Covered products (both Medicaid and commercial?)

• Compensation and payment processing

• Term, termination, post-termination, severability

• New AQCs are 3-5 year contracts

• UR/UM, QA, clinical coordination practices, guidelines and standards

(medical necessity)

• Privacy, reporting and recordkeeping

• Member eligibility, enrollment & disenrollment

• Procedures – negotiate greater MCO responsibility

• Verification (and risk of error) and effective date

20

Negotiation is a Key Part of Contracting

• The process of reaching

agreement that meets your

interests better than your

best “no deal” option

• “The art of letting the other

party have your way”

Daniele Vare

Good Deal

No Deal

Bad Deal

Many FACTORS affect your interest in and the shape of a deal,

such as price, timing, scope, operational considerations, value

perceptions, exclusivity, competitor impacts, territory/place, etc.

21

6. Structure and Manage for Success

• Build a Team - One person cannot handle all functions

• Business Development

• Developing and executing the strategy for the organization

• Leading growth and change

• Sales (and account services)

• Ensuring the growth plans of the organization are achieved by winning new

business, serving existing clients well and growing their business

• Marketing and Product Development

• Creating, communicating & delivering goods and services of value

• Producing the intelligence and research to support organizational strategy

• Shaping and conveying the brand of the organization to all stakeholders

• Public/Governmental Relations

• Maintaining good faith and reputation with communities & regulators

• Enables reactive capability, a “must have” when highly public

22

The Middle - Now I’m In. What Next?

Provide Account Management/Client

Services

• Ensure successful use of your services,

particularly start-up (model office & cut-over)

• Recommend new services or upgrades

• Maintain ongoing relationships with all key

decision makers

• Gain leads, references, service development

intelligence

• Develop and maintain account records

23

Other Account Management Practices

• Assign the right person for managing the client

and the business relationship

• Require project management skills/experience

• Require interpersonal skills necessary for

relationship building/management

• Document and operate by pre-defining expected

practices

• Make course corrections as necessary

• Raising and resolving problems

• Act on client problems

24

The End

• One view: there is no end, only the opportunity for

improvement

• How will you know when exit is the right next step?

• ACO headlines 7/16

• Seven Medicare Pioneer ACOs that didn't produce savings in the

first year … have told the CMS they will leave the Pioneer program

and enter the Medicare Shared Savings Program model, while

another two participants have indicated they will leave Medicare

ACO entirely

25

Questions & Discussion

Bill TenHoor

bill@tenhoor.com

© 2012 by Advocates for Human Potential –

Healthcare Solutions. All rights reserved. No part of

this document may be reproduced or transmitted in

any form or by any means, electronic, mechanical,

photocopying, recording, or otherwise, without prior

written permission of AHP.