AI Presentation Land - Atlanta Area Chapter

advertisement

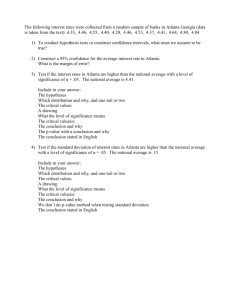

Welcome Members & Attendees Mastering Appraisal Fundamentals – Land (11:35 to 12:30 pm) Doug Main, MAI, CRE, Director, Deloitte Advisory "If you think it's hard to meet new people, try picking up the wrong golf ball.“ ~ Jack Lemmon Presenter: Doug Main, MAI, CRE, ASA, CRE, CCIM, CEC, SGA Director, Deloitte Advisory, Atlanta, GA • He has testified in District, State, Federal and Superior Courts, as well as in various mediation and arbitration venues, and has testified more than 50 times regarding damages, lost profit, bankruptcy, breach of contract, impact of detrimental conditions, construction defects, shareholder fraud, property tax, and other business disputes. • Managed and coordinated many complex, multi-disciplinary engagements in connection with mergers and acquisitions, litigation, reorganization, reporting, corporate financing, tax and estate planning, portfolio valuation, operational analysis, damage claims, investment and SOWT analyses, highest and best use analysis, financial & market studies, purchase price allocations, and site selection studies. • Geographic experience is national and international (e.g., Aruba, Australia, Bahamas, Brazil, Canada, China, France, Germany, Jamaica, Puerto Rico, Spain, Trinidad and Tobago, United Kingdom, etc.). • He has published and/or has been quoted in the New York Times, Time Magazine, The Washington Post, Los Angeles Business Journal, Korpacz Real Estate Investor Survey®, The Boardroom, San Diego Tribune, Baltimore Business Journal, Urban Land Institute, Crittenden's Resort Report/Golf Business & Real Estate, Atlanta Journal Constitution (AJC), and Merrill Lynch Waste Industry Research Report. Mr. Main was awarded Club Consultant of the Year by Boardroom Magazine and is a member of and the current Vice President of the Society of Golf Appraisers (SGA). • Speaker at various seminars and/or education sessions for the Counselor of Real Estate (CRE), Urban Land Institute (ULI), Appraisal Institute (AI), American Society of Appraisers (ASA), International Right of Way Association (IRWA), International Association of Assessing Officers (IAAO), and Continuing Legal Education (CLE) International. • He is a Certified Environmental Consultant (CEC) and his experience includes properties such as large acreage (10,00 acres +), subdivision, master panned communities, agri-business (e.g. crops, pastures, grain elevators, etc.), hospitality, MOBs, hospitals, casinos, commercial industrial, manufacture, waste management, mining, carbon credits, alternative energy business, wetlands, water rights, biofuel facilities, golf clubs, marinas, solar farms, co-generation facilities, intermodals, recycling facilities, wineries, hazardous facilities, waste to energy facilities, superfund sites, yacht clubs, tennis clubs, apartments, timeshares / intervals, lifestyle resorts and communities. Land Appraisal Fundamentals Piecing it Together Location, Location, Location Mind the Gap In economics, land is regarded as one of the four agents of production, along with labor, capital, and entrepreneurial coordination, and land provides the natural elements that contribute to a nation’s wealth. Trends Unemployment Rate June 2015 Month/Month Year/Year National 5.3% -0.2 -0.8 Georgia 6.1% -0.2 -1.2 Atlanta 5.8% -0.2 -1.3 Note: Metro level data is now seasonally adjusted.1 Atlanta-Sandy Springs-Roswell Unemployment Trends Source: BLS Recovery & Expansion – Challenges Remain Atlanta’s housing market: Positive Home Sales – In June, residential sales for Metro Atlanta rose 17.1 percent monthly (the best monthly increase since 2011) and 9.5 percent yearly to 5,492. Housing Inventory Balancing – Metro Atlanta’s housing inventory has been historically low for some time, but based on the latest numbers, the market may be turning a corner. In June, there were 16,680 homes for sale. That’s a 4.1-months supply and a 3 percent increase year-over-year. Moderating Home Prices – In June, median sales price was $238,000, a 3.9 percent increase from last year and a 0.8 percent decline from May. Average sales price, meanwhile, was $304,000, a 6.3 percent year-over-year increase and a 2.0 percent monthly increase. Some highlights - Metro Atlanta RE Market: • Listing inventory is up 49% from the bottom of February 2013. Inventory is up 5.3% from last month and basically flat compared to the same month last year. • Closings were up 4.9% from last month and up 12.3% from the same month last year. • Months of inventory are now 3.5 months based upon the latest closed sales trend. Six months supply is considered normal. • Buyer activity remains strong led by baby boomers and first-time buyers. At the same time, the pace of pre-foreclosures (notices of default) and foreclosures has slowed dramatically. • Resales and new homes are the majority of sales. • New Homes are making a significant comeback but that is also showing signs of leveling off as builders are having to pay higher prices for lots and other costs are rising. The spread of prices between new homes and resale is increasing which will benefit resale prices over time. Source: Metro Atlanta Case-Shiller Index Reported June 2015 What a change from a few years ago! Metro Atlanta Home Values are up 47.23% from the most recent low point of March 2012 according to the Case-Shiller Index. But remain down 10.95% from the peak of July 2007. The Story is… Source: LoopNet In Summary, Things Change… After Before 1991 Dubai, United Arab Emirates 2014 The Head Lines In FY 2015 alone, Georgia-lensed feature films and television productions generated an economic impact of $6 billion. Midtown moving South The Land Challenge How To Deal With Ambiguity: No “magic bullet” when it comes to valuing land. It can be a challenge, perhaps an impossible goal, to reach the point of 100% certainty. There is almost always a way to get reasonably comfortable with a “ballpark value” on a property… There are a number of reliable measurements you can use to get confident with the value of a prospective property. Land Banking What is Land Banking? The name implies almost exactly what it is, acquiring LAND to hold for future sale and/or development. Clearly not a new concept, and one that has ties with a passenger on the RMS Titanic… Land Banking (continued) We have all heard of the Titanic, and that fatal journey for 1,503 passengers, and one of them came from a family know for Land Banking in America. Can you guess which family, I am talking about? Hint: He was considered one of the riches men in the world at the time of the sinking of the Titanic. Answer: John Jacob "Jack" Astor IV (July 13, 1864 – April 15, 1912) Astor earned a prominent place in history when he died in the sinking of the Titanic in the early hours of April 15, 1912. Astor was among the 1,514 women, men and children on board who did not survive. He was the richest passenger aboard the Titanic and was thought to be among the richest people in the world at that time, with a fortune of about $150 million or about $3.5 billion today primarily from land banking and hotel ownership in Manhattan. What are they thinking… Ask the question, “how important will these factors be to the end buyer, developer, investor, etc….” • What is the zoning on this property? • How much inventory is available in the local market? • What are other, similar properties currently priced for in the near vicinity? • At first glance, how desirable is this property? • What kind of holdings costs are associated with this property? • Is there adequate road access to this property? (In other words, how easily can someone get to it?) • What is the size, shape & dimensions of the property? • How nearby (or remote) is this property to a major metropolitan area? • What do the adjoining properties look like? Is the property surrounded by farmland? forests? water? houses? blight? landfill? nuclear waste facility? • Is the property situated in a flood zone? If so, what impact will this have on the cost of flood insurance? and so on… Use Classification Land uses can be divided into any number of types, depending on market norms, etc. Traditionally, most appraisers have divided land uses into these major groups: Don’t Forget the Unit of Comparison • residential all types • Price per apartment unit • office • Price per guest room or key • retail • Price per bed • industrial • Price per playing court • mixed use • Price per pad • hospitality • Price per parking space • agricultural • Price per hole • various special use • Price per slip Golf Course • Price per linear foot Tennis and racquetball facilities • Price per acre Mobile home parks • Price per animal unit (pastureland) Parking Garage • Price per board foot (timberland) Landfills • Price per front foot Mines • Price per square foot Marinas • Price per buildable square foot Others • Price per tillable acre What is NIMBY? • Price per acre foot Market Analysis Be sure to identify the competitive differentials Market Indicators of Demand for Proposed Properties and Vacant Land • • • • • • • • • • • • • Area Examined Indicators of Demand Property-specific current and historical vacancy rates Current and historical rental rates Market area current and historical vacancy rates for existing competitive space Current and historical rental rates for existing competitive space Construction activity—competitive space Preleasing of planned space and space under construction Current condition and historical changes in fundamental forces of demand Macroeconomic area current and historical vacancy rates for existing property types Current and historical rental rates for existing property types Construction activity—property type Preleasing of planned space and space under construction Current condition and historical changes in fundamental forces: • Employment levels and foreclosure rates • Residential occupancy and foreclosure rates • Income levels and consumer spending Demand-Side Factors Residential Market • Population of the market area - size and number of households, rate of increase or decrease in household formation, composition, and age distribution • Income (mean or median per household and per capita) • Employment types and unemployment rate • Percentage of owners and renters • Land use patterns and directions of city and area growth and development • Factors affecting the physical appeal of the neighborhood, e.g., geography and geology (climate, topography, drainage, bedrock, and natural or man-made barriers) • Local tax structure and administration, assessed values, taxes, and special assessments • Externalities (noise, odors, etc.) • Others Retail Market… Office Market… Industrial Market… Supply-Side Factors • Quantity and quality of available competition (standing stock) • Volume of new construction (competitive and complementary)—projects in planning and under construction • Availability and price of vacant land • Availability of construction loans and financing • Costs of construction and development • Currently offered properties (existing and newly built) • Owner occupancy versus tenant occupancy • Causes and number of vacancies • Conversions to alternative uses • Special economic conditions and circumstances • Effect of building codes, zoning ordinances, and other regulations on construction volume and cost Testing Financial Feasibility The three techniques used to test financial feasibility involve the analysis of different measures of economic performance: • land residual analysis • feasibility rent • profitability index For any alternative use of vacant land, the cost of construction (including an estimate of entrepreneurial coordination) and the expected value of the specific property use should be known. The difference between those figures is the land residual, which is a primary indicator of financial feasibility. If the land residual is positive, the use is considered financially feasible Highest & Best Use Interim Use Excess & Surplus Land The valuation process essentially consists of determining the highest and best use for the land. The final estimate of highest and best use should be defensible, the logic internally consistent, and the conclusions well supported and documented by facts as well as opinions. Owners frequently have strong opinions of the highest and best use of their land. But emotional attachment, the original intent for purchase—even if it was bought 20 years ago—and misconceptions about the market can cloud an owner’s judgment. Development proposals therefore should be analyzed objectively. Many concepts come from architects or land planners and are focused more on design than economic issues. It is critical to consider the impact of value when evaluating each of these factors. Physical Factors - Physical factors play an important role in determining land use. The concept of HBU relates to what is done physically with real estate, and physical land use should not be confused with the motivation of owners or users. Regulatory and Legal Factors - legally permissible uses would conform to the land’s current zoning classification and local building codes along with any other relevant regulatory or contractual restrictions on land use. Financial Feasibility - narrows the number of legally permissible and physically possible uses down further through analysis of the economic characteristics of the potential alternative uses Maximum productivity – The remaining options are candidates for the test of maximum productivity, which is the final—and deciding—criteria for the highest and best use of both the land as though vacant and the property as improved. The selected highest and best use obviously should be supported by market demand, yet this is where most analyses fall short of support. The Valuation Process - Several valuation options exist, though some are less common than others. Revisiting Valuation Method Options Applicability and Limitations of Land Valuation Methods • Sales Comparison • Alternative Methods: • Market Extraction • Allocation • Income Capitalization Methods Direct Capitalization: Land Residual Method (land residual technique - A method of estimating land value in which the net operating income attributable to the land is capitalized to produce an indication of the land’s contribution to the total property.) Direct Capitalization: Ground Rent Capitalization Yield Capitalization: Subdivision Development Method (Discounted Cash Flow Analysis) Remember Market Extraction Importance of Timing Reconciliation – Stepping Back… Regarding land valuation: • How was land value estimated - e.g., by sales comparison, extraction, or allocation? • Is there an adequate number of sales? • Are the sales comparable? • Is there market support for the adjustments that were made? • Were those factors that could not be supported by quantitative adjustment dealt with adequately using qualitative analysis? • Is the range of adjusted sale or unit prices within the range exhibited in the market? Things I Like do… Linkage Location considers time-distance relationships, or linkages, between a property or neighborhood and all probable origins and destinations of residents coming to or going from the property or neighborhood. Location has both an environmental and an economic character. Time and distance are measures of relative access, which may be considered in terms of site ingress and egress, the characteristics of the areas through which traffic to and from the site passes, and transportation costs to and from the site. Things I Like do… Pictures worth a 1,000 words…. Things I Like do… (continued) Using technology to discover… • • • • County Assessor AgentPro247 Zillow, realtor.com, trulia.com, MLS, Reis.com, netronline.com, etc. Things I Like do… (continued) Q&A