- Rasjobs

advertisement

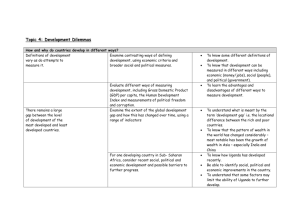

ERM- A Case Study AGENDA Client Background Introduction ERM- Business Drivers ERM - Approaches ERM- Implemented Lessons Learned Background- Client • A transnational BFSI BPO with operations in 6 countries and 8500 people with a turnover of 1.3 B $ • Has a software development centre to support its own insurance and broking software with 1000 professionals in 5 countries • Listed in UK, Need to comply with Turnbull recommendation • Grown via acquisition, creating a complex structure and risks too Client has risks spread in multiple countries with a challenge to manage and report at the Board level Accountability and responsibility for risks spread over different units in different countries was not clear There was no common process or framework for risk management Introduction Enterprise Risk Management is • A process, effected by an entity’s board of directors, management, and other personnel, applied in strategy setting and across the enterprise, designed to identify potential events that may affect the entity, and manage risks to be within its risk appetite, to provide reasonable assurance regarding the achievement of entity objectives [COSO Definition - ] Business Drivers • Client is a listed company and hence needs to adhere to the requirements of the Turnbull report and the Combined Code for corporate governance. • Compliance to various contractual requirement, standard requirement, continual improvement of internal controls within Client’s business drives the need for Risk Management. • Client had a Risk Register process as a method by which the key risks were being identified and the means of controlling these risks were clearly documented and monitored. It was bottom-up approach for identifying, documenting and managing risks. But it failed to get the required board attention due to non strategic in nature and was not broad based with scenarios inclusion Current State • Different businesses are managing risk differently with no visibility to the group’s objectives • Accountability and responsibility of the risk and its control was not very clear and defined • Potential risks were identified and managed on an ad hoc basis leading to a reactive approach and the potential for short-term solutions. • Risk awareness was low due to limited communication between management levels (Execs vs. Line Management) and across business/functional units. Risk is viewed as a negative topic and is not actively discussed. • Risk management activities were not prioritized and were not linked to strategy and/or the company’s sources of value Current State of Risk Management • Client has a process called as “Risk Register”, a bottom up approach to report, manage and monitor risks • Client’s risk register process is a structured process to ensure that key risks are identified, monitored, mitigated and – on an aggregated level and reported at each level of the organisation • Risk register creates an accurate representation of the risk profile to the business. It provide a framework through which the risks facing the business, and the means of controlling those risks, are clearly documented and monitored. • Risk register demonstrates the companies risk appetite by flagging those areas where controls can be improved further to mitigate these risk Risk Register- Explained in Detail 1. Group risk register contain the risks which are pervasive To the group as a whole and inventory risks which are material From the group perspective 2. The group risk register is derived from operating unit, sector Risk registers along with the input from XMB members and Group performance function heads 3. The Group Risk Register is approved by the XMB and the Group Board. Group Risk Register Regional Risk Register Entity Level Risk Register 1.The sector of regional risk register is compiled from al The operating unit risk registers which inventory all the risks That a sector as a whole faces 2. Along with the amalgamated operating unit risk register, the Sector heads draft risks which are applicable to the sector as a whole 3. The sector unit risk is approved by sector head 1. Each entity performs risk assessment in their own operating unit 2. Operating unit risk register documents key risks faced by The entity as well as procedures and controls in place to mitigate the risk 3. The operating unit risk is approved by operating unit head Risk Register- Example Performance Risk No function/com Risk Owner petency 1 Sales Head of Sales Risk Date Risk Source Raised Business Objective Head of Revenue to meet annual 8/12/2009 Sales objective of £xxx Inherent Risk Root Cause Economic conditions Lack of fast reaction to changing conditions 4 Description There is an operational risk that we will not meet our sales targets for the year for due to Downturn puts - external market conditions pressure on achieving - main target customer negatively sales and profit targets impacted by downturn There is a probable impact on Revenue and EBIT of £1 million and £200k Residual Risk Cons Likeli Risk equen hood (1ce (1-4) 16) (1-4) 4 Risk Title Mitigating Actions and Controls Increased SMT Meetings to focus 16 on both sales and cost Cons Likeli eque hood nce (1-4) (1-4) 4 3 Risk (1-16) 12 Embedded Assurance Future actions monitors/ Actio over mitigating for where Action Early n Due controls that residual scores Owner warning Date help to reduce are 8 or above indicators, if inherent risk of relevant 8 or above Monthly review with Group Finance team Monthly review Defined offerings Sales Collateral Monthly SC The ability to reporting person 11/30/ leverage the new Revenue and X 2009 regional structure's EBIT below customer base budget Challenges of Bottom Up Risk Register Process • Bottom up risk approach was not getting appropriately connected to board members due to its non-strategic nature and the way risk was being measured was not getting linked to company’s objective • It was difficult to run scenario’s to justify probability • There was no linkage to value • Client asked to create a better model. • Let’s see the top-down ONE Top-Down • In a typical top down risk management approach, the Senior Management (CxO), audit committee, and often the board members have the overall responsibility for assessing and managing risks • The benefit of the top down risk management is that there is a buy-in from Senior Management and risk is mitigated and perceived from the top • For top down Risk management to succeed, Management should have clear and measurable strategic objectives and then identify the risks to those objectives • Typically the risk to achieving the objectives are scenario based and depending on the probability of a scenario materializing and the impact it has on attainment of the objectives, controls are designed • Out of multiple risks and scenarios obtained from the risk management process, management prioritize the risk and then appropriately treat the risk Which one is Better • There is no right answer- Both the Bottom-up and Top-down approach has its own merits and limitations. • Top down approach works best to identify the strategic risks and risk scenarios while bottom up risk management approach works best for measuring and managing specific risks including operational risks • A good Enterprise Risk Management approach relies on both a topdown structure and bottom-up information, this combined approach also create a powerful synergy as it has Senior Management buy-in and risk ownership at the origin of the risks. • Client’s current risk register process is bottom-up approach and its STA (Strategy to Assurance) is its top-down approach, by this powerful combination, Client intend to create an excellent risk management framework Top-Down Approach- ERM Vision Strategy Vision is set by the Board Strategy is set by the Board and driven through the MC Enterprise Objectives Risk Risks Mitigating actions and controls Management Assurance Objectives are set by the Board, Regional and BU management and in individual PDRs. Reporting against objectives and resulting actions is governed through MD Significant risks are identified through top down STA, bottom up risk analysis and checked for completeness through risk hierarchy process. Mitigating actions are taken at Board, Region and BU level. Controls are identified and tested in the controls/compliance tool. Assurance is provided either to meet specific risks and associated objectives or as required by regulatory or compliance needs – as set out in the controls/compliance tool. ERM- Linkages to Strategy/BO Performanc e Risk function/co No mpetency/ global 1 Finance Risk Owner ABC Person Date who Strateg Risk identifie y Raised d risk XYZ Business Objective Risk Title Lean Maintain cost arbitrage Exchange Rate Process opportunity between or costs in US / UK / EMEA and India Risk Area Risk Type Foreign Exchange Financial Description Costs are in Indian Rupees while all revenue is in USD, GBP or Euros. Rates for converting of USD, GBP or Euros into INR impact the net profit realized as well as the effective cost of operations in USD, GBP or Euro terms. This impacts the cost differential available between the regions and India. Inherent Risk Root Causes Macro economic conditions and money supply. Risk owner of root causes (if not the risk owner) Residual Risk Likeliho od (1-4) Conseq uence (1-4) Risk (1-16) 3 4 12 Mitigating Actions and Controls Likelih ood (1-4) Conse quence (1-4) Risk (1-16) Draw up a FX management policy and take up sufficient forward covers / options to peg in foreign exchange rates at levels that we would be comfortable with. Give up some upside benefit, but minimize downside risk. 3 2 6 ERM- the COSO way Operating unit Region Risk assessment Client’s Group Control environment • Top of cube • Within the context of Client’s vision, management establishes strategic objectives and sets aligned objectives to cascade through the company. The ERM framework is geared to achieving client’s objectives, set out in four categories: • Strategic – high-level goals, aligned with and supporting its mission • Operations – effective and efficient use of its resources • Reporting – reliability of reporting • Compliance – Compliance with applicable laws and regulations • Facing side of cube • Client’s enterprise risk management consists of five interrelated components. These components are Control activities Information & communication Monitoring • • Control environment – “Controls and risk management tone” set by the Board - HR policies, ethical guidelines. Quality is a an example of a strong “tone”. • Risk assessment – how risks are analysed and managed eg risk register and risk summary report • Control activities – “hard” controls that address identified risks, such as IT application controls and bank reconciliations • Information and communication – the level and quality of communications, IT strategy and architecture • Monitoring – self assessments, PCQ, internal audit Side of cube • Control objectives should be at each business unit, region and group level – for example group delegated authorities should then be cascaded into a more detailed DA for each region and then each BU Benefits & Conclusion • Incorporate risk evaluation in decision making • Make informed risk aware decisions with respect to corporate objectives and its linkages • Strategic and operational risks, all identified and monitored • Responsibility and accountability clearly defined • Common understanding of risk across regions • Local regulation mapping was done for local assessment but not feasible for the same team to do it for every country as it needs expertise in legal and compliance advisory for local regulation (though mostly they are similar in nature but decoding is difficult sometimes) • Process is not easily repeatable across every industry • Going forward the plan is to use a automated tool for tracking and reporting