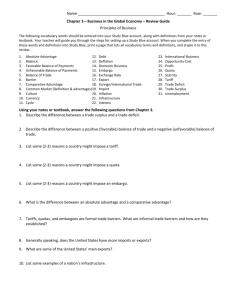

ESSAY QUESTIONS. Answer any 10, each question is 10 marks

advertisement

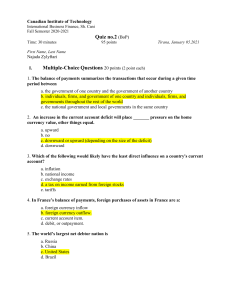

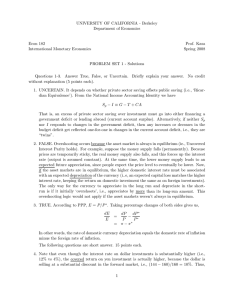

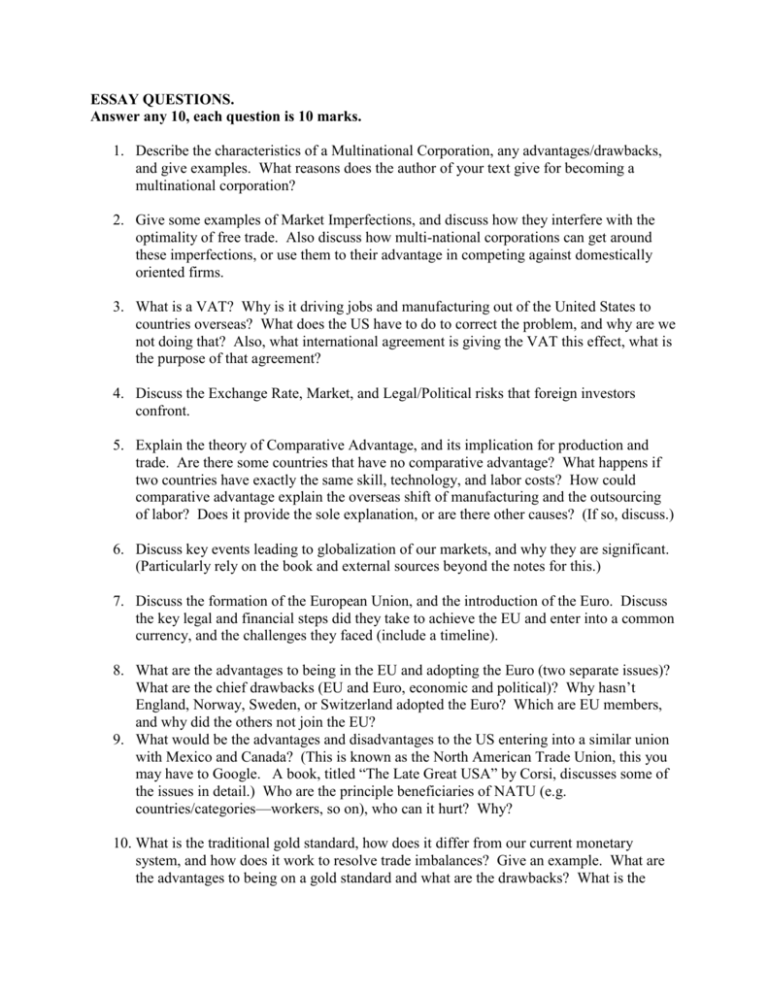

ESSAY QUESTIONS. Answer any 10, each question is 10 marks. 1. Describe the characteristics of a Multinational Corporation, any advantages/drawbacks, and give examples. What reasons does the author of your text give for becoming a multinational corporation? 2. Give some examples of Market Imperfections, and discuss how they interfere with the optimality of free trade. Also discuss how multi-national corporations can get around these imperfections, or use them to their advantage in competing against domestically oriented firms. 3. What is a VAT? Why is it driving jobs and manufacturing out of the United States to countries overseas? What does the US have to do to correct the problem, and why are we not doing that? Also, what international agreement is giving the VAT this effect, what is the purpose of that agreement? 4. Discuss the Exchange Rate, Market, and Legal/Political risks that foreign investors confront. 5. Explain the theory of Comparative Advantage, and its implication for production and trade. Are there some countries that have no comparative advantage? What happens if two countries have exactly the same skill, technology, and labor costs? How could comparative advantage explain the overseas shift of manufacturing and the outsourcing of labor? Does it provide the sole explanation, or are there other causes? (If so, discuss.) 6. Discuss key events leading to globalization of our markets, and why they are significant. (Particularly rely on the book and external sources beyond the notes for this.) 7. Discuss the formation of the European Union, and the introduction of the Euro. Discuss the key legal and financial steps did they take to achieve the EU and enter into a common currency, and the challenges they faced (include a timeline). 8. What are the advantages to being in the EU and adopting the Euro (two separate issues)? What are the chief drawbacks (EU and Euro, economic and political)? Why hasn’t England, Norway, Sweden, or Switzerland adopted the Euro? Which are EU members, and why did the others not join the EU? 9. What would be the advantages and disadvantages to the US entering into a similar union with Mexico and Canada? (This is known as the North American Trade Union, this you may have to Google. A book, titled “The Late Great USA” by Corsi, discusses some of the issues in detail.) Who are the principle beneficiaries of NATU (e.g. countries/categories—workers, so on), who can it hurt? Why? 10. What is the traditional gold standard, how does it differ from our current monetary system, and how does it work to resolve trade imbalances? Give an example. What are the advantages to being on a gold standard and what are the drawbacks? What is the implication for exchange rates (or the exchange rate system), when two nations are on a gold standard? 11. What was the difference between the traditional gold standard and the Bretton Woods (BW) system? Why did BW fail and when? When was BW put in place, and why was it created? What were the attempt(s) to revive the BW, what finally happened to exchange rates when it did fail? Why did they want BW to succeed, and what problems resulted after its failure? 12. List and explain the eight (or so) exchange rate arrangements. How do central banks enforce them (explain the mechanics of buying and selling)? In what two basic types can we classify each of these arrangements? What are the benefits and draw backs between these two types (explain the tradeoffs)? 13. What is the Balance of Payments (BOP), and what does it mean to have a surplus or deficit? Can you BOP deficit/surplus under fixed exchange rates? Floating rates? Explain how. What two primary accounts is the BOP composed of? What account does the book specify that I’ve left out, and why am I ignoring it? Explain what the two primary accounts are, and what having a surplus or deficit in these accounts implies. In which account will a deficit most likely lead to a depreciation of our currency if it is sustained over a long period of time? Why? 14. Explain using graphs and words the long-run effects of an increase in government spending (e.g. what it does to inflation, the rate of economic growth, and the amount of GDP/productivity that government consumes. Explain how this is similar to the public increasing its consumption (without increasing productivity) using graphs. Be sure to discuss what happens to Net Exports (NX). 15. Using those same graphs, explain why we grew so rapidly in the 90’s, and the problems we now confront. Also explain why our currency has devalued since 2001. 16. Explain what would happen (using graphs) if we were to suddenly find large new oil supplies in Alaska. Likewise, explain what would happen if terrorist attack destroy several of our oil terminals. Discuss what would happen to the US dollar visa vi other currencies following the attack. 17. Discuss the 2008 financial crisis, and chief contributing factors. What is the “Credit Crunch” the book discusses, explain exactly how it might lead to a recession, and why it does not fully explain the crisis. If we had not entered into a war, or had we cut other spending to offset its cost, would we be in a better position to handle the real estate crisis? Explain why. Explain how consumer spending has contributed to the crisis. 18. Discuss the Peso Crisis and Asian Crisis. What did they have in common, and how did they differ? Why did the Peso collapse? What two unique elements of the Peso Crisis are not normal to most currency crises? Discuss the common components of most crises (four), and what would be expected to occur under floating exchange rates given similar circumstances. 19. What is the Forex or FX market, how is that market organized (e.g. exchange etc.), who are the major participants, when and where does it operate, how is it managed, and in what major cities is it located and what regions do these hubs control? What is the trading volume of this market, and how is trading conducted? 20. Where are currency derivatives traded, and what financial entities predominate in their creation? If you wanted to find a job as a currency derivatives hedger working with major firms, where should you look?