US Organic Food Market Share

advertisement

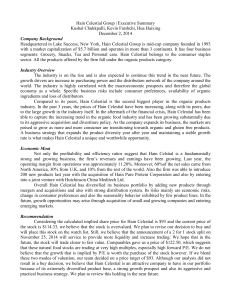

Kevin Farshchi Kushal Chukkapalli Hua Haixing December 2nd, 2014 Today’s Agenda Introduction Hain’s Business Macroeconomic Overview Industry Analysis Recent Stock Market Performance Financial Analysis Valuation Recommendation Introduction to Hain Hain Celestial Group produces, markets, distributes and sells organic and natural products under various brand names in the U.S, Canada and Europe Headquartered in Lake Success, New York Offers one of the strongest growth portfolios in the industry Some of the prominent brand names include Arrowhead Mills, Ella’s Kitchen, Avalon Organics and Earth’s Best Source: Page 2,Hain Celestial Annual report 2014 The Business Hain produces, markets, distributes and sells organic and natural products under various brand names in the U.S, Canada and Europe The firm sells to natural food distributors, supermarkets, natural food stores and other retail outlets Its business model includes acquiring natural/organic food and personal care companies or product lines Revenue drivers: mostly organic price premium, but also has the benefits of strong distribution networks and multitude of brands to increase quantity sold Business Segments Product Mix Grocery Products include infant formula, kids foods, rice, non-dairy beverages, cereals, pasta etc. Accounted for approximately 77% of net sales in 2014 5% Snacks Snack products include variety of potato, root vegetable, tortilla Grocery 6% Snacks Tea 12% chips, baked puffs, popcorn etc. Accounted for approximately 12% of net sales in 2014 Personal Care Tea Leading manufacturer and marketer of specialty teas. Include more than 70 varieties of herbal, green, wellness, white and chai teas. Accounted for approximately 5% of net sales in 2014 Personal care Cover a variety of personal care categories including skin, hair and oral care, deodorants, body washes, sunscreens etc. Source: Hain Celestial Annual report 2014, Page 4 77% Management CEO and founder Irwin Simon has continued confidence in the company’s ability to sustain high top line growth and maintain a business model involving strategic acquisitions By acquiring smaller companies, Hain is able to integrate new product lines and achieve economies of scale Historically, the companies that do not meet strategic or profitability targets are subject to divestitures Management is expecting 2015 to be another record year for top line growth, with estimates of 27-30% We are less optimistic than management Source: http://ir.hain-celestial.com/mobile.view?c=87078&v=203&d=1&id=1986645 Business Overview – Acquisition Strategies Target Main Market Main Products Year Tilda Limited UK Organic rice 2014 Rudi’s Bakery US Organic bread and baked goods 2014 Ella’s Kitchen UK Organic baby food 2013 UK Ambient UK Distribution channel in UK 2013 BluePrint US Natural cold-pressed juice 2013 • Quickly expanded through distribution channel right after acquisition to gain immediate revenue synergies • In Ella’s Kitchen deal, Hain got its US distribution within 30 days after the deal completed • Cost synergies – SG&A decrease as % of sales over year Source: http://www.just-food.com/analysis/hain-celestial-eyes-us-global-growth-with-tilda-acquisition_id125557.aspx Hain in the Organics Market GEOGRAPHIC SALES US Organic Food Market Share Pepci Co Danone Groupe U.S.A 0.30% Rest of World 0.50% Mondelez International 0.60% Starbucks 0.70% General Mills 14% 14% 1.70% Newman's Own 13% 11% 24% 30% 63% 59% 2013 2014 2.10% Organic Valley 2.20% Amy's Kitchen 2.20% Natural Path Foods 72% 3.00% Hain Celestial 4.70% Whitewave Foods 0.00% U.K 5.80% 1.00% 2.00% 3.00% 4.00% 5.00% Source:http://blogs.wsj.com/numbers/who-owns-what-in-organic-packaged-foods-1613/ 6.00% 7.00% 2012 Source: Hain Celestial Annual report 2014, Page 3 Macroeconomic Review Key catalysts: Consumer trends is clearly moving towards healthier & natural foods: CAGR of 14% from 2013-2018 Discretionary income continues to increase after the recession The success of organic & natural food products is really a shift from using discretionary income to using ordinary or “defensive” income on organic products The Organic Trade Association found that 81% of American Families reported purchasing organic food What is interesting is that just 18% of consumers are “power shoppers,” who account for over half of net sales This implies over 80% of consumers have not reached true purchasing potential (1) http://www.foodnavigator-usa.com/Markets/US-organic-food-market-to-grow-14-from-2013-18 Stable Sales Growth in US US Organic Sales 40.0 35.0 16.00% 14.90% 12.90% 12.00% 30.0 10.80% 25.0 25.0 20.1 20.0 15.0 11.80% 11.80% 27.9 31.5 35.1 11.43% 14.00% 12.00% 10.00% 22.3 8.00% 18.0 6.00% 10.0 4.00% 5.0 2.00% 0.0 Sales (bn USD) Growth Rate 2007 18.0 14.90% 2008 20.1 12.00% 2009 22.3 10.80% 2010 25.0 11.80% 2011 27.9 11.80% Source: http://www.organicnewsroom.com/2014/05/american_appetite_for_organic.html ,http://www.thepacker.com/fruit-vegetable-news/222580921.html 2012 31.5 12.90% 2013 35.1 11.43% 0.00% Industry Overview – Growth in UK • In 2013, sales of organic products in the UK grew by 2.8%, a decisive return to grow after four year of contraction since the 2008 financial crisis. • Stay tuned: we will see how successfully Hain captured this growth later on Source: Page 6, Organic Market Report 2014, Issued by Soil Association Industry Porter’s Five Forces Analysis Threat of new entrants (Low) • Mature industry • Entry of smaller players not that threatening Rivalry among existing firms (High) • Very competitive market, main competitors including Whitewave, Kelloge, General Mills, Mondelez International; Bargaining Power of Suppliers (Medium) • Suppliers are globally diversified • Rely on overseas suppliers Threat of Substitutes (Low) • Few true substitutes (organic) • A lot more inorganic substitutes Bargaining power of Consumers (Low) • Buyers are usually price takers in food industry Stock Market Performance Closing Price 12/1/2014 = $114.33 52 Week Range = $80.02-$115.68 Market Cap = 5.766 B Enterprise Value = 6.508 B Sector: Consumer Staples Imminent Stock Split Hain Celestial announced on November 25th, 2014 that stockholders approved a 2-for-1 stock split in the form of a 100% dividend Stockholders at the close of December 12, 2014 will receive an additional share of common stock for each share owned Investors will have twice as many shares at half the market price per share http://www.marketwatch.com/story/hain-celestial-announces-2-for-1-stock-split-2014-11-25 Key question: can we get a good rate of return at this price??? Huge price increase very recently We were long here SWOT Analysis Strengths • • • • S Rising demand for healthier food Strong Growth in UK market 2nd largest player in organic food industry Strong brand recognition with loyal customer base Weaknesses • High competition in the industry • Better established producers as new entrants to the organic market could decrease market share Opportunities Threats • Acquisitions: economies of scale & synergies • Emerging markets • Market consolidation • Consumers’ rise in • Adverse currency fluctuation • Uncertain R&D outcomes • Tightened spending would decrease demand for organic products • Product recalls 17 Recent Financial Performance 2015 Quarterly Earnings Highlights Revenue increased 35% Adjusted EPS increased 31% to $0.68 Sales in the UK increased 51% YoY Success of recent acquisitions: 23 brands had double digit revenue growth The sales increase primarily resulted from the acquisitions of HPPC in July 2014, Rudi’s in April 2014 and Tilda in January 2014, which collectively accounted for $131.6 million Markets reacted favorably to these numbers back in September Hain Celestial Form 10Q, Page 22-23 <http://ir.hain-celestial.com/mobile.view?c=87078&v=200&d=3&id=9888637> Financial Ratios Greenblatt Ratios Liquidity 2010 2011 2012 2013 2014 Current Ratio 2.26 2.17 2.21 2.10 1.89 Quick Ratio 1.13 1.17 1.29 1.19 1.14 2010 30% 1% EBIT/ Tangible assets EBIT/Enterprise value 2011 34% 2% 2012 38% 2% 2013 36% 3% 2014 35% 4% Solvency Debt/Assets Interest Coverage 2010 2011 2012 2013 2014 21.31% 18.36% 23.83% 29.63% 26.07% 9.17 9.92 10.31 10.00 10.00 Greenblatt Ratios 45% Profitability 40% 2010 2011 2012 2013 2014 27.75% 27.63% 26.38% 27.66% 27.66% ROA 6.61% 8.60% 8.36% 8.70% 7.95% ROE 10.34% 13.23% 14.50% 16.35% 14.56% Gross Margin 35% 30% 25% 20% Efficiency 15% 2010 2011 2012 2013 2014 A/R Turnover 7.78 8.73 8.99 8.67 8.26 10% A/P Turnover 6.86 8.51 9.15 7.72 7.15 5% Inventory Turnover 4.06 4.81 5.58 5.75 5.56 Days Sales Outstanding (DSO) 46.90 41.82 40.58 42.12 44.20 Days Payable Outstanding (DPO) 53.22 42.90 39.91 47.27 51.08 Days Inventory Outstanding (DIO) 89.88 75.86 65.46 63.48 65.66 Cash Conversion Cycle 83.56 74.78 66.13 58.32 58.78 0% 2010 2011 EBIT/ Tangible assets 2012 2013 EBIT/Enterprise value 2014 DuPont Analysis Dupont Analysis DuPont Analysis 100.00% 2.00 90.00% 1.80 80.00% 1.60 70.00% 1.40 2010 2011 2012 2013 2014 9.54% 10.05% 10.51% 11.09% 11.20% Interest Burden 88.46% 87.35% 89.09% 89.92% 90.30% 60.00% 1.20 Tax Burden 38.03% 56.48% 61.37% 66.29% 64.22% 50.00% 1.00 Asset Turnover 0.74 0.83 0.82 0.77 0.73 40.00% 0.80 Financial Leverage 1.56 1.54 1.74 1.88 1.83 30.00% 0.60 20.00% 0.40 10.00% 0.20 EBIT Margin ROE 3.73% 6.34% 8.21% 9.54% 8.64% 0.00% 0.00 2010 2011 2012 2013 EBIT Margin Interest Burden Tax Burden Asset Turnover Financial Leverage ROE 2014 Assumptions Revenue Growth COGS as a % of Sales SG&A/Sales Amortization of Goodwill & Intangibles Interest Expense/Operating Income Tax Rate Depreciation as a % of Net PP&E Capital Expenditures as a % of Revenue A/R as a % of Revenue Inventory as % of COGS A/P as % of COGS Current Scenario: Base Scenario FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 30.0% 27.0% 25.0% 20.0% 15.0% 72.3% 72.3% 72.3% 72.3% 72.3% 14.5% 14.5% 14.5% 14.5% 14.5% 0.5% 0.5% 0.5% 0.5% 0.5% 10.0% 10.0% 10.0% 10.0% 10.0% 33.5% 33.5% 33.5% 33.5% 33.5% 7.8% 7.8% 7.8% 7.8% 7.8% 1.4% 1.4% 1.4% 1.4% 1.4% 13.0% 13.0% 13.0% 13.0% 13.0% 21.0% 21.0% 21.0% 21.0% 21.0% 13.6% 13.6% 13.6% 13.6% 13.6% Discount Rate Calculation Cost of equity Rf Beta MRP E[R] Cost of Debt in Million USD Total Interest Expenses Current portion of long-term debt Long-term debt, less current portion Other noncurrent liabilities Total Amount of Financial Debt Cost of Debt 2.31% 0.381 7.00% 4.98% 23.4 100.096 767.827 5.02 872.943 2.68% WACC Calculation KE WE KD (After Tax) WD 15.42% 65.11% 1.78% 34.89% WACC Business Risk Premium 10.66% 0.50% Discount Rate 11.16% 1 Year Beta (weekly returns) 5 Year Beta Bloomberg 1 Year Beta 1.2 0.0 Realized Return YTD 0.3 Total Debt Total Common Equity Total Capital 867.9 1619.9 2487.8 Shares outstanding Current Price Total market value of equity 50.4 114.3 5757.1 34.9% 65.1% 100.0% Discounted Cash Flow Valuation FCF Build EBIT Plus: D&A Less: Taxes Less: Capex Less: Changes in NWC Unlevered FCF Terminal Growth Rate Discount Rate (WACC + premium) Terminal Value Discount Period (t) PV of FCF's Perpetuity Method 355.7 40.3 (107.2) (39.8) 7.3 241.7 451.7 44.3 (136.2) (50.6) 57.8 251.4 564.7 49.2 (170.2) (63.2) 68.0 312.5 677.6 55.1 (204.3) (75.9) 68.0 384.6 779.2 62.0 (234.9) (87.2) 61.2 457.8 $779.22 62.0 (234.9) (87.2) 0.0 519.0 3.0% 11.16% 5,778.27` 1 217.43 2 203.49 2 252.86 4 251.89 5 269.74 PV of Terminal Enterprise PV of FCF's Value Value Net Debt Equity Value 1,195.41 3,404.31 4,599.73 3,850.53 749.2 Shares 48.88 $/Share $78.78 Current Scenario: Base Scenario Discount Rate Sensitivity Sensitivity Analysis Discount Rate Terminal Growth Rate 78.78 10.66% 10.91% 11.16% 11.4100% 11.66% 2.50% 80.37 77.32 74.46 71.76 69.20 2.75% 82.79 79.58 76.56 73.73 71.05 3.00% 85.36 81.98 78.80 75.81 73.00 3.25% 88.11 84.53 81.18 78.03 75.07 3.50% 91.06 87.26 83.71 80.38 77.27 Trading Comparables Valuation US Organic Food Market Share Pepci Co Danone Groupe Mondelez International Starbucks WhiteWave Foods is the only 0.30% real comparable company to Hain Hain has lower sales but better margin compared with its peers 0.50% 0.60% 0.70% General Mills 1.70% Newman's Own 2.10% Organic Valley 2.20% Amy's Kitchen 2.20% Natural Path Foods 3.00% Hain Celestial 4.70% Whitewave Foods 0.00% 5.80% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% Trading Comparables Valuation Company Name General Mills, Inc. Mondelez International, Inc. The WhiteWave Foods Company Weight TEV/Total Revenue 0.1 2.3x 0.2 2.3x 0.7 2.4x LTM NTM TEV/EBITDA TEV/EBIT P/Diluted EPS TEV/Forward Total TEV/Forward Forward P/E Before Extra Revenue EBITDA 12.1x 14.6x 19.4x 2.3x 11.6x 17.8x 15.4x 19.2x 36.9x 2.4x 14.4x 21.9x 21.3x 29.8x 51.4x 2.1x 16.1x 33.6x LTM NTM TEV/Total TEV/EBITDA TEV/EBIT P/Diluted EPS TEV/Forward Total TEV/Forward Forward P/E Revenue Before Extra Revenue EBITDA Intrinsic Value/Share $ 89.10 $ based on Weighted Average Multiples Intrinsic Value/Share $ 90.42 $ based on WhiteWave's Multiples 98.32 $113.80 $ 129.56 $ 98.57 $ 104.78 $ 119.18 110.75 $131.77 $ 147.00 $ 94.13 $ 110.94 $ 134.89 Focus on EV/EBITDA & P/E ratio 50/50 Highest TP/Lowest TP: $122.5 Football Field Blended Price Target of $93 Comps DCF $40 $50 $60 $70 $80 $90 $100 $110 $120 $130