Equity Investments (significant Influence)

advertisement

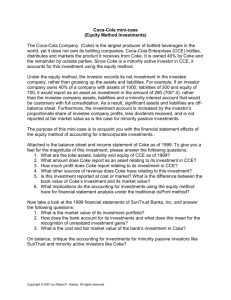

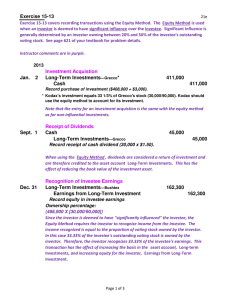

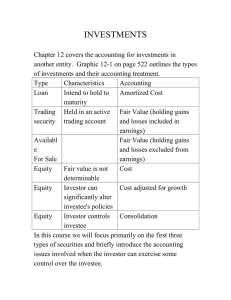

Equity Investments (significant Influence) When a company can exert significant influence over another, the equity securities it owns of that company must be accounted for using the Equity Method. Significant influence is usually believed to result if the company owns in excess of 20-25% of the outstanding shares of the other company. Under this method of accounting, we Record dividends as a return of investment (credit investment account), rather than as income Report income (and increase investment account) equal to percentage ownership in earnings of investee company. The investment account, thus, rises (falls) with those events that increase (decrease) retained earnings of investee company Here is an example from the annual report of Coca-Cola: Coke accounts for its investments in its bottling companies using the equity method. Details relating to this investment are found it the notes: Coke owns 40% of CocaCola Enterprises book value is $2,924. The investment would be on Coke’s books for $1169.6b (40% * $2.9b) were it not for the fact that Coke paid less than book value for the company (negative goodwill) that is also reflected in its investment account. One point to remember – investments accounted for under the equity method are not marked-to-market like passive investments discussed earlier. They are reported at cost, adjusted for dividends and the proportionate share of investee company earnings. As a result, there can be a significant amount of unrealized gains or losses as the following note illustrates: There is an unrealized gain of $2.7 billion relating to this investment. This will not be reflected in Coke’s income and stockholder’s equity until the investment is sold.