the Social Structure of Accumulation (SSA)

advertisement

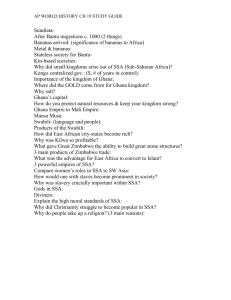

The Crisis of Contemporary Capitalism: the Social Structure of Accumulation (SSA) Perspective Michael Reich University of California at Berkeley mreich@econ.berkeley.edu SASE Conference, Paris July 17, 2009 Outline • Introduction to Social Structure of Accumulation Theory • The Contemporary Social Structure of Accumulation • The Current Economic Crisis and SSA Theory SSA theory was developed beginning in the 1970s to analyze changes in the U.S. It has been applied to numerous countries. Book-length treatments include: • David M. Gordon, Richard Edwards and Michael Reich, Segmented Work, Divided Workers: Historical Transformations of Labor in the United States (1982, reissued 2009). • Samuel Bowles, David M. Gordon and Thomas E. Weisskopf, Beyond the Waste Land (1984) and After the Waste Land (1989, reissued 1999). • Robert Helibroner, The Nature and Logic of Capitalism (1985). • David Kotz, Terrence McDonough and Michael Reich eds. Social Structures of Accumulation: the Political Economy of Growth and Crisis (1994). • Terrence McDonough, Michael Reich and David Kotz, eds. Contemporary Capitalism and Its Crises: Social Structure of Accumulation Theory for the 21st Century (forthcoming, Winter 2010). SSA Theory • An SSA-- the institutional framework in which capitalism operates in specific times and places. • SSAs undergo long-swing periods of stability and growth, of about 20 to 25 years, followed by similarly long periods of instability and slow growth. • Capitalism thus undergoes periodic crises that require major restructurings of the institutions that make up the system. These cqn be called systemic crises. • A new SSA emerges only after a realignment of political coalitions. • It takes considerable experimentation with new institutions and political contestation before a coalition emerges that is both politically dominant and that has developed new institutions that will be successful economically. . SSA Theory (continued) • To be successful economically, the new dominant coalition must create a new ensemble of institutions that are coherent, that can recreate stability, and that deliver improved economic outcomes for at least some of the groups that are included in the new coalition. • Once in place, a particular set of institutions is successful for a long period. But long-term commitments and vested interests prevent gradual changes to a new model. • The SSA then becomes stressed by accumulating economic and political problems, ushering in a new systemic crisis. Examples of Systemic Crises • The Depression of the1890s, resolved politically by the election of 1896 and economically by the merger wave of 1897-1903, the creation of the Federal Reserve system in 1913 and the defeat of industrial labor strikes after WWI. • The Great Depression, 1929-1941, resolved politically in 1932 and economically by the New Deal, Keynesian economics (WWII and after), a limited capital-labor accord and the welfare state. • Stagflation in the 1970s, resolved politically by the election of 1980 and economically by attacks on labor, tax cuts and deregulationist policies, especially in finance. • In each crisis period a substantial period of experimentation with new institutions preceded the consolidation of a new SSA. • Is the crisis that began in late 2007 a systemic crisis? Main institutions that make up an SSA • Capital-labor relations, including the organization of work, labor-management relations, and sources of labor supply. • Capital-capital relations, including forms of competition and corporate governance. • Financial institutions • Government’s role • International relations and institutions • Dominant political coalition Political coalition dynamics in SSAs • In new SSAs, the newly dominant political coalition, whether conservative or liberal, at first includes the center. Over time, politics tend to tilt in one direction and to exclude the center. This overreach leads to conflict with economic growth, and a crisis of the SSA. 1896-1932: Center-right coalition of industry and urban workers and professionals against agrarian interests. Gave way to an unchecked industry-finance alliance against workers and farmers, which then led to the Great Depression. 1932-1968: Governing alliance a liberal-center coalition of some elements of business, labor and Southern Democrats. Gave way by early 1970s to a liberal-left (moderate Democrats and McGovern Democrats) coalition that collapsed by 1980. 1980-2008(?): Governing alliance a right-center coalition (Republicans plus Reagan Democrats) in the Reagan era (especially after 1984) and continues to be dominant in Clinton years. Gives way in Bush era to right-far right coalition. SSA theory compared with Regulation Theory and to the Varieties of Capitalism School. • SSA theory rooted in relating SSAs to observed long swings in economic activity. And to understanding historically specific institutions of each period, each crisis is different. Institutional change is concentrated in crisis periods. • Regulation Theory: Developed at same time. Some overlap– e.g., Bowles and Boyer (1988). SSA concept is similar to combination of regimes of accumulation and modes of accumulation. Recent RT placing more emphasis on historical contingency, thus converging to SSA approach. • VoC: Similar concepts: social system of production, complementarities among institutions, possibility of co-existing models: LMEs, CMEs. VoC has greater attention to comparative analysis. VoC beginning to develop analyses of institutional change. Institutions of the Contemporary SSA Capital-labor relations • Decline of private sector unions • Productivity growth without wage growth, except among highlyeducated and top 1 per cent. • New technology and work organization based on IT and labor flexibility. • Resegmented labor– expanded low-wage labor segment in services. • Institutionalized through low minimum wage rates, temporary labor contracts (Europe) and growth of immigration (IRCA 1986). Capital-capital relations • Intense competition replaces stable postwar oligopolies: deregulation, globalization, technological change. • New governance: “financial managerialism.” Managers protected from shareholder initiatives and hostile takeovers. With new IT can better run global enterprises. New norms for CEO pay and incentive mechanisms. Institutions of the Contemporary SSA (continued) Finance • New financial instruments, securitization of home loans, derivatives, hedge funds, etc… • Reversal of Glass-Steagall and greater role of large banks. • Expansion of finance without creation of a separate financier or rentier class. Alliance of finance with managerial class Government • Reduced role for fiscal policy. • Greater role for monetary policy and central bank. • Growing role of money in campaign finance. • Deregulation in transportation and communication. Institutions of the Contemporary SSA (continued) International relations • End of Soviet system; U.S. the only military superpower. • Liberalization of trade, capital flows and greater role of private financial institutions: trade openness and financial globalization. • Plaza Accord of 1985, Bretton Woods II and sustained capital inflows to U.S., especially from Asia. Growth path of the Contemporary SSA • Reagan era did constitute a period of consolidation of a new SSA, based on the “end of the age of big government.” • This SSA has been enormously successful, but only for the very rich. Since 1985 real post-tax incomes quintupled for top 0.01 percent in the U.S. • Living standards in U.S. declined for the bottom 40 percent, stagnated for the next forty percent, increased somewhat among top fifth. Living standards for all but the top five percent at increased risk in the Bush era. Growth path (continued) •Declining profit rate trend reverses around 1985 and rises until 2006, then starts to fall. •Growth is slower than in previous SSA, but recessions are shorter and milder. Growth of top incomes leads to growing luxury consumption and to investment in financial instruments, to detriment of growth in real investment. •Inflows of capital from rest of world support growth of financial instruments, including to support consumption based upon debt. •Since late 1990s, growth of consumer debt to finance consumption growth without wage growth. Consumption increases from about 65 % to about 72% of GDP. Deregulation of finance, collapse of housing bubble and current crash • Unsustainable growth of housing bubble. • Reveals 30:1 leverage ratios in finance and new type of financial crisis. • In 2007, business cycle phase is synchronized globally (as in period before 74-75 crisis), so downturn is also synchronized globally. • These all lead to faster downturn than in 1929, and signal long crisis, not just a short-term deep recession. • Role of Fed and stimulus package: prevented total meltdown, but not enough to create long-term stability and growth. A Systemic Crisis of the Contemporary SSA? • Consumption boom based on spending of super-rich is unstable and inhibits savings and investment. • Weakness of investment and growth because “looting” and financial investments brought higher returns. • Long-term decline in skill base, productivity edge and public infrastructure. • Growth of unsocialized health and pension costs. • Growing current account deficit and potential rapid decline of the dollar. Prospects for a New SSA • In 2008, Obama articulated a vision for a new growth model and a path toward institutional reform. He has begun to take some steps down that path. • But a new coalition and path for growth have not yet emerged. SSA approach suggests it will take some time to build a new SSA. There are two competing visions and coalitions. • A liberal corporatist model, in which labor remains weak and big business, including finance, dominates the path of reform. Liberal corporatist SSA? • Some regulation of finance, limited reduction of income inequality through new but soft rules on CEO compensation, higher taxes at the top, higher minimum wage. • These will not suffice to generate a new investment boom, nor to reconnect wages and productivity. So consumption demand will remain limited. Net export growth is not likely to grow to the scale needed for robust growth of aggregate demand. • Fiscal policy therefore needed to maintain aggregate demand: . increased military and security spending, investments in and reform of health care, energy efficiency and conservation (for climate change and to reduce balance of payments deficit), education and physical infrastructure. • Would this be a coherent new SSA? Only if it regulates finance sufficiently to prevent the return of even bigger financial bubbles. Return of such bubbles seems likely, especially since there is little agreement on reform of the international financial system. A Social Democratic SSA in the U.S.? • A new Social Democratic compromise would change institutions so that wages (including the social wage) are reconnected to productivity growth. • Requires much stricter limits on CEO compensation, revival of labor, and an indexed minimum wage • As well as stricter financial regulation, including internationally. • Would involve a greater tilt toward social spending on health, education, environment and infrastructure. • Would it be coherent? Yes, but its prospects are still unclear. It will take more contestation and time to emerge.