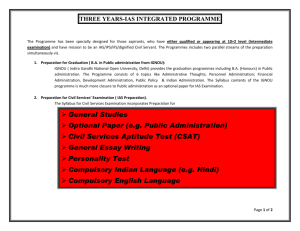

File - LPS Business DEPT

advertisement

Role and Formation of Financial Accounting Standards Mr. Barry A-level Accounting Year13 Outline • The Regulatory System of Accounting • Why accounting standards are required • Harmonisation of Standards (UK + International) • International Accounting Standards Board (IASB) • List of IAS / IFRS • US GAAP • IASB Framework (within which new standards are formulated) Mr. Barry A-level Accounting Year13 THE REGULATORY SYSTEM OF ACCOUNTING • Limited Liability companies most affected. • Local / National legislation • Accounting concepts (acctg assumptions /conventions) & individual judgement (eg value of property) • Accounting standards (national and intern’l) • Other International influences (EU, UN, World Bank, Stock Exchanges etc) • Generally accepted accounting practices (GAAP) • True and Fair View Mr. Barry A-level Accounting Year13 WHY THERE IS A NEED FOR MANDATORY STANDARDS Mandatory standards needed to define the way in which accounting numbers are presented in financial statements. Aim is that their measurement and presentation are less subjective. Until the 1960s thought that the accountancy profession could obtain uniformity of disclosure by persuasion BUT difficult to resist management pressures. During the 1960s confidence in the accountancy profession lost when internationally known UK-based companies were seen to have published financial data that were materially incorrect. Mr. Barry A-level Accounting Year13 Creative accounting Companies try and show their financial statements in the best possible light to attract potential investors or avoid paying taxation Accounting standards help minimise this unethical practice and allows sufficient comparability of financial statements between years and companies Mr. Barry A-level Accounting Year13 INTERNATIONAL ACCOUNTING STANDARDS BOARDS (IASB) It uses a framework that deals with: • The objective of financial statements, to provide information about the financial position, performance and changes that are useful to users • Qualities that financial information should have for it to be useful • Definitions of the elements of its financial statements and their recognition and measurement Mr. Barry A-level Accounting Year13 DIFFERENT SET OF TERMS 1. Ireland and UK standards – First SSAP : Statements of standard accounting practice – FRS : Financial reporting standards 2. International Standards – IAS : International accounting standards – IFRS : International financial reporting standards 3. US Standards – Mr. Barry US GAAP (Generally accepted accounting practices) A-level Accounting Year13 TWO APPROACHES TO REDUCE NATIONAL DIFFERENCES • Standardisation approach – Rules to account for similar items in all countries • Harmonisation approach – Allows for some different national approaches – Provides a common framework • Benefit from reducing national differences – Reduces training costs for profession – Permits greater comparability Mr. Barry A-level Accounting Year13 INTERNATIONAL BODIES STANDARDISING AND HARMONISING • IASC – IASs – IFRSs • European Union – Directives – Adopting IASs • IOSCO (International organisation of securities commissions – represent securities markets regulators) Mr. Barry A-level Accounting Year13 IASB • International Accounting Standards Board (IASB) • Independent ,privately funded Accounting Standard setter based in London • IASC (IAS Committee) based in USA • IASB – 14 members from 9 different countries. Auditors, preparers of Fin Stmts, users of F.Stmts and an Academic Mr. Barry A-level Accounting Year13 OBJECTIVES OF IASB • To develop IAS (International accounting Standards) – a single set of high quality, understandable and enforceable global accounting standards that require transparent and comparable information – to promote the application and use of those Standards • To co-operate with national accounting standard setters to achieve convergence in acc stds around the world Mr. Barry A-level Accounting Year13 STRUCTURE OF IASB • IASC : appoint IASB members, raise funds • IASB : set accounting stds (IAS) • Standards Advisory Council (advise IASc and IASB) • International financial reporting interpretations Committee. (Advise on IFRS - International Financial Reporting standards) Mr. Barry A-level Accounting Year13 PROCEDURE WHEN SETTING NEW STANDARD 1. Issue arises and Advisory board is consulted 2. IASB develops and publishes a “discussion document”, to get feedback from members of profession and public. 3. IASB reviews comments. Publishes an Exposure Draft for public comment 4. IASB reviews comments on the ED and finally issues a new IFRS. Whole process can take time ! Mr. Barry A-level Accounting Year13 IAS Relevant UK standard(s) IAS 2 Inventories SSAP 9 Stocks and long-term contracts IAS 7 Cash Flow Statements FRS 1 Cash flow statements Under IAS 7, the statement must report change in cash and cash equivalents (rather than cash, as in FRS 1). IAS 8 Accounting policies, changes in accounting estimates and errors FRS 18 Accounting policies FRS 3 Reporting financial performance Under IAS 8, all material errors must be adjusted for (FRS 3 only requires restatement for fundamental errors). IAS 10 Events after the balance sheet date FRS 21 Accounting for post balance sheet events FRS 21 issued in May 2004 (apart from the exemption for entities applying the FRSSE) implements IAS 10. Mr. Barry Effect of any substantial differences A-level Accounting Year13 IAS Relevant UK standard(s) IAS 11 Construction contracts SSAP 9 Stocks and long-term contracts IAS 12 Income taxes FRS 16 Current tax FRS 19 Deferred tax Under IAS 12, deferred tax must be recognised on all liabilities, including gains on revaluation (not required under FRS 19). IAS 14 Segment reporting SSAP 25 Segmental reporting IAS 14 additionally (to SSAP 25) requires separate identification of segments with different risks, returns or expectations. IAS 16 Property, plant and equipment FRS 15 Tangible fixed assets Under IAS 16, fair values must be used where one asset is obtained in exchange for another. The depreciation charge for each year has to reflect any increase in assets’ residual value ascertained at the balance sheet date. (Under FRS 15 increases in residual value are generally reflected in profits on disposal in the final year of the assets’ lives rather than in reduced depreciation.) Mr. Barry Effect of any substantial differences A-level Accounting Year13 IAS Relevant UK standard(s) Effect of any substantial differences IAS 17 Leases SSAP 21 Accounting for leases and hire purchase contracts Under IAS 17, leases of land and buildings are split into one operating lease for the land and another lease (finance or operating, depending on the terms) for the buildings. (Under SSAP 21 long-term property leases are generally treated as operating leases.) IAS 17 requires disclosure of total minimum lease payments (rather than SSAP 21’s requirements of commitments within one year). IAS 18 Revenue SSAP 9 Stocks and longterm contracts IAS 19 Employee benefits FRS 17 Retirement benefits Mr. Barry Some differences in detail of measurement approach. ‘Corridor’ approach to recognising actuarial gains and losses in IAS 19 means that recognition may be deferred. A-level Accounting Year13 IAS Relevant UK standard(s) IAS 20 Accounting for government grants and disclosure of government assistance SSAP 4 Accounting for government grants IAS 21 The effects of changes in foreign exchange rates FRS 23 The effects of changes in foreign exchange rates IAS 23 Borrowing costs FRS 15 Tangible fixed assets IAS 24 Related party disclosures FRS 8 Related party disclosures IAS 26 Accounting and reporting by retirement benefit plans SORP Financial reports of pension schemes Mr. Barry Effect of any substantial differences FRS 23 issued in December 2004 implements IAS 21 Related party transactions must be disclosed by type of related party, but names do not have to be given under IAS 24. There is no exemption equivalent to that in FRS 8 for intra-group transactions with 90% subsidiaries whose accounts are publicly available. A-level Accounting Year13 Relevant UK standard(s) Effect of any substantial differences IAS 27 Consolidated and separate financial statements FRS 2 Accounting for subsidiary undertakings Profits should be recognised in the P&L. IAS 28 Investments in associates FRS 9 Associates and joint ventures IAS 28 requires a parent to recognise only the obligations or payments made on behalf of a loss making associate. This is a stricter definition of when liabilities should be recognised than under FRS 9. IAS 29 Financial reporting in hyperinflationary economies FRS 24 Financial reporting in hyperinflationary economies FRS 24 issued in December 2004 implements IAS 29. Mr. Barry M.Ronan IAS A-level Accounting Year13 IAS Relevant UK standard(s) Effect of any substantial differences IAS 31 Interests in joint ventures FRS 9 Associates and joint ventures Proportionate consolidation of joint ventures (prohibited by FRS 9) is the benchmark treatment under IAS 31. IAS 32 Financial instruments: Disclosure and Presentation FRS 25 Financial Instruments: Disclosure and Presentation FRS 25 also has the effect of withdrawing FRS 4 ‘Capital Instruments’, except for material on the measurement of debt and gains and losses on the repurchase of debt. This material is withdrawn for entities applying the measurement requirements in FRS 26, but remains applicable for other entities. IAS 33 Earnings per share FRS 22 Earnings per share FRS 22 issued in December 2004 implements IAS 33. IAS 34 Interim financial reporting ASB statement on interim financial reporting Mr. Barry A-level Accounting Year13 IAS Relevant UK standard(s) IAS 36 Impairment of assets FRS 11 Impairment of fixed assets and goodwill IAS 37 Provisions, contingent liabilities and contingent assets FRS 12 Provisions, contingent liabilities and contingent assets Definitions in IAS 37 are more strictly associated with definite legal obligations. IAS 38 Intangible assets FRS 10 Goodwill and intangible assets SSAP 13 Accounting for research and development Under IAS 38, goodwill can stay on the balance sheet indefinitely (subject to impairment reviews) whereas FRS 10 has a rebuttable presumption of a maximum life of 20 years. Rules for capitalising research and development expenditure differ – more will be capitalised under IAS 38. IAS 39 Financial instruments: recognition and measurement FRS 26 Financial Instruments: Measurement FRS 26 issued in December 2004 implements the measurement and hedge accounting requirements of IAS 39. Mr. Barry Effect of any substantial differences A-level Accounting Year13 IAS Relevant UK standard(s) Effect of any substantial differences IAS 40 Investment property SSAP 19 Accounting for investment properties Under IAS 40, companies can choose between depreciated cost and fair value (with gains or losses going through the income statement). In contrast, SSAP 19 requires market value with gains and losses going through STRGL. Leased investment properties on leases can be accounted for as investment properties under IAS 40 and the present value of the minimum lease payments is recognised as a separate liability at the start of the lease. IAS 41 Agriculture No equivalent standard No equivalent standard Financial reporting standard for smaller entities (FRSSE) Mr. Barry Companies claiming compliance with IFRS must follow all standards in full, regardless of their size. A-level Accounting Year13 What we need to know!! IAS 2 Inventories IAS 7 Statement of Cash flows IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors IAS 10 Events After the Reporting Period IAS 16 Property, Plant and Equipment IAS 18 Revenue IAS 36 Impairment of Assets IAS 37 Provisions, Contingent Liabilities and Contingent Assets IAS 38 Intangible Assets Mr. Barry A-level Accounting Year13 IAS 1 Presentation of Financial Statements Overall requirements for the presentation of financial statements Mr. Barry A-level Accounting Year13 IAS 1 Presentation of Financial Statements • “Sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content…” • The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows. Mr. Barry A-level Accounting Year 12 IAS1 Context Mr. Barry A-level Accounting Year 12 • Prudence convention – Recognise revenues only when they are realised – Recognise expenses as soon as they are known even if they have not yet actually incurred. • Matching convention – Provides guidance concerning the recognition of expenses – Expenses should be matched to the revenues that they helped to generate (i.e. expenses must be taken into account in the same income statement in which the associated sale is recognised). Mr. Barry A-level Accounting Year13 Matching convention and the recognition of expenses When the amount paid during the year is more than the full expense for the period When the expense for the period is more than the cash paid during the period PREPAID EXPENSE ACCRUED EXPENSE 27 Mr. Barry A-level Accounting Year13 Format of the balance sheet recommended by IAS 1 • Assets – Definition – Economic resources that are controlled by an enterprise and whose cost can be objectively measured: • An asset is acquired in a transaction • An asset is an economic resource as it provides future benefits to the enterprise • The resource is controlled by the enterprise • Its cost (or fair value) at the time of acquisition is objectively measurable. Mr. Barry A-level Accounting Year13 Format of the balance sheet recommended by IAS 1 • Assets – Classification – Non-current assets are held with the intention of being used to generate wealth rather than being held for resale. – Current assets are • not held on a continuing basis. • They are held primarily for trading purposes • They are expected to be converted to cash at some future point in time in the normal course of trading (normal operating cycle). • If any portion of an asset / liability is to be settled or recovered after more than 12 months – then must disclose separately Mr. Barry A-level Accounting Year13 Format of the balance sheet recommended by IAS 1 • Liabilities – Definition – Present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow from the enterprise of resources embodying economic benefits Mr. Barry A-level Accounting Year13 Format of the balance sheet recommended by IAS 1 • Liabilities – Classification – Non-current liabilities represent those amounts due to other parties that are not liable for repayment within the twelve-month period following the B/S date (i.e.bank loan) – Current liabilities represent amounts due for repayment to third parties within 12 months of the B/S date (i.e. bank overdraft, trade payables, etc.), • They are expected to be settled within normal operating cycle. • They are held primarily for trading purposes. Mr. Barry A-level Accounting Year13 Format of the balance sheet recommended by IAS 1 • Equity – Amount of finance owners have provided to the enterprise – The equity section of a balance sheet normally contains: • Issued capital • Reserves • Retained earnings. • IAS 1 Specific disclosure requirements re Share Capital. Mr. Barry A-level Accounting Year13 Published Accounts • Regulated by the Companies Act 1985, amended 1989 and 2006 and IAS 1 • Annual returns must be completed and filed with the Registrar and kept at Companies House in Cardiff • Published accounts are used by shareholders and potential investors to allow them to make decisions Mr. Barry A-level Accounting Year13