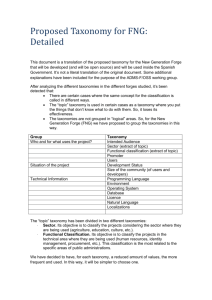

The new taxonomies

advertisement

New UK Accounts Taxonomies - Overview Peter Calvert XBRL UK – ICAEW Seminar – 19 May 2014 Why new taxonomies? New accounting regulations Improvements in the light of experience New requirements for XBRL tagging New ownership and organisational structure behind the taxonomies The new taxonomies Full IFRS for UK companies FRS 101 (reduced disclosure framework) FRS 102 (Financial Reporting Standard for UK and Ireland) Application of the standards Similarities and differences The development project Development team under FRC auspices – Accounting specialists – Taxonomy developer and coordinator – FRC project manager Technical infrastructure Oversight: – Governance Committee; Technical Task Force; Closed User Group review Timescales: March 2013 – Sept 2014 What happens next? Public review of the taxonomies began on 8 May and will last for two months Ends Tuesday, 8 July 2014 Feedback via comment letter or via ‘Yeti’ What happens next? Public review of the taxonomies began on 8 May and will last for two months Ends Tuesday, 8 July 2014 Feedback via comment letter or via ‘Yeti’ Complete taxonomies in light of feedback Release with supporting documents by or before September 2014 Implementation Aims and requirements General aims: – Accurate, clear – Cover data which is useful for analysis, comparison and review by consumers – Easy and efficient to use – Provide unambiguous and consistent tagged data for consumers Completeness requirement: – Financial data – Textual information Broadening use of XBRL HMRC: – Tax risk analysis, policy and planning Government departments: – Policy, statistics and other purposes Companies House: – Public and private consumers; investors; information companies; credit rating agencies; banks Company financial info in digital format Demands on taxonomies Support more effective use of XBRL by a broader range of consumers Support improved quality of tagging Limit and ease the burden on preparer community Meet the needs of 2016 and beyond Range of design and content decisions Main taxonomy features - 1 Stability decision – Basic ‘look and feel’ and many features unchanged Careful focus on content and user – Clarity of presentation and organisation – Consistency of approach Built-in guidance – Guidance tags, cross-references, supporting information in ‘documentation’ labels Accounting references Main taxonomy features - 2 Simplification of textual tagging Greater use of dimensions, where appropriate Introduction of ‘typed’ dimensions: – ‘Analysis’ items – Groupings – replacement of tuples Covered in FRC Accounts Taxonomies Design document Structure of the taxonomies Same underlying accounting base: IFRS published by IASB Broad range of taxonomy content is the same across the accounting frameworks Common ‘Core taxonomy’ Extensions to core taxonomy to create individual taxonomies for Full IFRS, FRS 101 and FRS 102 Summary Reasons for new taxonomies General aims List of new features Timescales Providing feedback Next presentations Questions?