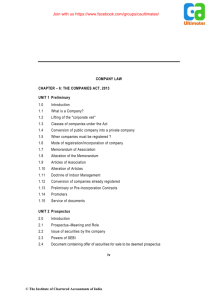

PHS templates for offers of Debt Securities Hybrid Instruments and

advertisement

1 Appendix 1 – Debt Securities Prepared on: [DD/MM/YY] NAME OF OFFER (the “Bonds”) EXAMPLE: OFFER OF [BONDS] IN [NAME OF ISSUER] (the “Bonds”) This Product Highlights Sheet is an important document. It highlights the key information and risks relating to the offer of the Bonds contained in the [Prospectus/Offer Information Statement]. It complements the [Prospectus/Offer Information Statement]1. You should not purchase the Bonds if you do not understand the nature of an investment in [type of securities], our business or are not comfortable with the accompanying risks. If you wish to purchase the Bonds, you will need to make an application in the manner set out in the [Prospectus/Offer Information Statement]. If you do not have a copy of the [Prospectus/Offer Information Statement], please contact us to ask for one. Issuer and Guarantor (if applicable) [●] Place of incorporation [●] Issue Price and denomination of the Bonds [●] Total amount to be raised in this offer [●] Example: S$[●] per S$[●] in principal amount of the Bonds. The Bonds will be issued in registered form in denominations of S$[●] each. 1 Example: Gross proceeds – S$[●] to S$[●] Net proceeds – S$[●] to S$[●] The [Prospectus/Offer Information Statement], [registered by/lodged with] the Monetary Authority of Singapore on [date], is available for collection at [time and place, if applicable] or accessible at [web address, if applicable]. PRODUCT HIGHLIGHTS SHEET Prior to making a decision to purchase the Bonds, you should carefully consider all the information contained in the [Prospectus/Offer Information Statement]. This Product Highlights Sheet should be read in conjunction with the [Prospectus/Offer Information Statement]. You will be subject to various risks and uncertainties, including the potential loss of your entire principal amount invested. If you are in doubt as to investing in the Bonds, you should consult your legal, financial, tax or other professional adviser. 2 [●] Listing status of Issuer and the Bonds [●] Issue Manager(s) / Arranger(s) [●] Underwriter(s) [●] Credit rating of Issuer/ Guarantor (if applicable)/ the Bonds (if any) and Credit Rating Agencies Example: Trustee / Registrar [●] Example: S$[●] in aggregate principal amount of [●]-year senior bonds with interest of [●]% per annum, made in two payments each year, on [date] and [date]. The Bonds will have an issue date of [date], and will mature on [date]. Example: Issuer – Primary Listing on the Mainboard of SGX-ST since [date]. Bonds – To be listed on the Mainboard of SGX-ST from [date]. Trading will be in board lots of S$[●] in principal amount. The Issuer has obtained, in respect of the Bonds, a credit rating of [●] rating by [Name of Credit Rating Agency]. INVESTMENT SUITABILITY WHO IS THE INVESTMENT SUITABLE FOR? This investment is suitable for you if you: o [State return objectives (e.g. capital growth/income/capital preservation) which the investment will be suitable for] o [State if the principal will be at risk] o [State how long investors should be prepared to hold the investment for] o [State other key characteristics of the product which will help investors determine whether the investment is suitable for them] Example: The Bonds are only suitable for you if you: o want regular income at a fixed rate rather than capital growth; o want priority in payouts over share dividends in an insolvency situation; o are prepared to lose your principal investment if we fail to repay the amount due under the Bonds; and o are prepared to hold your investment for the full 5 years (i.e. until maturity of the Bonds), or to exit the Bonds only by sale in the secondary market which may be unprofitable or impossible. Further Information Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on investment suitability. PRODUCT HIGHLIGHTS SHEET Description of the Bonds, including maturity date, tenure, coupon rate and frequency of coupon payments 3 KEY FEATURES Background Information on the Issuer WHO ARE YOU INVESTING WITH? Refer to – [Provide a brief overview of the relevant entity or if the relevant entity is the holding entity of a group, a brief overview of the group (the “Group”) including the nature of the Group’s operations and principal activities, principal markets the Group competes in, principal place of business and operational history). Provide brief information on the relevant entity’s board of directors and key executives, and to the extent known to the relevant entity, identify the controlling shareholder(s) of the relevant entity.] We are engaged in the business of [principal business] in [country]. Our Company was incorporated in [year] by our founding shareholders in [country]. We operate principally in [country]. Our board of directors comprise the following directors: (a) (b) (c) (d) (e) Director A (executive, non-independent); Director B (executive, non-independent); Director C (non-executive, independent); Director D (non-executive, independent); and Director E (non-executive, independent). Our key executives are [names and designations of executive officers]. Our controlling shareholders are [names of controlling shareholders] who hold [●]% and [●]% respectively of the Company. WHAT ARE YOU INVESTING IN? [State key features of the debentures offered, including, where applicable, (a) where the debentures are offered at a discount or premium, the face value of the debentures; (b) yield, redemption prices, interest rates; (c) dates of payment of interest and repayment of principal amount; (d) arrangements for redemption of the debentures e.g. whether at the option of debentures holder; (e) description of any subordination or seniority of the debentures to other debts of the relevant entity; (f) particulars of any security, guarantee or commitment intended to ensure that the issue will be duly serviced with regard to both the principal sum and interest payable on the debentures; (g) significant covenants; (h) where the debentures will not be listed and traded on a securities exchange, information on how and when investors may exit their investments; and (i) any other pertinent information which should be highlighted to investors. Description of these features should be presented using diagrams (e.g. tables, graphs and charts) where appropriate.] “[relevant section]” on page(s) [●] of the [Prospectus/Of fer Information Statement] for more information on our directors, key executives and controlling shareholder(s) “[relevant section]” on page(s) [●] of the [Prospectus/Of fer Information Statement] for more information on our [Bonds]. PRODUCT HIGHLIGHTS SHEET Example: “[relevant section]” on page(s) [●] of the [Prospectus/Of fer Information Statement] for more information on our business. 4 Example: We are offering up to S$[●] million in aggregate principal amount of Bonds to the public in Singapore. The issue price is S$[●] per S$[●] in principal amount of the Bonds. You will receive interests from [issue date] to [maturity date] at a rate of [●]% per annum, made in two payments on [date] and [date] each year. The Bonds are not secured by any underlying assets and ranks above our other unsecured debt (other than debt prioritised by law). You will have the same rights as our other debt obligations of the same class issued by us. We have previously issued S$[●] of [●]% debt obligations of the same class as the Bonds on [date]. Key Financial Information [Provide key profit and loss data (including net sales or revenue, profit or loss before tax, net profit or loss, and earnings or loss per share before and after the offer) and cash flows data (cash flows from operating, financing and investing activities) of the relevant entity in respect of each of the relevant number of most recent completed financial year(s) and any subsequent interim period for which financial information has been included in the Prospectus or Offer Information Statement. Briefly discuss the most significant factors, events or new developments which materially affected the relevant entity’s sales or revenue, expenses and profit or loss before tax for each financial period. Provide key balance sheet data (including total assets, total liabilities, net assets or liabilities and issued capital and reserves) as at the end of the most recent completed financial year or any subsequent interim period for which financial information has been included. In addition, include the profit forecast or profit estimate information if a profit forecast or profit estimate is disclosed in the Prospectus or Offer Information Statement. Key financial information should be presented using diagrams (e.g. tables, graphs and charts) where appropriate.] Example: Key profit and loss information Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] Net revenue [●] Profit/ (loss) before tax Profit/ (loss) after tax Profit/ (loss) after tax including discontinued operations [●] [●] [●] [●] [●] [●] Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on our financial performance. PRODUCT HIGHLIGHTS SHEET The Bonds contain a covenant constraining us from declaring or paying dividends or making any other payments or distributions. 5 Earnings/ (loss) per share – Basic Earnings/ (loss) per share Adjusted (after close of offer) [●] [●] [●] [●] Key cash flows information [●] [●] [●] [●] [●] [●] [●] [●] [●] Key balance sheet information Total assets Total liabilities Net assets/(liabilities) [●] [●] [●] Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] [●] [●] The most significant factors contributing to our financial performance over the last two completed financial years are as follows: Our revenue for [year] increased by S$[●] million ([●]%) due to an increase in sales volume contributed by our introduction of our new product in [year]. Our net profit from operations in [year] was S$[●] million, which is [●]% higher than our net profit from operations of S$[●] million in [year]. This was mainly attributable to lower finance costs of S$[●] million due to lower interest rates and lower loan principals. Our net cash generated from operating activities decreased by S$[●] million from S$[●] million in [year] to S$[●] million in [year] due to an increase in credit sales that contributed to an increase in trade receivables of S$[●] million from S$[●] million in [year] to S$[●] million in [year]. Our net assets increased by S$[●] million from S$[●] million in [year] to S$[●] million in [year] mainly due to the S$[●] million increase in inventories for our new product introduced in [year]. The above factors are not the only factors contributing to our financial performance in FY[●] and FY[●]. Please refer to the other factors set out in pages [●] to [●] of the prospectus / offer information statement. PRODUCT HIGHLIGHTS SHEET Net cash generated from operating activities Net cash used in investing activities Net cash generated from financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at end of year/period Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] 6 Trends, Uncertainties, Demands, Commitments or Events Reasonably Likely to have a Material Effect [Briefly discuss, for at least the current financial year, the relevant entity’s business and financial prospects, as well as any other known trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the net sales or revenues, profitability, liquidity or capital resources, or that would cause financial information disclosed in the prospectus or offer information statement to be not necessarily indicative of the future operating results or financial condition of the relevant entity. If there are no such trends, uncertainties, demands, commitments or events, provide an appropriate statement to that effect.] For the current financial year, our Directors have observed the following trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the net sales or revenues, profitability, liquidity or capital resources of the Group, or that would cause financial information disclosed in the prospectus to be not necessarily indicative of the future operating results or financial condition of the Group − (a) the demand for [activity] has increased with the recent growth [country]’s economy. We expect our revenue from our [business segment] to increase in line with the increase in [activity]; and (b) we expect the upward trend in [activity] to have a positive impact on the demand for our [service]. Operating costs are also expected to increase together with the increase in the level of [activity]. The above are not the only trends, uncertainties, demands, commitments or events that could affect us. Please refer to the other factors set out in pages [●] to [●] of the prospectus. Use of Proceeds [Provide information on how the proceeds raised from the offer will be allocated to each principal intended use. Information on the use of proceeds should be presented using diagrams (e.g. tables, graphs and charts) where appropriate.] Example: The net proceeds to be raised in the offer (after deducting estimated expenses to be borne by us) are S$[●]. The following represents our estimate of the allocation of the gross proceeds expected to be raised from the offer: Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on use of proceeds. PRODUCT HIGHLIGHTS SHEET Example: Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on trends and prospects. 7 S$ (million) - Allocation for each S$1.00 of gross proceeds raised - (a) Expansion of business [●] [●] (b) Working capital and general corporate purposes [●] [●] (2) Estimated listing expenses [●] [●] Total [●] 1.00 Details of utilisation (1) Net proceeds: WHAT ARE THE KEY RISKS OF THIS INVESTMENT? [Set out the key risks which had materially affected or could materially affect the relevant entity’s business operations, financial position and results, and the investor’s investment in the debentures if they occur. If a particular risk falls into multiple categories below, it is sufficient to include the risk under one category. There is no need to repeat the risk in more than one category. Securities-specific market risks or liquidity risks should be included under the market or liquidity risks section respectively. Where there is a risk that an investor may lose all of his initial principal investment, emphasise this with bold or italicised formatting.] Investing in the Bonds involves substantial risks. Set out below are some of the key risks of investing in the Bonds. This list is not exhaustive, and does not represent all the risks associated with, and considerations relevant to, the Bonds or your decision to purchase the Bonds. Please refer to the section "Risk Factors" on pages [●] to [●] of the [Prospectus/Offer Information Statement] for more information on risk factors. These risk factors may cause you to lose some or all of your investment. Business-Related Risks [State the material business-related risks which may affect the investor’s investment in the debentures e.g. risks relating to the industries within which the relevant entity operates, any significant supplier or customer relationships, the relevant entity’s properties, assets or equipment, distribution channels, material contracts, key personnel, intellectual property, corporate structure, financing, environmental concerns, competition, etc.] Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on risks factors. PRODUCT HIGHLIGHTS SHEET KEY RISKS 8 Example: Legal, Regulatory and Enforcement Risks [State the material legal, regulatory and enforcement risks which may affect the investor’s investment in the debentures, e.g. any litigation which may have material impact on the relevant entity, or legal or regulatory issues faced by the relevant entity etc.] Example: We are appealing to [name of authority] on a ruling against our Company regarding a tax dispute between the [inland revenue authority of country] and our Company from our operations in [country]. In the event that our appeal is not successful, we may be potentially liable to a fine of up to S$[●] which could materially and adversely affect our business and results of operations. Market and Credit Risks [State the market risks (including currency risks) and credit risks which may affect the traded price of the debentures] Example: The Bonds are subject to interest rate risk as the Bonds bear a fixed rate of interest. Subsequent changes in market interest rates may adversely impact the value of the Bonds. Generally, bond prices are inversely related to interest rate movements. A rise in interest rates could see a fall in bond prices. We may issue additional bonds with identical terms that may adversely affect the market price of the Bonds. Liquidity Risks [State the risks that an investor would face in trying to exit his investment in the debentures.] PRODUCT HIGHLIGHTS SHEET We compete against numerous businesses in our industry that may be larger and have greater financial resources. Our ability to compete effectively depends on several factors, including our market presence, our reputation, our competitors, and general trends in the industry and economy. There is no assurance that we can compete successfully. A substantial proportion of our revenue is derived from several major customers. Our financial results may be seriously impacted if we lose any of these customers or they reduce their volume of business with us. As we are a holding company that conducts substantially all of our business through our operating subsidiaries in [country], we rely on dividends paid by our subsidiaries for our cash needs. Any restrictions on our subsidiaries’ ability to make payments to us would adversely affect our ability to fund and operate our business. 9 Example: There is no prior market for the Bonds and an active trading market may not develop. In addition, bonds generally have lower liquidity as compared to equity securities. While an application has been made for admission to trade the Bonds on the SGX-ST, there can be no assurance that a liquid market will develop for the Bonds and that you will be able to sell the Bonds at a price that reflects their value, if at all. Other Pertinent Risks Example: We may elect to pre-pay the Bonds before the maturity date for tax reasons in the amount of 100% of the principal plus any accrued interest. You may not realise interest payments extending to the maturity date. DEFINITIONS [Provide definitions if necessary.] CONTACT INFORMATION HOW DO YOU CONTACT US? [Provide contact details of Issuer, distributor(s)/underwriter(s) and/or issue manager(s) whom investors can contact if they have enquiries. Include a website address and email address, if appropriate.] PRODUCT HIGHLIGHTS SHEET [State any other pertinent risks that have not been highlighted in the foregoing sections.] 1 Appendix 2 – Hybrid Instruments Prepared on: [DD/MM/YY] NAME OF OFFER (the “Securities”) EXAMPLE: OFFER OF [CONVERTIBLE BONDS] IN [NAME OF ISSUER] (the “Bonds”)1 This Product Highlights Sheet is an important document. It highlights the key information and risks relating to the offer of the Securities contained in the [Prospectus/Offer Information Statement]. It complements the [Prospectus/Offer Information Statement]2. You should not purchase the Securities if you do not understand the nature of an investment in [type of securities], our business or are not comfortable with the accompanying risks. If you wish to purchase the Securities, you will need to make an application in the manner set out in the [Prospectus/Offer Information Statement]. If you do not have a copy of the [Prospectus/Offer Information Statement], please contact us to ask for one. Issuer and Guarantor (if applicable) [●] Place of incorporation [●] Issue Price and denomination of the Securities [●] Total amount to be raised in this offer [●] Listing status of Issuer and the Securities [●] Example: S$[●] per S$[●] in principal amount for the Bonds. The Bonds will be issued in registered form in denominations of S$[●] each. Description of the Securities [●] Example: S$[●] in aggregate principal 1 Example: Gross proceeds – S$[●] to S$[●] Net proceeds – S$[●] to S$[●] Example: Issuer - Primary Listing on [Note to issuers and professional advisers: Please note that the examples in this template are based on an offer of convertible bonds (the “Bonds”) only. You should consider making appropriate modifications to the disclosures in the Product Highlights Sheet based on the features of the specific type of securities (e.g. convertible bonds, preference shares or perpetual securities) being offered.] 2 The [Prospectus/Offer Information Statement], [registered by/lodged with] the Monetary Authority of Singapore on [date], is available for collection at [time and place, if applicable] or accessible at [web address, if applicable]. PRODUCT HIGHLIGHTS SHEET Prior to making a decision to purchase the Securities, you should carefully consider all the information contained in the [Prospectus/Offer Information Statement]. This Product Highlights Sheet should be read in conjunction with the [Prospectus/Offer Information Statement]. You will be subject to various risks and uncertainties, including the potential loss of your entire principal amount invested. If you are in doubt as to investing in the Securities, you should consult your legal, financial, tax or other professional adviser. 2 amount of [●]-year convertible bonds with interest of [●]% per annum, made in two payments each year on [date] and [date]. The Bonds will have an issue date of [date], and will mature on [date]. the Mainboard of SGX-ST since [date]. Bonds – To be listed on the Mainboard of SGX-ST from [date]. Trading will be in board lots of S$[●] in principal amount. Issue Manager(s) / Arranger(s) [●] Credit rating of Issuer/ Guarantor (if applicable)/ the Securities (if any) and Credit Rating Agencies [To include credit rating if applicable to the Securities.] Trustee (if applicable) / Registrar [●] Underwriter(s) PRODUCT HIGHLIGHTS SHEET The Bonds may be converted into ordinary shares in our Company (“Shares”) at the holder’s option at the ratio of [●] ordinary shares per Bond and at the initial conversion price of S$[●] per Share. [●] Example: The Issuer has obtained, in respect of the Bonds, a credit rating of [●] rating by [Name of Credit Rating Agency]. INVESTMENT SUITABILITY WHO IS THE INVESTMENT SUITABLE FOR? This investment is only suitable for you if you: o [State return objectives (e.g. capital growth/income/capital preservation) which the investment will be suitable for] o [State if the principal will be at risk] o [State how long investors should be prepared to hold the investment for, and highlight any features on coupon-deferrals or cumulative features] o [State other key characteristics of the product which will help investors determine whether the investment is suitable for them] Further Information Refer to the “[relevant section]” on page(s) [●] of the 3 Example: The Bonds are only suitable for you if you: o are comfortable investing in securities that have features of fixed income securities but are not plain vanilla bonds; o want regular income at a fixed rate with an option to seek dividends and capital growth; o are prepared for lower interest payments compared to non-convertible debentures with similar features; and o are prepared to lose your principal investment if we fail to repay the amount due under the Bonds and the Bonds are not traded on any market, or lose a substantial amount of your principal investment if you sell the Bonds in a secondary market at a discount. [Prospectus/Off er Information Statement] for more information on investment suitability. WHO ARE YOU INVESTING IN? [Provide a brief overview of the relevant entity or if the relevant entity is the holding entity of a group, a brief overview of the group (the “Group”), including the nature of the Group’s operations and principal activities, principal markets the Group competes in, principal place of operations and operational history. Provide brief information on the relevant entity’s board of directors and key executive officers, their respective track record, qualifications, areas of expertise or responsibility, and to the extent known to the relevant entity, identify the controlling shareholder(s) of the relevant entity. Refer to – “[relevant section]” on page(s) [●] of the [Prospectus/Of fer Information Statement] for more information on our business. Example: We are engaged in the business of [principal business] in [country]. Our Company was incorporated in [year] by our founding shareholders in [country]. We operate principally in [country]. Our board of directors comprise the following directors: (a) (b) (c) (d) (e) Director A (executive, non-independent); Director B (executive, non-independent); Director C (non-executive, independent); Director D (non-executive, independent); and Director E (non-executive, independent). Our key executive officers are [names and designations of executive officers]. “[relevant section]” on page(s) [●] of the [Prospectus/Of fer Information Statement] for more information on our directors, key executives and controlling shareholders. Our controlling shareholders are [names of controlling shareholders] who hold [●]% and [●]% respectively of the Company. Key Features of the Securities WHAT ARE YOU INVESTING IN? [State key features of the Securities offered including, where applicable, (a) the face value, and the discount/premium the Securities are offered at; (b) yield, redemption Refer to the “[relevant section]” on page(s) [●] of PRODUCT HIGHLIGHTS SHEET KEY FEATURES Background information on the Issuer 4 prices, interest rates; (c) dates of payment of interest and repayment of principal amount; (d) arrangements for redemption of the Securities e.g. whether at the option of holder of the Securities; (e) description of any subordination or seniority of the Securities to other debts of the relevant entity; (f) particulars of any security, guarantee or commitment intended to ensure that the issue will be duly serviced with regard to both the principal sum and interest payable on the Securities; (g) significant covenants; (h) where the Securities will not be listed and traded on a securities exchange, information on how and when investors may exit their investments; and (i) any other pertinent information which should be highlighted to investors. Description of these features should be presented using diagrams (e.g. tables, graphs and charts) where appropriate. the [Prospectus/Off er Information Statement] for more information on our Securities. PRODUCT HIGHLIGHTS SHEET Where the Securities offered are convertible into or exchangeable for other securities, or include attached rights to obtain other securities, describe the type and class of these other securities, including the rights attached to these other securities and any restrictions on the free transferability of these other securities.] Example: Key Information on Bonds Offered We are offering up to S$[●] million in aggregated principal amount of Bonds to the public in Singapore. . The issue price is S$[●] per S$[●] in principal amount of the Bonds. You will receive interest payments of [●]% per annum, made in two payments on [date] and [date] each year. The principal amount invested will be repaid to you on [maturity date], unless the Bonds are redeemed early at the option of the Company if [event] or [event] occurs. The Bonds are convertible into Shares at your option, at any time up to and including the maturity date, at the ratio of [●] Shares per Bond and at the initial conversion price of S$[●] per Share. The conversion price may be adjusted from time to time under the following circumstances [list of circumstances]. We have only one class of shares, and the Shares will have the same rights as our other existing issued and paid-up shares, including voting rights. Shareholders will be entitled to all rights attached to their Shares in proportion to their shareholding, such as any cash dividends declared by the Company and any distribution of assets upon liquidation of the Company. We have not paid dividends in the past and we do not expect to pay dividends in the foreseeable future. There are no restrictions on the transferability of the Shares. Key Financial Information [Provide key profit and loss data (including net sales or revenue, profit or loss before tax, net profit or loss, and earnings or loss per share before and after the offer) and cash flows data (cash flows from operating, financing and investing cash flows) of the relevant entity in respect of each of the relevant number of most recent completed financial year(s) and any subsequent interim period for which financial information has been included in the Prospectus or Offer Information Statement. Briefly discuss the Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off 5 most significant factors, events or new developments which materially affected the relevant entity’s sales or revenue, expenses and profit or loss before tax for each financial period. Provide key balance sheet data (including total assets, total liabilities, net assets or liabilities and issued capital and reserves) as at the end of the most recent completed financial year or any subsequent interim period for which financial information has been included. In addition, include selected profit forecast or profit estimate information if a profit forecast or profit estimate is disclosed in the Prospectus or Offer Information Statement. Key financial information should be presented using diagrams (e.g. tables, graphs and charts) where appropriate.] Key profit and loss information Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] Net revenue [●] Profit/ (loss) before tax Profit/ (loss) after tax Profit/ (loss) after tax including discontinued operations Earnings/ (loss) per share – Basic Earnings/ (loss) per share - Diluted [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] Key cash flows information Net cash generated from operating activities Net cash used in investing activities Net cash generated from financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at end of year/period [●] Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] [●] [●] [●] [●] [●] [●] [●] [●] PRODUCT HIGHLIGHTS SHEET Example: er Information Statement] for more information on our financial performance. 6 Key balance sheet information Total assets Total liabilities Net assets/(liabilities) [●] [●] [●] Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] [●] [●] Our revenue for [year] increased by S$[●] million ([●]%) due to an increase in sales volume contributed by our introduction of our new product in [year]. Our net profit from operations in [year] was S$[●] million, which is [●]% higher than our net profit from operations of S$[●] million in [year]. This was mainly attributable to lower finance costs of S$[●] million due to lower interest rates and lower loan principals. Our net cash generated from operating activities decreased by S$[●] million from S$[●] million in [year] to S$[●] million in [year] due to an increase in credit sales that contributed to an increase in trade receivables of S$[●] million from S$[●] million in [year] to S$[●] million in [year]. Our net assets increased by S$[●] million from S$[●] million in [year] to S$[●] million in [year] mainly due to the S$[●] million increase in inventories for our new product introduced in [year]. The above factors are not the only factors contributing to our financial performance in FY [●] and FY [●]. Please refer to the other factors set out in pages [●] to [●] of the prospectus / offer information statement. Business Strategies and Future Plans [Briefly discuss the relevant entity’s or Group’s (if applicable) key strategies and future plans for generating income or capital growth for investors.] Example: We have a well-established brand name in [country] and we are recognised as the leading manufacturing company of [principal business] in [country]. We have a strong management team with over 20 years of experience in the industry and the management team has contributed significantly to our Company’s growth and expansion since our incorporation in [year]. We aim to strengthen our position in this industry and region by expanding our operations to [names of countries] in the next 3 years. We have also recently started a joint venture with [name of company] to enter into the [secondary business] market. We believe that there is a growing market for [secondary business] in [country] given the changing lifestyles of consumers in [country]. Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on our strengths, strategies and future plans. PRODUCT HIGHLIGHTS SHEET The most significant factors contributing to our financial performance over the last two completed financial years are as follows: 7 Trends, Uncertainties, Demands, Commitments or Events Reasonably Likely to have a Material Effect Example: Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on trends and prospects. For the current financial year, our Directors have observed the following trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the net sales or revenues, profitability, liquidity or capital resources of the Group, or that would cause financial information disclosed in the prospectus to be not necessarily indicative of the future operating results or financial condition of the Group− (c) the demand for [activity] has increased with the recent growth [country]’s economy. We expect our revenue from our [business segment] to increase in line with the increase in [activity]; and (d) we expect the upward trend in [activity] to have a positive impact on the demand for our [service]. Operating costs are also expected to increase together with the increase in the level of [activity]. The above are not the only trends, uncertainties, demands, commitments or events that could affect us. Please refer to the other factors set out in pages [●] to [●] of the prospectus. Use of Proceeds [Provide information on how the proceeds raised from the offer will be allocated to each principal intended use. Information on the use of proceeds should be presented using diagrams (e.g. tables, graphs and charts) where appropriate.] Example: The net proceeds to be raised in the offer (after deducting estimated expenses to be borne by us) are S$[●]. The following represents our estimate of the allocation of the gross proceeds expected to be raised from the offer: Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on use of proceeds. PRODUCT HIGHLIGHTS SHEET [Briefly discuss, for at least the current financial year, the relevant entity’s business and financial prospects, as well as any other known trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the net sales or revenues, profitability, liquidity or capital resources, or that would cause financial information disclosed in the prospectus or offer information statements to be not necessarily indicative of the future operating results or financial condition of the relevant entity. If there are no such trends, uncertainties, demands, commitments or events, provide an appropriate statement to that effect.] 8 (a) Expansion of business [●] [●] (b) Working capital and general corporate purposes [●] [●] (2) Estimated listing expenses [●] [●] Total [●] 1.00 Details of utilisation (1) Net proceeds: KEY RISKS WHAT ARE THE KEY RISKS OF THIS INVESTMENT? [Set out the key risks which had materially affected or could materially affect the relevant entity’s business operations, financial position and results, and/or the investor’s investment in the Securities if they occur. If a particular risk falls into multiple categories below, it is sufficient to include the risk under one category. There is no need to repeat the risk in more than one category. Securities-specific market or liquidity risks should be included under the market or liquidity risks section respectively. Where there is a risk that an investor may lose all of his initial principal investment, emphasise this with bold or italicised formatting.] Investing in the Securities involves substantial risks. Set out below are some of the key risks of investing in the Securities. This list is not exhaustive, and does not represent all the risks associated with, and considerations relevant to, the Securities or your decision to purchase the Securities. Please refer to the section "Risk Factors" on pages [●] to [●] of the [Prospectus/Offer Information Statement] for more information on risk factors. These risk factors may cause you to lose some or all of your investment. Business-Related Risks [State the material business-related risks which may affect the investor’s investment in the Securities e.g. risks relating to the industries within which the relevant entity operates, any significant supplier or customer relationships, the relevant entity’s properties, assets or equipment, distribution channels, material contracts, key personnel, intellectual property, corporate structure, financing, environmental concerns, competition, etc.] Example: We compete against numerous businesses in our industry that may be larger Refer to the “[relevant section]” on page(s) [●] of the [Prospectus/Off er Information Statement] for more information on risks factors. PRODUCT HIGHLIGHTS SHEET S$ (million) - Allocation for each S$1.00 of gross proceeds raised - 9 and have greater financial resources. Our ability to compete effectively depends on several factors, including our market presence, our reputation, our competitors, and general trends in the industry and economy. There is no assurance that we can compete successfully. A substantial proportion of our revenue is derived from several major customers. Our financial results may be seriously impacted if we lose any of these customers or they reduce their volume of business with us. As we are a holding company that conducts substantially all of our business through our operating subsidiaries in [country], we rely on dividends paid by our subsidiaries for our cash needs. Any restrictions on our subsidiaries’ ability to make payments to us would adversely affect our ability to fund and operate our business. [State the material legal, regulatory and enforcement risks which may affect the investor’s investment in the Securities, e.g. any litigation which may have material impact on the relevant entity, or legal or regulatory issues faced by the relevant entity etc.] Example: We are appealing to [name of authority] on a ruling against our Company regarding a tax dispute between the [inland revenue authority of country] and our Company from our operations in [country]. In the event that the appeal is not successful, we may be potentially liable to a fine of up to S$[●] which could materially and adversely affect our business and results of operations. Market and Credit Risks [State the market risks (including currency risks) and credit risks which may affect the traded price of the Securities.] Example: The Bonds are subject to interest rate risk as the Bonds bear a fixed rate of interest. Subsequent changes in market interest rates may adversely impact the value of the Bonds. Generally, bond prices are inversely related to interest rate movements. A rise in interest rates could see a fall in bond prices. We may issue additional convertible bonds with identical terms that may adversely affect the market price of the Bonds. Liquidity Risks [State the risks that an investor would face in trying to exit his investment in the Securities.] Example: There is no prior market for the Bonds and an active trading market may not PRODUCT HIGHLIGHTS SHEET Legal, Regulatory and Enforcement Risks 10 develop. In addition, bonds generally have lower liquidity as compared to equity securities. While an application has been made for admission to trade the Bonds on the SGX-ST, there can be no assurance that a liquid market will develop for the Bonds and that you will be able to sell their Bonds at a price that reflects their value, if at all. Other Pertinent Risks [State any other pertinent risks that have not been highlighted in the foregoing sections.] Example: We may elect to pre-pay the Bonds before the maturity date for tax reasons in the amount of 100% of the principal plus any accrued interest. You may not realise interest payments extending to the maturity date. DEFINITIONS [Provide definitions if necessary.] CONTACT INFORMATION HOW DO YOU CONTACT US? [Provide contact details of Issuer, distributor(s)/underwriter(s) and/or issue manager(s) whom investors can contact if they have enquiries. Include a website address and email address, if appropriate.] PRODUCT HIGHLIGHTS SHEET 1 Appendix 3 – Equity Securities Prepared on: [DD/MM/YY] NAME OF OFFER (the “Securities”) EXAMPLE: OFFER OF [ORDINARY SHARES] IN [NAME OF ISSUER] (“the “Securities”)1 This Product Highlights Sheet is an important document. It highlights the key information and risks relating to the offer of the Securities contained in the Prospectus. It complements the Prospectus2. You should not purchase the Securities if you do not understand the nature of an investment in [type of securities], our business or are not comfortable with the accompanying risks. If you wish to purchase the Securities, you will need to make an application in the manner set out in the Prospectus. If you do not have a copy of the Prospectus, please contact us to ask for one. Issuer / Manager / Trustee / TrusteeManager / Sponsor (where applicable) [●] Place of incorporation [●] Details of this offer [●] Total amount to be raised in this offer [●] Example: Total number of Shares to be offered – [●] Placement – [●] Shares Example: Gross proceeds – S$[●] to S$[●] Net proceeds – S$[●] to S$[●] Public offering – [●] Shares 1 [Note to issuers and professional advisers: Please note that the examples in this template are based on an offer of ordinary shares (the “Securities”) only (other than in the section on “What are the Fees and Charges payable to the [Trustee-manager/responsible person] that may affect us and your investment in our securities?”). You should consider making appropriate modifications to the disclosures in the Product Highlights Sheet based on the features of the specific type of securities (e.g. ordinary shares, units of a business trust or units of a real estate investment trust) being offered.] 2 The Prospectus, [registered by/lodged with] the Monetary Authority of Singapore on [date], is available for collection at [time and place, if applicable] or accessible at [web address, if applicable]. PRODUCT HIGHLIGHTS SHEET Prior to making a decision to purchase the Securities, you should carefully consider all the information contained in the Prospectus. This Product Highlights Sheet should be read in conjunction with the Prospectus. You will be subject to various risks and uncertainties, including the potential loss of your entire principal amount invested. If you are in doubt as to investing in the Securities, you should consult your legal, financial, tax or other professional adviser. 2 Issue Price [●] Example: S$[●] for each Share [●] [●] Underwriter(s) [●] Example: Application for primary listing on the Mainboard of SGX-ST submitted on [date], the Shares are expected to be listed on [date]. OVERVIEW WHO ARE WE AND WHAT DO WE DO? [Provide an overview of the Issuer and its subsidiaries (the “Group”), including the Group’s nature of operations and principal activities, principal markets the Group competes in, principal place of operations and operational history. If the Issuer is a real estate investment trust (“REIT”) or a business trust (“BT”), provide a summary of the Issuer’s portfolio of assets, including the valuation amount with and without income support yield enhancement arrangements (if applicable). Information should be presented using diagrams (e.g. tables, graphs and charts) where appropriate.] Example: We are engaged in the business of [principal business] in [country]. We were incorporated in [country] on [date] under the name of [name of company] (and together with our subsidiaries, referred to as the “Group”). On [date], we acquired all of the ordinary share capital of [name of subsidiaries]. Since our acquisition of [name of subsidiaries], we have been a major supplier of [principal business] in [country]. Our subsidiaries, [subsidiary X], [subsidiary Y] and [subsidiary Z] are responsible for design and manufacturing of our products in [country X], [country Y] and [country Z] respectively. Further Information Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on our background and business. The structure of our Group as at the date of this prospectus is as follows: [structure chart] WHO ARE OUR DIRECTORS AND KEY EXECUTIVES? [Provide brief information on the Issuer’s board of directors and key executives (i.e. CEO, CFO, COO). In respect of REITs and BTs, the reference above to the Issuer shall be read as a reference to the Manager and the Trustee-Manager respectively.] Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more PRODUCT HIGHLIGHTS SHEET Issue Manager(s) Listing status of Issuer and the Securities 3 Example: Our board of directors comprise the following directors: (a) (b) (c) (d) (e) information on our directors and management. Director A (executive, non-independent) Director B (executive, non-independent) Director C (non-executive, independent) Director D (non-executive, independent) Director E (non-executive, independent) Our key executives are [names and designations of executive officers]. WHO ARE OUR CONTROLLING [SHAREHOLDERS/UNITHOLDERS] AND [SPONSORS (IF RELEVANT)]? [Identify the controlling shareholder(s)/controlling unitholder(s) and sponsors (if relevant) of the Issuer, and state the percentage of shares/units of each class in which each controlling shareholder/controlling unitholder and sponsors (if relevant) has an interest, whether direct or deemed, as of the latest practicable date and immediately after the offer.] Example: Prior to the IPO, [controlling shareholder] holds [●]% of our Company’s total issued share capital. He is expected to hold at least [●]% of our Company post-IPO and to remain as a controlling shareholder. Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on our controlling [shareholders/ unitholders]. HOW WAS OUR HISTORICAL FINANCIAL PERFORMANCE AND WHAT IS OUR CURRENT FINANCIAL POSITION? [Provide key profit and loss data (including net sales or revenue, profit or loss before tax, net profit or loss, and earnings or loss per share before and after the offer) and cash flows data (cash flows from operating, financing and investing activities) of the Issuer in respect of each of the relevant number of most recent completed financial year(s) and any subsequent interim period for which financial information has been included in the Prospectus. Briefly discuss the most significant factors, events or new developments which materially affected the Issuer’s sales or revenue, expenses and profit or loss before tax for each financial period. Provide also key balance sheet data (including total assets, total liabilities, net assets or liabilities and issued capital and reserves) as at the end of the most recent completed financial year or any subsequent interim period for which financial information has been included. In addition, include the profit forecast or profit estimate information if a profit forecast or profit estimate is disclosed in the Prospectus. Key financial information should be presented using diagrams (e.g. tables, graphs and charts) where appropriate. For REITs and BTs with no historical financial performance, pro forma financial information may be provided. Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on our financial performance and position. PRODUCT HIGHLIGHTS SHEET [Name of chairman] has been our Company’s chairman since [date]. 4 Example: Key profit and loss information Year ended 31 December [Year] [Year] [Year] S$(‘000) S$(‘000) S$(‘000) Net revenue [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] [●] Key cash flows information Net cash generated from operating activities Net cash used in investing activities Net cash generated from financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at end of year/period [●] Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] [●] [●] [●] [●] [●] [●] [●] [●] Key balance sheet information Total assets Total liabilities Net assets/(liabilities) [●] [●] [●] Year ended 31 December [Year] [Year] S$(‘000) S$(‘000) [●] [●] [●] The most significant factors contributing to our financial performance over the last two completed financial years are as follows: PRODUCT HIGHLIGHTS SHEET Profit/ (loss) before tax Profit/ (loss) after tax Profit/ (loss) after tax including discontinued operations Earnings/ (loss) per share– Basic Earnings/ (loss) per share - Diluted Forecasted profit [Year] S$(‘000) [●] 5 The above factors are not the only factors contributing to our financial performance in FY[●] and FY[●]. Please refer to the other factors set out in pages [●] to [●] of the prospectus. INVESTMENT HIGHLIGHTS WHAT ARE OUR BUSINESS STRATEGIES AND FUTURE PLANS? [Briefly describe the Issuer’s or the Group’s (as the case may be) key strategies and future plans for the development of its business] Example: Key Strategies and Future Plans We have a well-established brand name in [country] and we are recognised as the leading manufacturing company of [principal business] in [country]. We have a strong management team with over 20 years of experience in the industry and the management team has contributed significantly to our Company’s growth and expansion since our incorporation in [year]. We aim to strengthen our position in this industry and region by expanding our operations to [names of countries] in the next 3 years. Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on our strategies and future plans. We have also recently started a joint venture with [name of company] to enter into the [secondary business] market. We believe that there is a growing market for [secondary business] in [country] given the changing lifestyles of consumers in [country]. WHAT ARE THE KEY TRENDS, UNCERTANTIES, DEMANDS, COMMITMENTS OR EVENTS WHICH ARE REASONABLY LIKELY TO HAVE A MATERIAL EFFECT ON US? [Where applicable, briefly discuss, for at least the current financial year, the Issuer’s or the Group’s (as the case may be) business and financial prospects, any significant recent trends in production, sales and inventory, and in the costs and selling prices of products and services, as well as any other known trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the net sales or revenues, profitability, liquidity or capital resources, or that would cause financial information disclosed in the prospectus to be not necessarily indicative of the Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more PRODUCT HIGHLIGHTS SHEET Our revenue for [year] increased by S$[●] million ([●]%) due to an increase in sales volume contributed by our introduction of our new product in [year]. Our net profit from operations in [year] was S$[●] million, which is [●]% higher than our net profit from operations of S$[●] million in [year]. This was mainly attributable to lower finance costs of S$[●] million due to lower interest rates and lower loan principals. Our net cash generated from operating activities decreased by S$[●] million from S$[●] million in [year] to S$[●] million in [year] due to an increase in credit sales that contributed to an increase in trade receivables of S$[●] million from S$[●] million in [year] to S$[●] million in [year]. Our net assets increased by S$[●] million from S$[●] million in [year] to S$[●] million in [year] mainly due to the S$[●] million increase in inventories for our new product introduced in [year]. 6 future operating results or financial condition of the Issuer or the Group (as the case may be). If there are no such trends, uncertainties, demands, commitments or events, provide an appropriate statement to that effect.] information on our business and financial prospects. Example: (a) the demand for [activity] has increased with the recent growth [country]’s economy. We expect our revenue from our [business segment] to increase in line with the increase in [activity]; and (b) we expect the upward trend in [activity] to have a positive impact on the demand for our [service]. Operating costs are also expected to increase together with the increase in the level of [activity]. The above are not the only trends, uncertainties, demands, commitments or events that could affect us. Please refer to the other factors set out in pages [●] to [●] of the prospectus. WHAT ARE THE FEES AND CHARGES PAYABLE TO THE [TRUSTEEMANAGER/RESPONSIBLE PERSON] THAT MAY AFFECT US AND YOUR INVESTMENT IN OUR SECURITIES [This section only applies in respect of offers of units in real estate investment trusts and business trusts] [Briefly discuss the key fees and charges payable by the Issuer in connection with the establishment and ongoing management of its operations (including management fees, trustee fees, acquisition fees divestment fees, development fees, and any other substantial fee or charge that is 0.1% or more of the value of the trust property of the business trust or the REIT’s asset value). Information on key fees payable should be presented using tables where appropriate.] Example: Payable by the Issuer Management fee (payable to the TrusteeManager/Manager) Amount payable Base Fee [●]% per annum of the Distributable Income. Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on fees and charges payable to the [trusteemanager/ responsible person]. PRODUCT HIGHLIGHTS SHEET For the current financial year, our Directors have observed the following trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the net sales or revenues, profitability, liquidity or capital resources of the Group, or that would cause financial information disclosed in the prospectus to be not necessarily indicative of the future operating results or financial condition of the Group− 7 Performance Fee [●]% per annum of our gross revenue less property expense in the relevant financial year (calculated before accounting for the Performance Fee in that financial year) Charged on a variable basis of up to [●]% per annum of the value of the Deposited Property, subject to a minimum of S$[●] per month, excluding out-of-pocket expenses and goods and services tax. Acquisition fee (payable to the TrusteeManager/Manager) [●]% for each of the following (as applicable and subject to there being no double counting): Divestment fee (payable to the TrusteeManager/Manager) [●]% for each of the following (as applicable and subject to there being no double counting): Development management fee (payable to the TrusteeManager/Manager) Entitled to [●]% of the total project costs incurred in a Development Project undertaken and managed by the Trustee-Manager/Manager on behalf of the Issuer. [type of acquisition] [type of divestment] WHAT ARE THE KEY RISKS WHICH HAD MATERIALLY AFFECTED OR COULD MATERIALLY AFFECT US AND YOUR INVESTMENT IN OUR SECURITIES? [Discuss the key risks which the Issuer considers to be the most important for the investor when deciding whether or not he should invest in the shares/units being offered, taking into account the possibility of the risk occurring and/or whether the event will have a material adverse impact on the Issuer’s or the Group’s business operations, financial position and results, and the investor’s investment in the shares/units. The Issuer should not set out the entire list of risk factors found in the “Risk Factors” section of the prospectus.] Example: KEY RISKS We consider the following to be the most important key risks which had materially affected or could materially affect our business operations, financial position and results, and your investment in our Shares. An economic downturn could negatively affect our profitability: Our industry is exposed to cyclical variations in the general economy and to uncertainty of future economic prospects. Economic downturns could have an adverse impact on overall demand. This would result in a decrease in our sales and earnings. Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on risk factors. PRODUCT HIGHLIGHTS SHEET Trustee fee (payable to TrusteeManager/Manager) 8 Our industry is highly competitive: We compete against numerous businesses and our competitors may be larger and have greater financial resources. We compete for customers, financing, employees and other resources. This creates both strong price and quality competition, which leads to increased costs in the form of marketing and customer services, in addition to price reductions. Our ability to compete effectively depends on several factors, including our market presence, our reputation, our competitors, and general trends in the industry and economy. There is no assurance that we can compete successfully. A substantial proportion of our revenues is derived from several major customers and loss of their business may seriously impact our financial results: Our five largest customers accounted for approximately [●]% of our revenues for the year ended [year], and our ten largest customers accounted for approximately [●]% of our revenues for the year ended [year]. Our revenues may significantly decrease if we lose any of these customers or if our customers reduce their volume of business with us. We face risks associated with our business being conducted in [country]: As most of our operations are conducted in [country], our business may be adversely affected if we cannot successfully manage inherent risks including: unexpected political or economic developments; fluctuations in foreign currency exchange rates; unfavourable tax consequences; adverse legal or regulatory changes; insufficient protection for intellectual property rights; and complexities relating to currency and capital transfers. The restrictions on our operating subsidiary’s ability to make payments to us could have a material adverse effect on our ability to fund and operate our business: We are a holding company and conduct substantially all of our business through our operating subsidiaries in [country]. Accordingly, we will rely on dividends paid by our subsidiaries for our cash needs, including the necessary funds to pay our operating expenses, service any debt we may incur, and pay any dividends that may be declared. The payment of dividends by [country] entities such as our subsidiaries is subject to limitations in accordance with the rules and regulations of [country], which may negatively affect our operations and profitability. There is no assurance that the level of dividends/distributions can be sustained at the forecast levels when the [yield enhancing arrangement] expires: We have entered into a [yield enhancing arrangement] with the [vendor] of the [property]. The [yield enhancing arrangement] will start from [commencement date] and end on [expiry date]. Following the expiry of the [yield enhancing arrangement], there is no assurance that the rental rates of the [property], and correspondingly, the level of dividends/distributions, can be sustained as the forecast levels. The above are not the only risk factors that had a material effect or could have a material effect on our business operations, financial position and results, and your Shares. Refer to “[relevant section]” on page(s) [●] of the Prospectus for a discussion on other risk factors and for more information on the above risk factors. Prior to making a decision to invest in our [shares/units], you should consider all the information contained in the prospectus. PRODUCT HIGHLIGHTS SHEET 9 WHAT ARE THE RIGHTS ATTACHED TO THE SECURITIES OFFERED? [Describe the type and class of shares/units being offered, including the rights attached to the shares/units and any restrictions on the free transferability of shares/units.] Example: Key Information on Shares Offered We have only one class of shares, and the Shares offered will have the same rights as our other existing issued and paid-up shares, including voting rights. Shareholders will be entitled to all rights attached to their Shares in proportion to their shareholding, such as any cash dividends declared by the Company and any distribution of assets upon liquidation of the Company. There are no restrictions on the transferability of our Shares. HOW WILL THE PROCEEDS OF THE OFFER BE USED? SDF [Provide information on the amount of proceeds raised from the offer will be allocated to each principal intended use. Information on the use of proceeds should be presented using diagrams (e.g. tables, graphs and charts) where appropriate.] Example: Use of Proceeds The net proceeds to be raised in the offer (after deducting estimated expenses to be borne by us) is S$[●]. The following represents our estimate of the allocation of the gross proceeds expected to be raised from the offer, assuming the over-allotment option is not exercised. We will not receive any proceeds from the sale of shares by vendors. Allocation for each S$1.00 of gross Details of utilisation S$ (million) proceeds raised (1) Net proceeds: (a) Expansion of business [●] [●] (b) Working capital and general corporate purposes [●] [●] (2) Estimated listing expenses [●] [●] Total [●] 1.00 Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on our use of proceeds. PRODUCT HIGHLIGHTS SHEET As of the date of this prospectus, our issued and paid up share capital was S$[●] consisting of [●] shares. Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on the [shares/units] offered in the IPO. 10 WILL WE BE PAYING [DIVIDENDS/DISTRIBUTIONS] AFTER THE OFFER? [Describe (i) the dividends/distributions per share/unit, if any, paid by the Issuer for each of the 3 most recent completed financial years, and (ii) the Issuer’s dividend/distribution policy, or if it does not have a fixed policy, to state so. Provide clear and prominent disclosure of any existing or proposed arrangement that materially enhances short-term yields while potentially diluting long-term yields. The disclosure should include a computation of the forecast distribution yield assuming that the arrangements are not in place.] Example: Over the last three financial years ended 31 December [year], [year] and [year], we have declared and distributed dividends of approximately $[●] million, $[●] million and $[●] million respectively; this amounted to dividends per share of our Company of $[●], $[●] and $[●] respectively. We currently do not have a fixed dividend policy. Any future payment of dividends by us would depend on our earnings, financial condition and other business and economic factors. If we do not pay any dividends, any return on investment may be limited to the value of our shares, and our shares may be less valuable because return on investment will depend entirely on capital appreciation. DEFINITIONS [Provide definitions if necessary.] CONTACT INFORMATION WHO CAN YOU CONTACT IF YOU HAVE ENQUIRIES RELATING TO OUR OFFER? HOW DO YOU CONTACT US? [Provide contact details of Issuer, distributor(s)/underwriter(s) and/or issue manager(s) whom investors can contact if they have enquiries. Include a website address and email address, if appropriate.] PRODUCT HIGHLIGHTS SHEET Refer to the “[relevant section]” on page(s) [●] of the Prospectus for more information on our [dividend/distrib ution] policy.