CHAPTER FIVE

advertisement

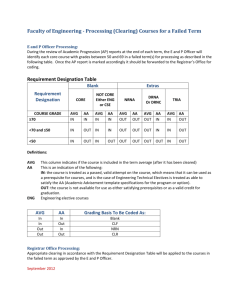

CHAPTER FIVE Territory Management TERRITORY A territory geographically defined area assigned to a sales person present customers potential customers SALES FORCE PRODUCTIVITY A crisis-In the last ten years, selling costs have risen almost twice as fast as average sales volume per salesperson HOW SALESPEOPLE SPEND THEIR TIME Face-to-Face Selling = 30% Telephone Selling = 21% Waiting / Travelling = 20% Administrative Duties = 17% Service Activities = 12% SALES FORCE PRODUCTIVITY How can we improve productivity? Focus on high volume accounts Focus on selling time MINIMUM ACCOUNT SIZE Don’t pursue accounts that are unprofitable!! COST PER CALL Cost per call is a function of number of calls per day number of days available to make calls direct selling expenses Direct Selling Expenses # Calls per day X # Days to Sell COST PER CALL Example (see Table 5.1; page 230) Total Direct Expenses = $90,250 205 days to sell; average 3 calls per day Cost per call = $90,250 / 205 x 3 = $146.75 BREAK EVEN SALES VOLUME The sales volume necessary to cover direct selling expenses Breakeven Volume is a function of: Cost per call Number of calls to close Sales costs as a percentage of sales BREAK EVEN SALES VOLUME Cost Per call X # of Calls to Close Sales costs as a % of Sales BREAK EVEN SALES VOLUME See Table 5-2; page 231 Electronics Industry --Cost per call = $133.30 --Number of calls to close = 3.9 --Sales Costs as a % of sales = 12.0 Breakeven volume = $133.30 x 3.9 / .12 = $4,332.25 TERRITORY IMPLICATIONS Perform a customer by customer analysis! Assess selling strategy ALLOCATION OF SELLING EFFORT Consider the time we spend with customers! Single Factor Models Portfolio Models Decision Models SINGLE FACTOR MODELS Easy to develop and use Classify accounts into categories based on one factor, such as market potential Assign all accounts in the same category the same number of sales calls Decisions are made on the basis of one factor. Differences among accounts are not taken into consideration SINGLE FACTOR MODEL CATEGORY AVG SALES AVG SALES CALLS-1998 CALLS-1999 A 25 32 B 23 24 C 20 16 D 16 8 PORTFOLIO MODELS Accounts are classified into categories of similar attractiveness for receiving sales call investment. Selling effort is allocated so that the more attractive accounts receive more selling effort. ACCOUNT ATTRACTIVENESS Account Opportunity The account’s need for and ability to purchase the product High / Low Competitive The Position strength of the relationship between the firm and the account Strong / Weak PORTFOLIO MODEL SEGMENTS Strong Competitive Position/High Account Opportunity “Core Accounts” Accounts are very attractive due to strong competitive position Accounts should receive a heavy investment of selling effort to maintain/improve competitive position PORTFOLIO MODEL SEGMENTS Weak Competitive Position/High Account Opportunity “Growth Accounts” Accounts are potentially attractive due to high opportunity Additional analysis required to identify accounts where competitive position can be improved. Target these accounts PORTFOLIO MODEL SEGMENTS Strong Competitive Position/Low Account Opportunity “Drag Accounts” Accounts moderately attractive; future opportunities are limited Accounts should receive an effort sufficient to maintain current position PORTFOLIO MODEL SEGMENTS Weak Competitive Position/Low Account Opportunity “Problem Accounts” Accounts very unattractive Accounts should receive a minimal of selling effort. Less costly forms of marketing might be considered (telemarketing, direct mail) and/or the elimination of account coverage PORTFOLIO MODEL EXAMPLE HI AO / STRONG CP Avg Calls 1998: 6.1 Avg Sales: $8,615 Number: 49 HI AO / WEAK CP Avg Calls 1998: 3.5 Avg Sales: $247 Number 35 LO AO / STRONG CP Avg Calls 1998: 5.8 Avg Sales: $2,990 Number: 20 LO AO / WEAK CP Avg Calls 1998: 3.3 Avg Sales: $130 Number: 56 DECISION MODELS Examine accounts on an individual basis Allocate sales calls to accounts that promise the highest sales returns The objective is to achieve the highest level of sales and to increase sales calls until marginal costs equal marginal returns DECISION MODEL EXAMPLE # PEOPLE 100 MGL PROFIT $85,000 MGL SALES COSTS $75,000 101 $80,000 $75,000 102 $75,000 $75,000 103 $70,000 $75,000 MANAGING TERRITORY PROFITABILITY Allocation of Effort Mix of Products Sold Price Concessions ROUTE MANAGEMENT Route should be circular Route should never cross itself Don’t use same route to go to and from a client Customers in neighboring areas should be visited in sequence TIME MANAGEMENT Telephone interruptions Drop in visitors Crises Meetings Lack of objectives Indecision/procrastination Poor communications TIME MANAGEMENT Get control of your time! Set goals and objectives Set priorities Develop a daily “to do” list Focus on the most important tasks MANAGEMENT’S ROLE Close Supervision Hands-off Management Management Recommendations FROM THE INTERNET The granddaddy of time management sites: http://www.relibrary.com/10tm1.htm FROM THE INTERNET See what a consultant says about improving sales force productivity at: http://www.brickerinc.com/netgain.ht m FROM YOUR TEXT Read everything in chapter five except pages 238 to 240 (Sales Funnel Method) pages 242 to 245 (Largest Angle Method)