APPENDICES TO “EQUILIBRIUM MARKUP PRICING STRATEGIES

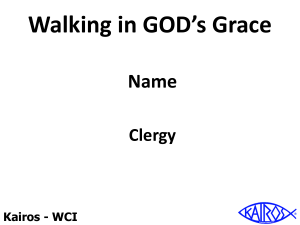

advertisement

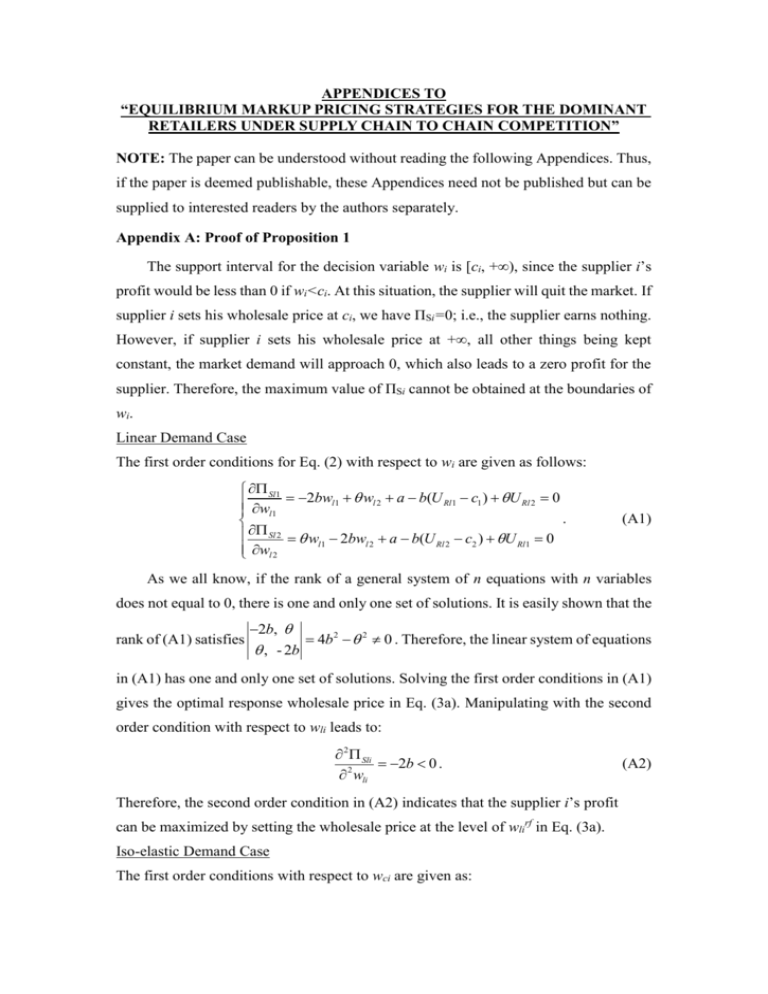

APPENDICES TO “EQUILIBRIUM MARKUP PRICING STRATEGIES FOR THE DOMINANT RETAILERS UNDER SUPPLY CHAIN TO CHAIN COMPETITION” NOTE: The paper can be understood without reading the following Appendices. Thus, if the paper is deemed publishable, these Appendices need not be published but can be supplied to interested readers by the authors separately. Appendix A: Proof of Proposition 1 The support interval for the decision variable wi is [ci, +∞), since the supplier i’s profit would be less than 0 if wi<ci. At this situation, the supplier will quit the market. If supplier i sets his wholesale price at ci, we have ΠSi=0; i.e., the supplier earns nothing. However, if supplier i sets his wholesale price at +∞, all other things being kept constant, the market demand will approach 0, which also leads to a zero profit for the supplier. Therefore, the maximum value of ΠSi cannot be obtained at the boundaries of wi. Linear Demand Case The first order conditions for Eq. (2) with respect to wi are given as follows: Sl1 w 2bwl1 wl 2 a b(U Rl1 c1 ) U Rl 2 0 l1 . Sl 2 wl1 2bwl 2 a b(U Rl 2 c2 ) U Rl1 0 wl 2 (A1) As we all know, if the rank of a general system of n equations with n variables does not equal to 0, there is one and only one set of solutions. It is easily shown that the rank of (A1) satisfies 2b, 4b 2 2 0 . Therefore, the linear system of equations , - 2b in (A1) has one and only one set of solutions. Solving the first order conditions in (A1) gives the optimal response wholesale price in Eq. (3a). Manipulating with the second order condition with respect to wli leads to: 2 Sli 2b 0 . 2 wli Therefore, the second order condition in (A2) indicates that the supplier i’s profit can be maximized by setting the wholesale price at the level of wlirf in Eq. (3a). Iso-elastic Demand Case The first order conditions with respect to wci are given as: (A2) Sc1 K ( wc 2 U Rc 2 ) ( 1) wc1 U Rc1 c1 0 ( wc1 U Rc1 ) 1 wc1 . Sc 2 K ( wc1 U Rc1 ) ( 1) w U c 0 c2 Rc 2 2 wc 2 ( wc 2 U Rc 2 ) 1 (A3) Obviously, the linear system of equations in (A3) has one and only one set of solutions which are given in Eq. (3b). Manipulating with the second order condition with respect to wci leads to 2 Sci 2 wci K ( wcj U Rcj ) wci wci rf ( wci U Rci ) 2 (U Rci ci ) 0 . (A4) Therefore, the second order condition in (A4) indicates that the stationary point of wcirf is the local maximum of ΠSi. Since wcirf is the only stationary point of ΠSi and the maximum value of ΠSi cannot be obtained at ci (the lower bound of wci), we can conclude that the supplier i’s profit can be maximized by setting the wholesale price at the level of wcirf in Eq. (3b) for the iso-elastic demand case. Appendix B: Proof of Proposition 3 It is intuitive that the markup URi satisfies 0≤URi≤UT(=[a+θ(URj+cj)]/b-ci). If retailer i sets her markup at the lower bound (i.e., URi=0), we have ΠRi=0; i.e., the retailer will earn nothing; however, if the retailer i sets her markup at the upper bound (i.e., URi=UT), the market demand for supply chain i will equal to 0, which will in turn yield zero profit for retailer i. Therefore, the maximum value for ΠRi cannot be achieved at the boundaries of URi. Linear Demand Case The first order conditions for Eq. (4) with respect to URli are given as follows: b Rl1 2 2 2 2 U 4b 2 2 2(2b )U Rl1 bU Rl 2 a(2b ) (2b )c1 b c2 0 Rl1 ; b 2 2 2 2 Rl 2 2 bU Rl1 2(2b )U Rl 2 a(2b ) (2b )c2 b c1 0 2 U Rl 2 4b It is easily shown that 2(2b 2 2 ), b b , 2(2b ) 2 2 (4b 2 b 2 2 )(4b 2 b 2 2 ) 0 . Therefore, the linear system of equations stated above has one and only one set of solutions, which are given in Eq. (5a). Also, we can show that 2 Rli 2b(2b2 2 ) 0. 2U Rli 4b2 2 Therefore, URli[FF] in Eq. (5a) maximizes retailer i's profit stated in Eq. (4). Iso-elastic Demand Case The first order conditions for Eq. (4) with respect to URci are given as follows: Rc1 K (U Rc1 c1 ) (U Rc 2 c2 ) ( 1)U Rc1 c1 0 U Rc1 c1 1 1 U Rc1 . K (U Rc 2 c2 ) (U Rc1 c1 ) Rc 2 ( 1)U Rc 2 c2 0 U U c 1 1 Rc 2 2 Rc 2 Obviously, the linear system of equations above has one and only one set of solutions which are given in Eq. (5b). It is easily shown that the second order conditions satisfy 2 Rci 2U Rci U Rci U Rci[ FF ] K ( 1) 2 2ci (U Rcj c j ) 0. 2 ci 1 ( 1) Therefore, URci[FF] in Eq. (5b) maximizes retailer i's profit. Appendix C: Proof of the Non-negativity of Eq. (5a) and Eq. (11) Proof of the non-negativity of Eq. (5a) Since b>θ is assumed in Eq. (1a) to ensure that the effect of the competitor’s price cannot exceed the effect of its own price, we know that the denominator of Eq. (5a) satisfies 16b4 17b2 2 4 2 = (4b2 2 2 b )(4b2 2 2 b ) >0. It is also known that, the market demand must be larger than 0 when the retail prices are at their lower bounds (i.e., pi=ci) to ensure a positive profit for the supply chain; i.e., we have a-bci+θcj>0 under the linear demand case. Therefore, we have U Rli[ FF ] > a(6b 2 3b 2 2 3 8b3 ) b 2 2 2(2b 2 2 ) 2 b (2b 2 2 ) c cj i 16b 4 17b 2 2 4 2 16b 4 17b 2 2 4 2 16b 4 17b 2 2 4 2 a (6b2 3b 2 2 3 8b3 ) b2 2 2(2b2 2 ) 2 b(2b2 2 )(bci a ) c i 16b4 17b2 2 4 2 16b4 17b2 2 4 2 16b4 17b2 2 4 2 2(b )(3b2 2 )(a bci ci ) = 0. 16b4 17b2 2 4 2 Proof of the non-negativity of Eq. (11) It is obviously that Eq. (11b) is nonnegative due to the assumption “b>θ”. In the following we prove Eq. (11a) is also nonnegative. As we have stated above, the market demand must be larger than 0 when the retail prices are at their lower bounds. Therefore, when the wholesale price for each supplier is set to equal to the production cost, we have Di=a-b(URi+ci)+θ(1+ηj)cj>0 for the hybrid scenario and Di=a-b(URi+ci)+θ(URi+ci)>0 for the [FF]-scenario. Therefore, Eq. (11a) can be transformed as wlirf= a 2b2 (2b2 2 ) b 2 c U Rli 2 (1 lj )c j 2 i 2 2 2b 4b 4b 4b 2 > a (2b ) 2b2ci (2b2 2 )U Rli b[b(U Rli ci ) a ] 4b2 2 = a (b ) (b2 2 )U Rli 3b2ci 4b2 2 > (b )(b )(U Rli ci ) (b2 2 )U Rli 3b2ci 4b2 2 = ci . Obviously, we have wlirf>0. Appendix D: Proof of Proposition 4 (a) under this situation, we have USli[FF]-URli[FF]= = 2b2 (2b )(a bc c)(4b2 b 2 2 ) 2 (4b2 b 2 2 ) (4b2 2 )(16b4 17b2 2 4 4 )2 2b2 (2b )(a bc c)(4b2 b 2 2 )2 (4b 3 )(b ) 2 (4b2 2 )(16b4 17b2 2 4 4 )2 ; As stated in Appendix C, we have a-bc+θc>0. Together with the assumption “b>θ”, we have “USli[FF]/URli[FF]<1” holds true no matter how the environment parameters change; (b) under this situation, we have USci[FF]-URci[FF]= ( 1) 2 ci - ci 1 = c >0. 1 ( 1) 2 i Thus, we have “USci[FF]/URci[FF]>1” no matter how the environment parameters change; Appendix E: Proof of Proposition 5 According to the discussions in Appendix A, we know that the maximum value of ΠSi cannot be obtained at the boundaries of wi. Linear demand case The first order conditions for Eq. (6) with respect to wli are given as follows: Sl1 w 2b(1 l1 ) wl1 (1 l 2 ) wl 2 a bc1 (1 l1 ) 0 l1 . Sl 2 (1 ) w 2b(1 ) w a bc (1 ) 0 l1 l1 l2 l2 2 l2 wl 2 It is easily shown that 2b(1 l1 ), (1 l 2 ) (1 l1 ), - 2b(1 l 2 ) (A5) (4b2 2 )(1 l1 )(1 l 2 ) 0 . Therefore, the linear system of equations in (A5) has one and only one set of solutions which are given in Eq. (7a). Manipulating with the second order condition with respect to wli leads to: 2 Sli 2b(1 li ) 0 . 2 wli Therefore, the second order conditions are satisfied. Iso-elastic Demand Case The first order conditions for Eq. (6) with respect to wci are given as follows: K (1 c 2 ) wc 2 Sc1 ( 1) wc1 c1 0 wc1 (1 c1 ) wc1 wc1 . K (1 c1 ) wc1 Sc 2 ( 1) wc 2 c2 0 w w (1 ) w c 2 c2 c2 c2 The unique set of solutions for (A6) is given in Eq. (7b). And the second order condition is also satisfied; i.e., we have 2 Sci 2 wci K wci wci rf ( 1) 2 (1 cj ) wcj ( ci ) 1 (1 ci ) 0. Appendix F: The Existence and Uniqueness of Equilibrium Makeup for [PP] (A6) For the iso-elastic demand case, the first order conditions for Eq. (8) with respect to ηci are given as: Rc1 K c1 (1 c1 ) c1 (1 c 2 ) c2 ( 1)c1 1 0 ( 1)(1 c1 ) 1 1 c1 . (A7) (1 ) c (1 ) c K c Rc 2 c2 2 c1 1 2 ( 1)(1 ) 1 1 ( 1)c 2 1 0 c2 c2 Obviously, the set of optimal solutions for (A7) is unique, and is given in Eq. (7b). And the second order condition is also satisfied; i.e., we have 2 Rci 2ci ci ci[PP] K (1 cj )c j 2 ci 1 ( 1) 1 0. Although we can analytically prove the existence and uniqueness of equilibrium markup for the iso-elastic demand curve, we fail to do that for linear demand curve. Nevertheless, we can graphically show the relationship between ηl1 and ηl2 which is depicted in Figure A1. It is obviously that, the equilibrium solution is unique. Fig.A1. The relationship between ηl1 and ηl2, a=10, b=1, c1=c2=1, θ=0.5 Appendix G: Proof of Proposition 8 Linear Demand Case The first order conditions for Eq. (10) with respect to wli are given as follows: Sli w 2bwli (1 lj ) wlj a b(U Rli ci ) 0 li , i j. Slj wli 2b(1 lj ) wlj a U Rli b(1 lj )c j 0 wlj It is easily shown that 2b, (1 lj ) , - 2b(1 lj ) (A8) (4b 2 2 )(1 lj ) 0 . Therefore, the linear system of equations in (A8) has one and only one set of solutions which are given in Eq. (11a) and (11b). Manipulating with the second order condition with respect to wli leads to: 2 Sli 2b 0 2 wli , i j. 2 Slj 2b(1 lj ) 0 2 wlj Therefore, the second order conditions are satisfied. Iso-elastic Demand Case The first order conditions for Eq. (10) with respect to wci are given as follows: K (1 cj ) wcj Sci ( 1) wci U Rci ci 0 wci ( wci U Rci ) 1 , i j. K ( w U ) Scj ci Rci ( 1) wcj c j 0 wcj w (1 ) w cj cj cj (A9) The unique set of solutions for (A9) is given in Eq. (12). And the second order conditions are also satisfied; i.e., we have 2 K ( 1) 2 (1 cj ) wcj Sci 0 1 2 wci (U Rci ci ) , i j. 2 2 Slj K ( 1) ( wci U Rci ) 0 2 ( c j ) 1 (1 cj ) wlj Appendix H: Proof of Proposition 9 Anticipating how the suppliers respond to the declared markups through Eq. (11) and Eq. (12) for the linear or iso-elastic demand case respectively, the dominant retailers decide the optimal markups to maximize their own profits as: ΠRi(URi|ηj)=URi∙Di(wi+URi,(1+ηj)wj), (A10a) ΠRj(ηj|URi)=ηjwj∙Dj(wi+URi,(1+ηj)wj), (A10b) According to the discussions in Appendix B, the maximum value for ΠRi cannot be achieved at the boundaries of URi and ηj. Linear Demand Case The optimal values of (URli, ηlj) which maximize the retailers’ profits can be obtained by solving the following equations: Rli w 0 li , i j. Rlj 0 wlj (A11) Unfortunately, we cannot prove the existence and uniqueness of the equilibrium outcomes analytically. Nevertheless, we can graphically show that there is one and only one set of solutions that satisfied (A11). The relationship between URli and ηlj is given in Figure A2. Fig. A2. The relationship between URli and ηlj, a=10, b=1, c1=c2=1, θ=0.5 Straightforward manipulation with the first order condition of Eq. (A10a) with respect to URli gives the optimal markup for the dominant retailer i as: URlirf= a(2b ) ci b (1 lj )c j . 2 2 2(2b ) 2 2(2b2 2 ) (A12) Substituting URlirf into the equation “∂ΠRlj(ηlj|URli)/∂ηlj=0” and solving it gives ηlj= 2 3 Y1 3 Y2 31 . (A13) where 1 2b2c j 2 (64b6 7 6 46b2 4 96b4 2 ) , 2 2c j (160c j b8 240c j 2b6 4 2 (ci 4a)b5 ( (227 / 2) 4c j 12 3a)b 4 (14 4 a 4 5ci )b3 (10 5 a 17 6c j )b 2 6 (ci 3a)b 2 7 a) 3 2c j (192c j b6 2 128c j b8 9 5b3ci 30 3b4a 31 4b3a 10 3b5ci 13b2 6c j 40 2b5a 89c j b4 4 4 7a 6 6ba 22 5b2a 2 7bci ) , , 4 (2 4c j (bci 2a ) 3 (9c j b 3a )b 2 2b2 (bci 3a ) b3 ( c j b a )) (( bci 2a ) 3 3b( c j b a ) 2 2b2 (bci 3a ) 8b3 ( c jb a )) , A 2 2 313 , B 2 3 91 4 , C 32 3 2 4 , B B 2 4 AC Y1 A 2 31 2 , B B 2 4 AC Y2 A 2 31 2 . Other optimal solutions (such as the optimal wholesale price, retail price, market demand, profits) can then be determined by substituting the expressions in (A13) into the corresponding functions. Appendix I: Proof of Proposition 10 According to the entries in Table 2, we have 2 2 1 wi[PP]/wi[FF]= = <1; ci c i 2 2 1 ( 1) 1 c 1 2( )1 1 Kc ΠRi[PP]/ΠRi[FF]= i ΠSi [PP] 1 j c 1 2( ) 1 Kc /ΠSi[FF]= i 1 j Kci 1c j 1 1 2( ) >1; 1 Kci 1c j 1 2( ) 1 1 <1. 1 Appendix J: The Elasticity of Demand Let ES be the elasticity of demand the supplier faces, and it can be stated as: ESi= dDi wi . dwi Di (A14) When the retailer offers a fixed-dollar markup; i.e., pi=wi+URi, the price elasticity of demand the supplier faces under an iso-elastic demand curve can be expressed as: ESi[ FF ] K (wi Ui ) 1 p j wi wi . K (wi Ui ) p j wi Ui (A15) When the retailer offers a percentage markup, i.e., pi=(1+ηi)w, the price elasticity of demand at the wholesale level can be stated as: ESi[ PP ] K (1 i ) wi 1 p j wi . (A16) K (1 i ) wi p j From (A15) and (A16), we have E Si[ FF ] wi 1. [ PP ] E Si wi U Ri (A17) Eq. (A17) implies that the supplier faces a more elastic demand when the retailer offers a percentage markup pricing strategy.