Slide 1 - Madan Chartered Accountant

advertisement

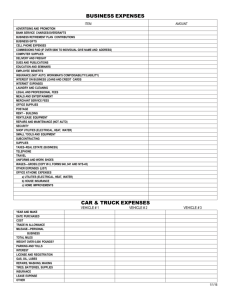

How to complete the T2125 form this coming tax season if you are a Sole Proprietor • If you have business income, fill out part 1 of form 2125 • In the example above Jane has gross sales of $100,000 this year. • She also has returns and allowances of $1,000 which is deducted from sales • Jane’s adjusted gross sales end of year is $99,000 • This amount will be carried forward to part 3 • Check this box if you have professional income • Professional income includes Work in Process(WIP) • If you have both professional and business income complete separate T2125 forms • Cannot check both boxes on the same return • Carry forwarded the amount from part 1 line C to be starting amount • Jane has no reserves deducted last year or other income (recapture) • Carry line 8299 forward to cost of goods sold • Start with carry forward amount from Part 3 line 8299 • Basic equation for costs of good sold is: Beginning Inventory + Purchases – Ending inventory = COGS •If any other costs are not listed above, add them as well • Subtract COGS from the carry forward amount to get gross profit • This will be the new carry forward amount, Line 8519 • Part 5 is where to deduct expenses for the year • Most of the expenses might be similar to the income statement amounts • For motor vehicle and CCA expenses , separate calculations are needed. • Deduct total expenses from gross income to get net income (loss) before adjustments • Carry Line 9369 forward to Part 6 Jane purchases a building for $100,000 on January 15, 2013 • Building is Class 1 and has a rate of 4% under classes of depreciable property • Since the Building was purchased this year it has 0 UCC or tax value • When purchasing a depreciable property during the current year only half its value can be deducted • Area C is for Building Additions • Area E is for Building Dispositions Say in that same year Jane had disposed of some equipment. The equipment had a remaining UCC (tax value) of $10,000 and was sold for $5,000. • If total CCA is negative it is considered recapture and must be added on Line 8230 as other income • Recapture occurs when selling depreciable property for more than its UCC or tax value • Since CCA is positive the $3,000 will be added to CCA expense section line 9270 • Area B is for equipment additions • Area D is for equipment dispositions • Enter business km • Enter car expenses that CRA allows deductions for • business use km total km x Expenses claimed = Your allowable motor vehicle expense for the year • CCA can be claimed on your car • See Class 10.1 for further details • added to line 9281 in Part 5 • Carry forward line 9369 from Part 5 to be starting point for Part 6 • If your business has any GST/HST rebates for partners received during the year they must be added to net income under line N • If a vehicles is shared with your partner and they have not paid you back for expenses it can be claimed. • The business home expense can be deducted in this section. • The T2125 form is now complete and net income for tax purposes has been calculated If you are a sole proprietor and have active business or professional income you must complete the T2125 form. Be Sure to speak to your accountant if you have any questions concerning the form or for other ways they might be able to save you tax