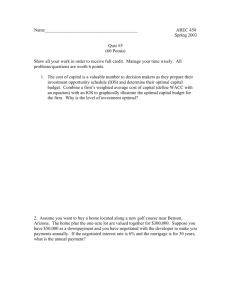

Capital Budgeting

advertisement

Chapter 12 Managerial Accounting Capital Budgeting Prepared by Diane Tanner University of North Florida Capital Budgeting Decisions What are capital budgeting decisions? Investment planning decisions involving the acquisition of long-term assets Impact more than one accounting period Long-term assets costs are allocated over multiple accounting periods Require a ‘capital’ investment i.e., Acquisition of a capitalized asset Related cash flows appear as investing activities on the statement of cash flows 2 Examples of Long-Term Assets Plant and equipment assets Equipment Furniture & fixtures Buildings Land Expansions such as subsidiaries Intangible assets Patents Trademarks Copyrights Franchises 3 Financial Accounting Review • Upon acquisition, capitalize a long-term asset: •Increase the respective Asset account •Decrease Cash • Depreciate or amortize the cost of the asset over its useful life • Asset reporting • In the Long-term Assets section of the balance sheet, and • As an investing activity on the statement of cash flows 4 Capital Budgeting Methods Methods of evaluating capital budgeting decisions Net present value (NPV) Internal rate of return (IRR) Payback period method (PBM) Accounting rate of return (ARR) 55 Cash Flows with Capital Budgeting Decisions Types of cash flows present in all capital budgeting decisions Operating cash flows Occur every year as net inflows (hopefully) Inflation and other budgeting issues may cause differences in amounts each year Investing cash flows Occur at time 0 (beginning of year 1) as an outflow for the cost of acquiring the asset Occur at end of the useful life as a cash inflow for the salvage value If an old asset if sold, occurs at the time the new asset is being acquired 6 Planning Capital Budgeting Decisions Use time lines to identify timing of cash flows Why? Because acquisition of long-term assets requires a period of time for the company to get its ‘money’ back Time lines should show all cash inflows and outflows Operating cash flows from revenues and expenses Investing cash flows from acquisition and disposition 0 1 2 3 (500) 120 90 140 4 110 7 Assumptions of Cash Flows All revenues are received in the same year earned All expenses are paid in the same period as incurred Annual operating cash flows occur at the end of the year Conservatism 8 9 Time Value of Money (TVM) • Why is the timing of cash flows considered? • Because investments extend over long periods of time • Investments that promise larger returns earlier in time are preferable to those that promise larger returns later in time • Time value of money is needed to assess cash flows • Interest can be considered to be a rental cost of money Methods of Determining TVM Financial calculator (BAII plus professional) Excel Mathematical formulas Tedious Time value of money tables Limited due to very little differential in interest rates is provided 10 TVM Approach 11 Draw a time line showing all cash flows Discount each cash flow Removes the interest portion of each cash flow The amount remaining after discounting is the amount that can be invested to accumulate to the total cash for some future period Use the NPV (net present value) approach Net together all of the discounted inflows and outflows to get the present value, or Use the IRR (internal rate of return) approach Internally determine the rate that the cash flows earn The End 12