Product Costing Systems: Concepts and Design Issues

advertisement

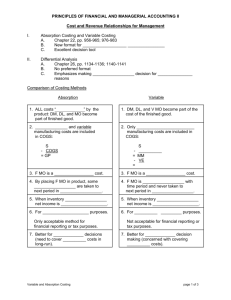

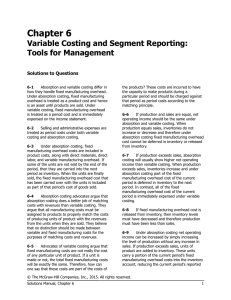

Product Costing Systems: Concepts and Design Issues Chapter 2 What is the Cost? Several years ago you purchased a bottle of wine for $25. Today it is worth $75. If you give the bottle to a friend as a gift, what is the cost of your gift? $0 $25 $25+ $75 ($50) Cost Objects Anything whose cost we want to determine Product, process, location, person, region, etc. Whether a cost is direct or indirect depends on the cost object As cost object becomes more detailed, fewer costs are directly related Direct vs. Indirect Costs Direct cost Easily and conveniently traceable to the cost object Indirect Not easily or conveniently traceable Cost is shared among cost objects No apparent “link” between the cost and the object Not cost effective to trace Product vs. Period Costs Product costs Reasonable and necessary costs to prepare the product for sale to the customer Direct materials Direct labor Overhead Part of inventory until product is sold Period costs Non-manufacturing costs Expensed when incurred Product costs Product vs. Period Costs Direct material Prime costs Direct labor Conversion costs Overhead Product vs. Period Costs Distinction between product and period costs is blurred for internal reporting Marketing cost may be considered part of the total cost of a product Labor may be considered overhead Only incremental costs may be considered Etc. Manufacturing Cost Flows Raw Materials Inventory (1) Work in Process (2) Inventory Factory Labor Overhead Finished Goods (3) Inventory Cost of Goods Sold (1) Materials are placed into production (Raw materials used in production) (This plus direct labor and overhead equals total manufacturing costs, i.e. inputs) (2) Goods are completed (Cost of goods manufactured, i.e. outputs) (3) Goods are sold Manufacturing Cost Flows Example Company Statement of Cost of Goods Manufactured and Sold Beginning raw materials inventory Add: Purchases of raw materials Raw materials available Less: Ending raw materials inventory Raw materials used in production $ $ $ Direct labor Overhead Total manufacturing cost 71,000 134,000 $ 390,000 Input $ 6,000 396,000 (8,000) $ 388,000 Output (2) $ 3,000 391,000 Add: Beginning work in process inventory Less: Ending work in process inventory Cost of goods manufactured Add: Beginning finished goods inventory Goods available for sale Less: Ending finished goods inventory Cost of goods sold 5,000 187,000 192,000 (7,000) 185,000 (1) (2,000) $ 389,000 Expense (3) Cost Drivers The cause of a particular cost Capacity driver Decision to acquire capacity Transaction driver Each occurrence causes the cost Duration driver Amount of cost depends on the duration of the event Cost Hierarchy Unit level Each additional unit (of something) creates more cost Batch level Each new batch, or the crossing of some threshold creates more cost Product level Change to product, or additional product, creates more cost Cost Hierarchy Customer level Each new customer creates more cost Facility level Change to facility creates more cost Cost Behavior How a cost changes in relation to changes in volume of activity Behavior depends on the definition of activity and relevant range Unit of product or batch? Fixed per batch, but vary inversely per unit Narrow or wide range? Fixed over a narrow range but step over a wider range Fixed Cost Total cost remains constant Cost per unit varies inversely with activity Cost Fixed Cost 120 100 80 60 40 20 0 Total Cost Cost per Unit 1 2 3 4 5 6 Units of activity 7 8 9 10 Step Fixed Cost Fixed through some range, but increases when some increment is crossed Cost Step Fixed Cost 140 120 100 80 60 40 20 0 Total cost Cost per unit 1 2 3 4 5 6 7 Units of activity 8 9 10 Variable Cost Cost per unit remains constant Total cost varies directly with activity Cost Variable Cost 120 100 80 60 40 20 0 Total Cost Cost per Unit 1 2 3 4 5 6 Units of Activity 7 8 9 10 Mixed Cost Contains a fixed and a variable component Cost per unit is not constant Cost Mixed Cost 140 120 100 80 60 40 20 0 Total cost Cost per unit 1 2 3 4 5 6 7 Units of activity 8 9 10 Absorption vs. Variable Costing Absorption costing Product costs include material, labor, variable and fixed overhead All of the reasonable and necessary costs to produce the product Income statement arranged by type of cost Product or period Revenue – cost of goods sold = gross profit Gross profit – S&A expenses = net income Absorption vs. Variable Costing Variable costing Product costs only include material, labor and variable overhead Fixed overhead is treated as a period cost Income statement arranged by cost behavior Variable then fixed Revenue – variable costs = contribution margin Contribution margin – fixed costs = net income Absorption vs. Variable Costing Selling price $ 100 per unit Material Labor Variable overhead $ $ $ 30 per unit 15 per unit 5 per unit Fixed overhead $ 50,000 Variable selling expenses $ Fixed selling expenses $ 10,000 Units produced Units sold Year 1 2,000 2,000 10 per unit Year 2 4,000 2,000 Year 3 2,000 4,000 Absorption vs. Variable Costing Absorption costing income statements Year 1 Year 2 Year 3 Sales $ 200,000 $ 200,000 $ 400,000 Cost of goods sold 150,000 125,000 275,000 Gross profit $ 50,000 $ 75,000 $ 125,000 Selling expenses 30,000 30,000 50,000 Net income $ 20,000 $ 45,000 $ 75,000 Variable costing income statements Sales $ 200,000 $ 200,000 Var. cost of goods sold 100,000 100,000 Var. selling expenses 20,000 20,000 Contribution margin $ 80,000 $ 80,000 Fixed overhead 50,000 50,000 Fixed selling expenses 10,000 10,000 Net income $ 20,000 $ 20,000 Difference $ - $ 25,000 $ $ 400,000 200,000 40,000 160,000 50,000 10,000 100,000 $ (25,000) $ Absorption vs. Variable Costing Fixed overhead Is it necessary to produce the product? Is it related to production volume? Is it a product or period cost? Which is more useful? Financial reporting Absorption required Decision making Variable does not distort cost as volume changes Throughput Costing Product costs only include unit level spending for direct costs (i.e. incremental costs) Materials, commissions, etc. All other indirect, past or committed costs are treated as period costs Labor (unless piece-rate), overhead, etc. Resources Supplied vs. Resources Used Cost of resource supplied Capacity (hours, etc.) available * cost per unit of capacity Cost of resource used Capacity used * cost per unit of capacity Cost of unused capacity Cost of resource supplied – cost of resource used A worker is paid for an 8-hour day. The worker can produce 10 units per hour and is paid $10 per hour ($1 per unit). The worker only produced 50 units on Monday. Cost of capacity available: $80 Cost of capacity used: 50 units * $1 per unit = $50 Cost of unused capacity: $80 - $50 = $30 Miscellaneous Cost Terms Committed cost Decision has been made to incur the cost in the future Discretionary cost Cost which can be increased or decreased at will Sunk cost Cost incurred previously Opportunity cost Benefit given up when one alternative is chosen over another