Business Loans, Grants and Government Incentives

advertisement

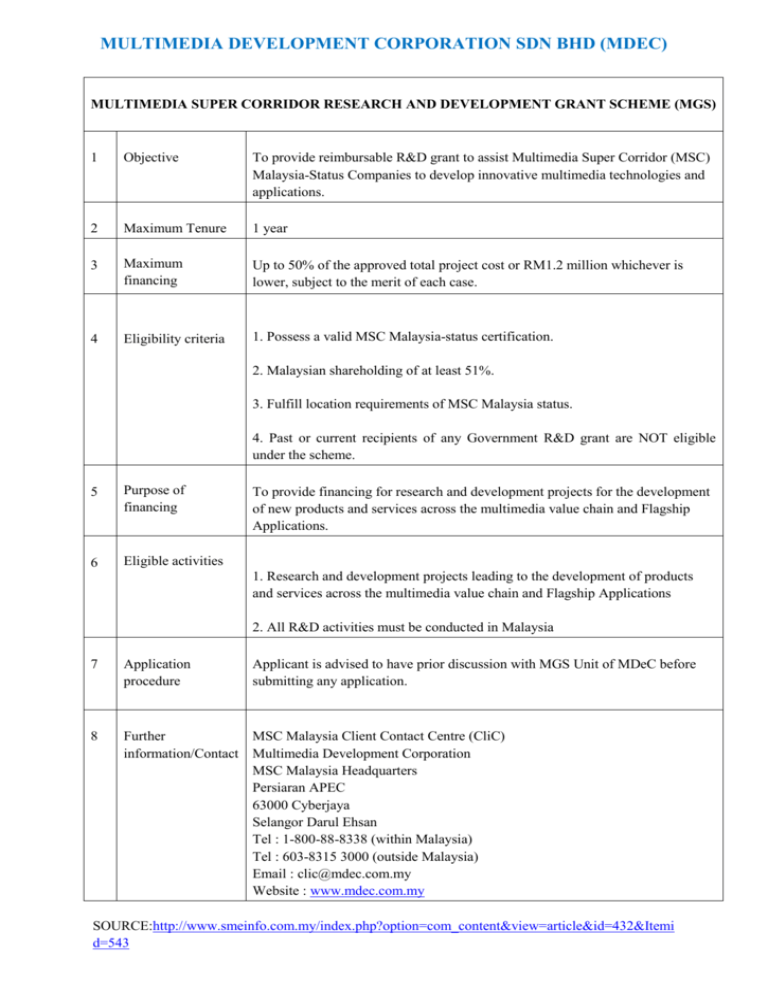

MULTIMEDIA DEVELOPMENT CORPORATION SDN BHD (MDEC) MULTIMEDIA SUPER CORRIDOR RESEARCH AND DEVELOPMENT GRANT SCHEME (MGS) 1 Objective To provide reimbursable R&D grant to assist Multimedia Super Corridor (MSC) Malaysia-Status Companies to develop innovative multimedia technologies and applications. 2 Maximum Tenure 1 year 3 Maximum financing Up to 50% of the approved total project cost or RM1.2 million whichever is lower, subject to the merit of each case. 4 Eligibility criteria 1. Possess a valid MSC Malaysia-status certification. 2. Malaysian shareholding of at least 51%. 3. Fulfill location requirements of MSC Malaysia status. 4. Past or current recipients of any Government R&D grant are NOT eligible under the scheme. 5 Purpose of financing 6 Eligible activities To provide financing for research and development projects for the development of new products and services across the multimedia value chain and Flagship Applications. 1. Research and development projects leading to the development of products and services across the multimedia value chain and Flagship Applications 2. All R&D activities must be conducted in Malaysia 7 Application procedure Applicant is advised to have prior discussion with MGS Unit of MDeC before submitting any application. 8 Further MSC Malaysia Client Contact Centre (CliC) information/Contact Multimedia Development Corporation MSC Malaysia Headquarters Persiaran APEC 63000 Cyberjaya Selangor Darul Ehsan Tel : 1-800-88-8338 (within Malaysia) Tel : 603-8315 3000 (outside Malaysia) Email : clic@mdec.com.my Website : www.mdec.com.my SOURCE:http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=432&Itemi d=543 MALAYSIAN VENTURE CAPITAL MANAGEMENT BERHAD (MAVCAP) VENTURE CAPITAL FINANCING 1 Objective To nurture and develop the technology sector and the venture capital market in Malaysia by providing venture capital financing. 2 Minimum Investment Limit RM50,000.00. 3 Maximum Investment Limit RM40 million 4 Participating financial institutions / Implementing MAVCAP 5 Priority sectors 1. Telecommunication and networking 2. Information technology 3. Internet 4. Electronics 5. Semi-conductors 6 7 Application procedure Please contact MAVCAP for further details of Investment Guidelines Application to be submitted to MAVCAP Further Malaysia Venture Capital Management information/Contact Berhad (545446-U) Level 10, Menara Bank Pembangunan Bandar Wawasan 1016, Jalan Sultan Ismail 50300 Kuala Lumpur Malaysia Tel : +603 2050 3000 Fax : +603 2698 3800 Website : www.mavcap.com.my SOURCE: http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=1234&Itemid=1200 MALAYSIAN INDUSTRIAL DEVELOPMENT AUTHORITY (MIDA) (MIDA) - INCENTIVES FOR HIGH TECHNOLOGY COMPANIES 1 Objective & Incentives A high technology company is a company engaged in promoted activities or in the production of promoted products in areas of new and emerging technologies. A high technology company qualifies for: 1. Pioneer Status with income tax exemption of 100% of the statutory income for a period of five years. Unabsorbed capital allowances as well as accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer income of the company; or 2. Investment Tax Allowance of 60% on the qualifying capital expenditure incurred within five years from the date the first qualifying capital expenditure is incurred. The allowance can be utilised to offset against 100% of the statutory income for each year of assessment. Any unutilised allowances can be carried forward to subsequent years until fully utilised. 2 Eligibility Criteria The high technology company must fulfill the following criteria: 1. The percentage of local R & D expenditure to gross sales should be at least 1% on an annual basis. The company has three years from its date of operation or commencement of business to comply with this requirement. 2. Scientific and technical staff having degrees or diplomas with a minimum of 5 years experience in related fields should comprise at least 15% of the company's total workforce. 3 Further MIDA Sentral information/Contact No.5, Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50470 Kuala Lumpur Malaysia Tel: 603 2267 3633 Fax: 603 2274 7970 Email: investmalaysia@mida.gov.my Website : www.mida.gov.my (MIDA) - INCENTIVES FOR SMALL AND MEDIUM ENTERPRISES - SMEs 1 Objective Effective from the Year Assessment 2009, for the purpose of imposition of income tax and tax incentives, the definition of SMEs is reviewed as a company resident in Malaysia with a paid up capital of ordinary shares of RM2.5 million or less at the beginning of the basis period of a year of assessment whereby such company cannot be controlled by another company with a paid up capital exceeding RM2.5 million. SMEs are eligible for a reduced corporate tax of 20% on chargeable incomes of up to RM500,000. The tax rate on the remaining chargeable income is maintained at 25%. 2 Incentives Small scale manufacturing companies incorporated in Malaysia with shareholders' funds not exceeding RM500,000 and having at least 60% Malaysian equity are eligible for the following incentives: 1. Pioneer Status with income tax exemption of 100% of the statutory income for a period of five years. Unabsorbed capital allowances as well as accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer income of the company; or 2. Investment Tax Allowance of 60% on the qualifying capital expenditure incurred within five years. This allowance can be offset against 100% of the statutory income for each year of assessment. Any unutilised allowances can be carried forward to subsequent years until fully utilised. A sole proprietorship or partnership is eligible to apply for this incentive provided a new private limited/limited company is formed to take over the existing production/activities. 3 Eligibility Criteria To qualify for the incentive, effective 2 March 2012, a small-scale company has to comply with the following criteria: 1. The value-added must be at least 25%; and 2. The managerial, technical and supervisory (MTS) ratio must be at least 20% 4 Further MIDA Sentral information/Contact No.5, Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50470 Kuala Lumpur Malaysia Tel: 603 2267 3633 Fax: 603 2274 7970 Email: investmalaysia@mida.gov.my Website : www.mida.gov.my (MIDA) - INCENTIVES FOR STRATEGIC PROJECTS 1 Objective Strategic projects involve products or activities of national importance. They generally involve heavy capital investments with long gestation periods, have high levels of technology, are integrated, generate extensive linkages, and have significant impact on the economy. 2 Incentives Such projects qualify for: 1. Pioneer Status with income tax exemption of 100% of the statutory income for a period of 10 years; Unabsorbed capital allowances as well as accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer income of the company; or 2. Investment Tax Allowance of 100% on the qualifying capital expenditure incurred within five years from the date the first qualifying capital expenditure is incurred. This allowance can be offset against 100% of the statutory income for each year of assessment. Any unutilised allowances can be carried forward to subsequent years until fully utilised. 3 Eligibility Criteria 4 Further MIDA Sentral information/Contact No.5, Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50470 Kuala Lumpur Malaysia Tel: 603 2267 3633 Fax: 603 2274 7970 Email: investmalaysia@mida.gov.my Website : www.mida.gov.my N/A (MIDA) - INCENTIVES FOR THE MACHINERY AND EQUIPMENT INDUSTRY 1 Objective N/A 2 Incentives Companies undertaking activities in the production of selected machinery and equipment are eligible for: 1. Pioneer Status with income tax exemption of 100% of the statutory income for a period of 10 years. Unabsorbed capital allowances as well as accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer income of the company; or 2. Investment Tax Allowance of 100% on the qualifying capital expenditure incurred within five years from the date the first qualifying capital expenditure is incurred. This allowance can be offset against 100% of the statutory income for each year of assessment. Any unutilised allowances can be carried forward to subsequent years until fully utilised. 3 Eligibility Criteria 4 Further MIDA Sentral information/Contact No.5, Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50470 Kuala Lumpur Malaysia Tel: 603 2267 3633 Fax: 603 2274 7970 Email: investmalaysia@mida.gov.my Website : www.mida.gov.my N/A (MIDA) - MAIN INCENTIVES FOR MANUFACTURING COMPANIES 1 Objective The major tax incentives for companies investing in the manufacturing sector are the Pioneer Status and the Investment Tax Allowance. Eligibility for Pioneer Status and Investment Tax Allowance is based on certain priorities, including the level of value-added, technology used and industrial linkages. Eligible activities and products are termed as "promoted activities" or "promoted products". 2 Incentive (Pioneer Status) A company granted Pioneer Status enjoys a five year partial exemption from the payment of income tax. It pays tax on 30% of its statutory income*, with the exemption period commencing from its Production Day (defined as the day its production level reaches 30% of its capacity). Unabsorbed capital allowances as well as accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer income of the company. Applications for Pioneer Status should be submitted to the Malaysian Investment Development Authority (MIDA). * Statutory Income is derived after deducting revenue expenditure and capital allowances from the gross income. 3 Incentive (Investment Tax Allowance) As an alternative to Pioneer Status, a company may apply for Investment Tax Allowance (ITA). A company granted ITA is entitled to an allowance of 60% on its qualifying capital expenditure (factory, plant, machinery or other equipment used for the approved project) incurred within five years from the date the first qualifying capital expenditure is incurred. The company can offset this allowance against 70% of its statutory income for each year of assessment. Any unutilised allowance can be carried forward to subsequent years until fully utilised. The remaining 30% of its statutory income will be taxed at the prevailing company tax rate. 4 Further information/Contact MIDA Sentral No.5, Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50470 Kuala Lumpur Malaysia Tel: 603 2267 3633 Fax: 603 2274 7970 Email: investmalaysia@mida.gov.my Website : www.mida.gov.my SOURCE: http://www.mida.gov.my/home/incentives-in-manufacturing-sector/posts/ MALAYSIA DEBT VENTURES BERHAD (MDV) PROGRAMMES 1 Objectives To provide debt financing to Malaysian companies in the ICT and high growth sectors in Asia. 2 Maximum financing rate Ranging from 5.5% to 6.8% 3 Maximum tenure 1 to 5 years 4 Maximum financing Up to 85% of the value of contract or total cost of the project, whichever is lower 5 Participating financial institutions / Implementing Ministry / Agency Malaysian Biotechnology Corporation (MBC) 6 Type of assistance / Form of financing 1. Revolving Project Loans To provide debt financing for domestic and foreign contract-backed project to deliver ICT and high-growth solutions 2. Open -ended project loans To finance exceptional open-ended (non contract-backed) projects such as Build-Own-Operate, Build-Operate-Transfer and etc 3. Partner Bank Facilities To provide financing facility, through panel banks, fully backed against MDV's guarantees. These facilities complement the project loans provided directly by MDV 4. Small contract financing To provide financing facility to companies that have secured ICT contracts and projects from the Government, multinational companies or other clients of similar status 7 Eligible sector / Types of financing 1. ICT 2. High growth ICT projects 8 Five-step loan Process: Step 1: Pre-assessment and Support MDV’s Origination & Assessment Team will discuss your company’s and project’s requirements and advise on the appropriate project and financing structure prior to application. We will also inform of MDV’s financing application and processing on requirements as outlined in Application Checklist. Step 2: Pre-due Diligence and Due Diligence Upon completion and submission of Application Form, MDV may conduct an Orientation Meeting, where you will present your company and project to MDV’s Assessment Team and duly appointed External Consultants, comprising technology consultants who will assess among others your management and technical team, and legal consultants/firms who will undertake statutory review and assessment of legal documentation of the relevant contract/project. MDV’s due diligence processes may also include interviews and site visits to contract awarder/sponsor and/or suppliers. Step 3: Decision The due diligence results and assessment will be compiled and presented to an independent financing committee for decision. Within three (3) working days of the presentation, MDV will issue letter of offer for approved financing applications. You will then have two (2) weeks to accept the terms and conditions. Step 4: Documentation Upon acceptance of the letter of offer, you will then execute the necessary legal documentation for the financing, including facilities agreement and security documentation. A Pre-Disbursement Briefing will then be conducted to explain MDV’s requirements with respect to drawdown of the facility granted. Step 5: First Drawdown and Disbursement You will be required to fulfill all conditions precedent and disbursement conditions prior to any disbursement. The solicitors appointed will then issue a release letter confirming that all conditions have been met. The necessary documents will then be required to support any drawdown requested. 9 Eligibility Criteria 1. Public or private limited company incorporated in Malaysia with a minimum paid-up capital of RM100,000 2. Minimum of five full-time employees 3. Main product or activity of the company exclude textile manufacturing, metal molding, agriculture activities or food production and/or processing 10 11 Application procedure Further information/Contact Applications to be submitted to MDV MALAYSIA DEBT VENTURES BERHAD (MDV) Level 5, Menara Bank Pembangunan 1016, Jalan Sultan Ismail 50250 Kuala Lumpur Malaysia Tel : 03-2617 2888 Email: info@debtventures.com Website: www.debtventures.com SOURCE: http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=1229&Itemid=1195 MALAYSIAN INDUSTRIAL DEVELOPMENT FINANCE BERHAD (MIDF) (MIDF) - SOFT LOAN FOR FACTORY RELOCATION 1 Objective Provides assistance for SMEs, including graduates of rehabilitation and incubation to open / relocate / expand their business through acquisition of factory / business premises. 2 Maximum financing rate 2% per annum 3 Maximum tenure Up to 15 years including up to 2 years period 4 Minimum financing RM50,000 5 Maximum financing RM1.5 million or 85% of the cost of the project (90% for Bumiputera) 6 Participating financial institutions / Implementing Ministry / Agency Malaysian Industrial Development Finance Berhad (MIDF) 7 Eligibility criteria 1. SMEs incorporated under the Companies Act 1965 or Registration of Business Ordinance 1956 2. At least 60% equity held by Malaysians 3. Subsidiaries of public-listed companies with shareholding not exceeding 20% 4. Companies to be located at approved location without having to close down the existing operation/premises 8 Purpose of financing 1. Purchase of ready made factories or/and business premises 2. Purchase of factory lots and construction of factories including related infrastructure 3. Cost of purchase of related machinery and equipment arising from relocation. 9 Eligible sector / Types of financing 1. Manufacturing 2. Manufacturing Related Services 3. Services (excluding insurance and financial services) 10 Eligible expenses 1. Purchase of ready-made factories/business premises; 2. Purchase of factory lot and construction of factories including related infrastructure; and 3. Purchase of related machinery and equipment due to relocation/expansion Applications to be submitted to MIDF 11 Application procedure 12 Further information/Contact Assistant Vice President and Head Group Corporate Communications, Malaysian Industrial Development Finance Berhad (3755-M), Level 19, Menara MIDF, 82, Jalan Raja Chulan, 50200 Kuala Lumpur Tel : (603) 2173 8888 Fax : (603) 2173 8877 E-mail: inquiry@midf.com.my Website : www.midf.com.my SOURCE: http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=612:softloan-scheme-for-factory-relocation&catid=81:financial-assistancesoft-loan&Itemid=127 (MIDF) - SOFT LOAN FOR ICT ADOPTION 1 Objective To assist the small and medium enterprises by providing soft loan to enhance their competitiveness, efficiency and productivity through the adoption of ICT in their business management and operation 2 Maximum financing rate 2% per annum 3 Maximum tenure Up to 5 ½ years including maximum 6 months grace period 4 Minimum financing RM20,000 5 Maximum financing RM500,000 6 Participating financial institutions / Implementing Ministry / Agency Malaysian Industrial Development Finance Berhad (MIDF) 7 Eligibility criteria 1. SMEs incorporated under the Companies Act 1965 or Registration of Business Ordinance 1956; 2.At least 60% equity held by Malaysians; 3. Subsidiaries of public listed companies (not exceeding 20% shareholding); and 4. Possess valid premises license 8 Purpose of financing To purchase software and hardware items to upgrade business efficiency and operation. 9 Sector coverage 1. Manufacturing 2. Manufacturing Related Services 3. Services (excluding insurance and financial services) 10 Eligible assistance Purchase of the following: 1. Software for upgrading engineering design capabilitis; 2. ERP softwareor other similar software; 3. Software such as Point of Sales System, Tracking System, Automated Store Management System and Inventory Management System; 4. Supporting software for specific industry such as animation, aviation, web hosting and others; 5. Related hardware, equipment and training costs. 11 Application Procedure Applications to be submitted to MIDF 12 Further information/Contact Assistant Vice President and Head Group Corporate Communications, Malaysian Industrial Development Finance Berhad (3755-M), Level 19, Menara MIDF, 82, Jalan Raja Chulan, 50200 Kuala Lumpur Tel : (603) 2173 8888 Fax : (603) 2173 8877 E-mail: inquiry@midf.com.my Website : www.midf.com.my SOURCE: http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=609:softloan-for-ict-adoption&catid=81:financial-assistancesoft-loan&Itemid=129 (MIDF) - SOFT LOAN PACKAGE FOR SMALL AND MEDIUM ENTERPRISES 1 Objective To provide financing to SMEs, including new start-up business for working capital requirements and expansion in productive capacity 2 Maximum financing rate 2% per annum 3 Maximum tenure 1. Land and Building : up to 15 years including grace period of up to 2 years; 2. IT Equipment : Up to 4 years including grace period of up to 1 year; 3. Revolving Working Capital - Subject to annual review 4. Machinery and Equipment : Up to 6 years including grace period of up to 1 year 5. Term Working Capital : Up to 3 1/2 years including grace period of up to 6 months 4 Minimum financing RM50,000 5 Maximum financing 1. Project Financing : RM 1.5 million 2. Fixed Assets Financing : RM 1 million 3. Working Capital Financing : RM 1 million 6 Participating financial institutions / Implementing Ministry / Agency Malaysian Industrial Development Finance Berhad (MIDF) 7 Eligibility criteria 1. SMEs incorporated under the Companies Act 1965 or Registration of Business Ordinance 1956; 2. At least 60% equity held by Malaysians; 3. Subsidiaries of public listed companies (not exceeding 20% shareholding); and 4. Possess valid premises license 8 Purpose of financing 9 Eligible sector / Types of financing Project, fixed asset and working capital financing 1. Manufacturing 2. Manufacturing Rrelated Services 3. Services (excluding insurance and financial services) 10 Eligible expenses 1. Project, fixed assets and working capital financing; 2. Costs incurred for initial store renovation and upgrade of store display for retail trade 3. Working capital for companies with confirmed contract from GLCs, MNCs, and the government including its agencies Applications to be submitted to MIDF 11 Application procedure 12 Assistant Vice President and Head Further information/Contact Group Corporate Communications, Malaysian Industrial Development Finance Berhad (3755-M), Level 19, Menara MIDF, 82, Jalan Raja Chulan, 50200 Kuala Lumpur Tel : (603) 2173 8888 Fax : (603) 2173 8877 E-mail: inquiry@midf.com.my Website : www.midf.com.my SOURCE: http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=610:softloan-for-smes&catid=81:financial-assistancesoft-loan&Itemid=130