so what's up with: the mystery subject?

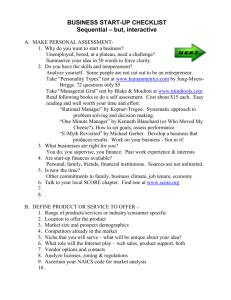

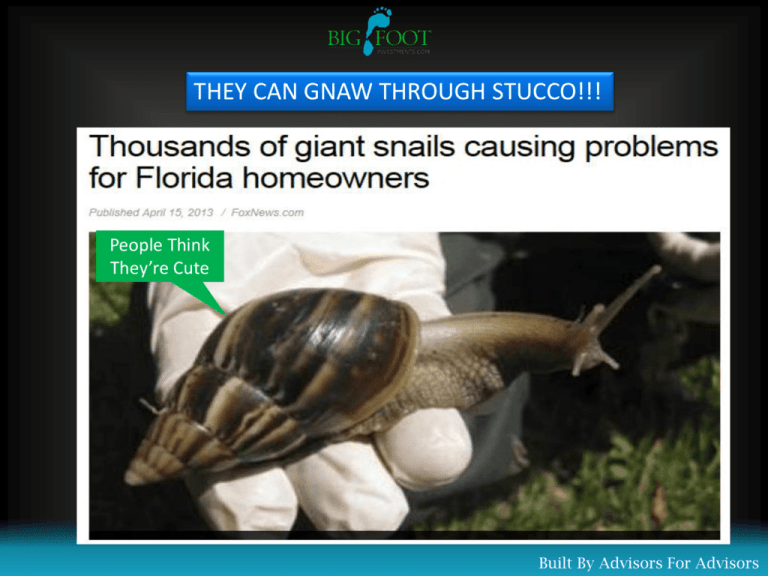

advertisement

THEY CAN GNAW THROUGH STUCCO!!! People Think They’re Cute Built By Advisors For Advisors BIGFOOT INVESTMENTS OPEN FORUM Apr 18th, 2013 WELCOME! Built By Advisors For Advisors AGENDA WELCOME! ADMIN NOTES QUOTE OF THE DAY OPTIMISM GAUGE CHARTS OF INTEREST SO WHAT’S UP WITH: THE “MYSTERY SUBJECT” A CLOSER LOOK AT: MX DAVID’S CORNER SWAPS AND SPREADS LEE’S COMMENTS QUESTIONS/COMMENTS Built By Advisors For Advisors “NOTES” IF YOU USE ANY OF OUR SLIDES, PLEASE REMEMBER TO HAVE THEM APPROVED BY YOUR COMPLIANCE DEPARTMENT. WE’LL UN-MUTE YOU ON OUR END SO YOU CAN ASK QUESTIONS. PLEASE MUTE AUDIO FROM THE MENU ON YOUR SCREEN SO WE DO NOT GET FEEDBACK. THANK YOU! Built By Advisors For Advisors BigFoot Investments is now on Twitter, LinkedIn! Built By Advisors For Advisors BigFoot On LinkedIn! Don’t Forget To Join Our “Group” Built By Advisors For Advisors Notifying You! SMS Alert System Built By Advisors For Advisors QUOTE OF THE DAY: If I’d just tried for those dinky singles….. ….I could’ve batted around 600! Babe Ruth Built By Advisors For Advisors Optimism Gauge As of: 4/18/2013 Built By Advisors For Advisors Measuring Our Economy Indicator Current Value Prior/Metric Value Current Value -0.632 -0.678(Revised) +1.0 Chicago Fed National Act Index (3 Mon Mov Av) 0.09 0.28(Revised) Unemployment 7.7 7.9 (Revised) +.50 361,250 358,500(Revised) -.50 ECRI Weekly Index 6.2 6.2 (Revised) +.50 Conf Board Leading Indicators (NEW) 94.7 94.8 -1.0 78.6(Final – Mar 2013) 77.6(Final-Feb 2012) -.25 Monthly Retail Sales (Adjusted) 416,990 416,070 +.50 NFIB Small Business Sentiment 89.5 90.8 -.50 51.3 (Expansion Line = 50) 54.2 +.50 Economic Capacity Utilization 78.5 78.3(Revised) +.50 Stock Market Moving Averages Weekly Data Points >50-day MA/>100-Day MA St Louis Fed Financial Stress Index Weekly Jobless Claims (4Wk Mov Av) University of Michigan Sentiment - Final ISM Manufacturing S&P Case-Shiller 20 City Comp Index N/A -.50 +.50 146.14 145.95 (Revised) +.50 Last Update: 4/18/2013 Total +1.75 Measuring Our Economy READING AS OF: 4/18/2013 Economic Optimism Index 45 65 35 NOTES/COMMENTS CURRENT READING: 59.1% PRIOR READING: 67.7% 75 BIAS: SLIGHTLY BULLISH 8 OF 13 INDICATORS POSITIVE 25 85 59.1% 15 95 Current Reading POSITIVE AS OF: 8/17/2012 Prior Reading TREND - DOWN Charts of Interest! Built By Advisors For Advisors “HEADLINE” DATA Source: NAHB/Wells Fargo Built By Advisors For Advisors BUT REALLY A “TALE OF 3 CITIES!” THE HEADLINE! BUT A REALLY IMPORTANT METRIC Source: NAHB/Wells Fargo Built By Advisors For Advisors CONSUMER “GOODNESS” Source: EIA Built By Advisors For Advisors The ZEW Study Center for European Economic Research Source: EIA Monthly Data Up to 350 financial experts Survey of expectations for the next 6 months Done for: Eurozone; Japan; Great Britain; U.S.A. Very respected publication Built By Advisors For Advisors The ZEW Study Source: EIA Built By Advisors For Advisors The ZEW Study Source: EIA Built By Advisors For Advisors CREDIT BAROMETERS IN THE “SAFE” ZONE Source: Chicago Fed Built By Advisors For Advisors 2 GOOD NUMBERS Built By Advisors For Advisors 2 OUT OF 3 IS GOOD Over 1M – High since 2008 Built By Advisors For Advisors SO WHAT’S UP WITH: THE MYSTERY SUBJECT? Built By Advisors For Advisors LET ME TELL YOU A STORY ABOUT WHY PEOPLE DO THINGS BECAUSE AFTER ALL….IN THE VALLEY OF THE BLIND THE ONE-EYED MAN IS KING… OR SO HE THINKS! Built By Advisors For Advisors IT’S AN OLD STORY ENTHUSIASM THIS WILL WORK FOR ME WHY SHOULDN’T I ? DON’T UNDERSTAND – DON’T TRY “THEY” SAY SO RUMOR IS FACT I BELIEVE…….YES!!! NOW’S THE TIME! I’LL DO IT TIME TO BRAG GO FOR MORE SO MANY JOIN ME – GETS EVEN BETTER DISILLUSIONMENT THE STORY CHANGES THE SPELL IS BROKEN THERE ARE EXPLANATIONS FINGERS POINT BLAME, CONSPIRACY CAN’T BE WRONG…CAN I? WHY DID I DO THAT?? IT LOOKS GREAT SIMPLE….RIGHT? COMPLICATIONS …CAN’T BE! WELL…THERE WERE SOME UPS AND DOWNS DON’T CONFUSE ME WITH DATA …. I’LL BE FINE WHAT THE HECK? ..OR NOT SEE..I’M OK EPITAPH: It is all so easy until it’s not You just think you know things –they are not as they appear Understanding is the key Adapting to change is difficult You must adjust to the facts THE END! WELL ….THERE’S A MORAL TO THE STORY YOU ARE ALWAYS “BEING SOLD” LIMITS ARE YOUR FRIEND WARNINGS ARE JUST THAT LOOKING BACK IT WAS ALWAYS SO OBVIOUS YOU WILL BE TEMPTED WHERE WAS YOUR PROCESS? IS THE ONE-EYED MAN REALLY A KING? SO WHAT’S GOING ON WITH GOLD? SO WE’RE TALKING ABOUT GOLD BUT YOU KNEW THAT! SO WHAT’S GOING ON WITH GOLD? OUR LITTLE STORY TELLS A TALE OF MISUNDERSTANDING BUT THERE ARE SOME PERTINENT THOUGHTS, ANALYSIS, & POSSIBILITIES Source: Business Insider/ETF Trends SO WHAT’S GOING ON WITH GOLD? SOME THOUGHTS The price pattern is broken when demand no longer outstrips supply The declining price, in turn, further reduces price And so on…. Fear “arrives” Source: Business Insider/ETF Trends SO WHAT’S GOING ON WITH GOLD? SOME ANALYSIS Gold is a commodity In the past we “pegged” it to something – now it’s difficult It’s not the ultimate currency – AS ONCE THOUGHT Subject to many forces in a global economy Will probably continue to trend down until we have a strong external influence The reasons gold has gone up may continue to pull it down: Economic environment ETF holdings New/revised estimates (think Goldman Sachs) Cyclical pattern Source: Business Insider/ETF Trends SO WHAT’S GOING ON WITH GOLD? OTHER FACTORS: Failed technical levels Bank of Japan actions U.S. Dollar Margin Calls Piling on by hedge funds Momentum/Model based trading FOMC minutes suggesting earlier rise in rates Source: Business Insider/ETF Trends SO WHAT’S GOING ON WITH GOLD? POSSIBILITIES: Large hedge funds moving out of gold Federal Reserve sales Central Bank selling Cypress unloading gold reserves Source: Business Insider/ETF Trends SO WHAT’S GOING ON WITH GOLD? WILL IT STAY DOWN? Depends on your macro view Depends on your definition of “investing” World debt burdens are a threat Fiat currencies erode faith Secular trend still in place Gold supply is getting more limited Emerging market buying? Recent sell-off is very technical Weaker dollar on horizon with debt issues Large short positions could trigger covering Source: Business Insider/ETF Trends THREE SLIDES TO THINK ABOUT HISTORICAL RELATIONSHOP BETWEEN GOLD/INFLATION RATIO OF GOLD TO INFLATION Average 3.33 Source: FRED Now 6.84 GOLD DOES NOT CORRELATE WELL WITH INFLATION DATA Source: FRED GOLD AND THE STOCK MARKET (S&P 500) Source: FRED A CLOSER LOOK AT: MX Built By Advisors For Advisors Enters Portfolio Built By Advisors For Advisors MagnaChip Semiconductor Corp (MX) MagnaChip Semiconductor Corporation designs and manufactures analog and mixed-signal semiconductor products for high-volume consumer applications. It operates in three segments: Display Solutions, Power Solutions, and Semiconductor Manufacturing Services. The Display Solutions segment offers source and gate drivers, and timing controllers that cover a range of flat panel displays used in liquid crystal displays (LCDs), light emitting diodes (LEDs), 3D and organic light emitting diode televisions and displays, notebooks, and mobile communications and entertainment devices. The Power Solutions segment develop, manufactures, and markets power management solutions, including metal oxide semiconductor field effect transistors, power modules, analog switches, LED drivers, DC-DC converters, voice coil motor drivers, and linear regulators. This segment offers its products for a range of devices, including LCD, LED, 3D televisions, smartphones, mobile phones, desktop PCs, notebooks, tablet PCs, and other consumer electronics, as well as for industrial applications, such as power suppliers, LED lighting, and home appliances. The Semiconductor Manufacturing Services segment manufactures various products comprising display drivers, LED drivers, audio encoding and decoding devices, microcontrollers, touch screen controllers, RF switches, park distance control sensors for automotives, electronic tag memories, and power management semiconductors. This segment offers semiconductor manufacturing services to fabless analog and mixedsignal semiconductor companies. MagnaChip Semiconductor Corporation provides its products and services to consumer electronics OEMs, subsystem designers, and contract manufacturers through a direct sales force, as well as through a network of authorized agents and distributors in the United States, Korea, Taiwan, China, Japan, Hong Kong, and Macau. The company is headquartered in Seoul, South Korea. Source: FinViz.com, April 2013 MagnaChip Semiconductor Corp (MX) POSITIVES: MagnaChip is a leading designer and manufacturer of analog and mixed signal semiconductor products. These chips are a main driving force behind touch solutions for mobile phones and PC applications. Possible concerns: The company has a high receivables rate. As a percentage of current assets it’s sitting around 35.88% Sources: PR Newswire, February 2013 Seeking Alpha, February 2013 ENTERS PORTFOLIO 4/1/2013 Built By Advisors For Advisors Trade Data Built By Advisors For Advisors Performance Built By Advisors For Advisors April 2013 Stock Picks Industry: Semiconductors As of March 28, 2013 - Subject to change. Dow Tech Index Built By Advisors For Advisors Dow Semiconductor Built By Advisors For Advisors FINVIZ SUMMARY Built By Advisors For Advisors Schwab Earnings Report Built By Advisors For Advisors Built By Advisors For Advisors Nasdaq.com Research Built By Advisors For Advisors Built By Advisors For Advisors Built By Advisors For Advisors Built By Advisors For Advisors Built By Advisors For Advisors Built By Advisors For Advisors Built By Advisors For Advisors Built By Advisors For Advisors Built By Advisors For Advisors THE CHARTS PLEASE! Built By Advisors For Advisors DAVID’S CORNER Built By Advisors For Advisors SWAPS & “SPREADS” IGNORE AT YOUR PERIL Built By Advisors For Advisors CREDIT ANTICIPATES – EQUITY CONFIRMS SWAPS AND SPREADS RATE PRIOR CURRENT Libor/OIS 14.55 14.00 Euribor/Eonia .133 .130 DTCC Repo Index Agency .209 .193 MBS .228 .208 Treas .202 .180 High Yield Federal Reserve Currency Swaps (ECB) USD million 2-Year Swap Spread 4.87 4.78 7 Day 505 1,200 Open 7,551 7,551 .146 STATUS* .150 *Note: Status Status As Of: 4/17/2013 = No impact = Negative Impact Built By Advisors For Advisors LEE’S COMMENTS Built By Advisors For Advisors UNDERSTANDING EMOTION IN THE MARKET PROCESS DESIGNED IN 1995 TO CYCLES IN THE TECH MARKET IDEA WAS TO EXPLAIN PRODUCT CYCLES AND DETERMINE IF A PARTICULAR TECHNOLOGY WAS “READY” SINCE THEN – APPLIED TO DIFFERENT INDUSTRIES COULD WELL BE APPLIED TO MARKETS GET’S TO THE HEART OF OVER-ENTHUSIASM POINTS TO PROCESS Source: Gartner Research Built By Advisors For Advisors UNDERSTANDING EMOTION IN THE MARKET Source: Gartner Research Built By Advisors For Advisors QUESTIONS & COMMENTS THANKS FOR JOINING US! Built By Advisors For Advisors IMPORTANT DISCLOSURE INFORMATION Content is intended for investment professional use/review only. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by BigFoot Investments.com), or any non-investment related content, made reference to directly or indirectly in this presentation will be profitable, equal any corresponding indicated historical performance level(s), be suitable for any investment professional’s clients portfolio or individual situation, or prove successful. The investment professional retains all decision making authority as to whether or not to follow and/or implement any of the presentation content. BigFoot has absolutely no responsibly for any suitability determination pertaining to any of the investment professional’s clients, such obligation being exclusively the initial and ongoing responsibility of the investment professional. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from BigFoot Investments.com. BigFoot Investments.com. is neither a law firm nor a certified public accounting firm and no portion of the content should be construed as legal or accounting advice. Investment Professional acknowledges that to the extent required to do so, it is his/her/its exclusively responsibility to advise his/her/its employer/broker-dealer of its BigFoot subscription. BigFoot Investments.com is a service of Lee Johnson Capital Management, an SEC registered investment adviser located in Fort Worth, Texas. A copy of the Lee Johnson Capital Management LLC’ current written disclosure statement discussing our advisory services and fees is available for review upon request. No Sharing of Content: You acknowledge that the presentation content is for investment professional use only. You warrant and represent not to share any portion of the presentation content with any non-subscriber, including but not limited to your clients or prospects Built By Advisors For Advisors