Money!

advertisement

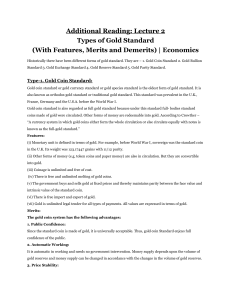

Money! Money • Medium of Exchange = anything that is used to determine value during the exchange of a good or service. • Money = anything that serves as a medium of exchange, unit of account, or store of value. • Unit of Account = money serves as a means of comparing values on goods and services (we relate $1 to 1 candy bar). • Store of Value – keeps its value if you hold on to it instead of spending it (you store it) Money • Different forms of money in existence today • Currency = paper and coin money used in societies today • Societies in the past would have also used gold, silver, fur, stones as currency, however in today’s standard these items would not serve as a function of money. • They do not meet the characteristics of money Money • Characteristics of Money • There are SIX key characteristics that help determine what counts as MONEY • 1. Durability = an object (such as our current currency , paper & coin) can withstand physical wear and tear that come with being used over and over again. • Money that is not durable cannot be trusted to serve as a store of value • Even though paper money can tear, it is still very durable in the sense that it can be washed, change from hand to hand several times, stay in storage and not waste away. Money (characteristics con’t) • 2. Portability = people are able to carry the money with them. • It can easily be transferred to another person • Paper and coins are very portable • Much easier than toting around gold bars, furs, or gemstones. • 3. Divisibility = can be easily divided into lower denominations or units • You only use the exact necessary amount • Paper and coins are easily divided into lower amounts Money (characteristics con’t) • 4. Uniformity = Units of money must count as the same. • Creates an accurate way of pricing • A $1 will always be the same as another $1 and will get you only a $1 worth of goods/services – no more or no less. • 5. Limited Supply = by keeping the supply limited it helps to keep the value of the currency. • Without a limited supply people could charge any amount for goods/services because there would be unlimited amounts of money to purchase • It would be “fake” • 6. Acceptability = every in the economy must be able to exchange your currency. • A store owner will accept our paper and coin money, because they know they can use that money to purchase other goods/services Money • Why is paper/coin money accepted? • It is actually referred to as FLAT money • Flat Money = called “legal tender” b/c the Government has declared that it will be accepted to pay off debts. • Flat Money is simply backed by the governments promise that it is accepted as currency. • Take out a piece of money • What do we use prior to paper/coin currency? • A system called the Barter System • Barter System = the exchange of a good/services for a different good/services • Common in the U.S. until the late 1800’s • Still common in African and Latin countries