2_SAME-SBAEstablishedBusinesses

advertisement

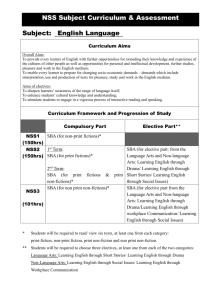

www.sba.gov 1 U.S. Small Business Administration San Antonio District Office Overview SBA Programs & Services Local SBA Resource Partners & Alliances Today’s Topic Servicing the Established Business www.sba.gov 2 Pamela Sapia District Director Ronald E. Dear Deputy District Director SBA SAN ANTONIO DISTRICT OFFICE HIPOLITO F. GARCIA FEDERAL BUILDING SUITE 298 615 E. HOUSTON ST. SAN ANTONIO, TX 78205 (210) 403-5900 www.sba.gov SADO.EMAIL@SBA.GOV 3 www.sba.gov 4 Business Development Team Sean Smith Mary Alice Blanco Lead Business Development Specialist & SCORE Liaison (210) 403-5929 mary.blanco@sba.gov Business Development Specialist, IT Representative & 7(J) Technical Assistance Representative (210) 403-5921 sean.smith@sba.gov Eric Spencer Business Development Specialist (210) 403-5940 eric.spencer@sba.gov Theresa Scott Stephanie Rapp Business Development Specialist & Primary HUBZone Liaison Officer (210) 403-5912 theresa.scott@sba.gov Business Development Specialist & Native American Representative (210) 403-5927 stephanie.rapp@sba.gov Daniel Del Rossi Program Support Assistant and First Point Contact/Front Desk (210) 403-5900 daniel.delrossi@sba.go v www.sba.gov 5 Size Standards www.sba.gov/size Ref: 13 CFR 121 Size Regulations • Firms must be small based on their primary NAICS Code, including affiliates. • Size is determined either by: • - average 3 years revenues or - # of employees (manufacturers, dealers, wholesalers) • • Note: Effective March 14, 2011 - SBA is now authorized to early graduate • (once in the program) a firm that exceeds the size standard for its • primary NAICS code, as adjusted, for three (3) successive program • years. www.sba.gov 6 NAICS Codes and Size • WWW.SBA.GOV/SIZE • Look up your code on the chart • Compare your data to the chart – three year average revenue or # of employees www.sba.gov 7 www.sba.gov 8 Teaming •Subcontract – prime contract agreement •Joint Ventures www.sba.gov 9 Mentor-Protégé Programs • Small and other than small business may qualify as Mentors • SBA Mentor Protégé Program is found in the 8(a) program 13CFR124.520 • Other agencies have Mentor Protégé Programs www.sba.gov 10 Mentor-Protégé Programs • Benefits – Access to participate contracts – Cost reimbursement – Direct payment for services – Credit for assistance – Develop subcontractors – Giving back www.sba.gov 11 SBA Surety Bond Guaranty Program • Public Private Partnership to provide small businesses with bonding assistance • Bid, Payment, Performance and ancillary Bonds up to $6.5 Million • Up to $10 Million if “best interest of the government” • SBA reimbursements from 70% to 90% www.sba.gov 12 SBA Surety Bond Guaranty Program For complete details on SBA’s Surety Guarantee Program please visit: www.sba.gov/services/financialassistance/suretybond/ For questions technical in nature, please contact the Surety Agent nearest you from the list located on above website. www.sba.gov 13 SBA Loan Guaranty Programs 7(a) Loans: 7(a) Basic and Preferred Lender Program - $5,000,000 SBA Express Loan Program – $350,000 Small/Rural Lender Advantage - $350,000 Patriot Express Loan Program - $500,000 Export Express Loan Program - $500,000 Export Working Capital and International Trade $5,000,000 Small Loan Advantage and Community Advantage - $250,000 temporary through 2013 Dealer Floor Plan - $5 million – temporary through 9/27/2013 Non-7(a) Loans: CDC/504 Loan Program $5,000,000 up to $5.5 million for land, building and equipment Microloans - $50,000 www.sba.gov Attend the next Capital Access Workshop! Phone (210) 403-5900 or sado.email@sba.gov SBA Disaster Loan Program • Available to small, other than small, homeowner, non-profits • Physical Disaster Loans-rebuild or replace • Economic Injury Disaster Loans – for working capital www.sba.gov 15 Affordable Care Act Program Affordable Care Act • • • • www.sba.gov/healthcare www.healthcare.gov www.irs.gov/aca www.dol.gov/ebsa/healthreform Helping Small Businesses Before, small businesses paid an average of 18 percent more for health insurance than large companies. Today, small businesses can get tax credits to help pay for coverage for their employees. www.sba.gov 16 Sean Smith 210-403-5921 sean.smith@sba.gov www.sba.gov 17