Welcome to Finance 254

advertisement

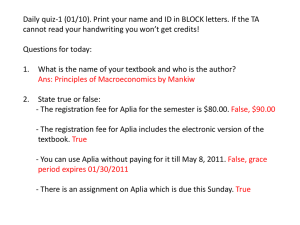

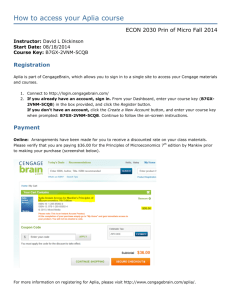

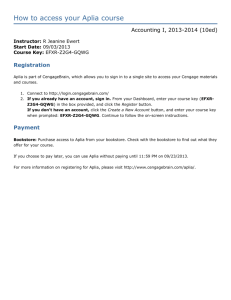

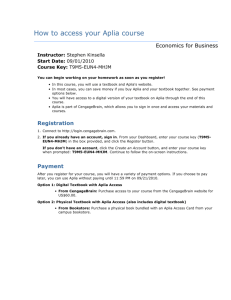

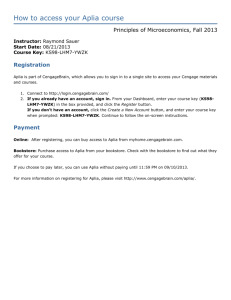

Welcome to Finance 221 Corporate Finance 1 The First Day/Week Agenda Course Overview Top 10 List What is finance and corporate finance. The goal of the firm Stock Prices and Intrinsic Value Agency Costs: Conflicts between managers and shareholders (probably disc. section) Different forms of Business Organizations. (disc sect) 2 Required Class Materials Textbook: Custom version of Fundamentals of Financial Management, Concise 5th ed. by Brigham & Houston with Aplia in bookstores or purchase e-book and Aplia online at aplia.com ($70). I-clicker for class participation Texas Instruments BAII Plus financial calculator Optional: Spring 2007 Fin 221 Course Syllabus book 3 Important Internet Addresses Course Website: http://www.business.uiuc.edu/~mdyer/fin221.ht m Syllabus and Class Notes Solutions to suggested textbook problems via UIUC Compass Textbook website: http://brigham.swlearning.com (choose Brigham and Houston, Concise 5th ed. of Fundamentals of Financial Management) 4 Contacting Prof. Dyer Office: 328J DKH Telephone: 244-7807 Office Hours: 10:15-noon Monday & Wednesday and 1-3 Thursday e-mail: dyer1@uiuc.edu 5 The Nitty Gritty Grade Breakdown: 500 total points Exams (400 points from 4 exams worth 100 points each) 25 multiple choice questions worth 4 points each Plus optional final exam to replace. 100 points from online Aplia assignments, class participation and investment project 6 Aplia Online Assignments (70 points) 17 assignments consisting of graded assignments for each chapter (Chapter # title II) and 4 assessment review assignments (basic math, calculator, accounting, 7 statistics). See details and due dates on Assignments & Projects page of the course website. First two assignments: Chapter 1 II and Mathematics II are due Jan. 28. You are allowed to drop 4 assignments and no credit will be given after an assignment’s due date deadline (11 PM Sundays). No answer feedback is given on the graded assignments until after the deadline. 7 Aplia Registration (also on Assignments page of 221 website) Our course key is 9G8K-VUEP-348Z You can begin working on your homework as soon as you register! In this course, you will use a textbook and Aplia's website. You will save money if you buy these together. You have two purchase options. You will have free access to the first four chapters of an online copy of your textbook at Aplia. You can access the remaining online chapters as soon as you submit a payment for your Aplia course. Don't buy anything until you understand your alternatives. 8 Aplia Registration Instructions Registration Instructions 1. Connect to http://www.aplia.com. 2. Click the System Configuration Test link below the Sign In and Register sections to make sure you can access all of the features on Aplia's website. This takes just a few seconds and tells you how to update your browser settings if necessary. 3. Return to http://www.aplia.com. • If you have never used Aplia before, click the New Student button and enter your Course Key: 9G8K-VUEP-348Z. Continue following the instructions to complete your registration. • If you have used Aplia before, sign in with your usual e-mail address and password and enter your Course Key when prompted: 9G8K-VUEP-348Z. If you are not prompted for a new Course Key, click the Enter Course Key button to enroll in a new Aplia course. Enter your Course Key when you are prompted. 4. If you understand your payment options, pay now. Otherwise, postpone your purchase decision by choosing the option to pay later. Your payment grace period ends at the end of the day on 02/06/2007. 9 Aplia Purchase Options Option A: Pay Aplia Directly Purchase access to your course directly from Aplia on their website for $70.00 USD. The website includes: Access to an online copy of your textbook. Content that has been customized for your textbook and course. However, if you try using the online textbook and decide you would also like a physical textbook, you can order one from Aplia for $50.00 USD plus $7.50 for shipping and handling. Option B: Purchase at Bookstore Purchase a bundle from your school's bookstore, which includes: An Aplia Access Card containing a Payment Code that you can enter on Aplia's website as payment for your Aplia course. A physical textbook. 10 Investment Project and Class Participation The Investment Project (15 points) will be posted at mid- semester on the Assignments and Projects Page of the course website. It is due Apr. 13. Class participation via I-clicker is worth a maximum of 15 points. I will ask 15 to 20 multiple-choice questions during the semester in lecture to be answered with your I-clicker. Register your I-clicker at http://www.iclicker.com/registration/ after answering questions in lecture next week. Please use your UIUC NetID as your student ID during this registration process. The last student to miss a question in each lecture section will win a $150 Best Buy or Circuit City gift certificate. 11 Miscellaneous Items Textbook problems assigned in syllabus will not be graded, but you are responsible for knowing how to do them. Solutions to these suggested problems are given on the course website via UIUC Compass and syllabus book. 12 TOP 10 LIST 13 What is Finance? Finance is primarily about making investment decisions. To make these decisions, one must determine value. What is the value of a stock, a bond, a company, or a real asset? 14 What is Corporate Finance? 15 Goal of the Firm To maximize owner’s wealth. The common stockholders (shareholders) are the owners of a corporation. This means maximizing shareholder wealth by maximizing stock price. 16 Factors that affect stock price Projected cash flows to shareholders Timing of the cash flow stream Riskiness of the cash flows 17 Responsibility of the Financial Staff Maximize stock value by: Forecasting and planning Investment and financing decisions Coordination and control Transactions in the financial markets Managing risk 18 Reminder Bring your Iclicker and financial calculator to lecture on Monday! 19 What determines Value? Timing and amount of expected future cash flows, and The riskiness of these expected cash flows which determines an investment’s interest rate or required rate of return. Value equals the present (today’s) value of these cash flows discounted at the required return. This is known as intrinsic value. A good investment is one whose value exceeds its market price. 20 Stock Prices and Intrinsic Value In equilibrium, a stock’s price should equal its “true” or intrinsic value. To the extent that investor perceptions are incorrect, a stock’s price in the short run may deviate from its intrinsic value. Ideally, managers should avoid actions that reduce intrinsic value, even if those decisions increase the stock price in the short run. 21 Conflicts Between Managers and Stockholders (Agency Costs) Managers are naturally inclined to act in their own best interests (which are not always the same as the interest of stockholders). But the following factors affect managerial behavior: Managerial compensation plans Direct intervention by shareholders The threat of firing The threat of takeover 22