- Atlantic Grupa

advertisement

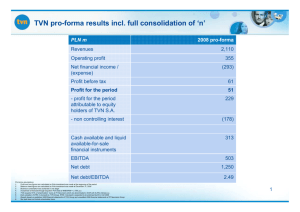

ATLANTIC GRUPA FY11 Financial results (audited) Performance in line with guidance alongside successful execution of integration processes February 23th, 2012 1 CONTENT KEY BUSINESS DEVELOPMENTS in 2011 and ANNOUNCEMENT of EVENTS in FY12 FINANCIAL RESULTS in 2011 FY12 GUIDANCE 2 KEY BUSINESS DEVELOPMENTS in 2011 Guidance delivered despite challenging macroeconomic environment Successful execution of integration of Droga Kolinska and Atlantic Grupa Divestment of non-core assets: 13% share in RTL Hrvatska television channel Bond refinancing: new corporate bond ATGR-O-169A Regular fulfilment of all financial obligations Surging prices of all key raw and packaging materials PPA – Purchase Price Allocation for Droga Kolinska Achievement of synergy effects 3 KEY INTEGRATION ACTIVITIES: Phase I Sales and distribution • Setting up joined distribution on all regional markets: establishing independent distribution companies on each regional market that are consolidated in the Distribution division • Implemented new commercial terms on all regional markets Logistics and investment Procurement and marketing • Setting up joined logistics operations and processes (the most complex one in Serbia with initial 11 distribution centres, reallocated to 4 new locations) • Implemented centralised procurement system • Developed purchasing category management concept with lead buyers for key raw materials • Logistics reorganisation in Croatia (in-house logistics as opposed to formerly outsourced logistics) • Sales force optimized • Implemented centralised marketing HR challenges • Creating new and efficient business organisation • Retaining and motivating the most qualitative workforce • Co-life of different corporate cultures • Developing fair rewarding schemes • Consolidation of office space on all regional markets First phase of integration activities carried out in the 1H11 4 KEY INTEGRATION ACTIVITIES: Phase II Consolidation of production facilities Consolidation of information technology • Previously outsourced bottling of Cockta for Croatian and B&H market has been replaced with inhouse bottling in Apatovec, Croatia • Consolidation of business IT solutions on several regional markets based on the assessment of business systems for operational support within Droga Kolinska and Atlantic Grupa and selection of best practice • Transfer of coffee roasting for Croatian market from previously outsourced producer to own production plant in Izola, Slovenia • Currently, feasibility studies are being prepared for transfer of other production from outsourced producers to own production plants • Redefining current IT contracts related to telecom services, licences and outsourced IT support Real estate management • Real estate and financial assets portfolio management with the goal to sell all assets that are not in accordance with the company’s core business operations – e.g. sale of 13% ownership in Croatian broadcasting channel – RTL Hrvatska • Currently the company assesses sale of several real estate that are not in accordance with the company’s core business operations Second phase of integration activities started in the 2H11 5 SUMMARY OF INTEGRATION ACTIVITIES and OTHER Distribution Logistics Investment management 46% of total synergy savings EUR 5.9m net synergy savings CORE program In November 2011, Atlantic Grupa launched cost reduction program – CORE program The key goal is to optimize the company’s primarily external expenses in the period from 2011 to 2013 Emphasis is on the group of expenses that are encountered as result of purchase of goods and services from suppliers 6 NEW BUSINESS MODEL OF ATLANTIC GRUPA from 2012 SBU COFFEE Turkish, Espresso, Instant SMU Croatia SBU BEVERAGES Vitamin instant drinks and teas Carbonated soft drinks Functional water and Water SBU SPORTS AND FUNCTIONAL FOOD SBU PHARMA AND PERSONAL CARE Sports and functional food VMS and OTC Pharmacy chain Cosmetics and personal care SMU Slovenia, Serbia and Macedonia SBU SAVOURY SPREADS SBU SNACKS Savoury spreads Sandwiches of extended freshness Sweet and salted snacks SMU HoReCa SMU International markets MU Russia Hotels, restaurants and cafes All markets outside ex.-YU region and Russia Baby food All products sold in CIS region Reorganization in 2012 with an aim to manage business segments and distribution markets more efficiently Operational business also includes Central procurement, Central marketing and Corporative quality management functions 7 ATLANTIC GRUPA ON CROATIAN CAPITAL MARKET in 2011 Performance on capital market Ownership structure on 30/12/2011 ATGR-R-A 47.7% Crobex Crobex10 18.2% 16.4% 5.3% L. Tedeschi East Capital Management Fiorio 0.36% 1.25% 5.79% EBRD 8.53% DEG 8.49% -15.4% -17.6% -37.9% -46.5% 19/11/0730/12/11 -67.2% 2011 2010 2009 2011 2010* Last price in reporting period 500.0 805.0 1,667,150 2,684,112 551,157 554,827 EV (HRK 000) 4,229,100 5,243,503 EV/EBITDA* 8.18 9.96 EV/EBIT* 13.68 19.01 EV/sales* 0.89 1.16 EPS (HRK) 5.90 26.43 P/E 84.71 30.46 Average daily turnover (HRK) Raiffeisen VPF 8.08% Raiffeisen OPF 54.32% Erste Plavi OPF 6.65% 2008 Valuation Market capitalization (HRK 000) TEDESCHI EMIL 50.20% PBZ CO OPF 7.88% AZ OPF 23.07% Pension funds 17.29% -47.6% -62.0% Others 8.09% From the end of March, ATGR-R-A has been included in domestic blue-chip index Crobex10 On 20 September 2011, Atlantic Grupa issued Notes amidst restructuring of its maturity debt structure Atlantic Grupa’s average market capitalization in 2011: HRK 2.2m – second place based on average Mcap among components of local blue-chip index Crobex10 Atlantic Grupa’s share retained total turnover and average daily turnover on the 2010 levels Normalized P&L figures *Pro-forma consolidated figures in 2010 8 CONTENT KEY BUSINESS DEVELOPMENTS in 2011 and ANNOUNCEMENT of EVENTS in FY12 FINANCIAL RESULTS in 2011 FY12 GUIDANCE 9 OWERVIEW of FY11 RESULTS Sales at 4,727.8 million kuna + 108.4% yoy based on reported figures + 1.2% yoy organic growth + 4.8% yoy growth compared to pro-forma consolidated level in the same period last year Normalized earnings before interests, taxes and depreciation (EBITDA) at 517.3 million kuna + 156.5% yoy based on reported figures - 1.7 yoy growth compared to pro-forma consolidated level in the same period last year Normalized earnings before interests and taxes (EBIT) at 309.2 million kuna + 110.9% yoy based on reported figures + 12.1% yoy growth compared to pro-forma consolidated level in the same period last year Net profit after minorities at 46.6 million kuna * Normalised net profit after minorities at 19.7 million kuna 10 RESULTS IN LINE WITH GUIDANCE HRKm 101.7% 98.2% 2011A 4,728 2011E 600 517 96.9% 2011A 527 2011E 4,750 4,650 309 400 4,650 200 0 4,550 Sales EBITDA EBIT 2011 result normalized 11 319 OVERVIEW OF ONE-OFF ITEMS in 2010/2011 Sale of Neva’s former location in Tuškanova * One of gain in the amount of 48.6 million kuna Acquisition of Droga Kolinska 2010 * Transaction costs in the amount of 52.2 million kuna * Positive financial impact of 16.9 million kuna (income on deposits from capital increase funds and positive exchange rate differences) Acquisition of the company Kalničke vode Bio Natura * Badwill in the amount of 5.1 million kuna Sale of non-core assets – 13% stake in the company RTL Hrvatska * One-off gain in the amount of 12.0 million kuna Acquisition of Droga Kolinska Transaction costs in the amount of 5.8 million kuna 2011 Purchase price allocation * One-off impact on increase in inventories in the amount of 22.8 million kuna * One-off impact on depreciation of tangible assets and amortization of intangible assets in the amount of 42.3 million kuna. Depreciation and amortization effect is one-off compared to 2010, but, lower depreciation and amortization will remain in 2012 and onwards * One-off impact on increase in financial borrowings in the amount of 1.2 million kuna 12 SALES in 2011 HRKm FY11 vs. FY10 FY11 FY10 FY11 vs. FY10 Pro-forma 4,728 5,000 4,728 +108.4% 4,000 2,269 4,800 FY11 FY10 FY11 vs. FY10 organic FY11 FY10 +1.2% 2,296 +4.8% 4,513 4,600 2,269 2,300 2,250 3,000 4,400 2,000 4,200 1,000 4,000 * Sales growth: +108.4% * Sales growth: + 4.8% comparing to pro-forma consolidated sales in 2010 * Sales growth : +1.2% without Droga Kolinska effect Growth generators: Growth generators: Growth generators: (i) Acquisition of Droga Kolinska (ii) Organic growth of Atlantic Grupa (i) Growth on regional markets after acquisition of Droga Kolinska (ii) Growth in coffee, sweet and salted snacks and baby food segments (iii) Growth in Sports and Functional Food and Pharma divisions 2,200 2,150 2,100 (i) Growth of own brands within Sports and Functional Food division (ii) Sales growth of private label (iii) Newly opened pharmacies and specialized stores (iv) Final consolidation of acquired pharmacy chain Dvoržak 13 GEOGRAPHIC SALES PROFILE 2011 9% 3% Croatia 28% 8% Serbia Slovenia B&H 6% Other ex. Yu* 8% Key WEU** Russia and EE 13% 25% Other Pro-forma consolidated 2010 Croatian market remained the largest selling market after acquisition of Droga Kolinska with 28.2% share of total sales, however the acquisition itself significantly reduced exposure to domestic market from 55.1% in 2010 Regional markets (without Croatia) have 52.0% share of total sales compared to 18.9% in 2010 Share of West European markets fell to 7.5% from 14.9% in 2010, as sales of acquired Droga Kolinska are mostly focused on regional markets and to smaller extent on Russian market East European markets have 3.0% share of sales compared to 1.8% in 2010, due to Droga Kolinska’s presences on those markets Stand-alone 2010 Croatia 4% 6% Serbia 8% 30% 6% Slovenia B&H Other ex. Yu* 9% Key WEU** Russia and EE 13% 2% 24% *Other ex. YU: Macedonia, Monte Negro, Kosovo Other **Key WEU: Germany, Italy, UK Croatia 9% Serbia Slovenia 15% B&H Other ex. Yu* 2% 3% 8% 55% Key WEU** Russia and EE 6% Other 14 SALES on KEY MARKETS – CROATIA 1,332.2 1,377.9 1,250.6 (in HRKm) 1,500 1,250 1,000 750 500 FY11 FY10 Pro-forma cons. FY10 Stand-alone -3,3% compared to 2010 pro-forma consolidated results -3,9% on organic level (without Droga Kolinska) Two key factors affected sales on Croatian market: i. Renewal of contracts with key customers due to integration of Droga Kolinska’s product portfolio during 2011 ii. Continuation of negative trends in Croatian economy Sales decline on the pro-forma consolidated level was partially cushioned by following: i. Increase in coffee and salted snacks category as well as mild increase in savoury spreads and beverages categories of Droga Kolinska ii. Growth of some principal brands iii. Growth in Pharma division 15 SALES on KEY MARKETS – SERBIA, SLOVENIA AND BOSNIA AND HERZEGOVINA FY11 1,204.2 1,400 FY10 Pro-forma cons. 1,068.6 FY10 Stand-alone 1,200 (in HRKm) 1,000 598.1 800 577.7 395.9 359.2 600 172.5 130.1 400 79.0 200 0 Serbia Serbian Market + 12.7% growth compared to pro-forma consolidated sales in 2010 -10.7% on organic level (without Droga Kolinska) The second largest market in Atlantic Grupa with 25.5% share of total sales Slovenia Slovenian market +3.5% growth compared to pro-forma consolidated sales in 2010 +2.5% on organic level (without Droga Kolinska) The third largest market in Atlantic Grupa with 12.7% share of total sales Growth: coffee, salted snacks, Cedevita and some principal brands B&H B&H market -9.3% drop compared to pro-forma consolidated sales in 2010 -2.5% on organic level (without Droga Kolinska) The third largest market in Atlantic Grupa with 7.6% share of total sales 16 SALES on KEY MARKETS – WEST EUROPEAN MARKETS AND RUSSIA FY11 300 264.1 FY10 Pro-forma cons. 246.3 244.3 FY10 Stand-alone (in HRKm) 250 180.0 200 144.0 150 41.5 100 57.3 49.3 50.3 48.3 44.5 41.4 50 0 Germany Italy UK Russia & EE West European markets +1.1% growth compared to pro-forma consolidated sales in 2010 +5.2% on organic level (without Droga Kolinska) Russian and East European markets -20.0% compared to pro-forma consolidated sales in 2010 Three key factors buoyed sales growth in this geographic region i. Double-digit growth in the sports food brand Champ and the functional food brand Multaben ii. Double-digit growth in private label sales iii. Further expansion of mass market outside the specialized sports channel. Decline mainly reflected lower sales of Multivita assortment, whereby growth in baby food assortment with brand Bebi was insufficient to annul decline in the former 17 SALES by PRODUCT TYPE 2011 5% 6% Own brands Principal brands 17% Private label 72% Farmacia Pro-forma consolidated 2010 5% Own brands +6.4% compared to pro-forma consolidated sales in 2010 +1.8% on organic level (without Droga Kolinska) Principal brands -9.7% yoy Share decrease due to conolidation of Droga Kolinske Private label +31.8% yoy Farmacia +15.6% yoy +9.8% on organic level (excluding acquired chain Dvoržak) Stand-alone 2010 11% Own brands 4% Principal brands 20% 8% Private label 71% Farmacia Own brands 41% Principal brands Private label 40% Farmacia 18 KEY BRANDS in 2011 597 HRK m Sales Net I 441 333 304 235 172 Grand Kafa Argeta Cedevita Barcaffe Multipower Smoki The following brands achieved growth: i. Coffee – Grand Kafa 12.3% i Barcaffe 9.7% ii. Sweet and salted snack – Najlepše želje 11.6% andSmoki 5.5% iii. Baby food – Bebi 11.7% iv. Sports and functional food – Champ and Multaben 171 Cockta 144 141 Najlepše želje Bebi 126 125 Champ Donat Mg Following brands posted yoy lower sales: i. Beverages – Cedevita and Cockta ii. Savoury spreads - Argeta 19 GROSS SALES by DIVISION HRKm 2,763 2011 2010 2,249 2,244 Distribution : +114.3% , -6.4% organic Consolidated distribution of Atlantic Grupa and Droga Kolinska, renewed contracts with key customers Unfavourable macroeconomic environment decreased consumption Portfolio rationalization 1,289 448 478 Distribution 1,207 Consumer Health Care 647 556 367 326 Sports and Functional Food 1,289 Droga Kolinska 2011 ex. Droga Kolinska 647 448 Distribution Pharma 478 Consumer Health Care 2010 556 367 Sports and Functional Food + 1.2% yoy organic growth + 4.8% compared to pro-forma consolidated sales in 2010 326 Pharma Consumer HealthCare: -6.4% Unfavourable macroeconomic situation Consolidation of distribution activities of Atlantic Grupa and Droga Kolinska affected this division’s sales Sports and Functional Food: +16.3% Growth of brands Champ and Multaben as well as private label Upward trend in mass market and online sales Pharma: +12.5% Pharmacy chain sales growth, opening of 4 new sales locations, consolidation of Dvoržak pharmacy chain Fidifarm sales growth Droga Kolinska: +0.2% Growth of product categories: coffee, sweet and salted snacks and baby food 20 SALES by CATEGORIES Distribution (Principal brands) 3% Sports and Functional Food 17% 14% Pharma &Personal care (Farmacia, Fidifarm, Multivita, Neva) 9% Coffee 14% Sweet and salted snack 12% Savoury spreads 10% Beverages 21% Baby food Indicative overview of sales by categories (according to the new business model) in 2011 reflect the following: Product category – coffee – with brands Grand Kafa i Barcaffe is the largest individual product category with 21% share in total sales Product category – beverages – with key brands Cedevita, Cockta, Donat Mg is the second largest product category with 14% share in total sales Product category – sports and functional foods – with key brands Multipower and Champ is the third largest product category with 14% share in total sales Distribution which includes principal brands has 17% share in total sales 21 PROFITABILITY DYNAMICS HRKm EBITDA 600 EBITDA 501 517 545 Normalized EBITDA 526 500 400 220 300 202 200 100 FY11 FY10 Pro-forma FY10 Stand-alone EBIT 400 EBIT Normalized EBIT 335 309 294 Two-fold higher profitability on EBITDA and EBIT levels compared to 2010 primarily reflected consolidation of Droga Kolinska Decline in EBITDA compared to pro-forma consolidated 2010 largely reflected 20.7% yoy higher production materials costs Normalised EBIT reflected the impact of finalised PPA process for Droga Kolinska on tangible assets depreciation and intangible assets amortization Normalised EBITDA Normalised EBIT Normalised Net profit Net profit 2011 vs. 2010 pro-forma -1.7% +12.1% -77.7% Net income Normalized net income 200 276 146 300 126 150 165 200 2011 vs. 2010 +156.5% +110.9% -67.5% 147 100 107 86 100 55 28 50 0 0 FY11 FY10 Pro-forma FY10 Stand-alone FY11 FY10 Pro-forma FY10 Stand-alone 22 PROFITABILITY DYNAMICS – Impact of surging prices on global commodity markets On the pro-forma consolidated level, production materials costs surged 21% yoy Soaring production materials costs came on the back of: * Growth in coffee, sugar, milk powder and others largely on the back of surging prices on the global commodity markets as well as packaging materials costs * Coffee rocketed 55% on average on global commodity markets (expressed through coffee “C” futures contract as the world benchmark for Arabica coffee) compared to 2010 Left graph - coffee price movements during 2010 and 2011– maximum at the beginning of May 2011 Right graph: beginning of May 2011 the highest coffee price since the end of 1997 In the following period: *The fundamentals indicate upward pressure on global coffee prices largely amidst historically low global coffee inventories and downtrend in inventories in weeks of consumption * But, excess of global supply should cushion uptrend in 2012 23 PURCHASE PRICE ALLOCATION for DROGA KOLINSKA Summary • Pursuant to the International Financial Reporting Standards (IFRS 3), Atlantic Grupa was obliged to allocate the purchase price of EUR 243,109 ths paid for Droga Kolinska’s assets acquired, within a year from the transaction. For that purpose, Atlantic Grupa engaged the independent appraiser. Intangible assets • Fair value of trademarks on 31 December 2010 is HRK 764.8m and has been increased by HRK 206.3m from their book value • Valuation based on income approach, i.e. Relief-from-Royalty method • Indefinite useful life: brands will not be amortised but tested annually for impairment Tangible assets • On 31 December 2010, fair value of tangible assets has been estimated at HRK 73.6m above its book value • Applied market-based approach and cost-based approach to value tangible assets Other assets and liabilities • On 31 December 2010, fair value of inventories has been estimated at HRK 22.6m above its book value • On 31 December 2010, fair value of financial borrowings has been estimated at HRK 1.2m above its book value Residual goodwill • Goodwill of HRK 571.5m has been calculated • Allocated to the following operating segments (CGUs): coffee, savoury spreads, snacks and confectionary, beverages, baby food and distribution 24 DIVISIONAL OPERATING PROFITABILITY 2011 HRKm 169.8 2010 Distribution 160 24% 120 80.3 83.2 80 56.6 Sports and Functional Food 50% 37.4 40 14.4 30.1 17% 16.0 16.9 5% CHC SFF Pharma Distribution +114.3% amidst Integration of Droga Kolinska and Atlantic Grupa’s portfolio Consumer HealthCare -32.0% amidst: Lower sales Higher production materials costs Pharma 4% Droga Kolinska 0 Distribution Consumer HealthCare Droga Kolinska Sports and Functional Food -52.3% amidst Front-loaded investments in new company in Spain Higher production materials and marketing and selling costs Higher service costs Pharma -5.2% amidst: Stronger growth in operating costs base, primarily service costs, staff costs and costs of goods sold 25 FINANCIAL INDICATORS in HRKm FY11 YE10* Net debt 2,494.0 2,495.8 Total assets 5,355.2 5,259.3 Equity 1,512.3 1,456.3 Current ratio 1.84 1.34 Gearing ratio 62.3% 63.2% Net debt/EBITDA** 4.8 4.7 Interest coverage ratio** 2.3 5.3 Capex 96.5 34.8 Cash flow from operating activities*** 165.1 101.5 * P&L items on pro-forma consolidated basis **Normalized *** Excluding impact of transaction costs Leverage indicators: Net debt-to-normalized EBITDA at 4.8 times Interest covered with normalized EBITDA at 2.3 times Gearing ratio (net debt-to-net debt and total equity) at 62.3% Require: prudent debt management and delivery of synergies In accordance with the Policy of active financial debt management, Atlantic Grupa fixed substantial portion of its longterm financial liabilities with interest rate swaps in the 1Q11 In 2011, Atlantic Grupa refinanced corporate bond in the nominal amount of HRK 115m maturing in 2016 26 CONTENT KEY BUSINESS DEVELOPMENTS in 2011 and ANNOUNCEMENT of EVENTS in FY12 FINANCIAL RESULTS in 2011 FY12 GUIDANCE 27 FY12 GUIDANCE (I) Further delivery of planned synergy potentials both on sales and costs side following finalisation of the first integration phase of Atlantic Grupa and Droga Kolinska; Focus on execution of the second integration phase (consolidation of production facilities, information technology consolidation, real estate portfolio management) as the basis for further improvement of operating efficiency; Strategic management guidance Further focus on organic growth through innovations in product categories and active brand management (new flavours, modernized packaging, product line extensions), strengthening the regional character of distribution business and further development of certain distribution channels as HoReCa segment; Meeting financial commitments on regularly basis coupled with active debt and financial cost management; Cost management through the CORE program and optimisation of operating processes on both centralised and lower levels, aiming to improve operating efficiency; Prudent liquidity management; Continuous analysis of global commodity markets with particular focus on coffee, sugar, cocoa and milk powder as well as more active application of hedging instruments; More focused development of risk management on all levels in the company. 28 FY12 GUIDANCE (II) 2012 Guidance (excluding one-offs) 2011 Normalized 2012/2011 4,964 4,728 5.0% EBITDA 550 517 6.3% EBIT* 385 351 9.5% Interest expense 223 222 In HRKm Sales * In 2011, EBIT was calculated on normalised EBITDA level, however depreciation and amortization expenses have not been normalized for the PPA impact in order to make it more comparable to 2012 guidance. 29 Appendix 30 FY11 CONSOLIDATED INCOME STATEMENT (AUDITED) In HRK000 Turnover Sales Other income Operating costs Cost of merchandise sold Change in inventories Production materials Energy Services Personnel costs Marketing expenses Other expenses Other (gains)/losses, net EBITDA EBIT EBT Taxes Net income Minority interest Net income II FY11 % of sales FY10 % of Pro-forma sales consolidated 4,575,540 101.4% 4,512,983 100.0% 62,557 1.4% 4,030,856 89.3% 1,201,640 26.6% 5,665 0.1% 1,309,183 29.0% 53,324 1.2% 327,564 7.3% 658,002 14.6% 314,792 7.0% 231,399 5.1% -70,713 -1.6% 544,684 12.1% 4,774,385 4,727,766 46,619 4,273,714 1,187,673 -5,772 1,579,935 61,238 308,439 635,047 313,218 212,994 -19,058 500,670 101.0% 100.0% 1.0% 90.4% 25.1% -0.1% 33.4% 1.3% 6.5% 13.4% 6.6% 4.5% -0.4% 10.6% 334,843 7.1% 294,252 78,837 23,945 54,892 8,291 46,601 1.7% 0.5% 1.2% 0.2% 1.0% 168,270 21,844 146,426 13,088 133,338 FY10 Standalone % of sales FY11/FY10 Pro-forma cons. 4.3% 4.8% -25.5% 6.0% -1.2% n/a 20.7% 14.8% -5.8% -3.5% -0.5% -8.0% -73.0% -8.1% FY11/FY10 Stand-alone 2,301,945 2,268,641 33,304 2,081,899 1,085,720 -9,405 291,074 12,141 163,340 325,942 148,692 128,510 -64,115 220,046 101.5% 100.0% 1.5% 91.8% 47.9% -0.4% 12.8% 0.5% 7.2% 14.4% 6.6% 5.7% -2.8% 9.7% 6.5% 164,985 7.3% 13.8% 103.0% 3.7% 0.5% 3.2% 0.3% 3.0% 123,122 16,325 106,797 11,804 94,993 5.4% 0.7% 4.7% 0.5% 4.2% -53.1% 9.6% -62.5% -36.7% -65.1% -36.0% 46.7% -48.6% -29.8% -50.9% 31 107.4% 108.4% 40.0% 105.3% 9.4% n/a 442.8% 404.4% 88.8% 94.8% 110.6% 65.7% -70.3% 127.5% FY11 NORMALIZED CONSOLIDATED INCOME STATEMENT (AUDITED) In HRK000 Turnover Sales Other income Operating costs Cost of merchandise sold Change in inventories Production materials Energy Services Personnel costs Marketing expenses Other expenses Other (gains)/losses, net EBITDA EBIT EBT Taxes Net income Minority interest Net income II FY11 % of sales FY10 % of Pro-forma sales consolidated 4,569,421 101.3% 4,512,983 100.0% 56,438 1.3% 4,043,127 89.6% 1,201,640 26.6% 5,665 0.1% 1,309,183 29.0% 53,324 1.2% 308,166 6.8% 658,002 14.6% 314,792 7.0% 198,017 4.4% -5,663 -0.1% 526,294 11.7% 4,774,385 4,727,766 46,619 4,257,105 1,164,918 -5,772 1,579,935 61,238 304,053 635,047 313,218 211,564 -7,096 517,280 101.0% 100.0% 1.0% 90.0% 24.6% -0.1% 33.4% 1.3% 6.4% 13.4% 6.6% 4.5% -0.2% 10.9% 309,169 6.5% 275,862 51,914 23,945 27,969 8,291 19,677 1.1% 0.5% 0.6% 0.2% 0.4% 149,127 23,496 125,631 13,088 112,543 FY10 Standalone % of sales FY11/FY10 Pro-forma cons. 4.5% 4.8% -17.4% 5.3% -3.1% n/a 20.7% 14.8% -1.3% -3.5% -0.5% 6.8% 25.3% -1.7% FY11/FY10 Stand-alone 2,295,825 2,268,641 27,184 2,094,170 1,085,720 -9,405 291,074 12,141 143,943 325,942 148,692 95,128 935 201,656 101.2% 100.0% 1.2% 92.3% 47.9% -0.4% 12.8% 0.5% 6.3% 14.4% 6.6% 4.2% 0.0% 8.9% 6.1% 146,595 6.5% 12.1% 110.9% 3.3% 0.5% 2.8% 0.3% 2.5% 103,979 17,978 86,001 11,804 74,197 4.6% 0.8% 3.8% 0.5% 3.3% -65.2% 1.9% -77.7% -36.7% -82.5% -50.1% 33.2% -67.5% -29.8% -73.5% 32 108.0% 108.4% 71.5% 103.3% 7.3% n/a 442.8% 404.4% 111.2% 94.8% 110.6% 122.4% -858.9% 156.5% BUSINESS SEGMENTS For the year ended 31 December 2011 (in thousands of HRK) Gross revenues Consumer Distribution Health Care Sports and Functional Food Pharma Droga Reconciliation Kolinska Group 2.784.594 458.099 654.224 373.558 2.276.696 744 6.547.915 24.532 337.961 4.340 27.015 1.379.682 - 1.773.530 2.760.062 120.138 649.884 346.543 897.014 744 4.774.385 EBITDA 93.993 86.893 20.116 22.986 270.659 6.023 500.670 Depreciation and amortization 13.722 30.333 5.748 6.990 100.893 8.141 165.827 EBIT 80.271 56.560 14.368 15.996 169.766 (2.118) 334.843 Total assets 973.849 566.217 196.322 620.003 3.421.431 (826.130) 4.951.692 Total assets at 31.12.2010 561.173 598.000 164.158 580.608 3.195.021 (208.437) 4.890.523 Consumer Distribution Health Care Sports and Functional Food Pharma Droga Reconciliation Kolinska Group Inter-segment revenues Total revenues For the year ended 31 December 2010 (in thousands of HRK) Gross revenues 1.308.296 492.044 558.412 330.832 n/p 9.647 2.699.231 21.397 352.128 4.024 19.737 n/p - 397.286 1.286.899 139.916 554.388 311.095 n/p 9.647 2.301.945 EBITDA 48.778 108.695 36.832 23.287 n/p 2.454 220.046 Depreciation and amortization 11.329 25.519 6.703 6.410 n/p 5.100 55.061 EBIT 37.449 83.176 30.129 16.877 n/p (2.646) 164.985 Inter-segment revenues Total revenues 33 BALANCE SHEET as of 31 December 2011 (AUDITED) in thousands of HRK, audited Property, plant and equipment Investment propery Intangible assets Available-for-sale financial assets Derivative financial instrument Trade and other receivables Deferred tax assets Non-current assets Inventories Trade and other receivables Non-current assets held for sale Prepaid income tax Deposits given Derivative financial instrument Cash and cash equivalents Current assets Total assets 31 December 2011 1,189,502 1,934 1,956,194 1,358 8,617 21,514 56,412 3,235,531 533,680 1,119,851 139,127 24,877 36,334 18,249 247,596 2,119,714 5,355,245 % of total assets 22.21% 0.04% 36.53% 0.03% 0.16% 0.40% 1.05% 60.42% 9.97% 20.91% 2.60% 0.46% 0.68% 0.34% 4.62% 39.58% 100.00% 31 December 2010 1,235,866 2,481 1,929,631 36,379 0 23,736 53,714 3,281,807 503,013 1,100,134 111,310 17,951 5,192 7,939 231,978 1,977,517 5,259,324 % of total assets 23.50% 0.05% 36.69% 0.69% 0.00% 0.45% 1.02% 62.40% 9.56% 20.92% 2.12% 0.34% 0.10% 0.15% 4.41% 37.60% 100.00% Capital and reserves attributable to equity holders of the Company 1,444,404 26.97% 1,392,624 26.48% Minority interest Borrowings Deferred tax liabilities Derivative financial instrument Other non-current liabilities Provisions Non-current liabilities Trade and other payables Borrowings Current income tax liabilities Derivative financial instrument Provisions Current liabilities Total liabilities Total equity and liabilities 67,920 2,346,725 193,064 62,393 36,357 54,540 2,693,079 719,606 375,035 12,553 20,673 21,975 1,149,842 3,842,921 5,355,245 1.27% 43.82% 3.61% 1.17% 0.68% 1.02% 50.29% 13.44% 7.00% 0.23% 0.39% 0.41% 21.47% 71.76% 100.00% 63,632 2,007,781 189,872 26,446 38,421 60,138 2,322,658 731,668 697,744 16,594 8,898 25,506 1,480,410 3,803,068 5,259,324 1.21% 38.18% 3.61% 0.50% 0.73% 1.14% 44.16% 13.91% 13.27% 0.32% 0.17% 0.48% 28.15% 72.31% 100.00% 34 FY11 CONSOLIDATED CASH FLOW STATEMENT (AUDITED) HRK 000 Jan - Dec 2011 Jan - Dec 2010 Net cash flow from operating activities Net CFO before interest and income tax paid 159.266 382.167 49.249 102.497 Cash flow from investing activities O/w Capex (55.924) (96.525) (1.568.133) (34.830) Net cash flow from / (used in) financing activities (90.925) 1.677.640 Net increase / (decrease) in cash and cash equivalents 12.417 158.756 Exchange gains / (losses) on cash and cash equivalents 3.201 (1.358) 231.978 247.596 74.580 231.978 Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Net cash from operating activities amounted to HRK 165.1m in FY11 and HRK 101.5m in FY10, once transaction costs excluded 35 Q&A Thank you for your attention! 36