Competitive_Advantage_IT

advertisement

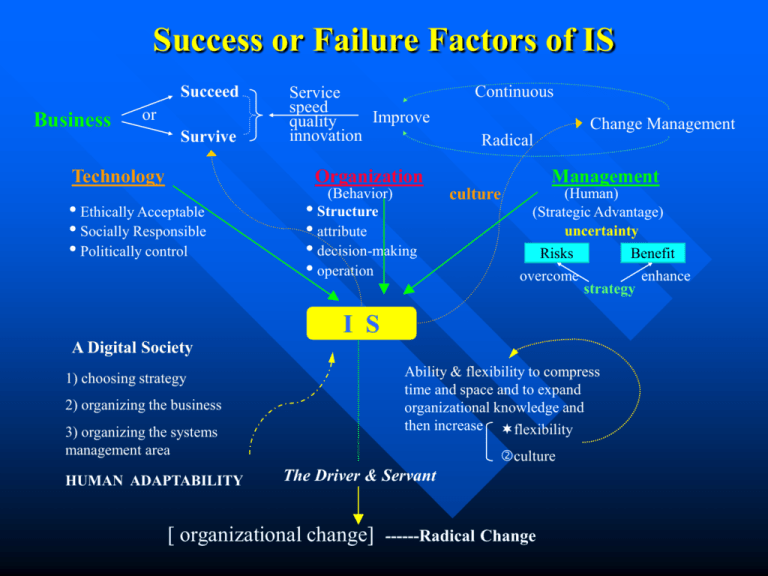

Success or Failure Factors of IS

Succeed

Business

or

Survive

Technology

Service

speed

Improve

quality

innovation

Continuous

Change Management

Radical

Organization

Ethically Acceptable

Socially Responsible

Politically control

(Behavior)

Structure

attribute

decision-making

operation

Management

culture

(Human)

(Strategic Advantage)

uncertainty

Risks

Benefit

overcome

enhance

strategy

I S

A Digital Society

Ability & flexibility to compress

time and space and to expand

organizational knowledge and

then increase flexibility

1) choosing strategy

2) organizing the business

3) organizing the systems

management area

HUMAN ADAPTABILITY

culture

The Driver & Servant

[ organizational change]

------Radical Change

Success or Failure Factors of IS (Cont’d)

[ organizational change]

A FIRM/ORGANIZATION:

Efficiency

------Radical Change

Evolution of change

Effectiveness

(Automate)

Innovation

(Informate)

(Innovate)

[Doing the things right]

[Doing the right things]

- creativity

-Proper utilization of

resource

{Save Money}

-Attainment of goals

- property of culture

Restructuring

Competitive Advantage

{Make Money}

Re-engineering

Cooperative Advantage

Electronic Market: flatten the organizational hierarchical structure

“ Revolutionary significance lies in generality” e.g., steam engineers--triggered the first Industrial

Revolution Computers--Seem to be triggering a second one.

IT Yesterday, Today and

Tomorrow

Yesterday

Today

Tomorrow

Computer age

Computer proc.

Computing

Accuracy

Automation

Efficiency

Information age

People proc.

Communication

Perspective

Information

Effectiveness

“doing things

right”

“doing the right

things”

Knowledge age

Knowledge proc.

Connectivity

Reality

Innovation

Performance/

Innovation

“creativity”

Three Necessary Perspectives

•Business Environment

•Enterprises Environment

Business

•IT Environment

Success

Simultaneous Revolutions

New Competitors

New Rules of

Competition

Industry structure

Changes

New Political

Agendas

The

Business

New regulatory

Environment

New

Technology

New Employees

and New Value

Increasing Customer

Expectation

Business Drivers

Market

Technology

Regulation

Employees/

Work

Organization

Business Processes

Solution to Business Requirements

A Systematic Approach

Vision

Strategy

Tactics

Business Plan

Competitive Options

Roles,

Roles and Relationships

Redefine/ Define

Telecommunications as the Delivery Vehicle

Success Factor Profile

The Information Technology

Environment

Administrative

Framework

ERA I

Data

Processing

ERA II

End-User

Computing

ERA III

Strategic

Systems

Primary

Target

Justification/

Purpose

Regulated

Monopoly

Organizational

Productivity/

Efficiency

Free Market

Individual

Effectiveness

Regulated

Free Market

Business

Process

Competitive

Advantage

Competitiveness: A Link to

National Goals

Human

Resources

Capital

Technology

Trade

Policy

Improved

Domestic

Performance

New

Competition

Decreased

Budget

Deficit

Increased

Competitiveness

in World Market

Reduced

Trade Deficit

Stronger

National

Security

More and

Better Jobs

Increased

Standard

of Living

The Diamond of National Advantage

Chance

Firm Strategic,

Structure

and Rivalry

Factor

Conditions

Demand

Conditions

Related and

Supporting

Industries

Government

Figure 3-1: FIVE COMPETITIVE

FORCES MODEL

NEW

MARKET

ENTRANTS

THE FIRM

SUPPLIERS

SUBSTITUTE

PRODUCTS

& SERVICES

Threats

TRADITIONAL

COMPETITORS

Bargaining power

CUSTOMERS

N

Port Competitive Model

Figure 3-1

Potential

New Entrants

Bargaining

Power

of Supplier

Intraindustry Rivalry

Strategic Business Unit

Substitute

Products

and Services

Bargaining

Power

of Buyers

Wal-Mart and the Porter

Competitive Model

Figure 3-2

Foreign

General

Merchandisers or Discounts

Potential

New Entrants

Established

Retailer Shifting

Strategy to Discounting or

Megastores

Intraindustry Rivalry

Strategic Business Unit

Bargaining

Power

of Supplier

SBU: Wal-Mart

Rivals:Kmart, Target, Toys

R Us, Specialty Stores

U.S. Product Manufacture

Consumers

Foreign Manufacture

Local Government

Substitute

Products

and Services

IT Product and Service Suppliers

Mail

Order

Home Shopping

Network

Electronic

Bargaining

Power

of Buyers

in Small Town, U.S.A

Consumers in Metropolitan Areas in

the U.S.

Canadian and Mexican consumers

Other Foreign Consumers

Telemarketing

Buying

Clubs

Door-to-door Sales

FIVE COMPETITIVE FORCES MODEL

NEW

MARKET

ENTRANTS

THE FIRM

SUPPLIERS

SUBSTITUTE

PRODUCTS

& SERVICES

Threats

TRADITIONAL

COMPETITORS

Bargaining power

CUSTOMERS

N

Activities of Value Chain

Support Activities

Administrative and Other

Indirect Value Added

Inbound

Logistics

Operations

Outbound

Logistics

Primary Activities

Marketing

and

Sales

Services

The Value Chain

(Value)

Manufacturing Industry Value

Chain Product and Service Flow

Figure 3-5

Research and

Development

Production

Engineering

and

Manufacturing

Sales and

Marketing

Administrative and Other

Indirect Value Added

Distributiion

Service

Examples of the Value Chain

N

Dr. Chen, The Trends of the Information Systems Technology

TM -18

Generic Value Chain

Figure 3-7

Firm

Infrastructure

Human

Resource

Management

Technology

Development

Financial

Policy

Regulatory Compliance

Legal

Accounting

Actuary Training Claims

Training

Product

Claims

Development

Training

Market Research

Actuary Training

Actuarial Methods

Investment Practice

IT

Communication

Procurement

Policy

Rating

Underwriting

Independent

Policy

Investment

Agent Network

Policy

Billing

Renewal

and

Collections

Sales

Claims

Settlement

Loss

Control

Agent

Management

Advertising

Inbound

Logistics

Operations

Outbound

Logistics

Marketing

and Sales

Service

Generic Value Chain

Figure 3-8

Firm

Information Systems Technology Planning and Budgeting Technology Office Technology

Infrastructure

Human

Training Technology Motivation Technology Information Technology

Resource

Management

Product Technology Computer-Aided

Software Development Tools Information

Technology

Systems Technology

Development Technology Pilot Plant Technology

Procurement

Information System Technology Communication Technology Transportation System Technology

Transportation

Technology

Material

Handling

Storage and

Preservation

Technology

Communication

System

Technology

Information

Technology

Inbound

Logistics

Basic

Technology

Materials

Handling

Machine Tool

Technology

Material

Handling

Technology

Packaging

Technology

Information

Technology

Operations

Transportation

Multimedia

Technology

Communication

System

Technology

Information

Technology

Diagnostic

Outbound

Marketing

and Sales

Service

Technology

Material

Handling

Technology

Packaging

Technology

Communication

System

Technology

Information

Technology

Logistics

and

Testing

Communication

System

Technology

Information

Technology

Porter’s Competitive Model

Figure 4-2

Aircraft Manufactures Aircraft

Potential

New Entrants

Leasing Companies

Labor Unions

Food Service Companies

Airport

Local Transportation Service

FAA (Air Traffic Controllers0

Hotels

Foreign

Carriers

Regional Carrier Start-ups

Cargo Carrier Business

Strategy Change

Intraindustry Rivalry

SBU: American Airlines

Rivals: United, Delta,

USAir Northwest,

Southwest

Bargaining

Power

of Supplier

Bargaining

Power

of Buyers

Travel Agents

Alternate Travel Services

Fast Trains

Boats

Private Transportation

Videoconferencing

Substitute

Products

and Services

Business Travelers

Pleasure Travels

Charter Service

U.S.

Military

Cargo and Mail

Generic Value Chain

Figure 4-3

Firm

Financial

Regulatory

Accounting

Infrastructure

Policy

Compliance

Flight,

Route

and

Human

Pilot Training

Baggage Handling

Yield Analyst

Resource

Training

Safety Training

Training

Management Computer Reservation System, Inflight System

Technology

Flight Scheduling System, Yield Management

Development System

Procurement

Community

Affairs

Legal

Agent Training

Inflight

Training

Product Development Baggage

Market Research

Tracking System

Information Technology

Communication

Route

Selection

Passenger

Service System

Yield

Management

System(Pricing)

Fuel

Flight Scheduling

Crew Scheduling

Facilities

Planning

Aircraft

Acquisition

Inbound

Logistics

Ticket

Counter

Operation

Gate

Operation

Aircraft

Operations

Onbord

Service

Baggage

Ticket

Baggage

Flight

System

Connection

Rental

Car an d

Hotel Reservation

System

Advertising

Advantage

Program

Lost

Baggage

Service

Complaint

up

Travel Agent

Programs

Handling

Group

Offices

Operations

Promotion

Outbound

Logistics

Sales

Marketing

and Sales

Service

Follow-

Interorganizational Systems

Figure 5-1

Customers

Vendors

Your Company

Support Services

Business Partners

Industry Forces

Government

Association Info

Sources

Competitors

Payment Process Industry

Figure 5-2

Merchants

Member

Banks

Visa International

or Mastercard

Card Holders

Individuals

Businesses

EDI Applications

Figure 5-3

Purchase

Orders

Invoices

Freight

Bills

Advance

Shipping

Notices

Electronic

Data

Interchange

Inventory/

Sales Data

EDI System Obstacles

Figure 5-4

Data

Communication

Application

Company data versus standards

Cross-industry standards

Standards administration

Time zones and windows

Communication protocols

Telecommunications equipment

Service cost and balance

Integration

Features and function supported

Interface

Electronic Data Interchange (EDI)

Through the Use of a Van

Figure 5-5

Electronic

Mailbox

Vendor Systems:

Mainframes

Customer order

Time

Schedule

Time Zone

Data Format

Communication

Protocols

Data Transmission

Speed

Minicomputers

Microprocessors

No Computer

Conversion/

Translation

Figure 5 -- extra

Mission

Values

Beliefs

Principles

Vision

Culture

Goals

Strategies

Objectives and

Measurements

Tactics

Business Plan

Authority and

Responsibility

The Vision -to-Action Process

Implementation

(Action)

Agreement and

Commitment

Tactics and

Business Plan

Strategy

Vision

Sensing

Opportunity

Feedback

Pyramid of Excellence

Stakeholder Value

Figure 6-4 Reprint

with permission of

Whirlpool Corporate

Where

Vision

Way

What

How

Value -Creating

Objectives

Worldwide

Excellence

System

Vision and Information Systems

Figure 6-6

Vision

Save

Money

Asset

Application

Networks

Expense

Strategic

Tactical

Invest

Tools

The Three Components of a New Strategy

Vision

External

Assessment

Internal

Assessment

A New Strategy

Figure 7-1

Strategic Management Process

Environmental Analysis

General Environment

Operating Environment

Competitive Positioning

Directions for Development

Company

Vision

Company

Strategic

History

Current

Strategy

Company Analysis

Figure 7-2

Structure

Value/ Culture

Competitive Positioning

Resources

Stakeholder

Analysis

Vision &

Strategy

Chosen

Strategy

Realized

Strategy

Strategy Implementation

Senior Management

Vision

and MacroStrategies

Empowered Implementors

Company Culture

Risks to be Avoided

Critical Performance Factors

Key Enterprise

Business Processes

Figure 7-3

MicroStrategies

and

Tactics

Business Uncertainties

Managing for Results

Objectives

Authority

Responsibility

Training

Motivation

Performance

Results

Reward

Figure 7-4

Control

Management Information Needs

Senior Management

Emerging Opportunities and Threats

External Impact of Strategies and Tactics

Internal Impact of Strategies and Tactics

Performance Measurements

Enpowered Implementors

Figure 7-5

IT-Based Strategies

Significant

Structure

Change

Traditional

Products

and Processes

Figure 7-6

Marketplace

Operation

Federal Express

USA Today

Charts Schwab

Whirlpool

Xerox

USAA

L.L.Bean

McKesson

Banc One

Boeing

Frito-Lay

Wal-Mart

Company Infrastructure

Data Management

User Applications

Voice Management

Network Management

Planning Process

Financial Strategy

Organization

Figure 7-7

Strategy Option Generator

Target

Customer

Thrust

Supplier

Differentiation Cost Innovation

Competitor

Growth Alliance

Mode

Offensive

Defensive

Direction

Use

Provide

Execution

Figure 8-1

Strategic Advantage

Strategy Option Generator

Target

Customer

Thrust

Supplier

Differentiation Cost Innovation

Competitor

Growth Alliance

Mode

Offensive

Defensive

Direction

Use

Provide

Execution

Figure 8-2

Strategic Advantage

Roles, Roles and Relationships

Senior Management

Users

Functional

Management

Figure 9-1

Informational Systems

Organization

Using IS to Compete

IT

Users

Senior

Management

Leadership

Information

Systems

Organization

Figure 9-2

Technology Transfer Through

Organizational Learning

Information

Technology

Applications

Organization

Figure 9-3

Using IS to Compete: Primary

Responsibilities

Senior

Management

Functional

Management

IS

Management

Figure 9-4

Direction

Conceptual

Approach

Specific

Approach

7

2

1

2

5

4

1

3

5

10

10

10

Making It Happen!

Competitive

Crisis

Management

Action

Initiators

Figure 9-5

Process

Improvement

Executive

Power

Suppliers

Board of Directors

A Business

Products/Services

Competitors

Figure 9-6

Suppliers

Board of Directors

Information

Systems

Organization

Competitors

Figure 9-7

Steering Committee

Suppliers

Opportunities

IT Needs

Real Dollars

Products

People

Direction

Information

Systems

Organization

Products & Services

Constraints Costs

Competitors

Figure 9-8

Wants & Needs

Justification

Real Dollars?

Value to Customer Chart

Product/Service

Value-Added

Process

What the

Customer Buys

Value to Customer

Figure 10-1

Value to Customer Analysis

Charles Schwab & Co.

Product/Service

Stock,

Computer-based

Trades

Client-broker Service

Street Smart

Telebroker

Equalizer

OneSource

•Electronic Transfers

•Trade Risk Analysis

Value-Added Process

Figure 10-2

Bond and

Mutual Fund Trades

Financial Product Options

Competetive Fees

Timely Execution of

Trades and Money

Transfer

Personal Service

Confidence in Financial

Custodial Responsibilty

What the Customer Buys

Value to Customer

Value to Customer Analysis

Mervyn’s

Product/Service

Point-of-Sale(POS)

System:

Ticketed Merchandise

UPC Scanning

Price Look-up

Credit Card Approval

Wireless Portable POS

Warehouse Management

EDI System with Vendors

Infobot Voice Response

System

Value-Added Process

Figure 10-3

Qualify Apparel/Home

Fashions

Competitive Prices

High Merchandise

Availability

Personal Service

Fast, Accurate Check-out

Fast Credit Approval

Access to Credit

Information

What the Customer Buys

Value to Customer

Value to Customer Analysis

Boeing Commercial Airplane Group

Product/Service

CAD

Design System and

Review Process

Customer Input Through

Network

Co-Design Process WITH

Customer

Quality Control System

Vendor EDI System

Value-Added Process

Figure 10-4

Aircraft

Designed for

Passenger,Comfort,

Operational Efficiency

and Safety

Flexible Design

Configuration

Competitive Price

Logical Support

What the Customer Buys

Value to Customer

Telecommunications Models

People

People

Figure 11-1

Communication

Machines

Machines

Linking Users to Information Within

Application

on

Networks

Enterprise

Department

Organization

Individual

Users

LAN

WAN

Public

Business

Enterprise

Network

Private

Application

Functions

Wired

Organizational

Wireless

Processes

Personal

Information

Figure 11-2

Traditional

Graphics

Data

Text

Images

Video

Voice

Multimedia

Information Systems Support of

Business Requirements

Business and Information

Technology Dynamics

Multi-Vendor/ Multi-Products

Information System Architecture

Open Systems

Standards

Vendor Hardware Software

Products and Services

Figure 11-3

User Organization

Application Function

Ease Of Use

Seamless and Transparent

Open Systems Environment

Other

Service

3.Database

1.Operating

Systems

Software

Application

5. Software Development Tools

4. User Interface

Figure 11-4

6. Systems

Management

Services

2. Communication

Service

A Telecommunications Perspective

Objective

Voice

Data

Efficiency

Voice Message

Volumes

Transmission

Volumes

Competitive

Advantage

Voice Applications

Plus Linkage

PCs and Application

Packages

Integrated Voice /Data Application

Figure 11-5

Success Factor Profile

Management

Business Vision

Culture

Risk Management

Plan Implement

IS Integral to the Business

IS Justification Mgmt. Process

Executive-IS Mgr. Partnership

Executive IS Experience

Operational Automation

Linkage to Suppliers

Linkage to Customers

Linkage to Customers Service

Pervasive Computing Literacy

IS Architecture

IS Marketing

IS User Relations

Figure 12-1

Importance

Responsibility

Assessment

Information Systems Organization

IS Vice-President

Finance &

Administration

Planning

Development &

Maintenance

Project

Management

System

Analysis

Systems

Support

Database

Administration

Computer

Operations

Network

Management

Systems

Programming

Programmers

Development

Center

Figure 13-1

Information

Center

Future IS Organization?

IS Executive

CIO

Client Interface

General and

Administration

IS Utility

Competitive

Systems

Administration

Data

Center

Data

Network

Professional

and Technical

Support

Finance

Performance

and Planning

Voice

Systems

Client Systems

Groups

Equipment

Development

Center

Figure 13-2

Telecommunications

Information Systems Value

Company/Enterprise

Function/Development

Personal/Individual

Figure 14-1

Infrastructure

Application

Personal Applications

and Tools

Evolution of Financial Strategy

Initiation

Expansion

Control

Maturity

I

II

III

IV

Organization

Application Single Area Proliferation Containment Strategy

People

Cost

Motivation Displacement Avoidance

Financial

Justification

Budget

Business Case

Installation

Audit

DP Planning

Little

Reactive

Organization

Finance

Dept.

Multiple

Dept.

Figure 14-2

DP

Efficiency

Competitive

Advantage

Charge-Out

System

Management

Process

Directed

Proactive

Centralized

Centralized Decentralized

Distributed

Management Process

Management Incentive

Eliminate

Simply

Automate

Business Case Process

IS Development Discipline

Interlock Management

Benefit Measurement

Figure 14-3

New Markets,

Opportunities

and

Competitors

Employee

Empowerment

Quality Circles

Teams

Figure 15-1

Organization

Downsizing

Outsourcing

Business Partnering

Corp. Alliance

Process

Reengineering

Redefining

Organizational

Responses to

Business Drives

Product

Customization

Markets

Customers

Global Standards

TQM

Time,

Flexibility and

Responsiveness

as Competitive

Factors

Traditional Roles in Planning

Vision

Strategic

Tactical

Traditional IS Role

Figure 15-2

Strategic Planning Model

Environment

(External)

Opportunities

Treats

Mission

Vision

Strategy Plan

Goals

Objectives

Enterprise

(internal)

Strengths

Weaknesses

Strategies

Positioning

Culture

(Explicit/Implicit)

Figure 15-3

Tactical Plan

Business Unit

Functional

Programs

Major Project

Business Plan

Detailed

Projects

Resources:

Headcount,

Capital and

Expense

Budgets

What to Plan

Strategic Enterprise

Planning

Strategic Information

Planning

Architecture

Planning

Tactical

Planning

Implementation

Planning

Figure 15-4

Enterprise Strategies

Information Strategies

Architecture

Time Oriented Objectives

Project Plans

Barriers to Aligning IS with Business Objectives

Business Plan

IS Track Record

and Credibility?

Communication of

Business Plan?

Senior Management

Perception of IS?

Executive Skills of

IS Executive

Clear IS Role?

Effective IS

Management?

Is keeping IS

aligned with the

business objectives

someone’s highpriority objective?

IS Organization?

IS Policies?

IS Skills and

Capabilities?

A problem with

IS Capacity?

Does IS Organization

Have a

User/Business Focus?

Figure 15-5

Managing IS to

Business Objectives?

Business-IS Planning

Business

Strategy

Dictates

Determines

Benefits

Information

Technology

Figure 15-6

IS Strategy

Business-IS Planning

Corporate

Vision

Business

Strategy

Opportunities

Dictates

IS

Strategy

1. Strategic Capability

2. Technology-driven

Business Change

Information

Technology

Figure 15-7

Technology

Environment

Enterprise-wide Information Systems

Strategic Planning Process

Business Domain

Strategic Plan

Business Processes

and Organization

Figure 15-8

Information Technology

Domain

Impact

Alignment

Information Technology

Opportunities

Information Systems

Architecture and

Organization

Xerox History

Continuous

Improvement

1959

Figure 16-1

1972 1979 1980

1983

1989

1990s

Important Supporting Elements

Recognition

and Reward

Tools and

Processes

Transition

Team

Xerox is a

Total Quality

Company

Training

Figure 16-3

Communication

Senior

Management

Behavior

A Win-Win Proposition

Delighted Customers

Satisfied

Stockholders

Enhanced

Community

Figure 16-5

Proud

Employees

Successful

Partners

Organizational Response to

Business Drivers

IS Significance

High Medium Low

New

Markets, Opportunities and

Competitors

Time,

Flexibility and Responsiveness as

Competitive Factors

Product

Customization

Process

Reengineering, Redefining and TQM

Employee

Empowerment and

Cross-Functional Teams

Organization Downsizing,

Outsourcing, Business Partnering

and Alliances

Figure 17-1

Organizational Response

Business Success Factors

IS Role

Mandatory Necessary Marginal

Business

Fitting

Leadership

Pieces into the Big Picture

Organizational

Responsiveness and Resilience

Realizing

that Solving Customer Problems

Requires a Team Approach

A Strong Company

Ability and Willingness to

Innovate, Change and Take Risks

Accomplishing All of These Factors While

Maintaining Necessary Balance

Good

Communication Throughout the Entire

Organization

Figure 17-2

Porter Competitive Model for the

Commercial Aircraft Industry

Tupolev,

Engine Manufactures

Electronics, Semiconductors, etc.

Other Material Suppliers,

Potential

New Entrants

Specialty Metals, Composite

Materials, etc.

Government Institutions

Bargaining

Power

of Supplier

Heavy Industries in Japan

Taiwan Aerospace,

Other Emerging

Industrial Power

Small-Aircraft Manufactures or

Aerospace, Military Companies:

Dassault, ATR, Lockheed

Intralndustry Rivalry

SBU: Boeing Airbus

McDonnell Douglas

Bargaining

Power

of Buyers

Airlines

Substitute

Products

and Services

Advances

Figure 2

Mitsubishi

Other

Capital Sources, banks,

investors

FAA, IATA, EPA

Other Regulating Bodies

IT Vendors

from Former Soviet Union

Leasing

Companies

Government Institutions

FAA, IATA, EPA

Other Regulating Bodies

in Small, Short-Haul,

Turboprop Technology

Advances in Automotive Industry and

Infrastructure

Fast Train for Distances Less than

400 Miles

Advances in Telecommunications,

Videoconferencing, etc.

Porter Value Chain for Boeing

Firm

Information Systems Technology Planning and Budgeting Technology Office Technology

Infrastructure

Human

Procurement training

Training for

Hiring & training of

People familiar with national &

Managing

relationship

competitiveness

engineers,

test

pilots,

international economics and politics

Resource

with suppliers

company-wide

skilled workers

Management Qualification of

R&D, Partnerships

Product development

Technology

suppliers New

Defense contracts

Market research

Development materials Partners

Regulation & Policies

Procurement

IS inventory

management JIT,

production forecast

CAD/CAM systems

Assembly of planes &

parts tracking

Material

Concurrent

qualification

Engine selection

Partners & joint

programs

Electronics, etc.

Inbound

Figure 3 Logistics

engineering

Flexible & modular

manufacture

Wide choice in

capacity with “family”

concept

Fly-by-wire

technology

Short development

cycles

Quick to market with

short manufacturing

cycles

Operations

Customer relationships

Tracking of issues

Worldwide

presence

Outbound

Logistics

Early

involvement of

customers in product

definition

Promotion,

advertising

Lobbying U.S. and

foreign governments

Seeking powerful

partners

Facilitation of

financing

Trade shows

Marketing

and Sales

Repair,

spare parts

service

Inspection & test

Upgrades

Training facilities for

customers

Maintenance

Service

Relationships Between Senior

Executives at Boeing

Frank Shrontz

CEO

Create the Vision

John Warner

Information Service

Group Implements the

Information Systems

Figure 5

Phil Condit President

Runs the Day-to-Day

Buisness

Ron Woodard Commercial

Airplane Group

Runs the Airplane Business

Dale Hougardy Head of

the 777 Program

Develops the 777

Jerry King Defense&

Space Group

Runs the Defense Business

Boeing Value to Customer Chart

Boeing Aircraft

Product/Service

An

aircraft designed for passenger

comfort, operational efficiency

and safe

Flexible design configuration

Competitive price

On-time delivery

Logistical support, training,

maintenance ----Peace of mind

CAD/CAM

system, review,

process, concurrent engineering

Customer and partner/supplier

through the network

Co-design with customer

Qualify control system

Vender EDI system

Value-Add Process

Figure 6

Value to Customer

What the Customer Buys

Organizational Response

Business Success Factors

IS Role

Mandatory Necessary Marginal

Business

Fitting

Leadership

Pieces into the Big Picture

Organizational

Responsiveness and Resilience

Realizing

that Solving Customer Problems

Requires a Team Approach

A Strong Company

Ability and Willingness to

Innovate, Change and Take Risks

Accomplishing All of These Factors While

Maintaining Necessary Balance

Good

Communication Throughout the Entire

Organization

Figure 17-2